This section provides information about the admin settings that must be performed to use the OFSBCE application features.

Topics:

· Currency Conversion Settings

To add a Fiscal Period, follow these steps:

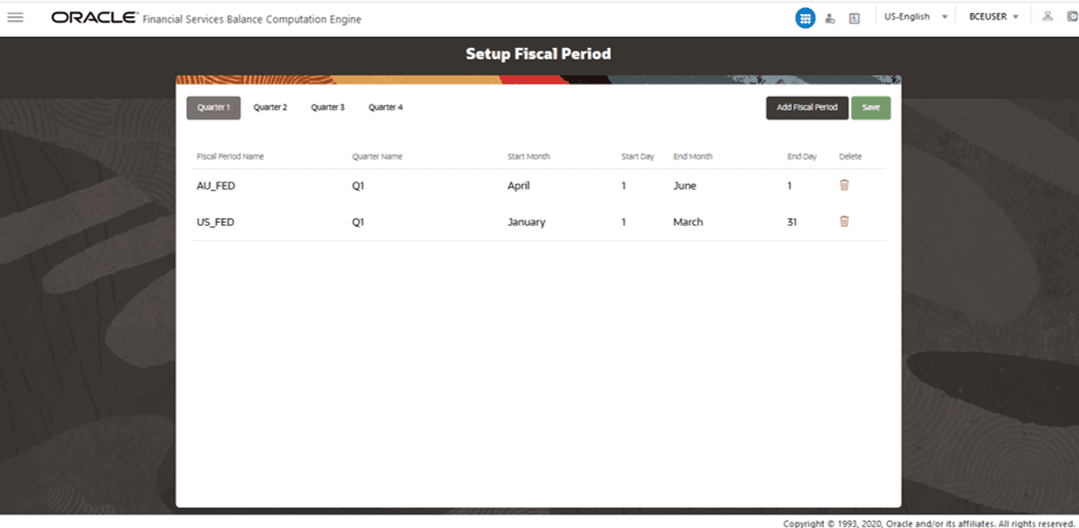

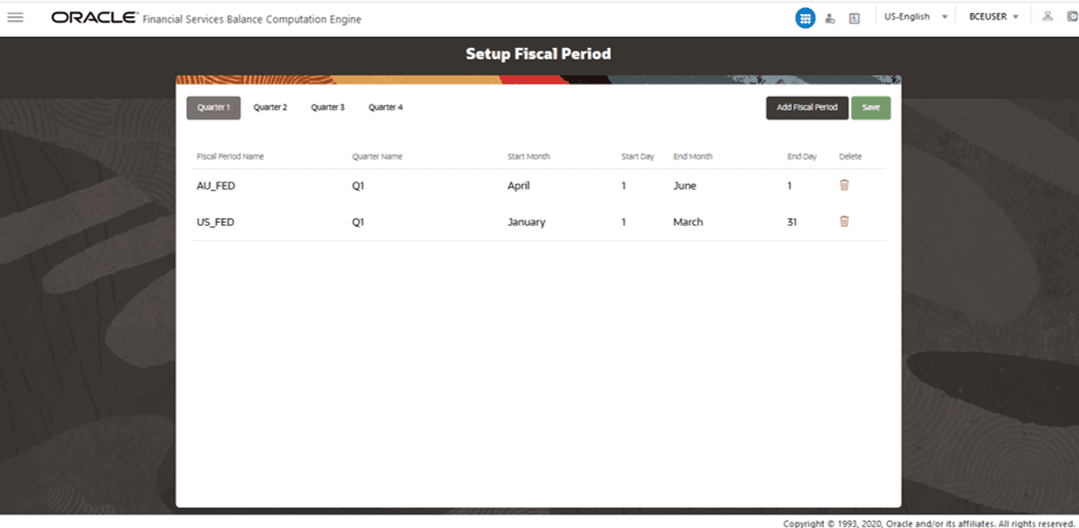

1. From OFSBCE Home, select Financial Services Balance Computation Engine. In the Navigation List, select Execution, select Administration and then select Setup Fiscal Periods. The Setup Fiscal Period page is displayed. In the illustration, already created Fiscal Period details are displayed.

Figure 9: Setup Fiscal Period Page

2. There are four built-in fiscal year quarters. They are Quarter 1, Quarter 2, Quarter 3, and Quarter 4. Select the required Quarter to create a new Fiscal Period.

3. To create a new Fiscal Period, click Add Fiscal Period. A new row is added in the list with a new Fiscal Period Name. To edit the name, double-click the Fiscal Period Name value and modify.

4. To select the starting month for the Fiscal Period, double-click the Start Month value and select the required value from the list. By default, this field displays January.

5. To select the starting day of the selected Fiscal Period Start Month, double-click the Start Day value and select the required value from the list. Similarly, select the values for End Month and End Day for the selected Fiscal Period.

6. Click Save to save these details for the new fiscal period.

7. To delete

an existing Fiscal Period, click the associated

with it.

associated

with it.

