2 Generic Credit Card

The Credit Card Transfer is an interface that communicates with the shore-side Credit Card Service provider to obtain the card authorization and settlement through batch transfers.

Prerequisite, Supported Systems, and Compatibility

This section describes the minimum requirements to operate the supported credit card device for Generic Credit Card Handling.

Prerequisite

Credit Card Transfer.exe

Tools.exe

SPMS Parameters

Compatibility

SPMS version 20.1 or later. For customer operating on version below 20.1, database upgrade to the recommended or latest version is required.

SPMS Parameters

This section describes the Parameters available to the Credit Card Transfer module and they are accessible in Administration module, System Setup, Parameter function.

PAR_GROUP General

Table 2-1 PAR Group General

| PAR Name | PAR Value | Description |

|---|---|---|

|

Enable Signature Capture for Credit Card |

0 or 1 |

0 - Disables Signature Capture for Credit Card 1 - Enables Signature Capture for Credit Card |

|

Number of day before debarkation |

2 |

Specifies the number of days before guest debarkation date to swipe the exact amount for debit/credit card in online mode |

|

Disable C/Card and Posting when auth is decline |

0 or 1 or 2 |

0 - No credit card deactivation and no posting is disable. 1 - We will deactivate the credit card first, if there is no more active credit card, the guest posting will be disable. 2 - Deactivates the credit card but posting is still enable. |

|

Online Initial Auth Amount |

<Amount> |

Specifies the initial authorization amount for all card types when card is swiped at the terminal in Online mode. |

|

Online Debit Initial Auth Amount |

10,20,30,40 |

Specifies four amounts for the debit card initial authorization amount |

|

Top Up Percentage |

<value> |

Specifies the top up percentage to be calculated with the total authorized amount. For example: Total Auth Amount=1000 * 15% = 1150. |

|

Number of Credit Card Front Digit to Display |

<Value> |

Only value 0 - 6 is allowed in this parameter. The value define in this parameter is to reflect the front digit of the credit card number in the report. |

|

Card Track Data not Stored |

<BLANK> |

List of card types that should not store track data in database. Format (‘Card Type 1’,’Card Type 2’). For example: ('DS','DI','JC','DC') |

PAR_GROUP Interfaces

Table 2-2 PAR Group Interfaces

| PAR Name | PAR Value | Description |

|---|---|---|

|

Batch CCard Processing Format |

OHCCreditCard |

Specifies the message format to be generated by Credit Card Transfer |

|

Merchant ID |

<character> |

Defines the Merchant ID for the authorization file |

|

CC Auth/Settlement Folder |

Folder path |

Repository location for authorization/settlement files generated by OHC Credit Card Interface Note: To avoid adverse impact on your system, please abstain from using the following folder path: System Directory“\Users\Public\Documents\Oracle Hospitality Cruise” |

PAR_GROUP Not Specified

Table 2-3 PAR_GROUP Not Specified

| PAR Name | PAR Value | Description |

|---|---|---|

|

CC Transfer Format |

OHCCreditCard |

Specifies the message format to be generated by Credit Card Transfer |

System Configuration

This section describes the setup of various system codes required by the Generic Credit Card handling and these codes are setup in Administration module, Financial Setup, Department Setup.

Department Setup

Department Setup

A debit and credit department code of each credit card type accepted by the ship must be configured for charging and posting to take place.

-

Login to Administration module and select Financial Setup, Department Setup from the drop-down list.

-

Click New to create a Sub-Department code.

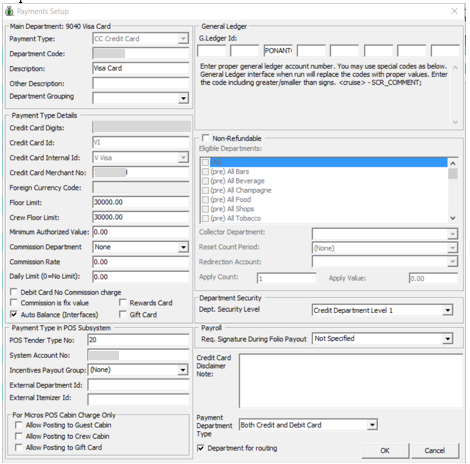

Figure 2-1 Department Code Setup

-

Under the Main Department section, enter the credit/debit card information such as Payment type, department code and description.

-

In the Payment Type Details section,

-

Enter the first two digits of the first set of the credit card number in Credit Card digit.

-

Enter the Credit Card ID, for example MC — MasterCard, VI — Visa, and others.

-

Select the corresponding Credit Card Internal ID from the drop-down box.

-

Enter the Credit Card Merchant Numberprovided by the Service Provider.

-

Set the Minimum Authorized Value to 0.

-

Select the Commission department from the drop-down list and update the commission rate in percentage.

