Setting Up Updateable PDF Tax Forms

Oracle’s PeopleSoft Payroll for North America provides updateable PDF tax forms to enable employees to update their federal and state (or provincial) tax withholding information in Fluid Employee Self-Service.

Note: Non-resident aliens do not have access to updateable PDF tax forms.

Note: If an employee has a Lock-in Letter or otherwise has a limit applied to the number of withholding allowances for a jurisdiction, then they do not have access to updateable PDF tax forms for that jurisdiction.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Roles Page |

USER_ROLES |

Verify or assign security roles for employees, administrators, and approvers to work with updateable PDF tax forms. See the Prerequisites section for the list of user roles delivered for the updateable PDF tax forms functionality. |

|

PY_PDF_TAXFORM or PY_PDF_TAXFORM_CN |

Define self-service updateable PDF tax forms. |

|

|

PY_PDF_AWE_OPTN or PY_PDF_AWE_OPTN_CN |

Define which changes on the tax withholding forms pages require Payroll Administration notification or approval. |

|

|

PY_JUR_MAPPING or PY_JUR_MAPPING_CN |

Map an updateable PDF tax form and special instructions to its tax jurisdiction, and add links to third-party resources. |

|

|

PY_PDF_COMP_MAP or PY_PDF_COMP_MAP_CN |

Specify access control, mapping, notification preferences (USA only), and approval preferences in jurisdictions for companies. |

|

|

PY_W4_FORM_MAP or PY_TD1_FORM_MAP_CN |

View the fields and parameters that are mapped between the updateable agency PDF and the PeopleSoft BI Publisher template. |

|

|

PY_VIEW_WH_FORM or PY_VIEW_TD1_FORM |

View tax withholding forms submitted by employees. |

Oracle’s PeopleSoft Payroll for North America provides updateable PDF tax forms to enable U.S. employees to update their federal and state tax withholding information, as well as Canadian employees to update their federal and provincial tax withholding information in Fluid Employee Self-Service.

The Self-Service Transaction

Employees access updateable tax forms from the:

(USA) Tax Withholding tile.

(CAN) Tax Withholding Canada tile.

The system extracts the employee’s data from PeopleSoft and prepopulates selected fields in an updateable PDF of the tax form for that jurisdiction.

When the employee updates the tax data and submits the form, the system saves the form, and displays a new PDF with a confirmation message and additional information. Depending on the settings on the PDF Tax Form Table page, the confirmation PDF can also include the completed withholding form. If no approvals are required, then submitting the form also updates the PeopleSoft Tax Data tables with the new information.

Notification

The system supports the delivery of notifications when:

Tax withholding form update is submitted by the employee.

Tax withholding form update fails.

Tax withholding form update is successful.

While employees are the recipients of the notifications for successful updates, payroll administrators also receive notifications in the case of TD1 Indian form updates. When a TD1 Indian form change is submitted and later updated to the database, the system sends a notification to the payroll administrator. The message notifies the administrator that the Percent Exempt value is set to 100% as default, which needs to be reviewed and updated accordingly for the employee on the Update Employee Tax Data page.

If the Approval Workflow Engine (AWE) is enabled and Approval Required is selected on the Company Mapping Page for the jurisdiction, the system submits the changes to the approver for approval first, and updates the data in the database only after the approval is granted. Notifications are also delivered as part of the approval process, when update requests are submitted for approval, denied, or approved.

Note: Oracle PeopleSoft delivers Notification Composer Framework to manage the setup and administration of all notifications in one central location.

Once you have adopted the Notification Composer feature, you must use it to create new notifications and manage your existing notifications.

Notifications delivered with HCM Image 47 or later must use Notification Composer.

For more information about Notification Composer Framework, see Understanding Notification Composer.

Important! Notification emails are sent to the primary email address for the recipient’s User Profile, not to the email address in the recipient’s HR personal data record.

Employees cannot update their own User Profile email address. Administrators are responsible for maintaining this information. To view or update the email address for a User Profile, click the Edit Email Addresses link on the General page of the User Profiles component

Updateable PDF Configuration

Oracle delivers updateable PDF tax form functionality with federal and state jurisdictions for USA and federal and provincial jurisdictions for Canada.

Payroll Administrators use the Tax Jurisdiction Mapping Page to add and maintain links to third-party resources, such as a tax withholding calculator or non-resident alien (NRA) and other forms that PeopleSoft does not yet support. Payroll Administrators can use the Text Catalog to modify the Special Instructions text and most messages and warnings to meet your organization’s needs.

It is the customer's responsibility to set up jurisdiction mapping for each company on the Company Mapping Page.

Adobe Acrobat Reader X or higher or Adobe Acrobat DC, PeopleSoft BI Publisher, PeopleSoft Payroll for North America and PeopleSoft ePay are required.

Updateable PDF tax forms functionality works for BI Publisher reports using PDF Templates only (not RTF templates, which can also be used to output PDF). PeopleSoft delivers many agency PDF tax withholding forms already mapped to BI Publisher report PDF templates.

Note: Updateable PDF tax forms are not available in tablets or smartphones.

Users must be assigned the appropriate roles in order to submit, review, or approve tax withholding requests. System-delivered roles include:

For employees:

(All) PeopleSoft User

(USA) NA Payroll WH Form User

(CAN) NA Payroll Canada WH Form User

For payroll administrators:

(USA) NA Payroll WH Form Admin

(CAN) NA Payroll Can WH Form Admin

For tax withholding request approvers:

(USA) NA Payroll WH Form Approver

(CAN) NA Payroll Canada WH Approver

For approvers to approve changes to self-service updateable PDF tax forms, PeopleSoft Approval Workflow Engine (AWE) must be enabled, and the Approval Required check box must be selected for federal (and each state for USA or province for CAN) on the Company Mapping Page.

