Understanding Social Security Benefits

This topic discusses Spanish social security benefits and calculation of benefits.

Benefit Types

Employees in Spain are eligible to receive the following types of benefits:

Temporary Disability Benefits for Common Sickness and Non-Industrial Accidents (IT) and Extended IT (IT PRORROGADA).

IT (Incapacidad Temporal) benefits are available to employees who have contributed to social security at least 180 days in the last five years before the leave date.

Disability Benefits Due to Work Related Injuries (AT & EP) and Extended AT & EP (AT/EP PRORROGADA).

AT & EP (Accidentes de Trabajo y Enfermedades Professionales) benefits are available to workers who have suffered workplace injuries.

Maternity/Paternity

These benefits are available to employees who have contributed to social security at least 180 days in the last five years before the date of birth. Because the legal benefits are paid entirely by Social Security, the payment amounts are not calculated by PeopleSoft Global Payroll for Spain. However, the system does calculate the common contingencies (CC) and professional contingencies (CP) bases for the days that employees are absent for maternity or pregnancy risk. These bases are required to calculate complementary benefits that are paid by the employer.

Risk During Pregnancy or Lactancy:

These benefits are available to any active employee. Because the legal benefits are paid entirely by Social Security, the payment amounts are not calculated by PeopleSoft Global Payroll for Spain. However, the system does calculate the common contingencies (CC) and professional contingencies (CP) bases for the days that employees are absent for risk during pregnancy or lactancy. These bases are required to calculate complementary benefits that are paid by the employer.

Minor Care (CUIDADO MENOR).

This benefit is available to any active employee with the required contributing period that requests a work schedule reduction of at least 50% to take care of a child affected by serious sickness. The legal benefits are paid by Social Security for the currently worked period. The system does not calculate this benefit as an amount to be paid. Instead, it calculates it as a possible complementary benefit that may be paid by the employer. No Social Security contributions are calculated/reported for the non-worked period. You manage this benefit using the absence take CUIDADO MENOR. To be eligible for this benefit, an employee needs to be identified as a regular part time employee for the affected period. Therefore the variable CLI VR RED JORNADA should be defined.

Legal and Complementary Benefits

Two types of benefits exist:

Legal benefits known as Subsidio IT and Subsidio AT.

Complementary benefits paid by the employer known as the Prestación Complementaria IT, Prestación Complementaria AT, Prestación Complementaria MT, Prestación Complementaria RE, and Pretación Complementaria CM.

Note: Employer complementary benefits are defined on the Complementary Benefit page. The system automatically calculates the portion of the benefits that is the legal benefits, Subsidio, and the portion that is paid by the employer, Prestación Complementaria.

For maternity/paternity, risk during pregnancy or lactancy, or minor care benefits, the system calculates the elements Subsidio MT, Subsidio RE, and Subsidio CM as part of the complementary benefits calculation.

Bases(Base Reguladora Diaria)

In PeopleSoft Global Payroll for Spain, daily legal social security benefits are calculated as a percentage of a daily benefits base (Base Reguladora Diaria or BRD). The daily bases are derived from the CC and CP funding bases for social security for previous months and divided by the contributing days in that period. This table identifies the social security funding base from which the daily base for each benefit is derived:

|

Benefit |

Social Security Base Used for Benefit Calculation |

|---|---|

|

IT and Extended IT (subsidio IT) |

Common contingencies corresponding to the previous month. |

|

AT & EP and Extended AT & EP (subsidio AT) |

Professional contingencies base corresponding to the previous month - overtime of that month + overtime average for the last 12 months. |

|

Maternity/Paternity |

Common contingencies corresponding to the previous month. |

|

Risk during pregnancy or lactancy |

Professional contingencies base corresponding to the previous month - overtime of that month + overtime average for the last 12 months. |

|

Minor care |

Professional contingencies base corresponding to the previous month - overtime of that month + overtime average for the last 12 months. |

Note: You can override these BRD values.

See Overriding BRDs and Relapse Days for Absence Events.

