Setting Up Updateable PDF Tax Forms

Oracle’s PeopleSoft Payroll for North America provides updateable PDF tax forms to enable employees to update their federal and state tax withholding information using PeopleSoft employee self-service (ePay) Fluid User Interface.

Note: Non-resident aliens do not have access to updateable PDF tax forms.

Note: If an employee has a Lock-in Letter or otherwise has a limit applied to the number of withholding allowances for a jurisdiction, then they do not have access to updateable PDF tax forms for that jurisdiction.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Roles Page |

USER_ROLES |

Verify or assign the security roles of PeopleSoft User and NA Payroll WH Form User to enable access to updateable PDF tax forms. Note: The Payroll Administrator must have the NA Payroll WH Form Admin role to do this. See PeopleTools, Administration Tools, Security Administration Administering User Profiles, Specifying User Profile Attributes, Setting Roles. |

|

PY_PDF_TAXFORM |

Define self-service updateable PDF tax form, including controlling whether to mask the National ID in the display. |

|

|

PY_PDF_AWE_OPTN |

Define which changes on the Federal Tax Withholding Forms and State Tax Withholding Forms pages require Payroll Administration notification or approval. |

|

|

PY_JUR_MAPPING |

Map an updateable PDF tax form and special instructions to its tax jurisdiction, and add links to third-party resources. |

|

|

PY_PDF_COMP_MAP |

Map federal and state tax jurisdictions for the company, including control of the jurisdiction display sequence on the self-service Tax Withholding page, inactive job and person of interest access, and setting notification or approval required for each jurisdiction. |

|

|

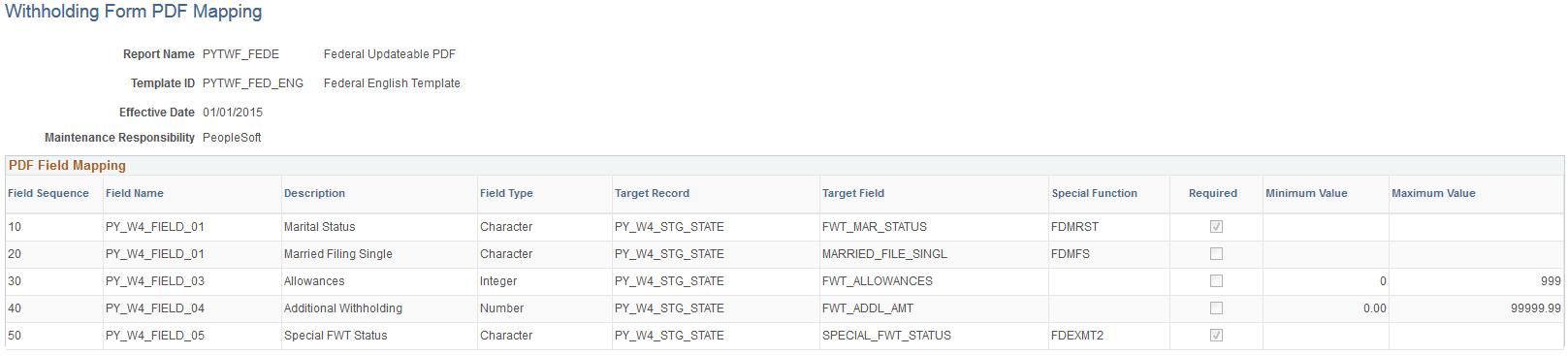

PY_W4_FORM_MAP |

View the fields and parameters that are mapped between the updateable agency PDF and the PeopleSoft BI Publisher template. |

Oracle’s PeopleSoft Payroll for North America provides updateable PDF tax forms to enable USA employees to update their federal and state tax withholding information using ePay self-service and the PeopleSoft Fluid User Interface.

The Self-Service Transaction

Employees access updateable tax forms from the Fluid Interface Payroll tile. The system extracts the employee’s data from PeopleSoft and pre-fills selected fields in an updateable PDF of the tax form for that jurisdiction.