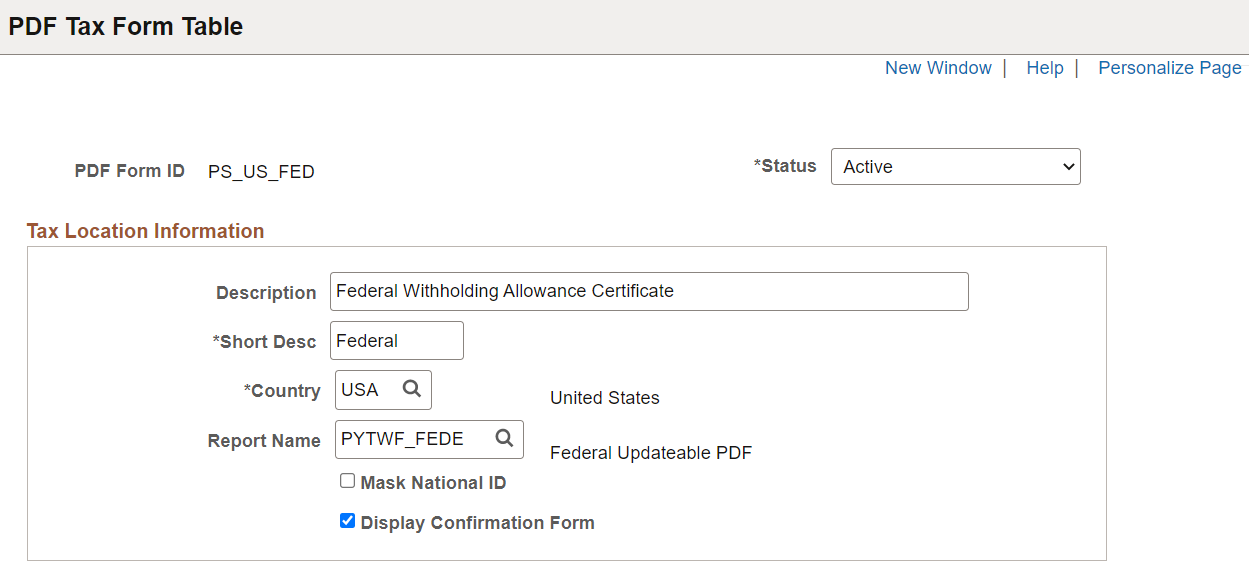

Use the PDF Tax Form Table page (PY_PDF_TAXFORM or PY_PDF_TAXFORM_CN) define self-service updateable PDF tax forms.

Navigation:

This example illustrates the fields and controls on the PDF Tax Form Table page.

|

Field or Control |

Description |

|---|---|

|

Report Name |

Select the name of the BI Publisher report to use for the updateable PDF tax form. |

|

Mask National ID |

Select this check box to mask all but the last four digits of the national ID (Social Security Number for USA or Social Insurance Number for Canada) on the employee’s updateable PDF tax form. Note: The full number appears for users with the Payroll Administrator role regardless of this setting. |

|

Display Confirmation Form |

Select this check box to include a filled-out withholding form in the confirmation PDF that employees see after submitting changes on an updateable PDF. This check box is selected by default in all PeopleSoft-delivered PDF tax forms. The confirmation PDF appears regardless of this setting. If this check box is not selected, the confirmation PDF includes only a confirmation message without a copy of the withholding form. Note: This check box is available if you use PeopleTools 8.55.07 or later. On earlier versions of PeopleTools, the confirmation PDF always includes a copy of the withholding form. |

