Topics:

· About Financial Service Analytical Applications

· About Oracle Fusion Accounting Hub Cloud Service

· About Financial Services Data Foundation Integration with Accounting Hub Cloud Service

· OFSAA-AHC Interface Architecture Overview

· OFSAA–AHC Integration Overview

· Data Flow for FSDF Integration with AHCS

Oracle Financial Services Analytical Applications (OFSAA) enables financial institutions to:

· Measure and meet risk-adjusted performance objectives

· Cultivate a risk management culture through transparency

· Lower the costs of compliance and regulation

· Improve insight into customer behavior

OFSAA uses industry-leading analytical methods, shared data models, and application architecture to enable integrated risk management, performance management, customer insight, and compliance management. OFSAA actively incorporates risk into decision-making, enables to achieve a consistent view of performance, promote a transparent risk management culture, and provide pervasive intelligence.

OFSAA delivers a comprehensive, integrated suite of financial services analytical applications for both banking and insurance domains. It includes many applications such as Profitability Management, Asset Liability Management, Customer Insight, and Risk Management.

See Oracle Financial Services Analytical Applications portal for additional details.

Fusion Accounting Hub Cloud, part of Oracle Enterprise Resource Planning Financials Cloud suite, is a robust accounting engine that integrates and aligns information from virtually any source system to consistently enforce accounting policies and meet multiple reporting requirements, giving institutions the agility, control, and insight needed to run their business. Oracle Fusion Cloud Financials empowers modern, adaptable finance with increased productivity and improved business decisions. Oracle Financials is a comprehensive solution delivering extensive support for global companies in a variety of industries, and continuous innovation in key technologies such as machine learning, intelligent automation and analytics, deployed in the cloud to achieve more, faster and with fewer resources.

See Oracle Financials Cloud portal for additional details.

Integration of AHC and OFSAA provides a basis for a unified finance and risk architecture to the financial services industry. The benefits of having a ready-to-use interface between AHC and OFSAA are as follows:

· The OFSAA repository of transaction and reference information becomes a single, unified analytical repository for risk and finance.

· The integration improves consistency in risk and finance data for producing risk-adjusted measures.

· OFSAA customers can take advantage of AHC rules and accounting engines to improve the efficiency and audit ability to transform transactions from financial services systems such as deposits, loan accruals, payments, trades, and withdrawals into accounting.

· Information in the OFSAA foundation such as customer, account, product, branch, and channel information is accessible in AHC, for defining accounting treatments in addition to generating accounting balances. Conditional logic can be used to vary accounting treatments based upon values from transactions and contract balances. The same OFSAA transactions and contract balances are used by AHC to book entries and generate financial balances, which in turn are reused by OFSAA for analytical processing.

· Using AHC balances for analytical processing facilitates the reconciliation of operational risk losses and accounting as prescribed by regulations such as Basel II and III. These accounting balances can be reconciled using the OFSAA Reconciliation Framework. Reconciliation rules can be defined to map AHC balances to product processor information. For example, accounting for provisions and losses can be based upon customer account balances, as provided to OFSAA and read by AHC enhancing the reliability of operational risk and provisioning measurement.

The following are the core constituents or functions of FSDF Integration with AHCS:

· Preconfigured Subledger Applications:

§ Retail Banking

§ Commercial Banking

§ Investment Banking

§ Islamic Banking

§ Treasury

§ Core Banking (using pass-through)

· Automated population of the source system and Subledger Application registration with AHCS.

· The configurable mechanism for grouping events data.

· The prebuilt mechanism for publishing events information to Accounting Hub Cloud Service.

· User interface allowing configuration of Subledger Applications and associated events information.

· The prebuilt mechanism to ingest balance information against the AHCS chart of accounts (GL Balance) and with Supporting Reference information (SR Balance).

