(CAN) Using the PeopleSoft Fluid User Interface to Update PDF Tax Forms

Oracle’s PeopleSoft updateable PDF tax forms functionality enables Canadian employees to update their federal and provincial tax withholding information using Fluid Employee Self-Service. For an overview of this process, see Understanding Updateable PDF Tax Forms.

Note: Updateable PDF tax forms are not available in tablets or smartphones.

The following video provides an overview of the updateable Canadian federal tax withholding form:

Video: Image Highlights, PeopleSoft HCM Update Image 46: Employee Self-Service Canadian Federal TD1

Video: Image Highlights, PeopleSoft HCM Update Image 47: Canadian Provincial Online Withholding PDF Forms

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HC_PY_SS_NAVCOLL_FL (cref for the tile) PY_IC_WH_PTILE_FLU (page for dynamic data) |

Access a collection of self-service payroll transactions, including making tax withholding updates. |

|

|

PY_TD1_MAIN_FL |

View your tax withholding information and access the tax withholding forms for the federal and provincial jurisdictions. |

|

|

PY_TD1_MAIN_FD_SCF |

Update federal tax withholding forms, and view additional agency links (if any) as well as submitted form updates. |

|

|

PY_TD1_MAIN_ST_SCF |

Update provincial tax withholding forms, and view additional agency links (if any) as well as submitted form updates. |

|

|

EOAWMA_TXNHDTL_FL |

Payroll administrators use this page to approve tax withholding changes that employees submit using self-service. |

Using updateable PDFs to change withholding elections consists of these steps:

The employee accesses the Tax Withholding Page to review current withholding details.

The employee selects a jurisdiction to update.

Depending on the selected jurisdiction, either the Federal Tax Withholding Forms Page or the Provincial Tax Withholding Forms Page appears. These pages list relevant withholding forms and any additional information.

The employee clicks the specific withholding form to be updated.

The system displays a warning that a form with personal information will be downloaded to the user’s computer.

If the employee continues past the warning, the system downloads the form and, depending on the browser settings, prompts the user to save or open the PDF file.

The employee opens the PDF file.

If the browser does not prompt the employee to open the file, the employee can open it manually.

The employee enters new withholding elections in the updateable PDF form and then selects the Submit button in the PDF file.

The system prompts the employee to enter their PeopleSoft User ID and password.

The system validates the employee’s logon credentials and updates the database (if no approval is required) or sends the request to the approver (if approval is required).

The system displays a new PDF file with a confirmation message.

As delivered, the new PDF file also includes a filled-out withholding form with the employee’s new elections. If you use PeopleTools 8.55.07 or later, the PDF Tax Form Table Page includes a configuration option to include or exclude a copy of the withholding form.

The system sends a confirmation email to the primary email address in the employee’s User Profile.

Important! Notification emails are sent to the email address that is associated with the employee’s PeopleSoft User ID, not to the email address in the recipient’s HR personal data record.

Employees cannot update their own User Profile email address. Administrators are responsible for maintaining this information. To view or update the email address for a User Profile, the administrator clicks the Edit Email Addresses link on the General page of the User Profiles component

If approvals are required, the system sends the approval request to the approver on the Pending Approvals - TD1 Tax Withholding Form Page. It sends the employee an additional email after the request is approved.

