This chapter provides the details of Inflation-Indexed Instruments.

Topics:

· Introduction to Inflation-Indexed Instruments

· Data requirement Inflation-Indexed Instruments

· Dynamic Inflation Indexing logic

Inflation-Indexed Instruments is designed to provide investors with a hedge against inflation and can be either in the form of an asset or liability. Banks can invest in inflation-indexed security/bonds or can issue inflation-indexed deposit and advance inflation-indexed loan.

These instruments were created to meet the needs of longer-term investors wanting to insulate their investment principal from erosion due to inflation. The initial paramount and/or interest is indexed to the non-seasonally adjusted Consumer Price Index (CPI) or Whole-sale Price Index (WPI). The index ratio (IR) is determined by dividing the current Index level by the level that applied at the time the security was issued or last re-indexed. If there is a period of deflation, the principal value can be reduced below par at any time between the date of issuance and maturity. However, if at maturity the inflation-adjusted principal amount is below par, the security is redeemed at par.

There are three types of Inflation-Indexed Instruments available in the market:

1. Inflation protection to both principal and interest payments

§ The inflation component would be adjusted in the principal by multiplying the principal with IR. At the time of redemption, adjusted principal or the face value, whichever is higher, would be paid

§ The interest rate will be protected against inflation by paying a fixed coupon rate on the principal adjusted against inflation

2. Inflation protection only to the principal

§ The inflation component would be adjusted in the principal by multiplying the principal with IR. At the time of redemption, adjusted principal or the face value, whichever is higher, would be paid.

§ The interest rate will be paid on an unadjusted principal.

3. Inflation protection only to interest payments

§ The principal will not be adjusted against inflation. The face value will be redeemed at maturity

§ The interest rate will be protected by adjusting the coupon rate against inflation

FSI_D_BORROWINGS, FSI_D_LOAN_CONTRACTS, FSI_D_INVESTMENT, FSI_D_TERM_DEPOSITS, and FSI_D_MORTGAGES are the instrument tables which support the Inflation Indexing functionality. Below columns are essential for Modeling Instrument as Inflation indexed:

|

Column Name |

Display Name |

Description |

|---|---|---|

|

BASE_INDEX_VALUE |

Base Value of Index |

This is the value of the index at the time of the origination of the contract. This is expected to be a number. Example: If the index used is the Consumer Price Index (CPI) then the value will be 101, 110, etc. This must not be represented as a rate i.e. inflation rate such as 7%. This is applicable in case of the index (like inflation) linked instruments. |

|

INDEX_ID |

Index Identifier |

System Identifier of the index which will be used to determine cash flows for index-linked instruments. Example: System ID of Consumer Price Index (CPI), Wholesale Price Index (WPI). When left NULL, it is assumed that there is a negotiated index rate which will be supplied separately, in the FSI_ACCOUNT_INDEX_HIST table. |

|

INDEX_ADJ_TYPE |

Index Adjustment Type |

In the case of index-linked instruments, this indicates the components (principal, interest) to which indexation is applicable. Possible values are Not applicable, Principal and Interest, Principal only, Interest only. The reference table is FSI_INDEX_ADJ_TYPE_CD/MLS. |

|

CAP_PROTECTION_CATEGORY |

Capital Protection Category |

This indicates whether capital (i.e. the principal) is protected at a minimum level in case of index-linked instruments or not. This is applicable for Index Adjustment Type of “Principal and Interest” or “Principal Only”. Reference table is FSI_CAP_PROTECTION_CAT_CD/MLS |

|

MAX_INDEX_VALUE |

Maximum Value of Index |

This is the maximum value of the index from the origination date till as of the date of the contract. This is expected to be a number. Example: If the index used in Consumer Price Index (CPI) then the value will be 101, 110, etc. This must not be represented as a rate i.e. inflation rate such as 7%. This is applicable in case of the index (like inflation) linked instruments, when CAP_PROTECTION_CATEGORY = 2 (Max during life), where the highest index value needs to be protected for instrument lifetime. |

· FSI_ACCOUNT_INDEX_HIST

When INDEX_ID is not provided (or NULL) in the instrument record, the Engine refers to the FSI_ACCOUNT_INDEX_HIST table for current Index Value. Identity Code, Id Number, and As of Date acts as a unique identifier.