-

Check the Debit Card No Commissioncharge if commission is not applicable to debit card.

-

-

In the Department Security access, select the appropriate security level from the drop-down box.

-

Select the Payment Type under the Payment Department Type, either Both Credit and Debit card, Credit card or Debit card.

-

Click OK to save.

Receipt Setup

A receipt can be generated upon payment and this requires a report template to be set up. A Standard Credit Card receipt template is available in Administration module, System Setup, Report setup, _Receipts group. Please contact Oracle Hospitality Cruise Support if you would like to configure a customized receipt format.

Transaction Services Installation

In order to have the program to work seamlessly and as a standard installation, a Web Services installation is required. Download the latest Installation Guide from Oracle Help Center and follow the steps to install

Registering a Credit Card

The Generic Credit Card handling has two operating modes - Attended and Unattended. The Unattended Mode offers user a payment solution in an unmanaged environment such as kiosk, self-service outlets, whereas the Attended Mode would require users’ intervention. Registration of credit card in both modes are performed through a Web Service function.

Registering Credit Card in Attended Mode

The Attended Mode is a direct sales mode that register a card, perform the sale transaction, and deactivate the card after the sale transaction is complete and at the same time insert the card details into the account as Inactive. A board card or cruise card is required in order to process the sales transaction and a re-registration of the card if the guest decide to use the same card for settlement at a later stage

-

Login to Management module and navigate to Guest Handling screen.

-

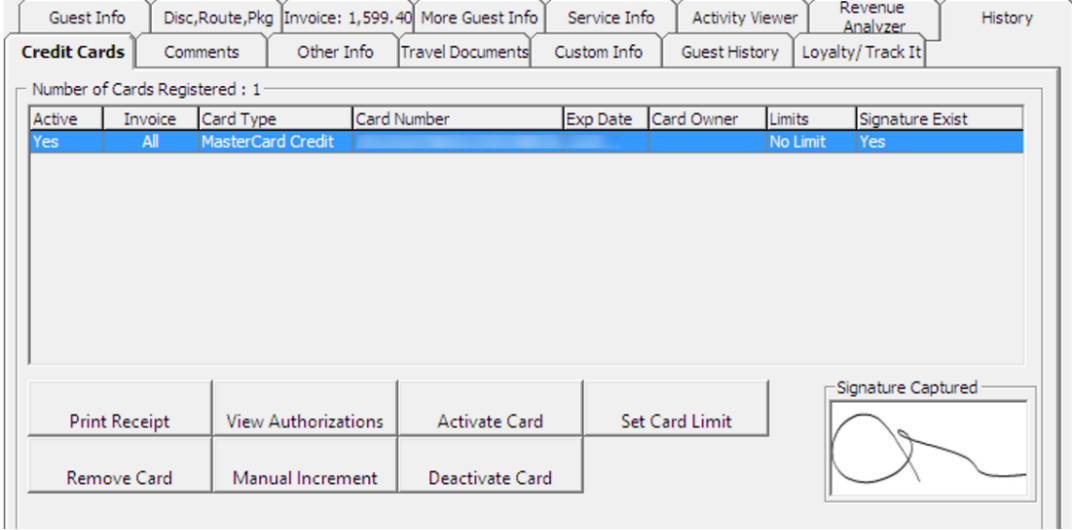

In the Search Panel, browse for the guest account and navigate to the Credit Card tab in the guest account. The registered card should be in an Inactive mode.

-

To display the initial authorization, select the credit card and click CView Authorization in the middle section of the screen.