When the employee updates the tax data and submits the form, the system saves the form, and displays a new PDF with a confirmation message and additional information. Depending on the settings on the PDF Tax Form Table page, the confirmation PDF can also include the completed withholding form. If no approvals are required, then submitting the form also updates the PeopleSoft Tax Data tables with the new information.

Notifications

When an employee submits a change, the system sends the employee an email notification.

Important! Notification emails are sent to the primary email address for the recipient’s User Profile, not to the email address in the recipient’s HR personal data record.

Employees cannot update their own User Profile email address. Administrators are responsible for maintaining this information. To view or update the email address for a User Profile, click the Edit Email Addresses link on the General page of the User Profiles component

The system also notifies the Payroll Administrator of submitted change. If the Approval Workflow Engine (AWE) is enabled and Approval Required is selected on the Company Mapping Page for the jurisdiction, the system submits the changes to the Payroll Administrator for approval first, and updates the data only after approval is entered.

Updateable PDF Configuration

Oracle delivers updateable PDF tax form functionality with USA federal and state jurisdictions available on the Company Mapping page, but you must set these up for each company.

Payroll Administrators use the Tax Jurisdiction Mapping Page to add and maintain links to third-party resources, such as a tax withholding calculator or non-resident alien (NRA) and other forms that PeopleSoft does not yet support. Payroll Administrators can use the Text Catalog to modify the Special Instructions text and most messages and warnings to meet your organization’s needs.

Adobe Acrobat Reader X or higher or Adobe Acrobat DC, PeopleSoft BI Publisher, PeopleSoft Payroll for North America and PeopleSoft ePay are required.

Updateable PDF tax forms functionality works for BI Publisher reports using PDF Templates only (not RTF templates, which can also be used to output PDF). PeopleSoft delivers many agency PDF tax withholding forms already mapped to BI Publisher report PDF templates.

Note: Currently, due to Adobe PDF limitations, updateable PDF tax forms are available only from a desktop or laptop; they are not available from a mobile device.

The PeopleTools security roles of PeopleSoft User and NA Payroll WH Form User must be assigned to each user ID that should have access to updateable PDF tax forms. Jurisdictions must be mapped to the company.

For Payroll Administrators to approve changes to self-service updateable PDF tax forms, PeopleSoft Approval Workflow Engine (AWE) must be enabled, and the Approval Required check box must be selected for each state on the Company Mapping table.

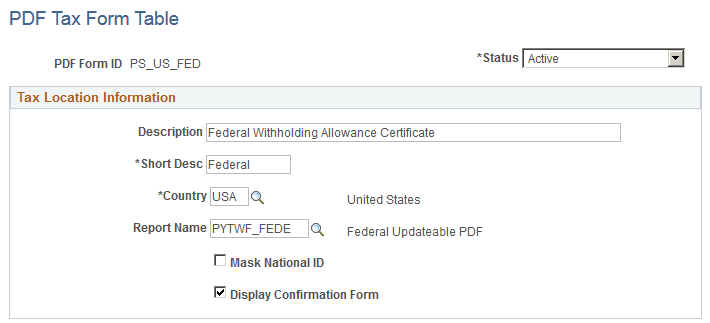

Use the PDF Tax Form Table page (PY_PDF_TAXFORM) define self-service updateable PDF tax form, including controlling whether to mask the National ID in the display.

Navigation

Image: PDF Tax Form Table page

This example illustrates the fields and controls on the PDF Tax Form Table page.

|

Field or Control |

Definition |

|---|---|

| Report Name |

Select the name of the BI Publisher report to use for the updateable PDF tax form. |

| Mask National ID |

Select this check box to mask all but the last four digits of the national ID (US Social Security Number) on the employee’s updateable PDF tax form. Note: Even when masked, the full number appears for the Payroll Administrator role. |

| Display Confirmation Form |

Select this check box to include a filled-out withholding form in the confirmation PDF that employees see after submitting changes on an updateable PDF. In all of PDF tax forms that PeopleSoft delivers, this check box is selected by default. You can de-select it if you do not want to include the filled-out withholding form in the confirmation PDF. The confirmation PDF appears regardless of this setting, but if this check box is not selected, the confirmation PDF includes only a confirmation message without a copy of the withholding form. Note: This check box is available if you use PeopleTools 8.55.07 or later. On earlier versions of PeopleTools, the confirmation PDF always includes a copy of the withholding form. |

