Understanding Tax Calculation

This topic discusses:

Tax calculation.

IRPF calculation overview.

Normalization.

IRPF in the pay process flow.

IRPF tax reporting for nonresidents.

A person (Spanish or foreign) receiving money in Spain, or a Spanish person working abroad, being eligible to pay taxes in Spain, can be considered from taxes point of view as: -Resident--> Affected by IRPF "Impuesto sobre la renta de las personas físicas" -Non-resident (taxed or not taxed)--> Affected by IRNR "Impuesto sobre la renta de no residentes" -Tax exempt. This information is setup at employee level though the page "Transnational Mobility" under Maintain tax data ESP component

Payees in Spain (Spanish or foreign) and Spanish payees working abroad who are eligible to pay taxes in Spain fall into three main categories:

Residents who are subject to Impuesto sobre la Renta de las Personas Físicas (IRPF).

Nonresidents (taxed or not taxed) who are subject to Impuesto sobre la Renta de No Residentes (IRNR).

Tax exempt payees.

You define the category for each payee on the Transnational Mobility page of the Maintain Tax Data ESP (GPES_PAYEE_DATA) component.

In the case of IRPF, the withholding amount originates from employee income and reductions and depends on which tax regulations are applicable to an employee. Spain does not have one single set of tax regulations for IRPF. General state tax regulations exist as well as four regions with specific tax calculations. Each tax location is known as a fiscal territory (Territorios Fiscales). An employee is associated with one fiscal territory depending on where the employee is living and working. PeopleSoft Global Payroll for Spain calculates the IRPF for all the fiscal territories:

Hacienda Estatal (state territory).

Hacienda Foral de Navarra.

Hacienda Foral de Alava.

Hacienda Foral de Guipuzcoa.

Hacienda Foral de Vizcaya.

You assign each payee to one fiscal territory using the Maintain Tax Data page of the Maintain Tax Data ESP (GPES_PAYEE_DATA) component.

Note: The fiscal territories Hacienda Foral de Navarra, Hacienda Foral de Alava, Hacienda Foral de Guipuzcoa, and Hacienda Foral de Vizcaya are known as historical territories.

PeopleSoft Global Payroll for Spain provides the different calculation rules and setup data for each fiscal territory. It delivers setup data using tax brackets and calculation variables. You can view and update the tax brackets and other tax data that PeopleSoft Global Payroll for Spain delivers.

To calculate an employee's withholding percentage, the system:

Estimates the total annual income.

(State territory only) Estimates the social security contribution.

(State territory only) Calculates the available reductions.

These include deductions for dependents, any personal deductions due to age or disability, and any spousal garnishments.

(State territory only) Subtracts the social security contribution and the available reductions from the total annual income.

Note: The annual income for historical territories is reduced if needed by spousal garnishments and reductions linked to irregular income, which are the starting point for getting the IRPF percentage.

Calculates the withholding percentage.

The system generates the withholding percentage based on the previous steps. If needed, you can alter this percentage, but the system uses it only if it is higher than the one it calculated.

To prevent large differences between the estimated IRPF tax rate and the real tax contribution needed at the end of the year, a process calculates the withholding percentage multiple times during the year. This process is called normalization. The percentage withholding normalization process accounts for incomes earned and taxes and contributions paid, as well as income, tax, and contribution estimates for the remainder of the contract period or year.

PeopleSoft Global Payroll for Spain delivers a page where you can define the normalization schedule for IRPF calculation.

The Normalization Schedule ESP page is read by the regular payroll process list to determine when to run the normalization process. The exception to this is that the process is always run for new hires in the month that they are hired and for all employees who are compensated on a net to gross basis. You may need more than one schedule if you have different tax calculation dates for different pay entities.

Overriding IRPF Normalization

Even when the normalization schedule indicates that the system should normalize tax rates, it only does so if there have been changes to tax calculation data since the previous tax calculation. Additionally, when the system eventually normalizes tax rates, it does not apply tax rate limits according to Article 87.5. By overriding the variable CLI VR CALCULA TAX, you can force normalization and choose whether the system applies Article 87.5 tax rate limits.

CLI VR CALCULA TAX can be overridden at the pay entity, pay group, payee, or calendar level. If you enter a value for CLI VR CALCULA TAX other than the default value of 0, the system recalculates the tax rates for all payees affected by the override. For values 1 through 10 and 13, the system applies tax rate limits according to Article 87.5. For values 11, 12, 14, and 15, the system does not apply the Article 87.5 tax rate limits.

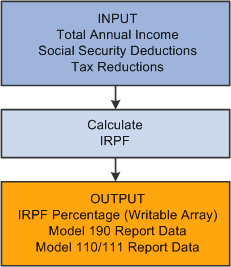

Image: IRPF process flow for PeopleSoft Global Payroll for Spain

This diagram illustrates how the IRPF calculation process fits into the overall pay process flow of PeopleSoft Global Payroll for Spain from the input of income, deduction, tax, and social security data to the output of the IRPF percentage.

PeopleSoft Global Payroll for Spain provides functionality for you to manage IRNR tax data that the payroll process generates for nonresident workers. This IRNR tax-reporting functionality enables you to create the Model 216 and Model 296 reports. You specify whether a payee is subject to IRNR and whether they are taxed or tax exempt on the Transnational Mobility page of Maintain Tax Data ESP (GPES_PAYEE_DATA) component.