-

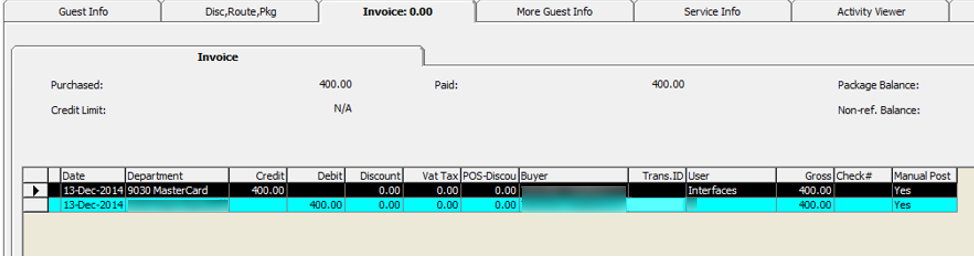

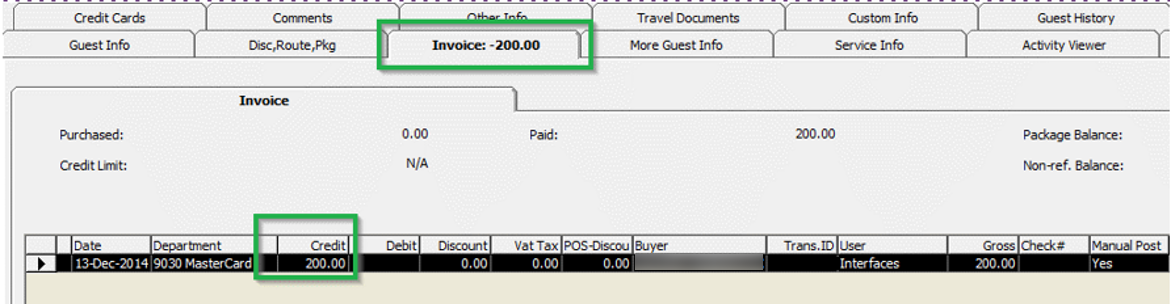

Navigate to the Invoice tab to view the sale transaction of the credit card. The amount is credited automatically onto the invoice if the card is a Debit Card.

Figure 2-2 Authorization Display on Invoice — Credit Card

Figure 2-3 Management Authorization Display on Invoice — Debit Card

Registering Credit Card in Unattended Mode

The Unattended mode registers the card as Active in the guest account and post a credit if the registered card is a debit card. A board card or cruise card is required for payment card registration.

-

Login to Management module and navigate to Guest Handling screen.

-

In the Search Panel, browse for the guest account and navigate to the Credit card tab in the Guest account.

Figure 2-4 Management Authorization View

-

Select the registered credit/debit card and click View Authorizations to display the Initial Authorization.

Figure 2-5 Management Initial Authorization View

Credit Card Transfer Interface

The Credit Card Interface has several functions enabled for Generic Card Transfer handling through the Credit Card Batch Authorization and they are listed below.

Table 2-4 Credit Card Transfer Interface Functions

|

Authorization |

Settlement |

|

|

Creating Incremental / Top up Authorization File

-

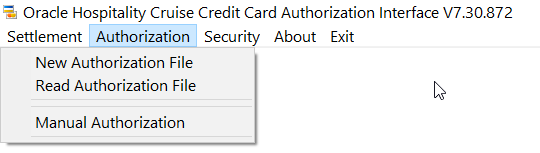

Start the Credit Card Transfer Interface and select Authorization menu, and New Authorization File from the drop-down menu.

Figure 2-6 Credit Card Transfer — Authorization Tab

-

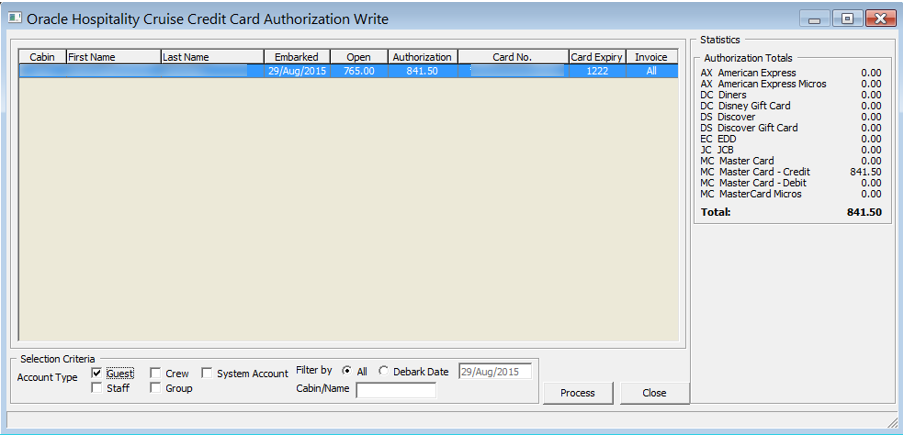

In the Cruise Credit Card Authorization Write screen, a list of credit cards requiring incremental authorization are displayed in the grid. Use the Selection Criteria to filter the desire information.