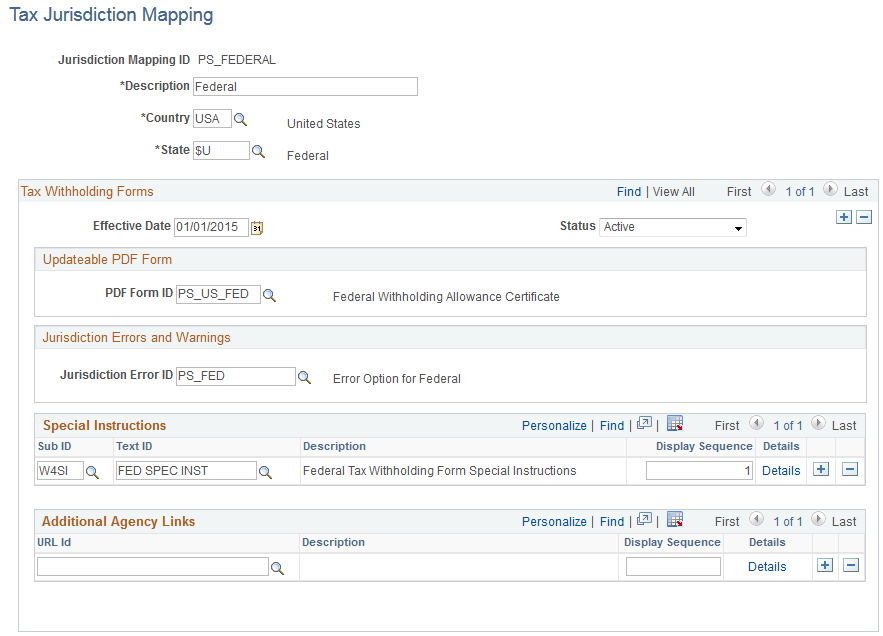

Use the Tax Jurisdiction Mapping page (PY_JUR_MAPPING) to map an updateable PDF tax form and special instructions to its tax jurisdiction, and add links to third-party resources.

Navigation

Image: Tax Jurisdiction Mapping page

This example illustrates the fields and controls on the Tax Jurisdiction Mapping page.

Updateable PDF Form

|

Field or Control |

Definition |

|---|---|

| PDF Form ID |

Specify the updateable PDF tax form to use for this jurisdiction. Available forms are from the PDF Tax Form Table Page. |

Jurisdiction Errors and Warnings

|

Field or Control |

Definition |

|---|---|

| Jurisdiction Error ID |

Select the error or warning to use when AWE is enabled. Errors and warnings are available from the Tax Jurisdiction Error Options Page. |

Special Instructions

|

Field or Control |

Definition |

|---|---|

| Sub ID |

Select the Text Catalog Sub ID for the text to use as special instructions for the updateable PDF tax form. |

| Text ID |

Select the Text Catalog ID to use for this updateable PDF tax form. You can add or delete a Text ID. If more than one row is defined, the system adds a line space between the two instructions (to create a new paragraph) on the employee self-service Tax Withholding Forms page (either the Federal Tax Withholding Forms Page or the State Tax Withholding Forms Page). |

For information on using the Text Catalog to configure text, see Configuring the Text Catalog in your PeopleSoft HCM Applications Fundamentals product documentation.