|

Column Name |

Display Name |

Description |

|---|---|---|

|

AS_OF_DATE |

MIS Date |

The date at which the data is current, for example, “30-SEP-10” |

|

IDENTITY_CODE |

Identity Code |

System identified data |

|

ID_NUMBER |

Account Surrogate Key |

Unique record identifier such as account number. |

|

INDEX_START_DATE |

Index Start Date |

Date from which the given index value is applicable |

|

INDEX_END_DATE |

Index End Date |

Date till which the given index value is applicable |

|

INDEX_VALUE |

Value of Index |

Value of index to be used to calculate cash flows for index adjusted instruments |

NOTE:

If FSI_ACCOUNT_INDEX_HIST table is used to store Index Value, please ensure to give Index value for all date ranges from origination till maturity.

· FSI_INDEX_ADJ_TYPE_MLS

|

INDEX_ADJ_TYPE_CD |

INDEX_ADJ_TYPE |

DESCRIPTION |

|---|---|---|

|

0 |

Not applicable |

Not applicable |

|

1 |

Principal and Interest |

Principal and Interest |

|

2 |

Principal only |

Principal only |

|

3 |

Interest only |

Interest only |

· FSI_CAP_PROTECTION_CAT_MLS

|

CAP_PROTECTION_CATEGORY_CD |

CAP_PROTECTION_CATEGORY |

DESCRIPTION |

|---|---|---|

|

0 |

No Floor |

No Floor |

|

1 |

Floor of 1 |

Floor of 1 |

|

2 |

Max during life |

Max during life |

If Inflation Adjustment Type (INDEX_ADJ_TYPE) is “Not applicable” then Instrument is NOT treated as Inflation-indexed. Else, if it is “Principal and Interest” or “Principal only” or “Interest only”, the engine determines the instrument as inflation-indexed.

Once the instrument is determined as inflation-indexed, the engine calculates Index Factor, and Inflation adjusted Principal, Inflation adjusted Interest, and Adjustment to Principal and Adjustment to Interest.

4. Calculation of Index Factor

The logic of calculation is dependent on Capital protection category (CAP_PROTECTION_CATEGORY)

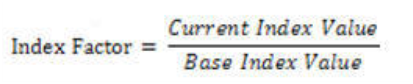

§ If Capital Protection Category is ‘0’ (No Floor) then

Description of the Index Factor formula follows

For example, if Base index value given = 100, on a given date, Current index value = 98. When capital protection category is “No Floor”, index factor = 98/100 = 0.98.

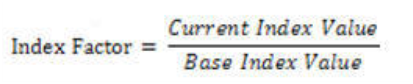

If Capital Protection Category is ‘1’ (Floor of 1) then

Description of the Index Factor formula follows

If Base index value given = 100, and current index value = 98, if capital protection category is “Floor of 1”, then index factor = 1, maximum of 1 and calculated index factor of 0.98.

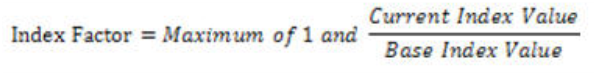

§ If Capital Protection Category is ‘2’ (Max during life) then

Description of the Index Factor formula follows

When the capital protection category = Max during life, the engine would not be able to go back to obtain historical index value for calculation of maximum index value from the origination date till as of date. Hence max index value from origination to as of date needs to be provided in the field- MAX_INDEX_VALUE. The engine will use this value and forecasted Index factor (calculated) to determine Max's index value.

i. If Max_index_value given is 101 (index factor = 101/100 = 1.01, assuming base index of 100), index factor calculated on previous date is 1.03, whereas for current date it is 0.98. Then Index factor (max) for current date= 1.03, maximum of 1.01, 1.03, 0.98.

If instead Max_index_value is 104 (index factor = 1.04 assuming base index of 100), then index factor (max) for current date= 1.04, maximum of 1.04, 1.03 and 0.98.

If the Index factor (max) goes below 1, then the floor of 1 is applied.