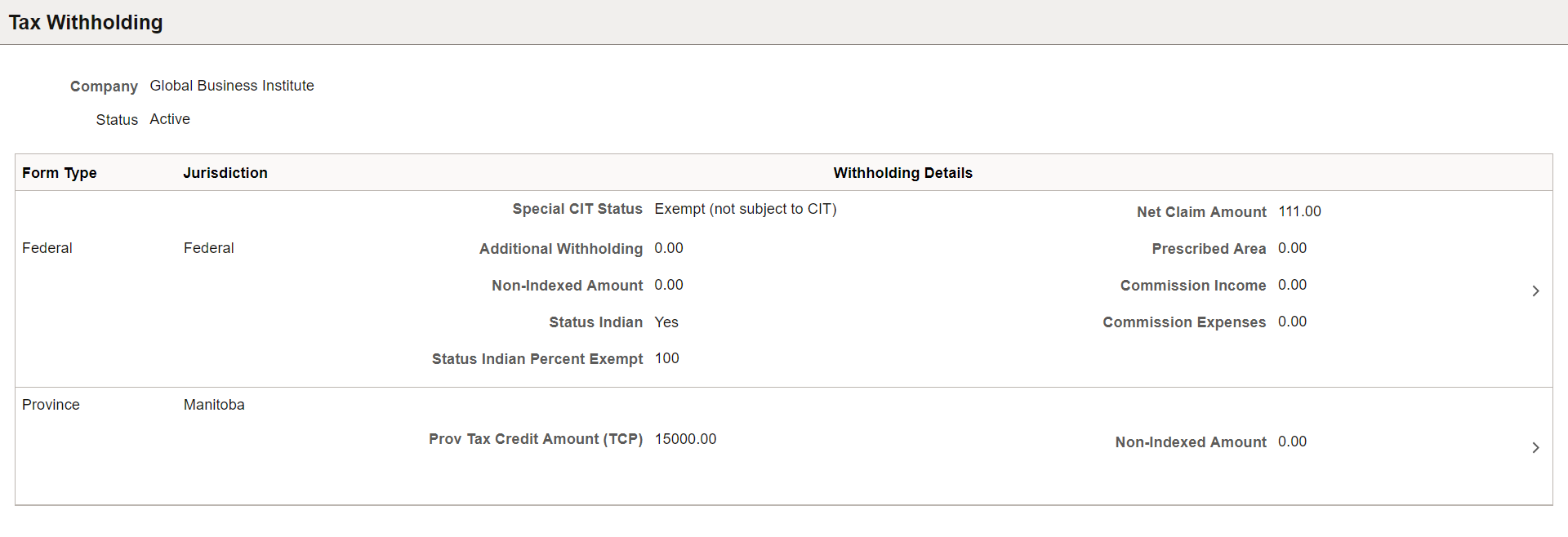

Use the Tax Withholding page (PY_TD1_MAIN_FL) to view your tax withholding information and access the tax withholding forms for the federal and provincial jurisdictions.

Navigation:

Select the Tax Withholding Canada tile from the Payroll Dashboard.

Select Tax Withholding Canada from the Fluid Navigation Collection for Payroll.

This example illustrates the Tax Withholding page for Canada.

The Tax Withholding page displays the employee’s federal and provincial tax information.

The presence of TD1 tax withholding forms determines the display of some tax withholding information. For example, if Form TD1X is set to Inactive in the setup, the Income and Expense fields are not displayed. Similarly, if Form TD1-IN is set to Inactive, the Status Indian and Percent Exempt fields are not displayed.

If an employee works for only one company, the Company field is read-only. If the employee works for more than one company, the Company field is editable, and the page initially displays information related to the employee’s primary job.

Each employee can be associated with only one province at any given time. To determine the correct provincial form to display for the employee, the system uses the current province that is specified on the Provincial Income Tax Data Page. To make sure that the correct form and provincial income tax data are displayed, employee data must be set up accurately on the Provincial Income Tax Data page.

(Quebec) If the employee has a tax distribution setup for Quebec on the Update Tax Distribution Page, tax withholding forms for Quebec are displayed. Two forms are delivered: one is the source deductions return form that is applicable to all employees in Quebec; the other is a separate form for commissioned employees (which can be inactivated in the setup as needed).

While most provincial tax withholding forms display the same list of fields on this page, there are exceptions. For example, an additional field Dependant Claim Amount (Y) is shown on the rows for British Columbia and Ontario. A different, longer list of fields are displayed for Quebec.

A chevron appears in rows where updateable PDF tax forms are available.

When the employee has submitted a tax withholding change request and the request is in pending approval, selecting the row displays a modal page that shows the current withholding details and the values that were changed (with a color indicator) in the submitted request.

For more information about the setup of the Tax Withholding page, see Setting Up Updateable PDF Tax Forms.