Additional Agency Links

|

Field or Control |

Definition |

|---|---|

| URL Id |

Payroll Administrators can define additional forms or resources to make available by selecting from URL IDs defined in the PeopleTools URL Table. When more than one row is added, this field must be defined to save the page. For information about the URL Table, see PeopleTools, Administration Tools, System and Server Administration, Using PeopleTools Utilities, Using Administration Utilities, URL Maintenance. |

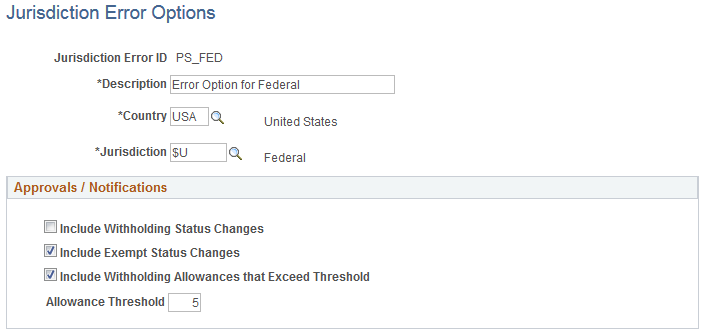

Use the Jurisdiction Error Options page (PY_PDF_AWE_OPTN) to define which changes on the Federal Tax Withholding Forms page and State Tax Withholding Forms pages require Payroll Administration notification or approval.

Navigation

Image: Jurisdiction Error Options page

This example illustrates the fields and controls on the Jurisdiction Error Options page.

Approvals / Notifications

|

Field or Control |

Definition |

|---|---|

| Include Withholding Status Changes |

If AWE is enabled, selecting this check box submits to the Payroll Administrator for approval any Tax Status, Allowance, Additional Amount, Additional Allowance or Additional Percent changes. Approval will be required before the changes are applied to tax data in the system. If AWE is disabled, selecting this check box notifies the Payroll Administrator of the changes, but does not require approval before saving the tax data. Settings on the Company Mapping Page determine if this is a notification or if approval is needed. |

| Include Exempt Status Changes |

If AWE is enabled, selecting this check box submits to the Payroll Administrator for approval, the employees who have changed their status to Exempt. Approval will be required before the changes are applied to tax data in the system. If AWE is disabled, selecting this check box notifies the Payroll Administrator of the changes, but does not require approval before saving the tax data. Settings on the Company Mapping Page determine if this is a notification or if approval is needed. |

| Allowance Threshold |

Enter the highest number of allowances permitted for the jurisdiction. If AWE is enabled, the system submits to the Payroll Administrator for approval, the employees who have changed their withholding allowances to an amount that exceeds the defined threshold. If AWE is disabled, the system notifies the Payroll Administrator of the changes, but does not require approval before saving the tax data. Settings on the Company Mapping Page determine if this is a notification or if approval is needed. |

