In today's turbulent markets, financial institutions require a better understanding of their risk-return, while strengthening competitive advantage and enhancing long-term customer value. Oracle Financial Services Analytical Applications (OFSAA) enable financial institutions to measure and meet risk-adjusted performance objectives, cultivate a risk management culture through transparency, lower the costs of compliance and regulation, and improve insight into customer behavior.

OFSAA uses industry-leading analytical methods, shared data models, and applications architecture to enable integrated risk management, performance management, customer insight, and compliance management. OFSAA actively incorporates risk into decision making, enables to achieve a consistent view of performance, promotes a transparent risk management culture, and provides pervasive intelligence.

Oracle Financial Services Analytical Applications delivers a comprehensive, integrated suite of financial services analytical applications for both banking and insurance domains.

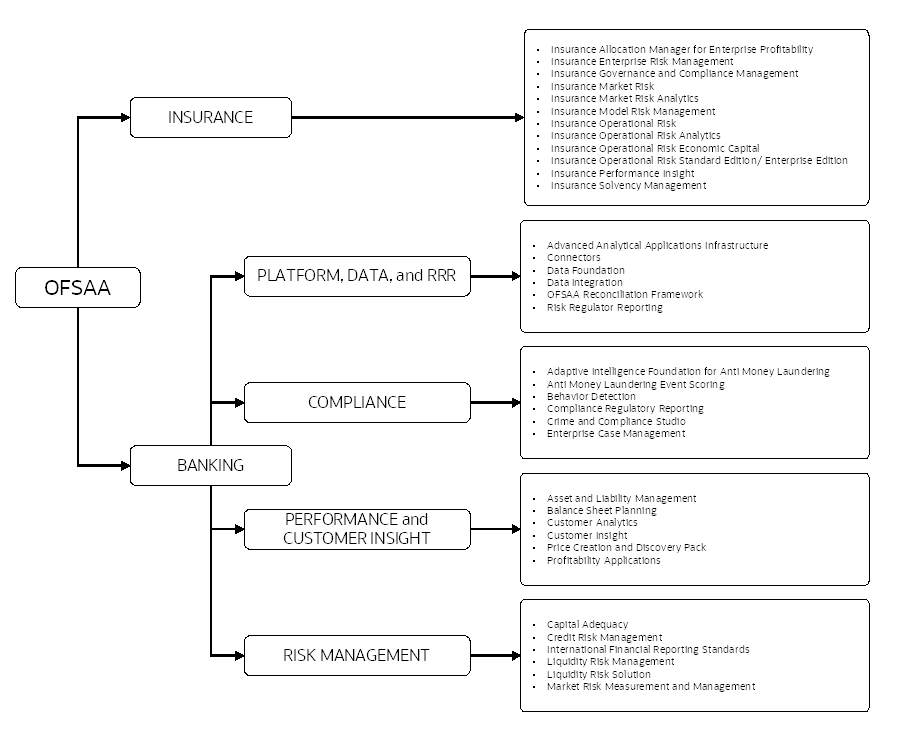

The following figure depicts the various application packs that are available across the OFSAA Banking and Insurance domains.

Figure 1: OFSAA Application Packs

Topics:

· Oracle Financial Services Analytical Applications Infrastructure (OFS AAI)

· About Oracle Insurance Planner Application Pack

· Installation and Upgrade Scenarios

Oracle Financial Services Analytical Applications Infrastructure (OFS AAI) powers the Oracle Financial Services Analytical Applications family of products to perform the processing, categorizing, selection, and manipulation of data and information required to analyze, understand and report on specific performance, risk, compliance, and customer insight issues by providing a strong foundation for the entire family of Oracle Financial Services Analytical Applications across the domains of Risk, Performance, Compliance and Customer Insight.

Topics:

· Components of OFSAA Infrastructure

· OFSAA Infrastructure High Availability

The OFSAA Infrastructure includes frameworks that operate on and with the Oracle Financial Services Analytical Applications Data Model and form the array of components within the Infrastructure.