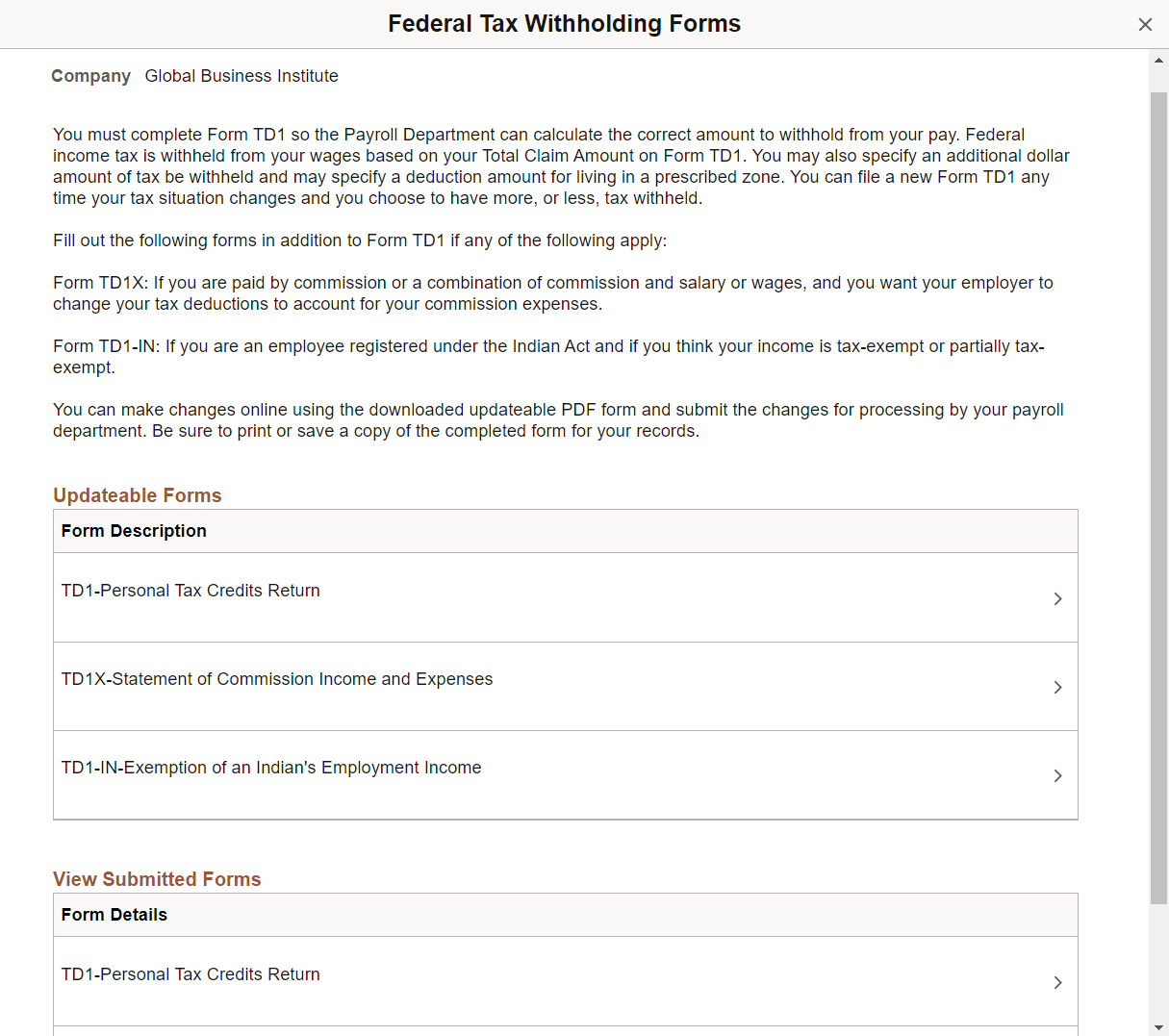

Use the Federal Tax Withholding Forms page (PY_TD1_MAIN_FD_SCF) to update federal tax withholding forms, and view additional agency links (if any) as well as submitted form updates.

Navigation:

Click the Federal row with a chevron on the Tax Withholding page.

This example illustrates the Federal Tax Withholding Forms page for Canada.

Payroll Administrators can configure and control text that appears on the Federal Tax Withholding Forms page to meet your organization’s needs.

