Creating EFT Files

This section provides an overview of EFT files and discusses how to create EFT files.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMY_EFT_FILE_RC |

Create EFT files. Enter the parameters for the electronic file creation. |

The system creates the Malaysia standard MAYH deposit file by using a process that gives you multiple options that control the contents of the file. The process creates a separate MAYH file for each source bank account that is referenced in the processing. The options for the content of a file are:

Net pay only.

Recipient payments only.

Net pay and recipient payments.

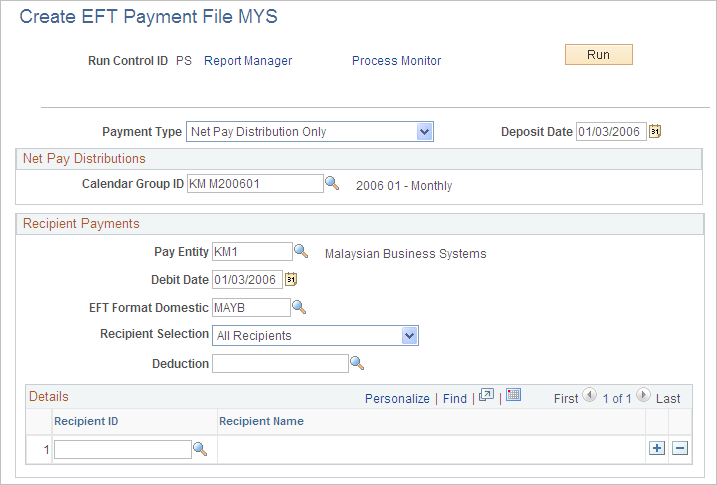

Use the Create EFT Payment File MYS (create electronic funds transfer file MYS) page (GPMY_EFT_FILE_RC) to create EFT files.

Enter the parameters for the electronic file creation.

Navigation

Image: Electronic Funds Transfer page

This example illustrates the fields and controls on the Electronic Funds Transfer page. You can find definitions for the fields and controls later on this page.

An application engine process extracts the salary data from the GP_PAYMENT table and creates the EFT file for transmission to the bank. You can create files for net pay only, recipient payments only, both net pay and recipient payments, or specific deductions.

Note: You must prepare and finalize the banking process (GP_PMT_PREPARE) before you can create the MAYB file. When the MAYB file is created, the system changes the payment status in GP_PAYMENT from F (finalized) to T (transferred).

|

Field or Control |

Definition |

|---|---|

| Payment Type |

Select from Net Pay Distributions Only, Net Pay and Recipients, or Recipient Deductions Only. The EFT file that the system creates contains data that is only for payments of the type that you specify. |

| Deposit Date |

Enter the date of the actual transfer of funds and the date that they are deposited with the bank. This value is normally the same as the payment date that is on the pay calendar, but you can change it if the payment date is not a business date. The date cannot be in the past. |

Net Pay Distributions

|

Field or Control |

Definition |

|---|---|

| Calendar Group ID |

Enter the ID for the calendar group for which you want the system to extract payee net pay data. You can select only calendars for which the banking process is finalized. You do not need a calendar group ID for the payment type recipient deductions only. |

Recipient Payments

|

Field or Control |

Definition |

|---|---|

| Pay Entity |

When you set up deduction recipient data, specify a pay entity as part of the payment details. In the details, you specify commission details and the group number. |

| Debit Date |

The system extracts recipient payments if the debit date is equal to the recipient's deposit schedule. If the recipient does not have a deposit schedule, the system extracts payments by using the debit date without reference to a deposit schedule. The date appears in the file header. |

| EFT Format Domestic |

Select either MAYB (May Bank - Malaysia) or RHB (Rashid Hussein Bank). |

| Recipient Selection, Deduction, and Recipient ID |

The system includes payments according to these rules (and according to the debit date and its rules): All Recipients: Payments for all deductions for all recipients according to the debit date rules. Selected Deduction: Payments for all recipients for the (single) selection that you make in the Deduction field. Selected Recipients: Payments for all deductions for the recipients that you select in the Recipient ID field. |