Understanding Process Lists

This topic discusses:

Functions of process lists.

Batch processing and the Process List Manager.

Ordering elements and sections in a process list.

Retroactive processing considerations for process lists.

Process lists control payroll processing at the highest level. They perform three basic functions:

Identify the sections, or sets of elements, to resolve during the payroll process and the order in which they resolve.

Identify the gross and net pay accumulators for the payroll process.

The banking process determines net pay by referencing the net pay accumulator.

Specify whether the process applies to absence or payroll processing.

They're very similar, but some differences occur during retroactive processing.

The Process List Manager, a program that calls the PIN Manager during the payroll process to resolve elements on the process list, begins at the top of the process list and reads one section at a time, according to the specified sequence. Whenever the Process List Manager encounters a conditional formula, it calls the PIN Manager for resolution. If the formula resolves to zero, the section is not processed; if the formula resolves to a nonzero number, the section is processed.

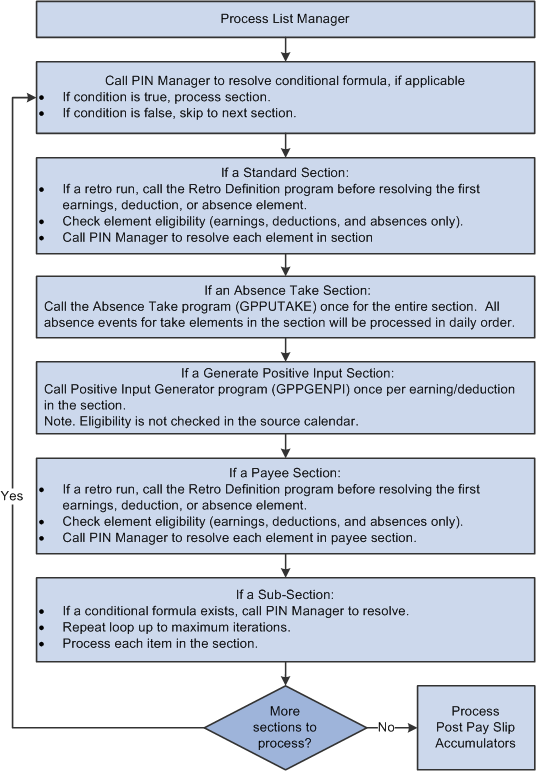

Image: The Process List Manager

This diagram illustrates how the Process List Manager and PIN Manager work together to resolve each section of the process list during a payroll or absence run.

Here are some guidelines for verifying that elements in sections and sections in process lists are ordered logically in the correct sequence for the payroll run:

Entitlement processing for absences adds to the balance.

Take processing takes away from the balance. If you include absence entitlement and absence take elements on the same process list and put the entitlement elements before the take elements, the additional balance becomes available for take processing.

If an array needs to populate data fields before the system can execute a conditional formula, add the section with the array before the conditional section.

Non-percent rate code earnings need resolving before any percent rate code earnings, so that members of any Comp Rate (compensation rate) code group that need to be used in a percent calculation have been resolved.

Base pay rate code earnings need resolving before any non base-pay rate code earnings, so that the appropriate hourly rate can be calculated and available for any hourly, plus flat amount rate code calculations.

If an element exists in a standard section and a generate positive input section and if the standard section precedes the generate positive input section, the system considers any adjustments to base and units when generating positive input for that element.

The PIN Manager returns the value as the resolved amount, plus the adjustment. If an element exists only in a generate positive input section, adjustments are ignored during processing.

This topic discusses:

How changes to a process list can affect retroactive processing.

Recalculating subprocess sections during retroactive processing.

How Changes to a Process List Can Affect Retroactive Processing

Pay attention to effective dates. If you modify an effective-dated set of data that applies to previously processed payroll periods, when retroactive processing is run, the results will vary. If you want to change the section for future payroll periods only, add a new effective-dated row to the section, then modify the list of elements.

Recalculating Subprocess Sections During Retroactive Processing

When a subprocess section is executed during retroactive processing, the Retro Recalc (retroactive recalculation) option, which you select for the earning and deduction elements on the Earnings - Calculation page, applies. For example, if you select Do Not Recalc (do not recalculate), the element isn't recalculated when it's encountered in the subprocess section.