Recording One-Time Tax Deductions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAY_SHEET_ADD_O |

Review one-time tax considerations for a single employee, override an existing tax, increase an existing tax, and refund a tax amount. |

|

|

By Payline - One-Time Taxes Page |

PAY_SHEET_LINE_O |

Review one-time tax considerations for a single employee, override an existing tax, increase an existing tax, and refund a tax amount. |

|

By Payline Security - One-Time Taxes Page |

PAY_SHEET_LN_O |

Review one-time tax considerations for a single employee, override an existing tax, increase an existing tax, and refund a tax amount. |

The system computes regular taxes based on tax data at the company level and the employee level. To make a permanent change to tax data, use the appropriate tax page, depending on which data you change.

While each One-Time Tax record corresponds to a Pay Earnings record, the one-time deduction is based on all the pay earnings that are associated with the employee, unless you pay the pay earnings on a separate check. In this case, the one-time deduction that is associated with the pay earnings affects only the pay earnings on that separate check.

To make a one-time tax for the same tax apply to only one pay earnings, pay the pay earnings on a separate check. If you enter more than one one-time tax for the same tax on multiple pay earnings, but don't enter separate check information, the system produces an error message during the Pay Calculation process.

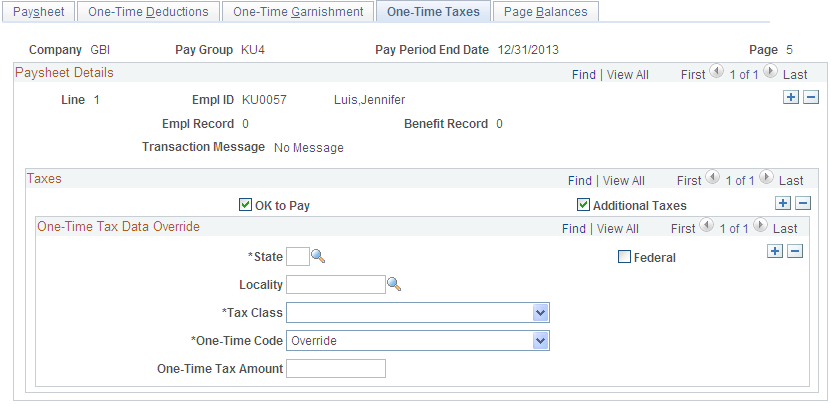

Use the By Paysheet - One-Time Taxes page (PAY_SHEET_ADD_O) to review one-time tax considerations for a single employee, override an existing tax, increase an existing tax, and refund a tax amount.

Navigation

Image: By Paysheet - One-Time Taxes page

This example illustrates the fields and controls on the By Paysheet - One-Time Taxes page.

Taxes

|

Field or Control |

Definition |

|---|---|

| Additional Taxes |

This check box determines whether the system takes, on an individual check, the additional withholding specified on the Federal Tax Data 1 page, State Tax Data 1 page, and the Canadian Income Tax Data pages. By default, this check box is selected. If you do not want to take the employee's regular additional taxes out of a check, deselect this check box. The system ignores this check box in the following situations:

|

One-Time Tax Data Override

|

Field or Control |

Definition |

|---|---|

| (CAN) Canadian Tax Type |

Select from the available values:

|

| One-Time Code and One-Time Tax Amount |

Select from the following one-time codes:

Note: Arrears Payback is not a valid option for one-time tax overrides. |

| PA EIT Work PSD Code and PA EIT Residence PSD Code(Pennsylvania Earned Income Tax work Political Subdivision code, and Pennsylvania Earned Income Tax residence Political Subdivision code) |

(These fields appear only when the state is Pennsylvania.) Under PA Act 32, you must identify the PSD code of the employee's work locality and residence locality for each Pennsylvania local Earned Income Tax (EIT) amount withheld from an employee. You must enter the codes for the following one-time data entry transactions:

Note: To save the page, you must enter both codes when the pay check date on the calendar is 01/01/2012 or after, Locality is not blank, and Tax Class is Withholding. |

Note: (USA) Do not use the One-Time Taxes page to change taxes that have wage limits associated with them, such as FICA, state disability, and state unemployment. The system recalculates taxes with maximums every time you run the Pay Calculation process. If you make an adjustment this pay period, the system corrects it in the next pay period.

Note: (CAN) Do not use the One-Time Taxes page to change taxes with associated wage limits, such as CPP, Quebec Pension Plan, and Employment Insurance. The system recalculates taxes with maximums every time you run the Pay Calculation process. If you make an adjustment this pay period, the system corrects it in the next pay period.