Figure 2-7 New Authorization Screen

-

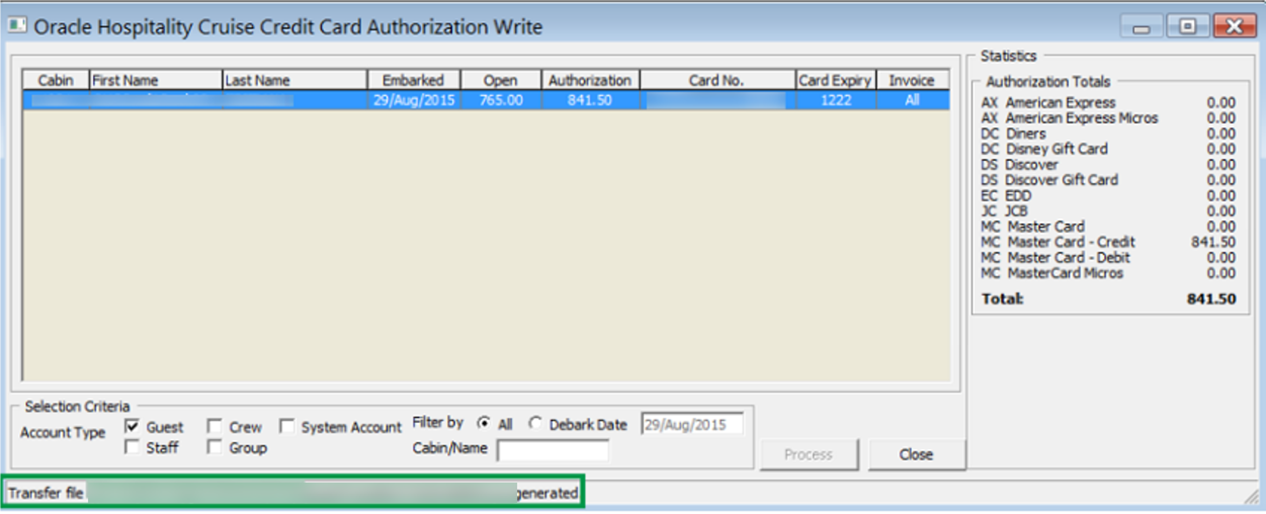

Click the Process button to generate the Authorization file. After the file generation completes, location of the saved file is indicated on the screen.

Figure 2-8 Authorization File Location

-

In Management module, Guest Handling function, select the guest account and navigate to Credit Card tab. Click View Authorization to open the Authorization screen. Status of the transaction pending authorization are reflected as ‘Outstanding’.

Figure 2-9 Management — Authorization Screen Manual

Reading Authorization File

-

Repeat step 1 of Creating Incremental/Top Up Authorization File and select Read Authorization File from the drop-down menu

-

At the Cruise Credit Card Authorization Read screen, click Open Fileand search for the response file provided by the merchant. For example, the file name is XXXXXX.pcr

-

Click Process to process the response transactions. A progress status is shown on the screen.

-

Navigate to Management module, Guest Handling function and located the guest account, and navigate to Credit Card tab.

-

Click the View Authorization button to view. The authorized transaction status ‘Authorized’.

Figure 2-10 Management — Authorization Screen Manual

Obtaining Manual Authorization

-

In Management module, Guest Handling function, select the guest account.

-

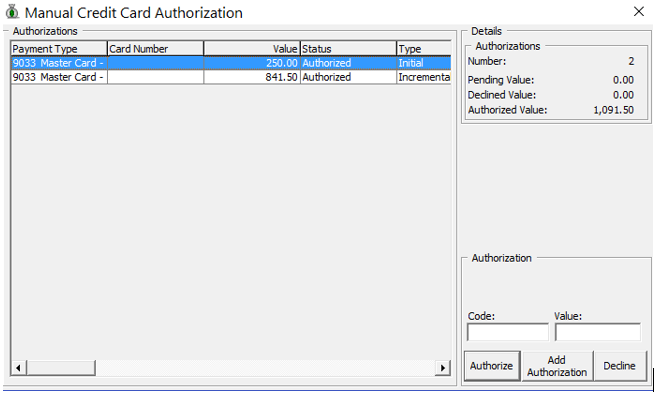

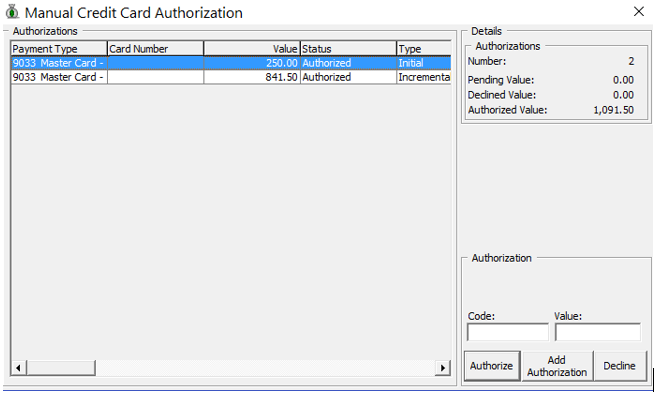

Navigate to the Credit Card tab and click View Authorization.

-

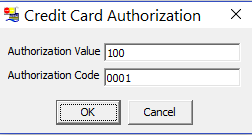

In the Authorization screen, select Add Authorization.