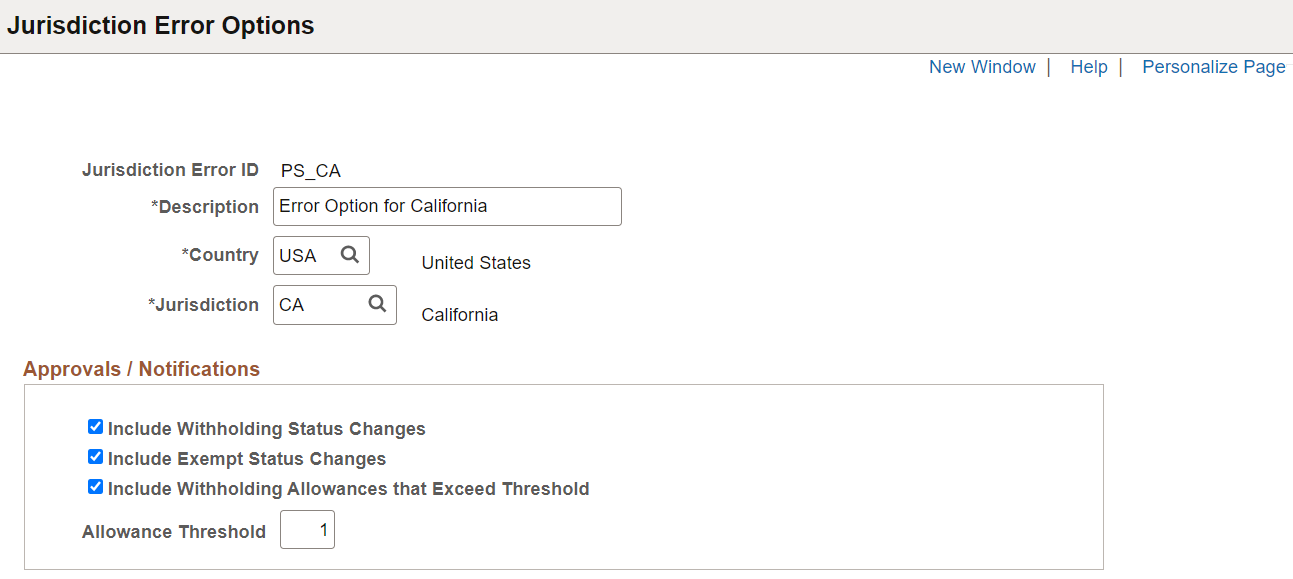

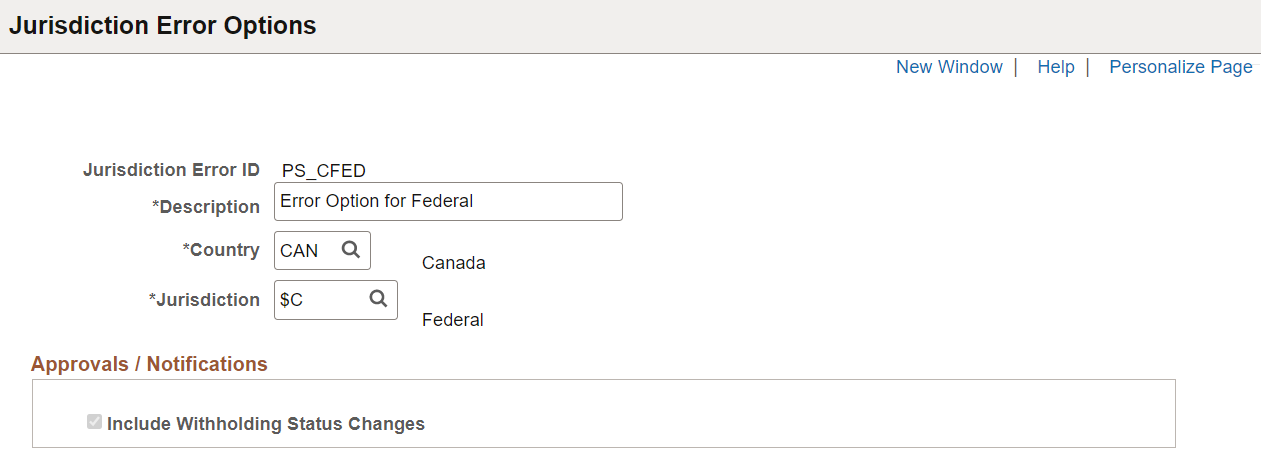

Use the Jurisdiction Error Options page (PY_PDF_AWE_OPTN or PY_PDF_AWE_OPTN_CN) to define which changes on the tax withholding forms pages require payroll administration notification or approval.

Navigation:

This example illustrates the fields and controls on the (USA) Jurisdiction Error Options page.

This example illustrates the fields and controls on the (CAN) Jurisdiction Error Options page.

Approvals / Notifications

|

Field or Control |

Description |

|---|---|

|

Include Withholding Status Changes |

If AWE is enabled, selecting this check box submits to the approver for approval any Tax Status, Allowance, Additional Amount, Additional Allowance or Additional Percent changes. Approval will be required before the changes are applied to tax data in the system. If AWE is disabled, selecting this check box notifies the Payroll Administrator of the changes, but does not require approval before saving the tax data. (CAN) This option is selected by default and is not editable. If AWE is enabled for Canada, the approval process will be triggered when any change is made to the form, regardless of what that change is. In AWE is disabled for Canada, no approval notification will be triggered to the approvers. Submitted details will be updated to the database directly. Settings on the Company Mapping Page determine if this is a notification or if approval is needed. |

|

Include Exempt Status Changes |

If AWE is enabled, selecting this check box submits to the approver for approval if the employees have changed their status to Exempt in the form. Approval will be required before the changes are applied to tax data in the system. If AWE is disabled, selecting this check box notifies the Payroll Administrator of the changes, but does not require approval before saving the tax data. This field is applicable to USA only. Settings on the Company Mapping Page determine if this is a notification or if approval is needed. |

|

Include Withholding Allowances that Exceed Threshold |

If AWE is enabled, selecting this check box submits to the approver for approval if the withholding allowance changes exceed the value that is specified on the Allowance Threshold field. Approval will be required before the changes are applied to tax data in the system. If AWE is disabled, selecting this check box notifies the Payroll Administrator of the changes, but does not require approval before saving the tax data. This field is applicable to USA only. Settings on the Company Mapping Page determine if this is a notification or if approval is needed. |

|

Allowance Threshold |

Enter the highest number of allowances permitted for the jurisdiction. This field is applicable to USA only. |

