Understanding Social Security Terms and Concepts

This topic discusses:

Social security in the pay process flow.

Bases.

Percentages and rates.

General and special schemes.

Work groups.

Minimum and maximum funding bases.

Upper and lower ceilings.

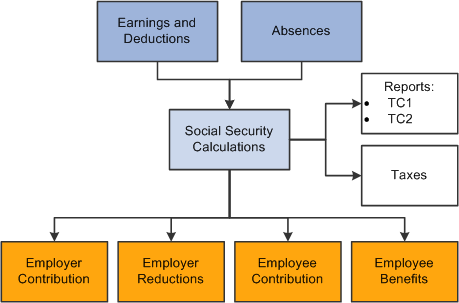

Image: Social security in the pay process flow for PeopleSoft Global Payroll for Spain

This diagram illustrates how social security processing fits into the overall pay process flow of PeopleSoft Global Payroll for Spain. The social security process calculates the employer and employee contributions and the employer reductions, and generates data for the social security reports TC1 and TC2. The next step after social security processing is the tax calculation.

PeopleSoft Global Payroll for Spain calculates social security contributions and deductions as a percentage of a funding base, except in the case of trainees and apprentices, whose contributions and deductions are based on fixed rates. For employees with multiple jobs, the calculation is based on reduced maximum and minimum bases that you define on the Multiple Employment page.

PeopleSoft Global Payroll for Spain delivers accumulators for these funding bases:

Common Contingencies Base: Used to calculate the common contingencies contribution.

Professional Contingencies Base: Used to calculate social security contributions for:

Temporary Disability (Incapacidad Temporal (IT)) and Permanent Disability, Death, and Survival Benefits (Invalidez, Muerte, y Supervivencia, (IMS).

Unemployment.

Professional training.

FOGASA (Fondo de Garantia Salarial.

Structural Overtime Base: Used to calculate social security contributions for structural overtime.

Non Structural Overtime Base: Used to calculate social security contributions for nonstructural overtime.

Note: PeopleSoft Global Payroll for Spain calculates the common contingencies and professional contingencies bases for trainees and apprentices for use in processing social security benefits. These bases are not required for calculating social security contributions.

PeopleSoft Global Payroll for Spain calculates social security contributions and deductions either as percentages of a funding base or on the basis of fixed rates, depending on the social security contribution ID assigned to the employee. The social contribution ID defines:

Social security employee type.

Contribution type.

For employees with a social security employee type of regular, the contribution type is percentage. For this type of employee, PeopleSoft Global Payroll for Spain calculates contributions and deductions as a percentage of the common contingencies (CC) base, the professional contingencies (CP) base, or the structural and nonstructural overtime bases. For employees whose social security employee type is trainee, the contribution type is rate, which means that contributions and deductions are based on fixed rates. The exact rates or percentages are set by law and can vary from year to year.

Note: View and update the percentages and rates used in the social security calculation on the Contribution page.

The social security system is divided into a general scheme and various special schemes. The general scheme applies to most employees working for others, while special schemes cover the self-employed and some categories of employees, such as sailors, those in the coal mining industry, and housekeeping employees. Currently, PeopleSoft Global Payroll for Spain delivers rules only for the general scheme.

Grant holders (becarios) are integrated into the general scheme, but have special rules regarding social security calculation:

They must be associated with the contribution group number 7.

They must be assigned a contribution ID of 008.

They must have an Empl Class (employee class) of Intern on the Job Information page.

The common contingencies base is the minimum base for the general scheme.

The professional contingencies base is the minimum base for the general scheme.

Becarios do not need to be associated with an official contract type, for purposes of generating the FAN flat file.

Note: Although PeopleSoft Global Payroll for Spain delivers rules for only the general scheme, you can define rules for other schemes using the Scheme, Work Group, and Contribution pages.

All employees who contribute to social security are assigned to government-defined work groups based on their levels of education, professional skills, and job titles. Every year, the government establishes different minimum and maximum funding bases and ceilings for each work group and scheme.

Note: Define the values of the maximum and minimum bases and ceilings for the general scheme on the Scheme page.

For each work group, the government establishes a minimum and a maximum base to use for calculating the common contingencies funding base. This means that for an employee in a specific group, the social security funding base cannot be greater than or less than the maximum or minimum established for that group. For example, if an employee's earnings subject to social security contributions are so high that the calculated funding base exceeds the upper limit, the actual funding base must be reduced to the upper limit. That is, social security contributions are based only on the portion of a payee's salary that is equal to or falls within the upper and lower limits for each group.

Note: Define the maximum and minimum funding bases for common contingencies on the Work Group page.

Each year, the government establishes upper and lower ceilings for calculating the professional contingencies base. Just as in the case of the common contingencies contributions, social security contributions for professional contingencies are based only on the portion of a payee's salary that is equal to or falls within the upper and lower ceilings. The ceilings are the same for all work groups within a scheme.

Note: Define the upper and lower ceilings for professional contingencies on the Scheme page.