-

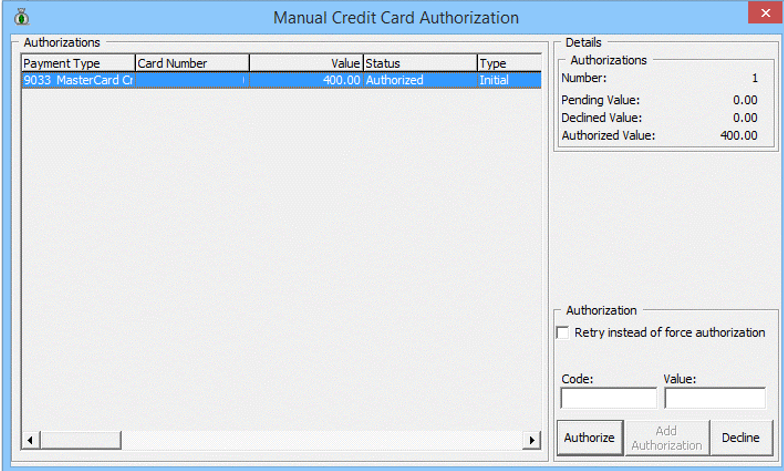

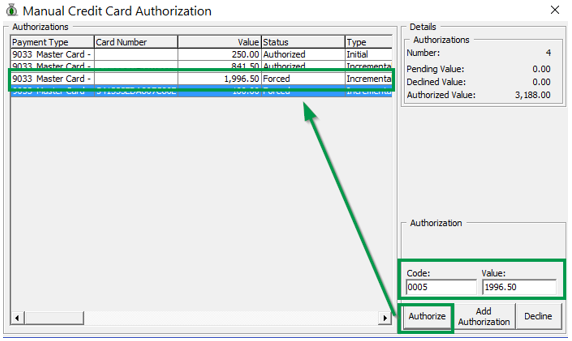

Enter the value and the authorization code in the Credit Card Authorization screen when prompt, and click OK to save. This sets the status to ‘Authorized’ in the Manual Authorization screen.

Figure 2-11 Management — Add Authorization Screen — Credit Card Authorization

-

The Authorized code and value is shown at Authorization section when selecting the manual authorized transaction.

Figure 2-12 Manual Authorization Screen, Forced Status

Creating Settlement File

-

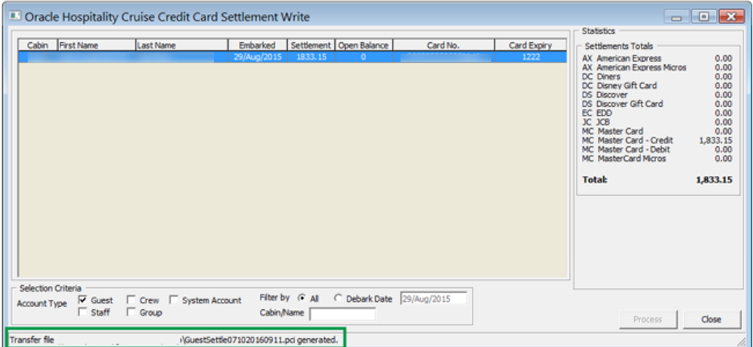

In the Credit Card Transfer Interface program, select from the drop-down menu Settlement, then New Settlement File.

-

Click the Process button to generate the Settlement File. After the Settlement file is created, location of the saved file is shown on the screen.

Figure 2-13 Settlement Write Screen

Reading Settlement File

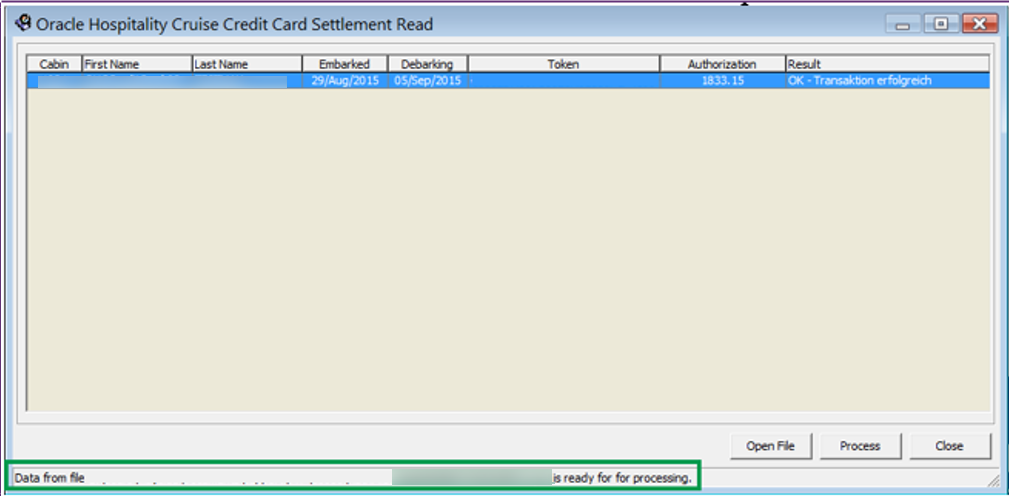

-

From the Settlement drop-down menu, select Read Settlement File.

-

On Cruise Credit Card Settlement Read screen, click Open File button and locate the Settlement Response file.