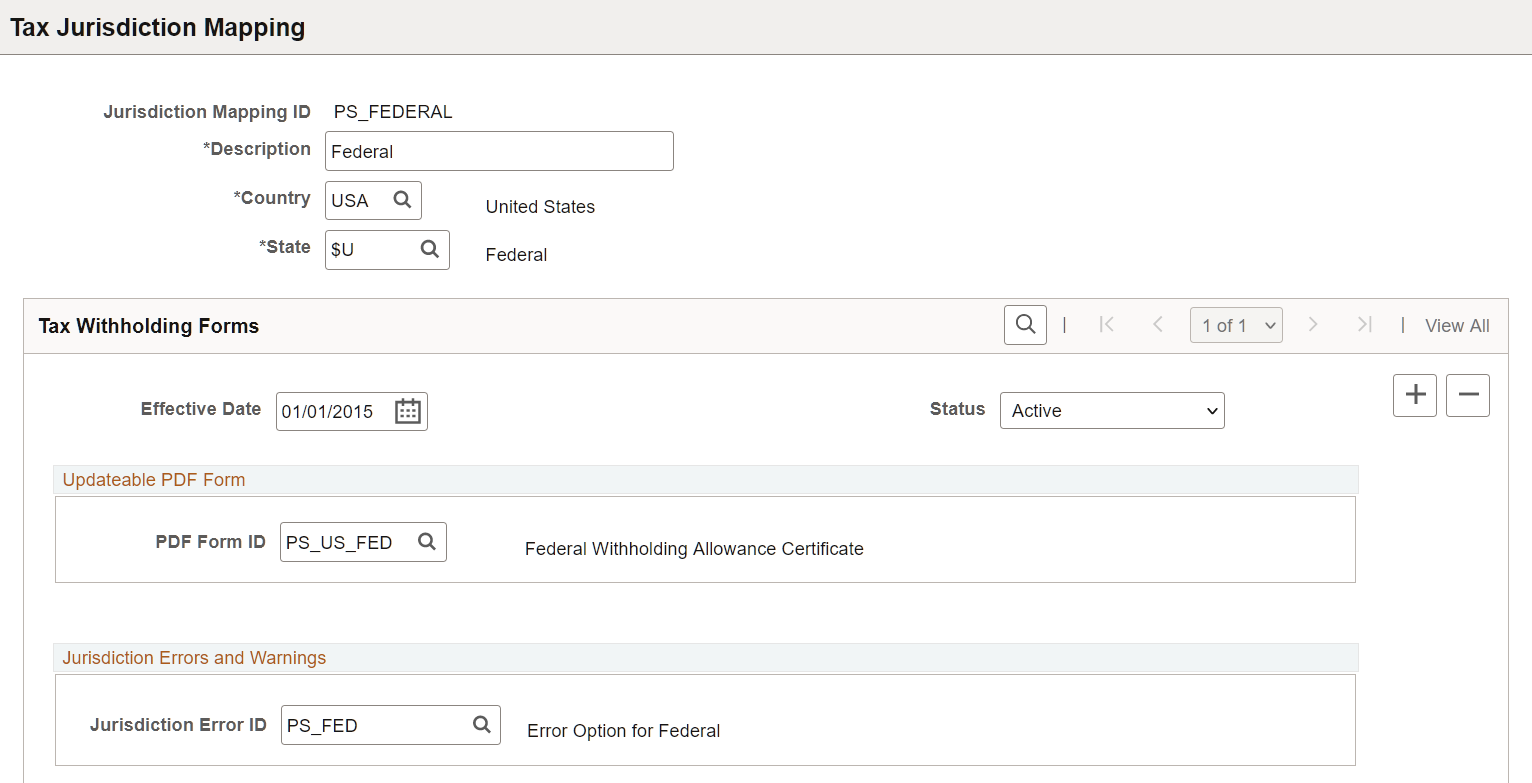

Use the Tax Jurisdiction Mapping page (PY_JUR_MAPPING or PY_JUR_MAPPING_CN) to map an updateable PDF tax form and special instructions to its tax jurisdiction, and add links to third-party resources.

Navigation:

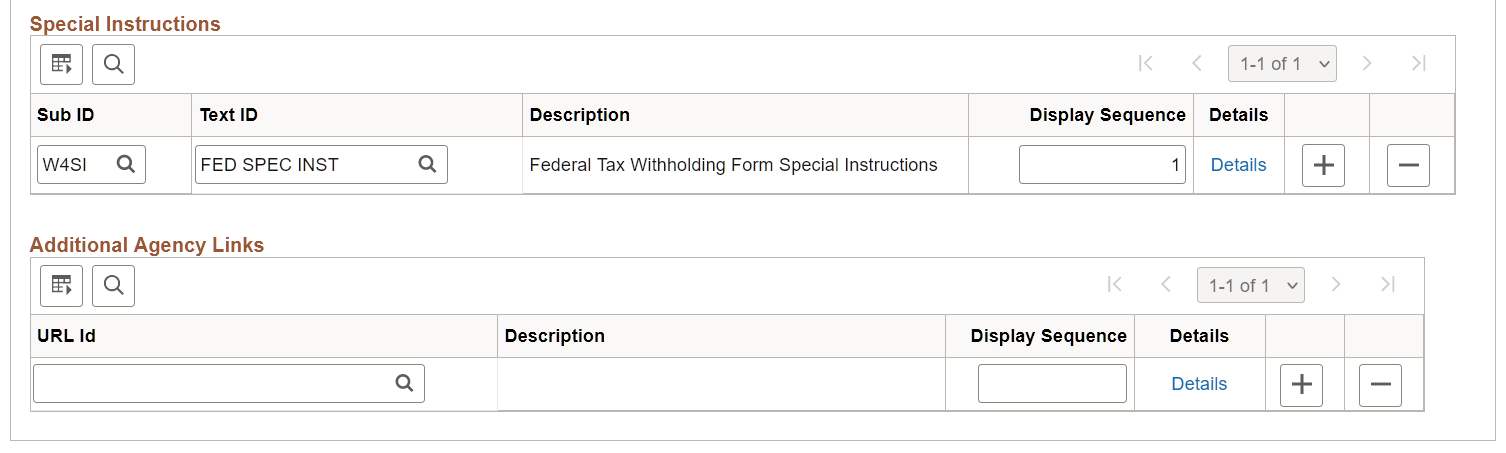

This example illustrates the fields and controls on the (USA) Tax Jurisdiction Mapping page (1 of 2).

This example illustrates the fields and controls on the (USA) Tax Jurisdiction Mapping page (2 of 2).