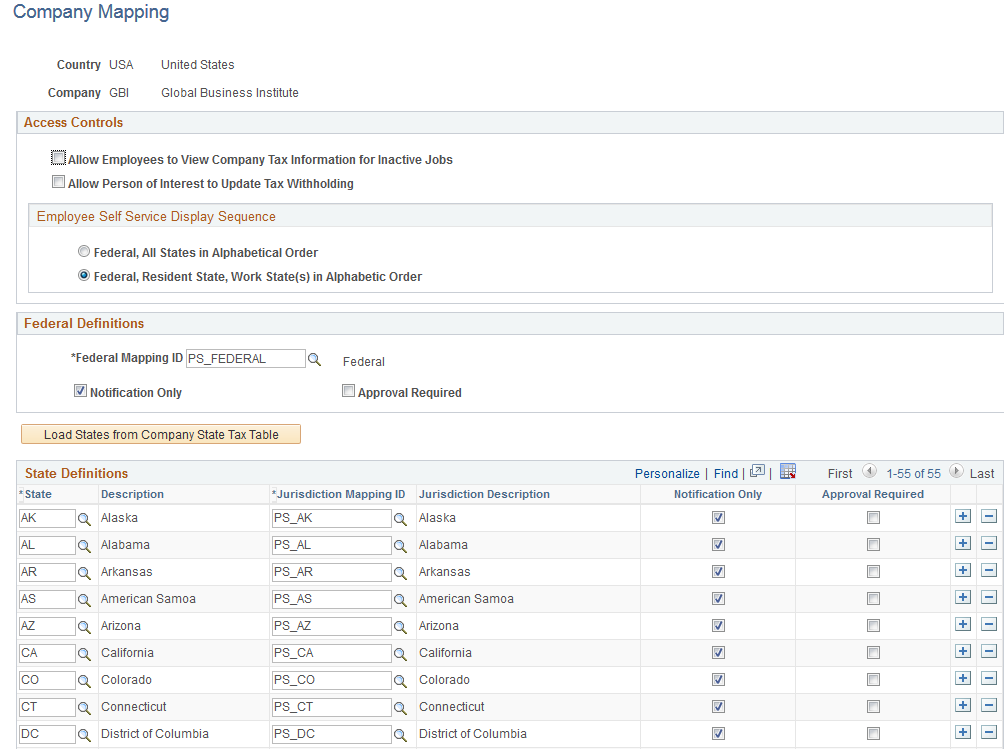

Use the Company Mapping page (PY_PDF_COMP_MAP) to map federal and state tax jurisdictions for the company, including control of the jurisdiction display sequence on the self-service Tax Withholding page, inactive job and person of interest access, and setting notification or approval required for each jurisdiction.

Navigation

Image: Company Mapping page

This example illustrates the fields and controls on the Company Mapping page.

|

Field or Control |

Definition |

|---|---|

| Allow Employees to View Company Tax Information for Inactive Jobs |

Select this check box to allow an employee assigned to an inactive job to view their tax withholding information. The system looks at the Update Employee Tax Data page and Job Record to determine if the employee is assigned to more than one company. If the employee is associated with only one company information on the self-service Tax Withholding page is read only. If the employee has more than one company a search icon is available so the employee can select the active or inactive company that they want to view. |

| Federal, All States in Alphabetical Order or Federal, Resident State, Work State(s) in Alphabetic Order |

Select an option to control the order in which jurisdictions appear on the self-service Tax Withholding page. The system displays the employee’s tax withholding information from the Federal Tax Data and State Tax Data pages in the Employee Pay Data component, and provides access to the employee’s updateable PDF withholding form for that jurisdiction. The order in which the jurisdictions appear depends on the selection that you make here. If a jurisdiction does not have income tax, the Tax Status on the self-service Tax Withholding page is n/a for not applicable. If a state has an associated local income tax, the row appears, but no updateable PDF is available. |

| Notification Only |

Select the Notification Only check box to send a notification to the Payroll Administrator when employees make the changes defined on the Tax Jurisdiction Error Options Page. |

| Approval Required |

Select the Approval Required check box for Approval Workflow Engine (AWE), if enabled, to submit changes to your Payroll Administrator for approval before updating tax records in the system. For more information about AWE, see Understanding Approvals in your PeopleSoft HCM Application Fundamentals documentation. When Approval Required is selected and the employee submits changes on the updateable PDF tax form, the systems displays Pending Approval in that row on the self-service Tax Withholding page. The employee can click the arrowhead in that row to access the Pending Approval page and view the status and changes, however the changes are not updated in the Tax Data pages and the employee is prevented from making further tax withholding changes for that jurisdiction until the Payroll Administrator has entered approval. |

| Load States from Company State Tax Table |

When the Company Mapping page appears for an unmapped company, the State Definitions grid is empty. Click the Load States from Company State Tax Table button to load all of the state definitions that are defined in the Company State Tax Table. |

| Jurisdiction Mapping ID |

Click the search icon beside the Jurisdiction Mapping ID field to select the state’s respective Jurisdiction Mapping ID from the list of IDs that PeopleSoft delivers predefined. on the Tax Jurisdiction Mapping Page. To save the Company Mapping page, you must identify the Jurisdiction Mapping ID for each state that you want to use, and delete all rows that you do not want to use. |

Use the Withholding Form PDF Mapping page (PY_W4_FORM_MAP) to view the fields and parameters that are mapped between the updateable agency PDF and the PeopleSoft BI Publisher template.

Navigation

Image: Withholding Form PDF Mapping page

This example illustrates the fields and controls on the Withholding Form PDF Mapping page.

PeopleSoft delivers agency tax withholding forms pre-mapped to a BI Publisher PDF template for many tax jurisdictions. The Withholding Form PDF Mapping page is read only for the PDFs that PeopleSoft delivers pre-mapped.