NOTE |

The Setup Fiscal Period page must contain the Fiscal Period sourced as a part of the Fiscal Period present in the STG_LEGAL_ENTITY table. |

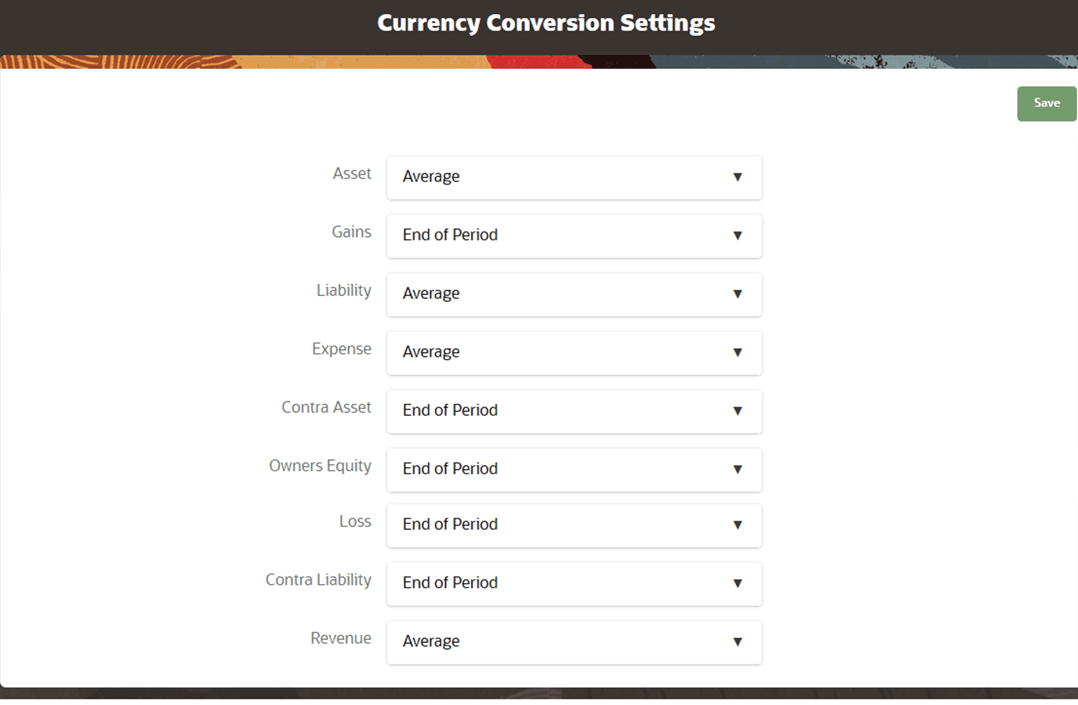

Setup the currency conversion settings to assign the Rate Type to a GL Type, which is required during the Execution process in PMF.

To setup the currency conversion settings, follow these steps:

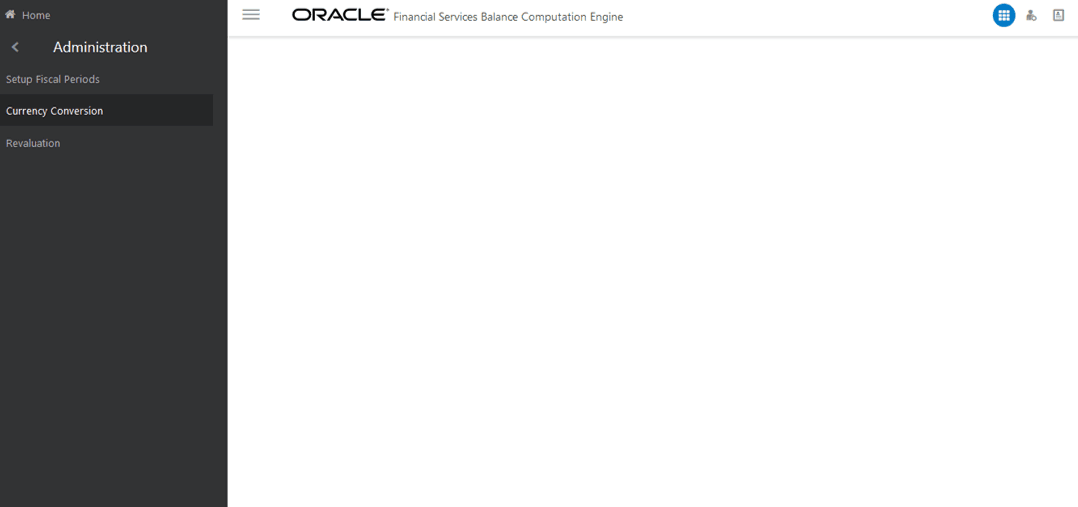

1. From OFSBCE Home, select Financial Services Balance Computation Engine. In the Navigation List, select Currency Conversion.The Currency Conversion Settings page is displayed.