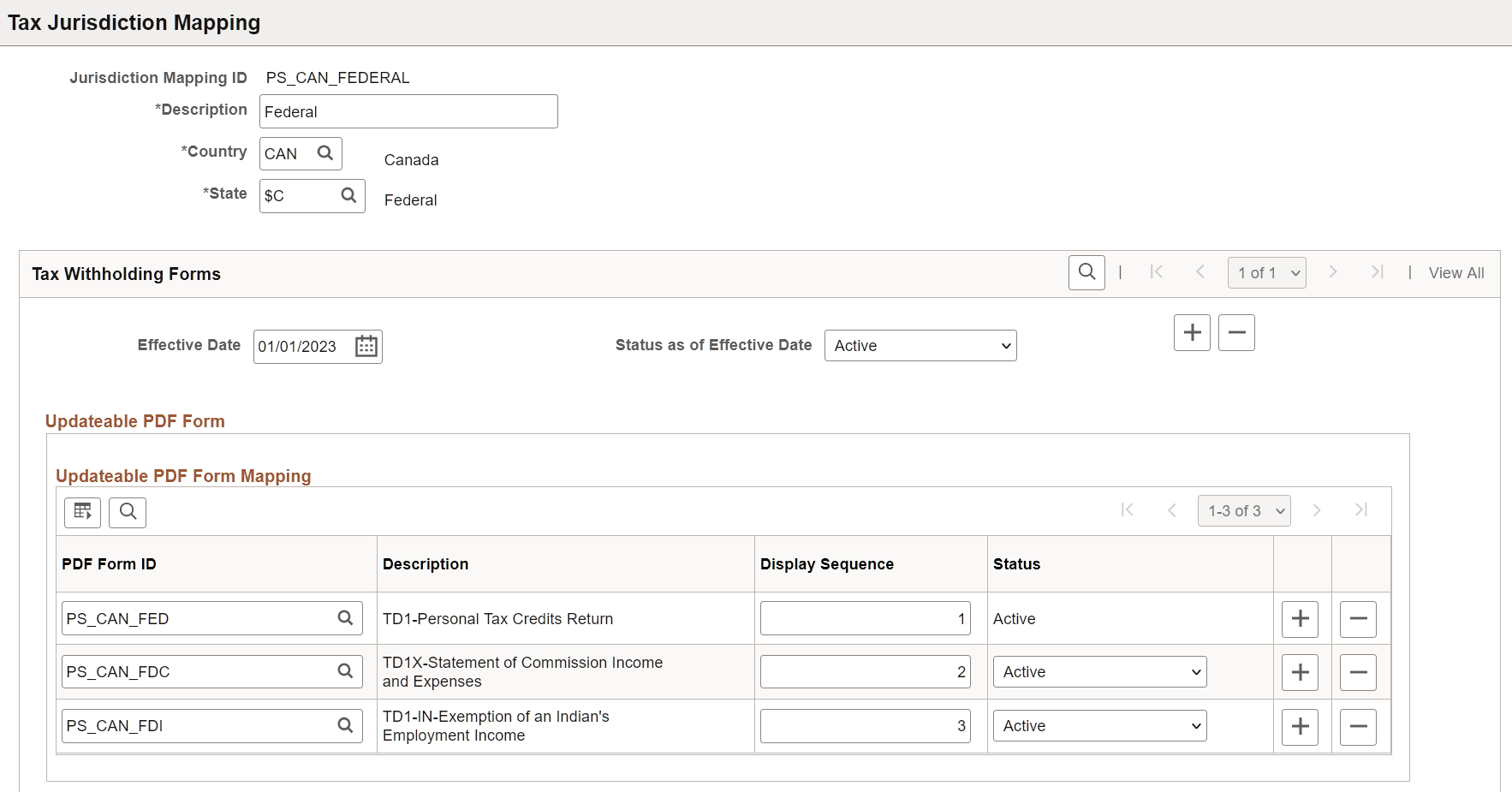

This example illustrates the fields and controls on the (CAN) Tax Jurisdiction Mapping page (1 of 2).

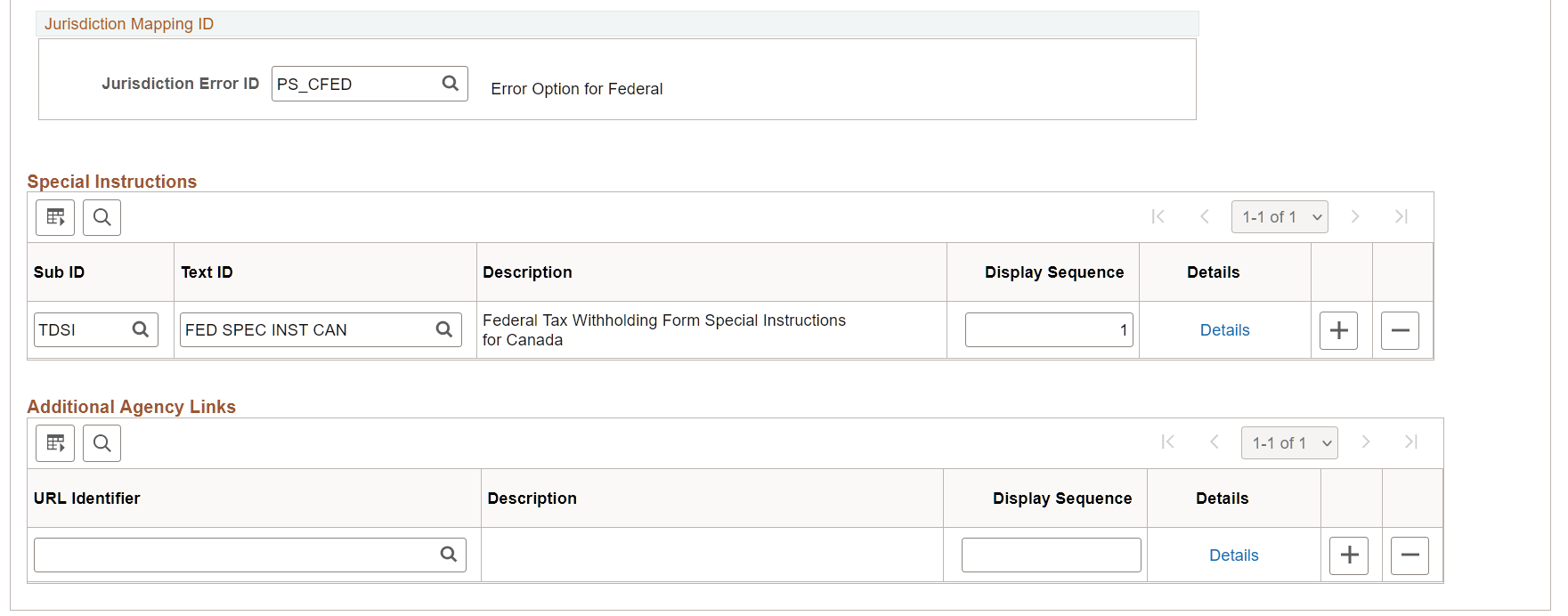

This example illustrates the fields and controls on the (CAN) Tax Jurisdiction Mapping page (2 of 2).

Note: Payroll for North America delivers tax jurisdiction mappings for U.S. federal, states and territories, as well as Canadian federal, provinces and territories.

(USA) Updateable PDF Form or (CAN) Updateable PDF Form Mapping

|

Field or Control |

Description |

|---|---|

|

PDF Form ID |

Specify the updateable PDF tax form to use for this jurisdiction. Available forms are from the PDF Tax Form Table Page. (CAN) The system supports multiple updateable PDF tax forms for the federal jurisdiction, for example, TD1, TD1X, and TD1-IN. Multiple forms are also available for the Quebec province. |

|

(CAN only) Display Sequence |

Enter a unique order number in which the tax form is displayed on the tax withholding forms page in Employee Self-Service. |

|

(CAN only) Status |

A form becomes available for update on the Federal Tax Withholding Forms Page in Employee Self-Service, if its status is set to Active. For example, the status for Form TD1 is always set to Active, and is configurable for Forms TD1X and TD1-IN. |

