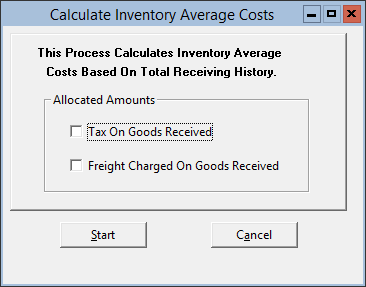

Calculating the Inventory Average Cost

You can calculate inventory based on the average cost of goods received. This process looks at all receiving records for each item and calculates the cost of the inventory based on an average cost of inventory since inception.

Figure 1-52 Calculating the Inventory Average Cost

Parent topic: Warehouse Functions