-

The status of the process is on the Settlement Read screen. Click the Process button to read and update the Settlement record.

Figure 2-14 Settlement Read Screen

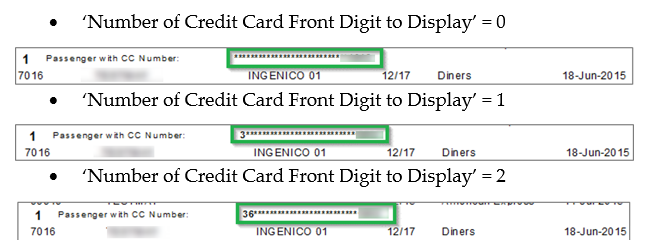

Report

The credit card digits to print on report depends on the setting defined in Parameter, ‘Number of Credit Card Front Digit to Display’. This parameter only supports value from 0 - 6.

Below are the examples of the number of front digit to show on the report, based on the value defined.

Figure 2-15 Reporting — Number of Front Digit to Appear in Report

Troubleshooting Section

This section describes the troubleshooting steps to resolve some known issue encountered in Generic Credit Card handling.

Table 2-5 Tools Known Issue and Solution

| Known Issue | Solution |

|---|---|

|

Error — ‘Key unable to upload’ |

Register |

|

Error — ‘License Key has not been set’ |

Register |

Credit Card Transfer Interface

Table 2-6 Credit Card Transfer Interface Known Issue and Solution

| Known Issue | Solution |

|---|---|

| Credit Card Transfer doesn’t reflect correct desired credit card format | Check the credit card format setup in Administration Module, System Setup, Database Parameter, ‘Interfaces’, ’Batch CCard Processing Format’. |

Table 2-7 Web Services Log

| Parameter | Description |

|---|---|

|

<GuestSearch> |

The program searches the guest details from the information obtained from the Credit Card device; all guests in same cabin are also shown on the Credit Card device. |

|

<GetAmount> |

Credit Card device prompts to insert/swipe payment card and SPMS will determine the pre-authorization amount based on card info retrieve from Credit Card device. The Credit card pre-authorization amount is based on parameter ‘Online Initial Auth Amount’ and the debit card pre-authorization amount is based on parameter ‘Online Debit Initial Auth Amount’. |

|

<UpdateCardInfo> |

The SPMS obtain information provided by merchant or service provider through the card device and inserts the token, status and modification date from the response into the card record and authorization record for Approved and Declined cards. |

|

<AddRouting> |

If the transaction is approved, the Credit Card device will display the other guest names of the same cabin with for routing process. SPMS updates the RES_QROUTE_ACC if routing is assigned through the device. |

|

<TmlTweet> |

The function maintains the Credit Card device ‘keep alive’ status. Additional information update such as cruise currency, pending transaction depends on this function. |

|

<gbCardRegistration> |

This parameter identifies whether the guest/crew/system account is allowed to perform payment card registration or not. The value for the parameter is either true or false. |

|

<gbRounting> |

This parameter identifies whether the guest/crew/system account is allowed to perform payment routing or not. The value for the parameter is either true or false. |

|

<GuestSearch> |

The program searches the guest details from the information obtained from the Credit Card device; all guests in same cabin are also shown on the Credit Card device. |

|

<GetAmount> |

Credit Card device prompts to insert/swipe payment card and SPMS will determine the pre-authorization amount based on card info retrieve from Credit Card device. The Credit card pre-authorization amount is based on parameter ‘Online Initial Auth Amount’ and the debit card pre-authorization amount is based on parameter ‘Online Debit Initial Auth Amount’. |

|

<UpdateCardInfo> |

The SPMS obtain information provided by merchant or service provider through the card device and inserts the token, status and modification date from the response into the card record and authorization record for Approved and Declined cards. |

|

<AddRouting> |

If the transaction is approved, the Credit Card device will display the other guest names of the same cabin with for routing process. SPMS updates the RES_QROUTE_ACC if routing is assigned through the device. |

|

<TmlTweet> |

The function maintains the Credit Card device ‘keep alive’ status. Additional information update such as cruise currency, pending transaction depends on this function. |

|

<gbCardRegistration> |

This parameter identifies whether the guest/crew/system account is allowed to perform payment card registration or not. The value for the parameter is either true or false. |

|

<gbRounting> |

This parameter identifies whether the guest/crew/system account is allowed to perform payment routing or not. The value for the parameter is either true or false. |

|

<gbLastDay> |

This parameter identifies the guest/crew/system account’s last day of the cruise. The parameter is controlled by Parameter, ‘General’, ‘Number of Before Disembarkation Days’ and value for the parameter is either true or false. For example: If [Disembarkation date] - [Number of Before Disembarkation Days] = [System Date], then <gbLastDay> = true, else <gbLastDay> = false. |

|

<gbDebitRefund> |

This parameter identifies whether the guest/crew/system account is allowed to receive a refund the balance from their invoice account. The value for the parameter is either true or false. |

Generic Credit Card Mapping Fields

This section describes the field definition supported by Generic Credit Card (OHCCreditCard) format.