(USA) Jurisdiction Errors and Warnings or (CAN) Jurisdiction Mapping ID

|

Field or Control |

Description |

|---|---|

|

Jurisdiction Error ID |

Select the error or warning to use when AWE is enabled. Errors and warnings are available from the Jurisdiction Error Options Page. |

Special Instructions

|

Field or Control |

Description |

|---|---|

|

Sub ID |

Select the Text Catalog Sub ID for the text to use as special instructions for the updateable PDF tax form. |

|

Text ID |

Select the Text Catalog ID to use for this updateable PDF tax form. You can add or delete a Text ID. If more than one row is defined, the system adds a line space between the two instructions (to create a new paragraph) on the tax withholding forms page. See special instruction examples on the (USA) Federal Tax Withholding Forms Page, (CAN) Federal Tax Withholding Forms Page, or the (USA) State Tax Withholding Forms Page. |

|

Display Sequence |

Enter a unique display order number for the text. |

|

Details |

Select to view the content of the selected text ID. |

For information on using the Text Catalog to configure text, see Configuring the Text Catalog in your PeopleSoft HCM Applications Fundamentals product documentation.

Additional Agency Links

|

Field or Control |

Description |

|---|---|

|

URL Id or URL Identifier |

Payroll Administrators can define additional forms or resources to make available by selecting from URL IDs defined in the PeopleTools URL table. When more than one row is added, this field must be defined to save the page. For information about the URL table, see PeopleTools, Administration Tools, System and Server Administration, Using PeopleTools Utilities, Using Administration Utilities, URL Maintenance. |

|

Display Sequence |

Enter a unique display order number for the link. |

|

Details |

Select to view the link address. |

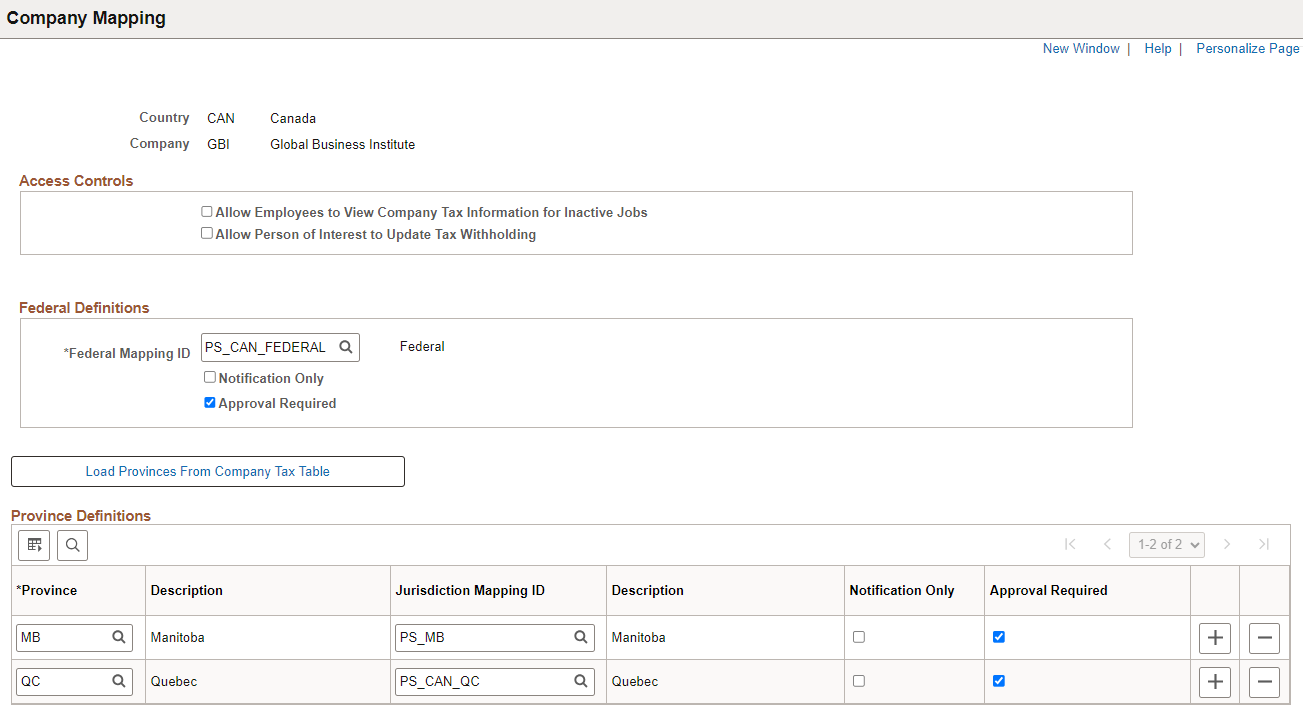

Use the Company Mapping page (PY_PDF_COMP_MAP or PY_PDF_COMP_MAP_CN) to specify access control, mapping, as well as notification preferences (USA only) and approval preferences in jurisdictions for companies.

Navigation:

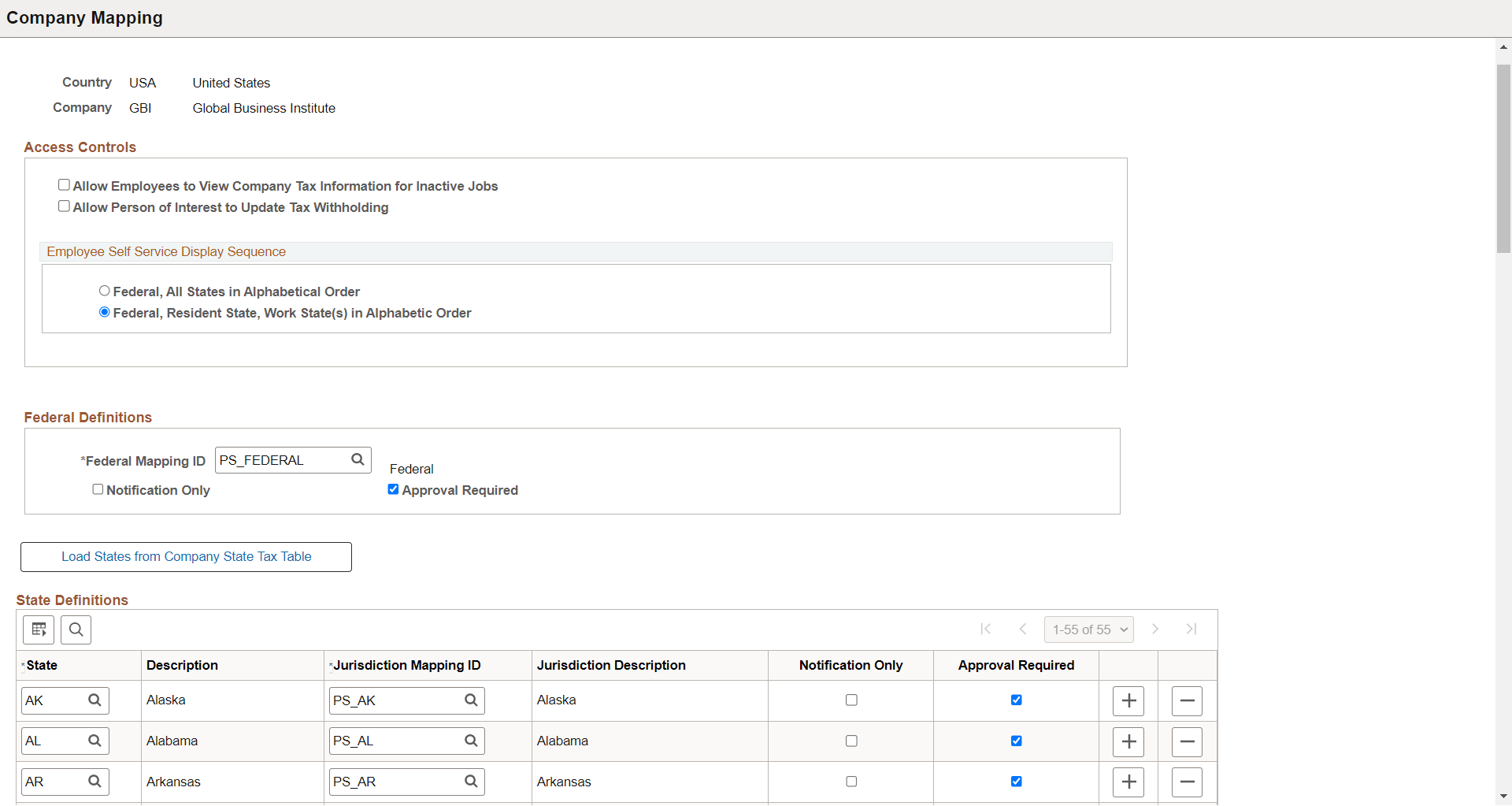

This example illustrates the fields and controls on the (USA) Company Mapping page.

This example illustrates the fields and controls on the (CAN) Company Mapping page.

Access Controls

|

Field or Control |

Description |

|---|---|

|

Allow Employees to View Company Tax Information for Inactive Jobs |

Select this check box to allow an employee assigned to an inactive job to view their tax withholding information. The system looks at the Update Employee Tax Data page and Job Record to determine if the employee is assigned to more than one company. If the employee is associated with only one company, information on the tax withholding forms page is read-only. If the employee has more than one company a search icon is available so the employee can select the active or inactive company that they want to view. |

|

Allow Person of Interest to Update Tax Withholding |

Select this check box to allow persons of interest to update their tax withholding information in Employee Self-Service. |

Employee Self Service Display Sequence

Note: This section is applicable to USA only.

|

Field or Control |

Description |

|---|---|

|

Federal, All States in Alphabetical Order or Federal, Resident State, Work State(s) in Alphabetic Order |

Select an option to control the order in which jurisdictions appear on the self-service Tax Withholding page. The system displays the employee’s tax withholding information from the Federal Tax Data and State Tax Data pages in the Employee Pay Data component, and provides access to the employee’s updateable PDF withholding form for that jurisdiction. The order in which the jurisdictions appear depends on the selection that you make here. If a jurisdiction does not have income tax, the Tax Status on the self-service Tax Withholding page is n/a for not applicable. If a state has an associated local income tax, the row appears, but no updateable PDF is available. |

Federal Definitions

|

Field or Control |

Description |

|---|---|

|

Federal Mapping ID |

Select the mapping definition defined on the Tax Jurisdiction Mapping Page for the federal jurisdiction. |

|

Notification Only |

Select this check box to send a notification to the Payroll Administrator when employees make the changes defined on the Jurisdiction Error Options Page. Note: This field is applicable to USA only. |

|

Approval Required |

Select this check box for Approval Workflow Engine (AWE), if enabled, to submit changes to the approver for approval before updating tax records in the system. For more information about AWE, see Understanding Approvals in your PeopleSoft HCM Application Fundamentals documentation. When Approval Required is selected and the employee submits changes on the updateable PDF tax form, the systems displays Pending Approval in that row on the tax withholding forms page. The employee can select the chevron in that row to access the Pending Approval page and view the status and changes, however the changes are not updated in the Tax Data pages and the employee is prevented from making further tax withholding changes for that jurisdiction until the approver has entered approval. |

|

(USA) Load States from Company State Tax Table (CAN) Load Provinces from Company Tax Table |

When the Company Mapping page appears for an unmapped company, the State Definitions or Province Definitions grid is empty. Use the button to load all of the state or province definitions that are defined in the Company State Tax Table. |

(USA) State Definitions or (CAN) Province Definitions

|

Field or Control |

Description |

|---|---|

|

Jurisdiction Mapping ID |

Select the mapping definition for the state or province. PeopleSoft delivers predefined mapping definitions on the Tax Jurisdiction Mapping Page. To save the Company Mapping page, you must identify the Jurisdiction Mapping ID for each state or province that you want to use, and delete all rows that you do not want to use. |