The OFSAA Infrastructure components or frameworks are installed as two layers; primarily, the metadata server and Infrastructure services run on one layer, while the UI and presentation logic run on the other. The UI and presentation layer is deployed on any of the supported J2EE Servers.

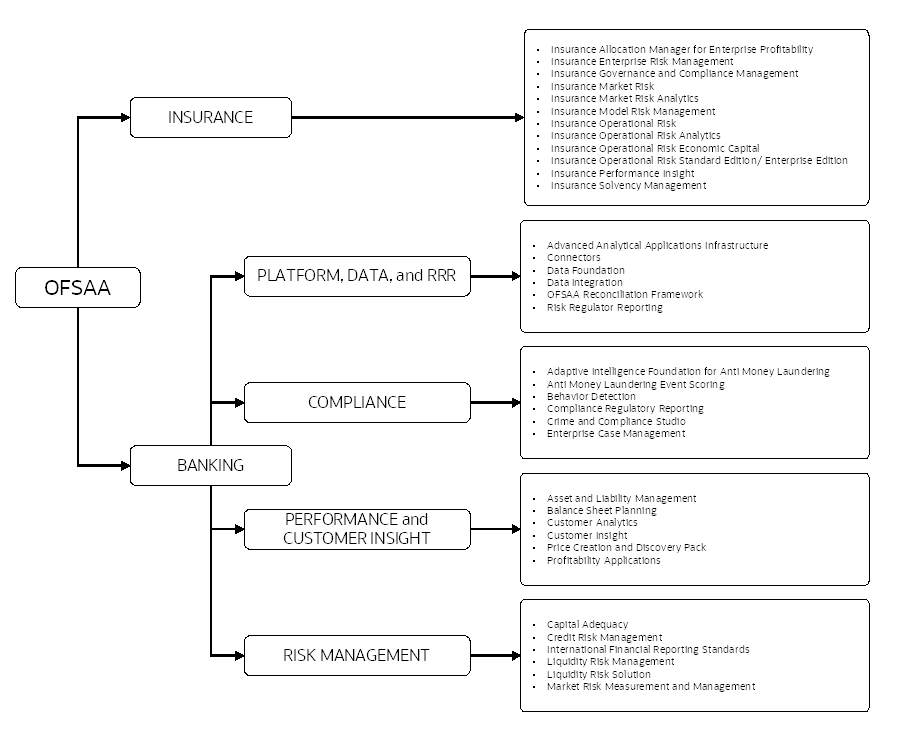

The following figure depicts the various frameworks and capabilities that make up the OFSAA Infrastructure.

Figure 2: Components of OFSAAI

The current release of the OFSAA Infrastructure supports only the Single Instance installation for the Infrastructure components. However, the High Availability (HA) for the Database Server and (or) the Web application server clustering and deployment is supported in this release.

This release supports the Active-Passive model of implementation for OFSAAI components. For more information, see the Oracle Financial Services Analytical Applications Configuration for High Availability Best Practices Guide.

