Understanding the IRR Process

This topic lists prerequisites and discusses the IRR process.

Here are some prerequisite tasks that must be completed before you can process IRR and ROST reports:

Set up IRR remarks.

Set up Nature of Action (NOA) codes.

Before you create an IRR, you must define NOA codes to report to the Office of Personnel Management (OPM) on IRRs. Each NOA code has a unique numerical code that identifies the nature of action for statistics and data processing.

PeopleSoft delivers standard NOA codes in the Nature of Action table in PeopleSoft HCM. These codes are based on information from the OPM Bulletin Board. You can also create new NOA codes.

Define IRR reportability for earnings codes.

Define the pay year for every pay calendar that you establish.

The IRR Fiscal Data Accumulation Structured Query Report (SQR) Report process (FGPY006) requires this. We recommend that the pay year match the pay end date.

Associate Personnel Action Request (PAR) remarks with IRRs.

All PAR remarks display on the IRR Service History (Individual Retirement Record service history) page. However, only the PAR remarks that you designate as IRR reportable in the PAR Remarks table appear in the final IRR report.

You must maintain an IRR for each employee who is covered by either the Civil Service Retirement System (CSRS) or the Federal Employee Retirement System (FERS). Employees who are covered by CSRS require SF-2806. Employees who are covered by FERS require SF-3100.

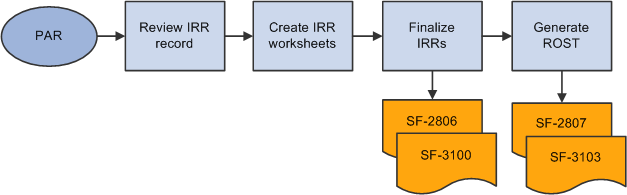

Summary of the IRR Process

Here is a summary of the steps in the IRR process:

Link a separation NOA code to a PAR.

The system generates an IRR control record and the IRR process begins.

View and maintain IRR-related information in the IRR component.

Create an IRR worksheet to verify the information that is stored on the IRR pages.

Run the Individual Retirement Records SQR Report process (FGPY007) to generate the final IRR.

Generate a ROST form that summarizes the information in all of the IRRs for that payroll run.

Generate a supplemental IRR or correction IRR if adjustments are necessary.

Create an IRR Fiscal Data Accum (Individual Retirement Record fiscal data accumulation) report.

Illustration of the IRR Process

This illustration shows an overview of IRR and ROST processing:

Image: Steps for generating IRR records and ROST reports

This illustration shows an overview of IRR and ROST processing.