For more information about the setup of the Federal Tax Withholding Forms page, see Tax Jurisdiction Mapping Page.

Updateable Forms

If a chevron appears in a row in this section, then an updateable PDF tax form is available. Select the row to access and update the tax withholding form.

Additional Agency Links

If your Payroll Administrator has attached any links to third-party resources, they will appear in this group box. PeopleSoft does not provide or maintain the third-party links. It is up to your Payroll Administrator to add and maintain them.

View Submitted Forms

This section lists the updated PDF tax forms that you have submitted.

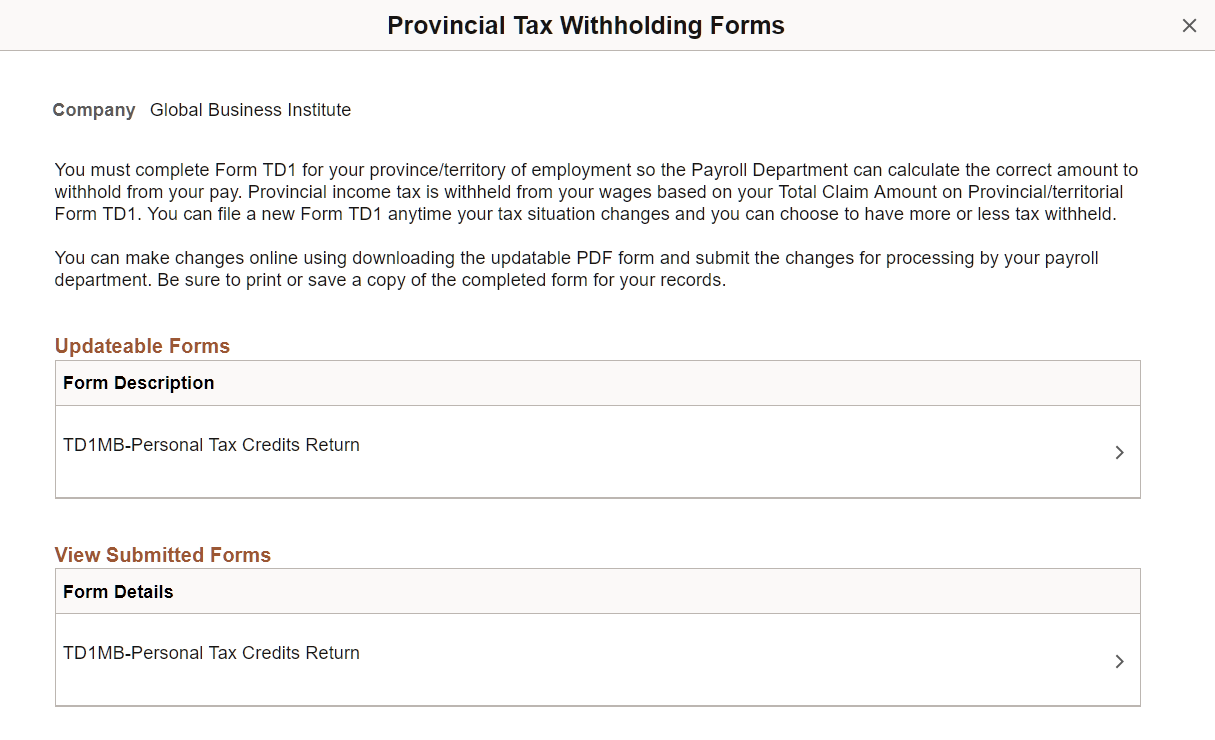

Use the Provincial Tax Withholding Forms page (PY_TD1_MAIN_ST_SCF) to update provincial tax withholding forms, and view additional agency links (if any) as well as submitted form updates.

Navigation:

Click a Province row with a chevron on the Tax Withholding page.

This example illustrates the Provincial Tax Withholding Forms page for Canada.

Payroll Administrators can configure and control text that appears on the Provincial Tax Withholding Forms page to meet your organization’s needs.

For more information about the setup of the Provincial Tax Withholding Forms page, see Tax Jurisdiction Mapping Page.