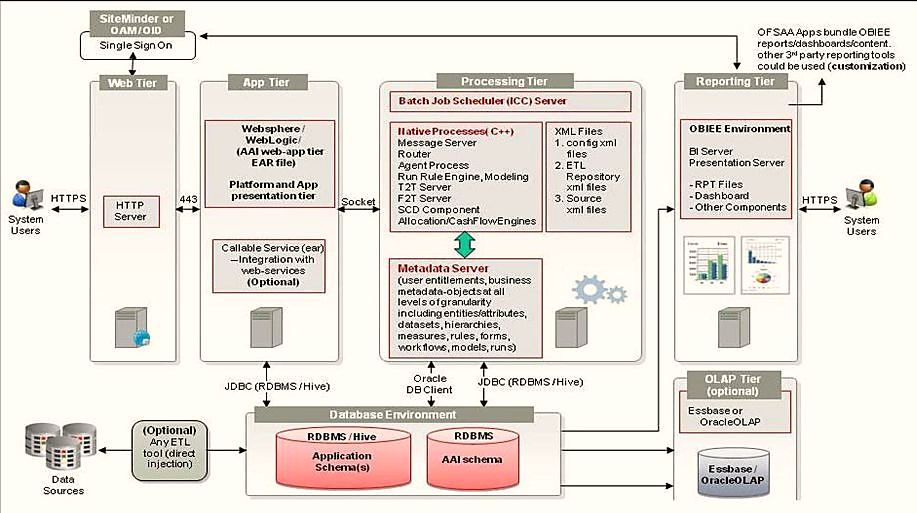

The following figure illustrates the deployment topology of OFSAA application packs.

Figure 3: Logical Architecture Implemented for OFSAA Application Packs

An Insurance company’s management is required to take many decisions based on its projected financial statements and KPIs. The decisions include new business mix decisions, risk management-related decisions, capital optimization decisions, and all other decisions that are to be based on forward-looking revenue statements and the balance sheet. Oracle Insurance Planner (OIP) is being developed to work as a decision support system.

OIP, as part of the first release, comes with the ability to create model points and project new business into the future based on the sales estimates or seed values and growth rates provided by the user. Users can upload the projections in respect of existing business as well and can club the projections for further analysis and reports. Reports and forward-looking statements are on the product roadmap and will be part of future releases.

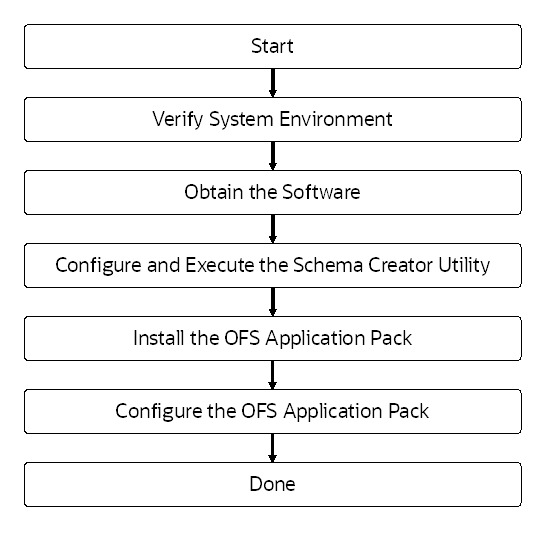

To install an Oracle Insurance Planner application pack 8.1.2.0.0 instance, users and administrators must download this installer. The following figure displays the order of procedures you will need to follow to install a new Oracle Insurance Planner Pack 8.1.2.0.0 instance.

Figure 4: Installation Flow

Release 8.1.2.0.0 of Oracle Insurance Planner supports various installation and upgrade scenarios. A high-level overview of the possible scenarios is provided in the following table. Detailed procedural steps are provided in the succeeding sections of this document.

Scenario |

Installation and Upgrade Instructions |

|---|---|

|

|

Installing Release 8.1.2.0.0 application pack for the first time (new installation). |

1. Prepare for the Installation. |

Install an OIP application pack on an Existing OFSAA Instance You have already installed an application pack from release 8.1.2.0.0 and now you want to install the OIP application pack Release 8.1.2.0.0. Example: Oracle Insurance Accounting Analyzer Pack is already installed and now you want to install Oracle Insurance Planner. |

1. Run the schema creator utility ONLY for the new pack. 2. Update the PACK.xml file for the newly licensed pack. 3. Update the Silent.props file of the newly licensed pack. 4. Run the pre-requisites for Pack on Pack Instalaltion. 5. Trigger the Release 8.1.2.0.0 installation. |

This table lists the applications or app combinations that must not be installed on a single infodom.

If you are installing |

Do not Install the Listed Application in the Same Environment |

|---|---|

OFS_OIP_PACK |

None |