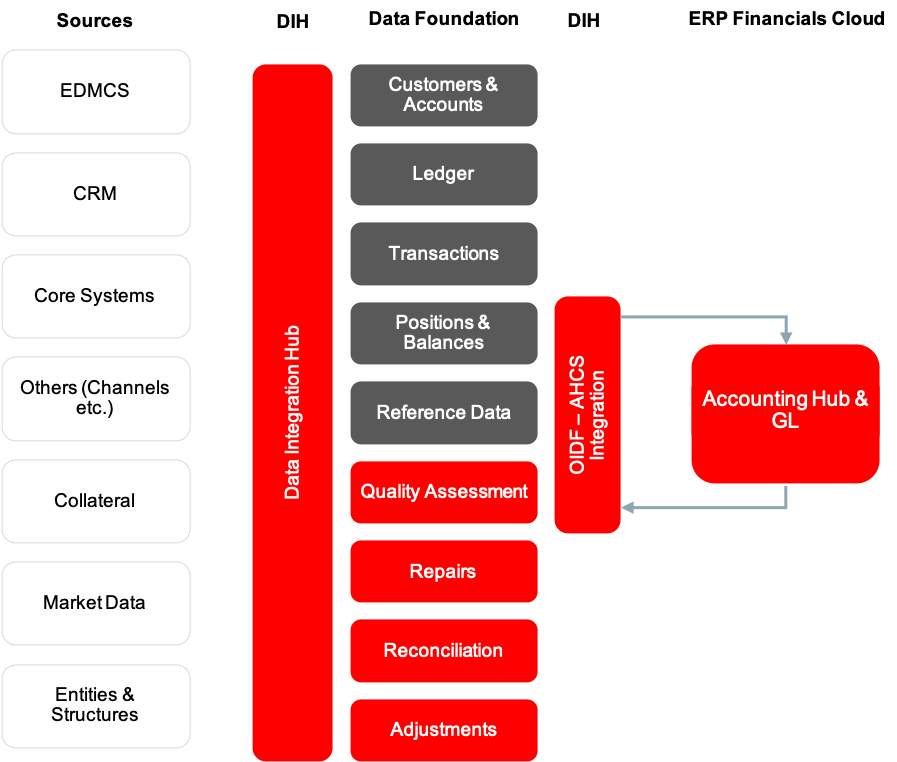

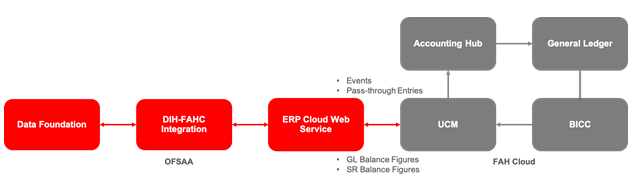

The following illustration displays the OFSAA-AHC Interface Architecture.

Figure 1: OFSAA-AHC Interface Architecture

The data flow between OFSAA and ERP Financials Accounting Hub Cloud and GL (abbreviated AHCS) is bi-directional. OFSAA includes all the accounts, contracts, and transaction information that AHC generates for its Subledger accounting. Additionally, the various products under the OFSAA suite require General Ledger and supporting reference balances.

Insurance data is extracted from OFSAA to AHC through DIH connectors (pre-packaged or custom) and is processed within the AHC using accounting rules. The updated GL balances are then extracted, to load General Ledger Balances and Supporting Reference Balances.

The flow from AHC to OFSAA is achieved through prebuilt DIH connectors. These connectors extract the GL and SR Balances from AHC and load them into the OFSAA staging post, which is available for all downstream applications.

The data flow between OFSAA and AHC takes place through files, as AHC is in the cloud environment.

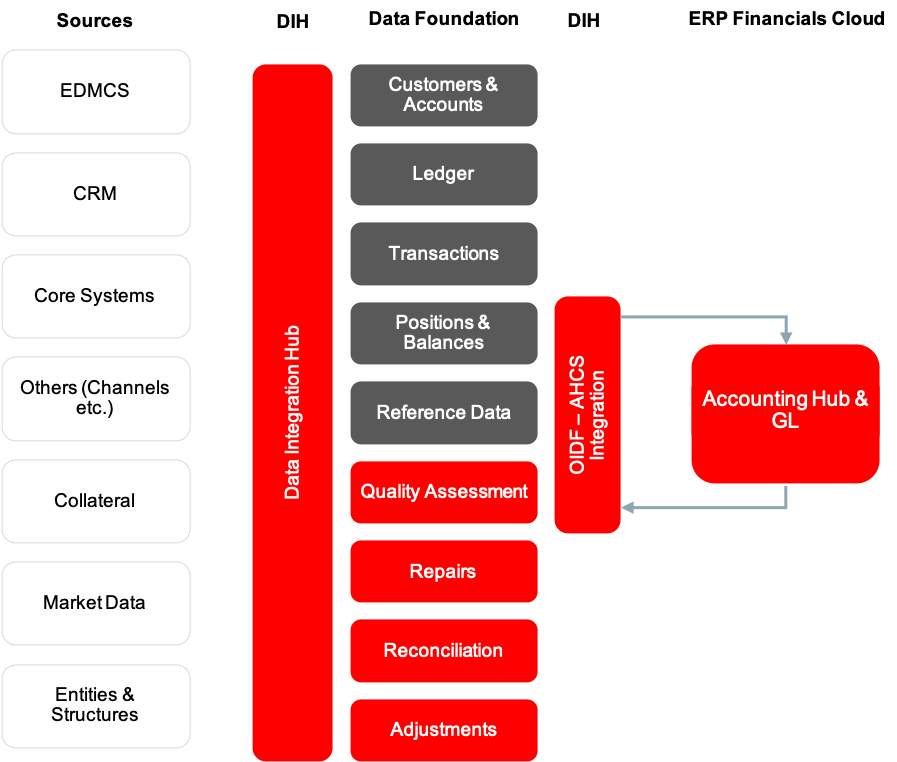

Figure 2: OFSAA–AHC Integration

The data flow between OFSAA and AHC takes place through files, with communication over REST APIs.