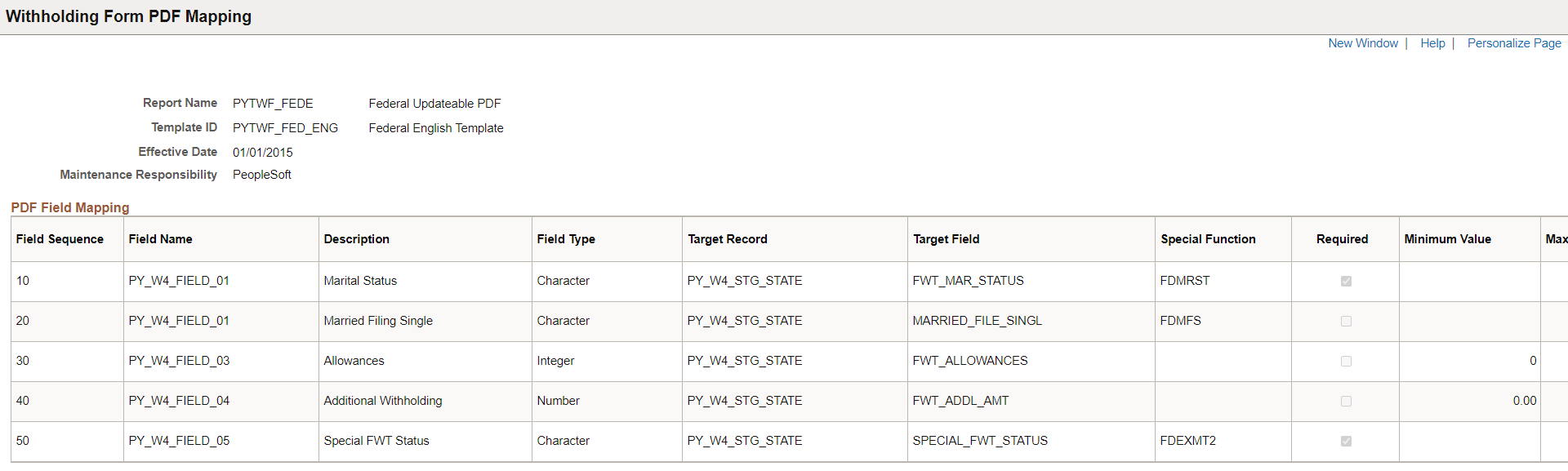

Use the Withholding Form PDF Mapping page (PY_W4_FORM_MAP or PY_TD1_FORM_MAP_CN) to view the fields and parameters that are mapped between the updateable agency PDF and the PeopleSoft BI Publisher template.

Navigation:

This example illustrates the fields and controls on the Withholding Form PDF Mapping page.

PeopleSoft delivers agency tax withholding forms pre-mapped to a BI Publisher PDF template for many tax jurisdictions. The Withholding Form PDF Mapping page is read only for the PDFs that PeopleSoft delivers pre-mapped.

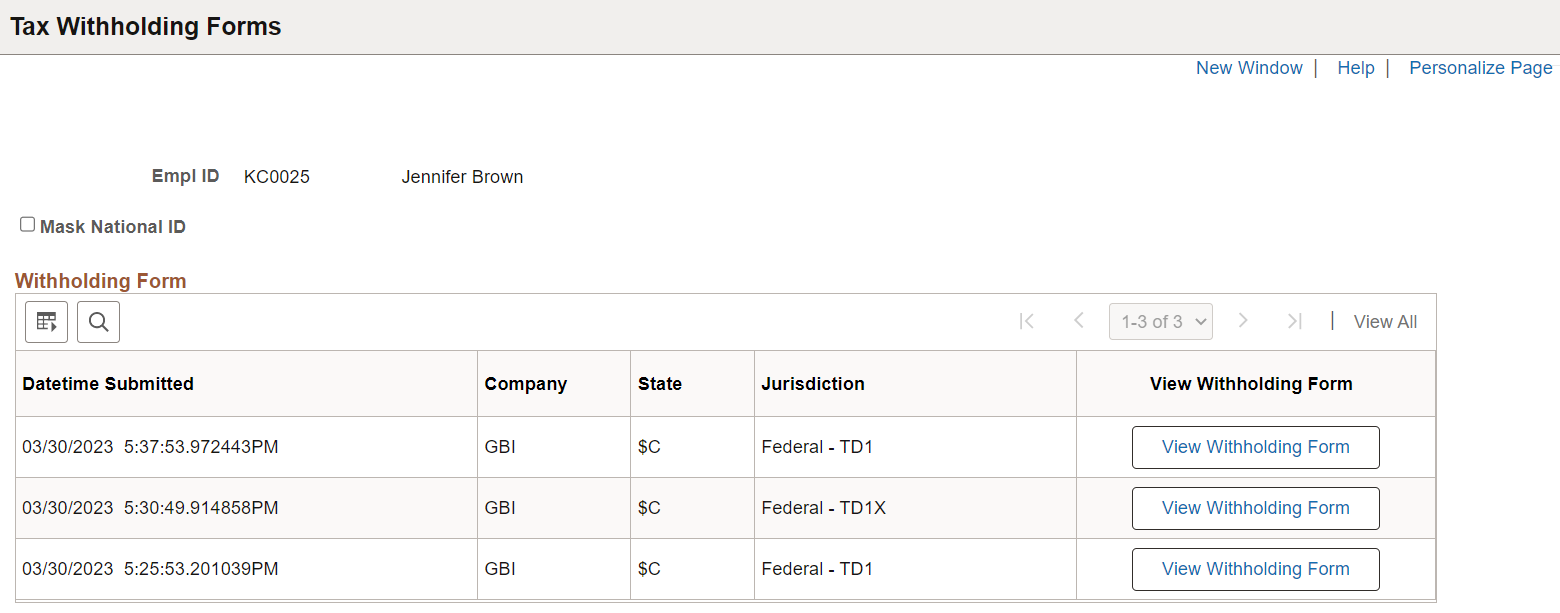

Payroll administrators use the Tax Withholding Forms (PY_VIEW_WH_FORM or PY_VIEW_TD1_FORM) to view tax withholding forms submitted by employees.

Navigation:

This example illustrates the fields and controls on the Tax Withholding Forms page.

|

Field or Control |

Description |

|---|---|

|

Mask National ID |

Select to mask the national ID that is shown in the tax withholding forms. When selected, only the last four digits of the national ID is displayed. |

|

View Withholding Form |

Select to view the selected PDF form in new browser window or tab. |