The system calculates the BRD for part-time employees differently. Instead of using the social security base of the previous month it uses the average of the three or twelve months—depending on the absence—prior to the begin date of the absence.

Normally the system calculates the BRD by dividing the bases of the corresponding period of time by the contributing days in that period. In the case of absences for which the benefit is paid directly by Social Security (maternity, paternity, risk during pregnancy or lactancy, minor care, and extended IT and AT/EP), the requirement is to include calendar days when calculating those benefits for employees with an assigned schedule (irregular part-time employees).

Note: The variable CLI VR MET CLC BRD determines from which contracts and schedule types the system retrieves contribution data when calculating BRD. When CLI VR MET CLC BRD has its default value of 1, the system retrieves contribution data across all contracts and schedule types. If you change the value of CLI VR MET CLC BRD to any value other than 1, the system retrieves contribution data for only a payee's most recent contract or most recent schedule type change. If both a contract and schedule type change occur for a payee, the system uses the most recent of the changes when calculating the BRD.

The variable CLI VR OPC CLC BRD determines if the system counts periods affected by certain absences when calculating BRD. For the default value, A, the system includes days and bases of unpaid personal leave in the BRD calculation. For any other values, the system does not include days and bases of unpaid personal leave in the BRD calculation.

With complementary benefits, employers can select from the following bases:

Social security common contingencies base.

Employees' gross daily salary.

Any other user-defined daily accumulator.

You specify the base for complementary benefits on the Complementary Benefit page.

Percentages

The percentages used to calculate benefits are set both by the government (in the case of legally mandated benefits) and by employers (in the case of complementary benefits). The percentages used to calculate the IT benefit (Subsidio IT) vary depending on the number of days that the employee is on leave, while the amount of the AT and EP benefit (Subsidio AT) is currently set at 75 percent of the daily base (the Base Reguladora Diaria) for each day of leave. Both maternity/paternity and risk during pregnancy or lactancy are paid at 100 percent of the daily base (Base Reguladora Diaria). Minor care is paid at 100 percent of the reduced working time.

Rounding

The variable SS VR OPCALC SUBSD determines how the system rounds IT benefit amounts:

|

SS VR OPCALC SUBSD Value |

Calculation Method |

|---|---|

|

D Note: This is the default value. |

BRD = Base Previous Month ÷ Contributed Days (Rounded to two decimal places) IT Subsidy = BRD × Percentage × Number of Days (Rounded to two decimal places) |

|

P |

BRD = Base Previous Month ÷ Contributed Days (Rounded to two decimal places) IT Subsidy Daily Price = BRD × Percentage (Rounded to two decimal places) IT Subsidy = IT Subsidy Daily Price × Number of Days |

These two calculation methods can produce slightly different values, so choose the one that works best for your business process.

Pago Delegado

Pago Delegado refers to the system whereby an employer pays IT or AT benefits to an employee, but is later reimbursed for these payments by Social Security. That is, the company acts as the direct provider of benefits and is later repaid. In the case of IT, the employer can reimburse, as pago delegado, the social security benefits from the 16th day of sickness. In the case of AT, the employer has the right to reimburse from the first day of sickness. This reimbursement isn't a real refund, but rather a discount of the total amount to pay through the social security TCs.

Social Security Benefits in the Pay Process Flow

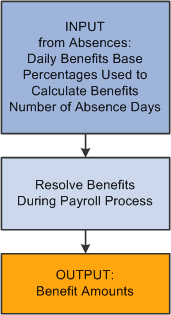

Image: Benefits in the pay process flow for PeopleSoft Global Payroll for Spain

This diagram illustrates how benefits processing, from the entering of absence data and resolving of benefits during the payroll process that yield the benefit amounts, fits into the overall pay process flow of PeopleSoft Global Payroll for Spain.

As shown in the diagram, benefits preparation takes place during absence processing. The absence processing calculates the daily benefits base (Base Reguladora Diaria), the percentages to apply to the base, and the number of days that the employee is on each type of leave. Then, during the payroll process, the benefits setup in absences are resolved.