The integration consists of the following processes:

1. Generate SLA templates in the application for registration flow with AHCS

2. Extract data from FSDF for AHCS using DIH Connectors

3. Load GL data from AHCS using DIH Connectors

AHCS provides a macro-enabled XLSM template for the definition of SLAs while integrating with third-party systems. This template is deployed as part of OIDF Integration with AHCS installation and must be obtained from your instance of AHCS before setup or configuration.

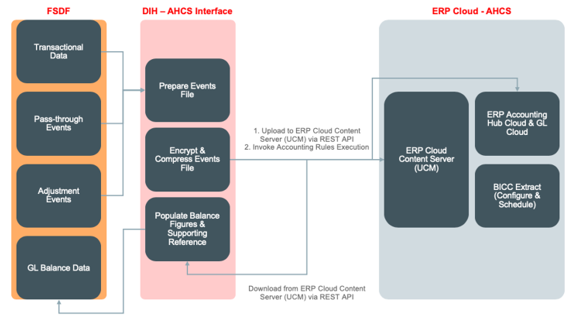

The sequence of steps are as follows:

1. Set up the application with information including details of your AHCS instance and required credentials.

2. Configure Sub Ledger Applications, required data attributes, and transaction types.

3. Register Sub Ledger Applications with AHCS:

4. Obtain the XLSM template file from your instance of AHCS

5. FSDF Integration with AHCS (the application) automates the population of the templates required for SLA registration by AHCS. This is relevant for SLAs defined out of the box and those configured by you.

6. Manually validate the filled templates using the macro-enabled functions built into them.

7. In case of errors, make required changes in the application and repeat the process.

8. After completion, , use the built-in function to generate a ZIP-format file from the filled, validated template files.

9. The file contains metadata of the source system that has to be registered, along with details of the SLA, its required attributes, and transaction types. The sequence of steps needs to be performed for each SLA defined in the application. See Registering with AHCS section below for more details.

10. The ZIP-format file thus generated must needs to be uploaded manually into your instance of AHCS.

11. After completion, Data Template for the SLA needs to be downloaded from AHCS and uploaded against the SLA in the application.

12. Configure your instance of AHCS as per financial accounting requirements.

13. After the setup, configuration, and registration steps are completed, execute batches of tasks that are automatically configured by the application. The application processes events, pass-throughs, and adjustments data, prepare required data files, format them appropriately, publish them to AHCS using its interfaces, and optionally, trigger processing of accounting rules in AHCS.

14. Configuration and processing of accounting rules, journals, sub-ledgers, and General Ledger are performed in your instance of AHCS.

15. Your instance of AHCS also needs to sequence or schedule production of GL balance and balance information with Supporting Reference using its standard processes

16. On completion of AHCS processing, including the production of files with GL balance and supporting reference balance information, execute a batch of tasks that obtains the files and load data into General Ledger and Management Leger entities in Data Foundation.

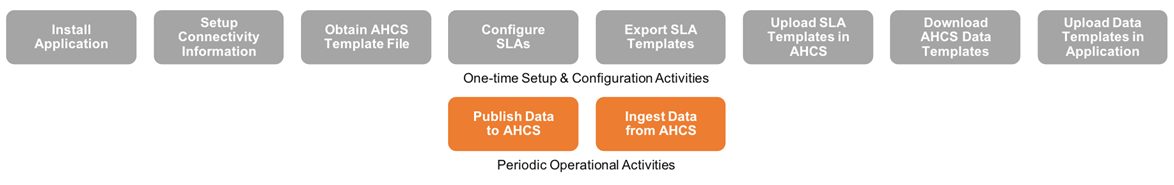

This section explains the data flow for FSDF Integration with AHCS.

Figure 3: Data Flow for FSDF Integration with AHCS

The FSDF Integration with AHCS is as follows:

· Transactions and pass-through accounting information are collated into Data Foundation through DIH Foundation.

· If required, said data is standardized in Data Foundation.

· DIH – Accounting Hub integration extracts relevant data from Data Foundation and prepares ZIP file, with header and line details, and metadata.

· DIH – Accounting Hub integration invokes ERP Cloud web service over REST APIs to a byte-stream ZIP file to ERP Cloud Universal Content Manager.

· See Oracle ERP Financials documentation for information on Accounting Hub Cloud. Note that, the URL for ERP Financials is accurate at the time of publishing this manual and may change with time. See your AHCS tenancy documentation for up-to-date details.

· Extracts of GL and supporting reference balance figures from Accounting Hub Cloud Service are configured and scheduled in BI Cloud Connector console, as detailed here.

· GL and SR balance extracts so configured in BICC produce output files and put those in UCM.

· Data Foundation Integration with Accounting Hub Cloud invokes an ERP Cloud web service over REST APIs to obtain the files produced by BICC.

· Data Foundation Integration with Accounting Hub Cloud loads GL and SR balance figures into appropriate Staging entities in Data Foundation as per mapping information detailed in this guide.