File Name Format

The file naming format for Generic Credit Card is explained in below table. For example: GuestTransfer#######.pci.

Table 2-8 Generic Credit Card File Format

| Name | Description |

|---|---|

|

Guest |

The first word of the file name is representation of the Account Type base on the filter used to generate the authorization file. Guest - GuestTransfer#######.pci Crew - CrewTransfer#######.pci Group - GroupTransfer#######.pci Staff - StaffTransfer#######.pci All filter - <Blank>Transfer#######.pci |

|

Transfer |

The second word of the file name represent the type of transfer. TestTransfer = test authorization file Transfer = Authorization transaction file Settle = Settlement transaction file. |

|

071020161138 |

The date/time format of the authorization file DDMMYYYYHHMM. |

|

PCI or PCR |

The file format extension of the authorization file pci = request file pcr = response file |

Request File Format

The following table describes the field definitions for a Request File for Authorization and Settlement.

Table 2-9 Request File Format

| Field | Type | Size | Definition |

|---|---|---|---|

|

Header |

|||

|

Head |

Varchar |

4 |

Fixed value: “HEAD”. |

|

data-source |

Varchar |

30 |

File sender name, example “MV SHIP”. |

|

Date |

Int |

12 |

Format: YYMMDDHHMMSS, 111019130712. |

|

file-number |

Int |

12 |

Counter for the file. |

|

Version |

Varchar |

4 |

Version string of our batch file, example 1.0. |

|

Batch Record |

|||

|

MerchantID |

Varchar |

20 |

Merchant ID. For example: HOTEL. |

|

Paytype |

Varchar |

10 |

“CC” - for VI, MC. “EDD” - for EC. “TO” - for if token with value. |

|

Trxtype |

Varchar |

12 |

|tstauth|incauth|capture|refund tstauth: Test authorization, it is a mandatory authorization prior to generating an initial authorization. incauth: Incremental authorization increases amount of an existing authorization. Input has to be the total amount (initial+additional amount). capture: Book a pre-authorization. Capture amount has to be less than or equal to the authorized amount. refund: Refund an amount only valid for an existing order. |

|

TransID |

Varchar |

50 |

Unique transaction identification number in ASCII. Does not support special characters. |

|

TransID reference |

Varchar |

50 |

Reference to the original unique transaction where necessary. For example: capture, refund, incauth for an already existing transaction. |

|

Amount |

Int |

9 |

Always in the smallest currency unit in cent for Euro and so on. For example 100 for 1 Euro.b Empty if Trxtype=register. |

|

Currency |

Varchar |

3 |

Currency code according to ISO 4217 for this transaction. For example; EUR, USD, or follow the Ship’s currency. |

|

Description |

Varchar |

27 |

Note to payee in text for EDD Debit Card or other Payment Method. |

|

AppCodeTel |

Int |

6 |

Special authorization code obtained manually through telephone for an authorization from an acquirer. |

|

Customer |

Varchar |

27 |

Customer name. |

|

CD_customerid |

Varchar |

16 |

Customer ID in Customer Relationship Management System (CRM). |

|

CD_customertype |

Varchar |

12 |

Type of customer, For example: crew, passenger, staff and others. |

|

CD_orderid |

Varchar |

16 |

Unique order-id. |

|

CD_paxid |

Varchar |

16 |

Customer unique ID. |

|

CD_cruiseid |

Varchar |

10 |

Travel number. |

|

CD_accountid |

Varchar |

12 |

On-board account number. |

|

CD_roomid |

Varchar |

6 |

Cabin number |

|

CD_invoiceid |

Varchar |

12 |

Account number |

|

Reference |

Varchar |

30 |

Additional reference. |

|

Token |

Varchar |

30-40 |

Universally unique identifier (UUID). For example: ed4bdf30-4ac4-102f-991a-000bcd838e00. Reference for a payment account, either from pre-registration (manifest) or from earlier batch reply. Token usage is mandatory. |