Figure 10: Navigation to Currency Conversion

2. Select the required value for each entity.

Figure 11: Currency Conversion Settings Page

Select the End of Period, Daily or Average Rate Type for the following GL type entities:

§ Asset

§ Gains

§ Liability

§ Expense

§ Contra Asset

§ Owners Equity

§ Loss

§ Contra Liability

§ Revenue

3. Click Save to save the currency conversion settings.

The Revaluation Process reads the following setup information during the process execution. To setup the Revaluation Settings, follow these steps:

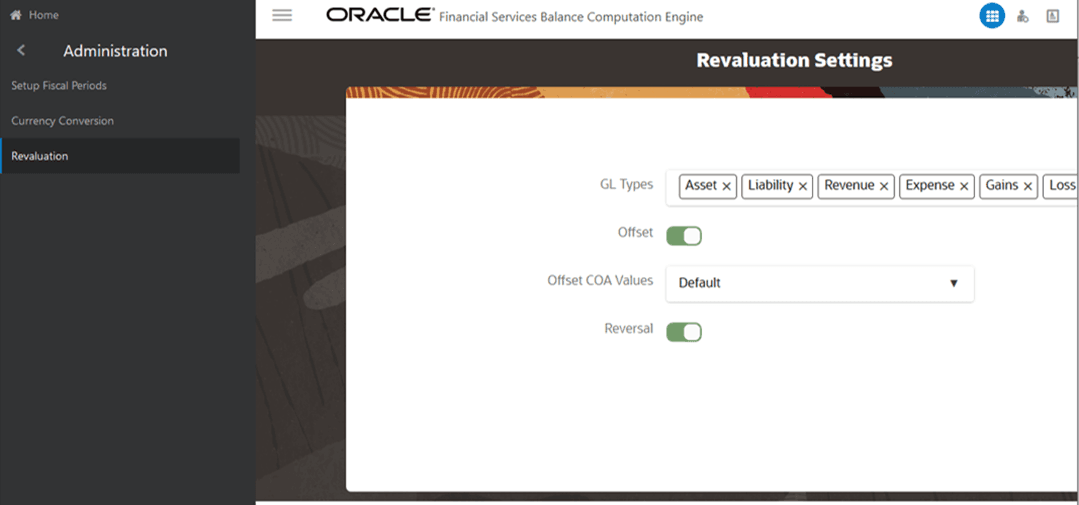

1. From OFSBCE Home, select Financial Services Balance Computation Engine. In the Navigation List, select Revaluation. The Revaluation Settings page is displayed.

Figure 12: Navigation to Revaluation Settings

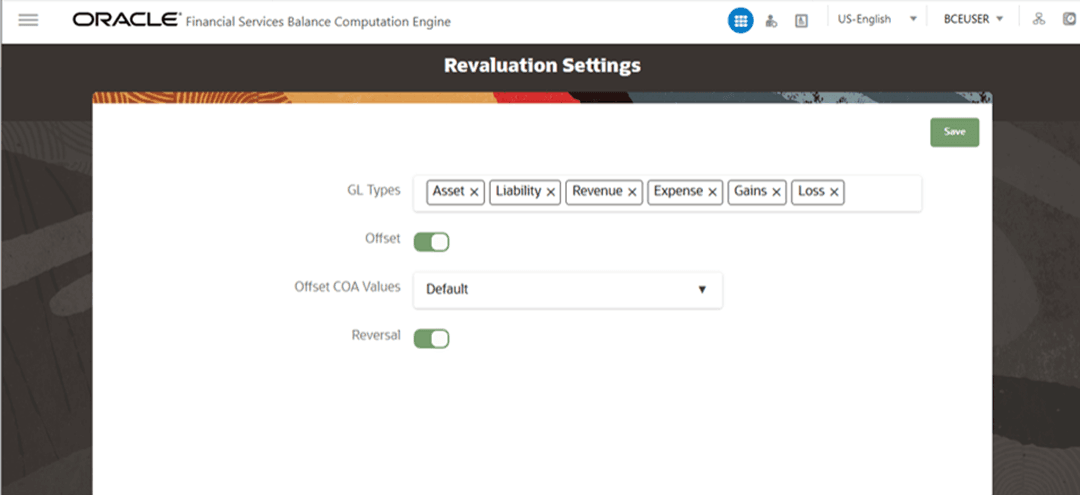

2. In the Revaluation Settings page, set the following values. These settings affect the design and execution part of the Revaluation Process in the PMF.

Figure 13: Revaluation Settings Page

Table 1: Revaluation Settings entities and their description

Entity |

Description |

GL Types |

The General Ledger types of those journal entries, which must be considered during the Revaluation Process. |

Offset |

Select this option if you must generate the offset balances against the Revalution Adjustments for equivalents. |

Offset COA Values |

Order the Offset Chart of Account values either by the Default value or System value. System: Instrument gain is a part of the output of the offset entries. Every calculation is done at the Management Ledger Gain level including the instrument account. Then in the Revaluation process execution stage, for each account in the Management Ledger Period Balances, the offset balance is generated. Default: When the Offset COA Values are set to Default, the system generates the offset balances at the Legal Entity grain. |

Reversal |

Select this option if you want to revise the Revaluation for period balances by reversing the prior period adjustments and adding current period adjustments. |

3. Click Save to save the Revaluation settings.