For dynamic business, this field is not required, as the engine will be able to calculate Index Factor from the New Business Origination date, hence will calculate Max Index Factor from Origination.

If INDEX_ID, given in Instrument data, is NULL or ‘0’ “Current Index Value” is obtained from FSI_ACCOUNT_INDEX_HIST. The engine will match the instrument with Index data using Identity Code, Id Number, and As of Date. The index value for the respective date will be derived from given applicable date ranges.

If Index value needs to be derived from the forecasted Economic Indicator, INDEX_ID should be populated with Economic Indicator System ID. Index Value for the respective date will be derived from the applicable forecasted Modeling Time Bucket.

“Base Index Value” is available at the instrument record.

NOTE:

Index Factor is only populated at FSI_O_PROCESS_CASH_FLOWS table, as FE 194. For more information on FE, see Financial Elements.

If Economic Indicator is used to set up Index value, the field Value Type in Rate management Economic Indicator UI should be saved as Numeric.

5. Calculation of Inflation-adjusted Principal and Interest

§ When Inflation Adjustment type is ‘1’ (Principal and Interest), then

Description of the Inflation-adjusted Principal and Interest formula follows

§ When Inflation adjustment type is ‘2’ (Principal only), then

Description of the Inflation-adjusted Principal formula follows

§ When Inflation adjustment type is ’3’ (Interest only)

Description of the Inflation-adjusted Interest formula follows

Here principal or interest cash flow are index unadjusted principal and interest cash flow. For details around how Principal and Interest cash flows are calculated, see the Cash Flow Calculations.

NOTE:

If Inflation adjustment is “Principal only”, Interest cash flow is not inflation-adjusted (remains as is). Similarly when adjustment is “Interest only”, Principal cash flow is not inflation-adjusted (remains as is).

For example, for a inflation indexed instrument, on payment date, unadjusted principal cash flow is 100,000 and calculated index factor is 1.02 (Base index =100 and current index on payment date is 102), then Index Adjusted principal cash flow = 100,000 * 1.02 = 102,000

Balances are adjusted using unadjusted principal cash flow. From the above example, if balance before principal cash flow is 1,000,000 then the balance would be reduced to 900,000 (1,000,000-100,000).

Index adjusted Principal runoff is populated in existing principal payment FEs. Similarly, Index adjusted Interest runoff is populated in existing interest payment FEs.

6. Calculation of Index adjustment to Principal and Interest

§ Index adjustment to principal: Difference between principal cash flow before applying index adjustment and index adjusted principal cash flow.

§ Index adjustment to interest: Difference between interest cash flow before applying index adjustment and index adjusted interest cash flow.

Index adjustment to principal cash flows is populated in FE 178. Index adjustment to interest cash flow is populated in FE 179. For IR Gap FE 665 and FE 669 are populated respectively. For LR Gap FE 1665 and 1669 are populated.

If Index Adjusted principal cash flow = 100,000 * 1.02 = 102,000, and unadjusted Principal cashflow is 100,000, then index adjustment to principal cash flow will be = -2,000 (100,000 – 102,000)

NOTE:

For more information on FE in which Inflation Adjustment to Principal, Inflation Adjustment to Interest, see the Financial Elements.

When instrument reprices multiple times, interest in reprices event calculated gets adjusted with Index factor. If within a payment event there are multiple reprice events, interest on each event gets adjusted with each respective index factor.

Dynamic Inflation indexing, for New Business, follows a similar flow, except the logic of deriving Current Index Value and Base Index Value.

In the case of Dynamic business Current Index value is always obtained by looking up the forecasted Economic Indicator for Dynamic Cash flow date. The engine looks up into the forecasted Time Bucket.

Base Index Value is obtained by looking up the forecasted Economic Indicator for Dynamic business Origination date. This date is looked up into the forecasted Time Bucket, and the respective index data of that time bucket is obtained.

NOTE:

In Transaction Strategy, Base Index Value can either be entered into field Base Index Value or left blank. If it is blank, the engine will obtain Base index value from the forecasted Economic Indicator for defined Transaction strategy origination date. This date is looked up into the forecasted Time Bucket, and the respective index data of that time bucket is obtained.

If the Base Index Value is entered, the engine will consider it for calculation.