|

CC_brand Varchar |

Varchar |

10 |

Credit card brand MasterCard, VISA, AMEX, DC, JCB. |

|

CC_cardowner |

Varchar |

27 |

Card owner. |

|

EDD_accountowner |

Varchar |

27 |

Bank account owner. |

|

Track1enc |

Varchar |

256 |

For future use. |

|

Track2enc |

Varchar |

256 |

For future use. |

|

Track3enc |

Varchar |

256 |

For future use. |

|

KSN |

Varchar |

32 |

For future use. |

|

Device |

Varchar |

32 |

For future use. |

|

Batch Footer |

|||

|

Foot |

Varchar |

4 |

Fixed value: „FOOT“. |

|

Counter |

Int |

9 |

Total number of records. |

Table 2-10 Response File Format

| Field | Type | Size | Definition |

|---|---|---|---|

|

Head |

Varchar |

4 |

Fixed value: “HEAD”. |

|

data-source |

Varchar |

30 |

File sender name, example “MV SHIP”. |

|

Date |

Int |

12 |

Format: YYMMDDHHMMSS, 111019130712. |

|

file-number |

Int |

12 |

Counter for the file. |

|

Version |

Varchar |

4 |

Version string of our batch file, example 1.0. |

|

Response Record |

|||

|

TransID |

Varchar |

50 |

Unique transaction ID. |

|

Token |

Varchar |

40 |

UUID for this payment account. Only if the payment account (credit card or EDD) is valid. |

|

Return-code |

Varchar |

10 |

00000000 (8 zeros for OK) NNNNNN (for Error, ex. 23055310). |

|

Status |

Varchar |

10 |

Textual representation of return code, „OK“, „Error“. |

|

Description |

Varchar |

255 |

Description for Status. |

|

Reference |

Varchar |

30 |

Additional reference. Same as input parameter. |

|

CD_customerid |

Varchar |

16 |

Customer number from CRM. |

|

Approvalcode |

Int |

6 |

Approval-code for this transaction. |

|

EPAref |

Int |

9 |

EPA-Reference for this transaction, only used for Accounting. |

|

auth_time |

Varchar |

20 |

Server time stamp for the single transaction, format YYYY-MM-DDTHH:MM:SS as UTC Time. |

|

Footer |

|||

|

Foot |

Varchar |

4 |

Fixed value: „FOOT“. |

|

Counter |

Int |

9 |

Total number of records. |

Sample BIN Range

Below are the sample eligible BIN range for Generic Credit Card.

400626,400626,DEL,Visa Debit,16 480240,480240,DEL,Visa Debit,16

407704,407705,DEL,Visa Debit,16 407704,407705,DEL,Visa Debit,16

408367,408367,DEL,Visa Debit,16 484412,484412,DEL,Visa Debit,16

409400,409402,DEL,Visa Debit,16 484415,484417,DEL,Visa Debit,16

412285,412286,DEL,Visa Debit,16 484427,484427,DEL,Visa Debit,16

413733,413737,DEL,Visa Debit,16 490960,490979,DEL,Visa Debit,16

413787,413788,DEL,Visa Debit,16 492181,492182,DEL,Visa Debit,16

418760,418760,DEL,Visa Debit,16 495065,495065,DEL,Visa Debit,16

419176,419179,DEL,Visa Debit,16 495090,495094,DEL,Visa Debit,16

419772,419772,DEL,Visa Debit,16 498824,498824,DEL,Visa Debit,16

420672,420672,DEL,Visa Debit,16 499844,499846,DEL,Visa Debit,16

446213,446254,DEL,Visa Debit,16 499902,499902,DEL,Visa Debit,16

446257,446272,DEL,Visa Debit,16 400115,400115,ELC,Visa Electron,16

446274,446283,DEL,Visa Debit,16 400837,400839,ELC,Visa Electron,16

446286,446286,DEL,Visa Debit,16 412921,412923,ELC,Visa Electron,16

450875,450875,DEL,Visa Debit,16 424962,424963,ELC,Visa Electron,16

453978,453979,DEL,Visa Debit,16 444000,444000,ELC,Visa Electron,16

454313,454313,DEL,Visa Debit,16 484406,484408,ELC,Visa Electron,16

456705,456706,DEL,Visa Debit,16 484411,484411,ELC,Visa Electron,16

456725,456745,DEL,Visa Debit,16 484418,484426,ELC,Visa Electron,16

458046,458046,DEL,Visa Debit,16 484428,484455,ELC,Visa Electron,16

460024,460024,DEL,Visa Debit,16 491730,491759,ELC,Visa Electron,16

465830,465879,DEL,Visa Debit,16 499806,499806,ELC,Visa Electron,16

465901,465950,DEL,Visa Debit,16 512499,512499,MCD,MasterCard Debit,16

474503,474503,DEL,Visa Debit,16 512746,512746,MCD,MasterCard Debit,16

474551,474551,DEL,Visa Debit,16 516001,516001,MCD,MasterCard Debit,16

475110,475159,DEL,Visa Debit,16 535420,535819,MCD,MasterCard Debit,16

475183,475183,DEL,Visa Debit,16 537210,537609,MCD,MasterCard Debit,16

476220,476269,DEL,Visa Debit,16 557347,557496,MCD,MasterCard Debit,16

476340,476389,DEL,Visa Debit,16 545721,545723,MCD,MasterCard Debit,16