Updateable Forms

If a chevron appears in a row in this section, then an updateable PDF tax form is available. Select the row to access and update the tax withholding form.

Additional Agency Links

If your Payroll Administrator has attached any links to third-party resources, they will appear in this group box. PeopleSoft does not provide or maintain the third-party links. It is up to your Payroll Administrator to add and maintain them.

View Submitted Forms

This section lists the updated PDF tax forms that you have submitted.

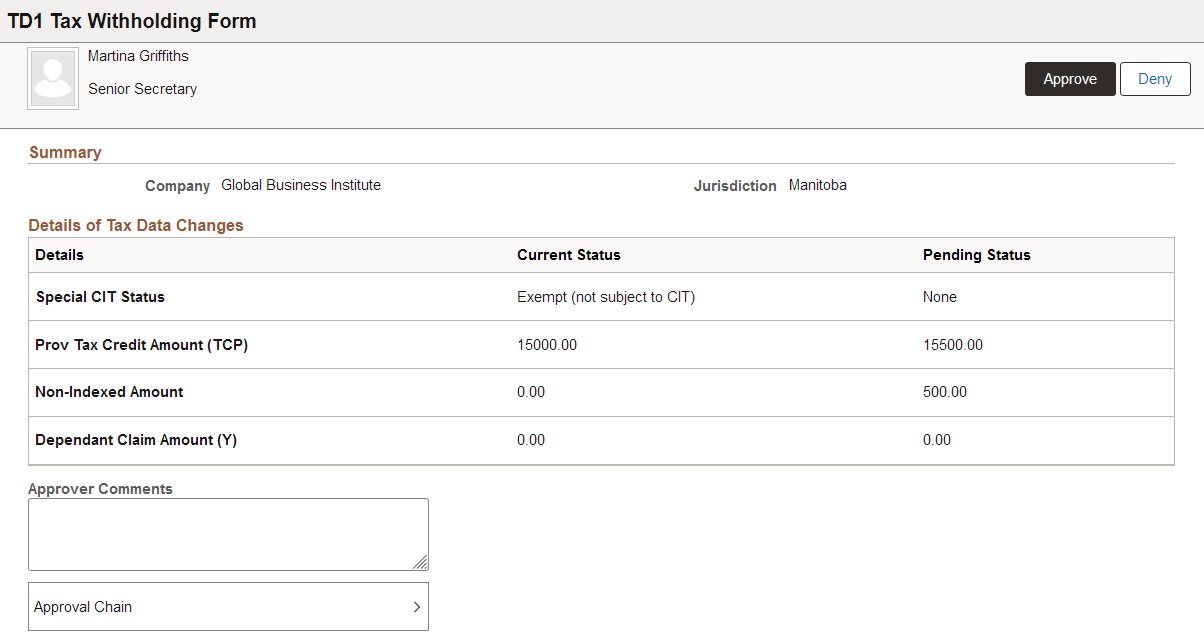

Payroll administrators use the Pending Approvals - TD1 Tax Withholding From page (EOAWMA_TXNHDTL_FL) to approve tax withholding changes that employees submitted using Employee Self-Service.

Navigation:

On the Manager Self-Service home page, select the Approvals tile to access the Pending Approvals page. Then select a TD1 Tax Withholding Form entry on the Pending Approvals page.

Select the push notification (or the link from an email notification) of a tax withholding change, if notifications are enabled in the setup.

This example illustrates the Pending Approvals - TD1 Tax Withholding Form page.

Approval Options

The approval options on this page are common to all fluid approval transactions, as described in the documentation for the Pending Approvals - <Transaction Details> Page.

|

Field or Control |

Description |

|---|---|

|

Approve and Deny |

Use these buttons to take action on the requested approval. |

|

Approver Comments |

Enter any comments related to the approval action you take. |

|

Approval Chain |

Click this item to open the Approval Chain page, where you can review information about all approvers for the transaction. |

Summary

This section displays the company name and the name of the tax jurisdiction.

Details of Tax Data Changes

This section displays the current status and pending status of the fields that the employee updated on the withholding form.

All fields are listed, including those that the employee did not change. The specific fields can vary according to the tax jurisdiction.