(USA) Using the PeopleSoft Fluid User Interface to Update PDF Tax Forms

Oracle’s PeopleSoft updateable PDF tax forms functionality enables USA employees to update their federal and state tax withholding information using Fluid Employee Self-Service. For an overview of this process, see Understanding Updateable PDF Tax Forms.

The following videos demonstrate how employees work with updateable PDF tax forms:

Video: Video Feature Overview: PeopleSoft Online Withholding Forms

Video: PeopleSoft HCM 9.2 Image 18 Highlights: Updateable PDF for W4

Note: Updateable PDF tax forms are not available in tablets or smartphones.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HC_PY_SS_NAVCOLL_FL (cref for the tile) PY_IC_WH_PTILE_FLU (page for dynamic data) |

Access a collection of self-service payroll transactions, including making tax withholding updates. |

|

|

PY_W4_MAIN_FL |

View a list of your tax withholding information and access a tax withholding form for a jurisdiction. |

|

|

PY_W4_MAIN_FED_SCF |

View a list of updateable federal tax forms and additional agency links, if any, and access the form or URL. |

|

|

PY_W4_MAIN_ST_SCF |

View a list of updateable state tax forms for that jurisdiction and additional agency links, if any, and access the form or URL. |

|

|

EOAWMA_TXNHDTL_FL |

Payroll administrators use this page to approve tax withholding changes that employees submit using self-service. |

Using updateable PDFs to change withholding elections consists of these steps:

The employee accesses the Tax Withholding Page to review current withholding elections.

The employee selects a jurisdiction to update.

Depending on the selected jurisdiction, either the Federal Tax Withholding Forms Page or the State Tax Withholding Forms Page appears. These pages list relevant withholding forms and any additional information.

The employee clicks the specific withholding form to be updated.

The system displays a warning that a form with personal information will be downloaded to the user’s computer.

If the employee continues past the warning, the system downloads the form and, depending on the browser settings, prompts the user to save or open the PDF file.

The employee opens the PDF file.

If the browser does not prompt the employee to open the file, the employee can open it manually.

The employee enters new withholding elections in the updateable PDF form and then selects the Submit button in the PDF file.

The system prompts the employee to enter their PeopleSoft User ID and password.

The system validates the employee’s logon credentials and updates the database (if no approval is required) or sends the request to the approver (if approval is required).

The system displays a new PDF file with a confirmation message and a reminder to close the original PDF.

As delivered, the new PDF file also includes a filled-out withholding form with the employee’s new elections. If you use PeopleTools 8.55.07 or later, the PDF Tax Form Table Page includes a configuration option so that you can prevent the filled-out form from appearing.

The system sends a confirmation email to the primary email address in the employee’s User Profile.

Important! Notification emails are sent to the email address that is associated with the employee’s PeopleSoft User ID, not to the email address in the recipient’s HR personal data record.

Employees cannot update their own User Profile email address. Administrators are responsible for maintaining this information. To view or update the email address for a User Profile, the administrator clicks the Edit Email Addresses link on the General page of the User Profiles component

If approvals are required, the system sends the approval request to the approver on the Pending Approvals - W-4 Tax Withholding Form Page. It sends the employee an additional email after the request is approval.

Use the Tax Withholding page (PY_IC_W4_FL) to view a list of your tax withholding information and access a tax withholding form for a jurisdiction.

Navigation:

Click the Tax Withholding tile from the Payroll Dashboard.

Click Tax Withholding from the Fluid Navigation Collection for Payroll.

This example illustrates the Tax Withholding page for USA.

The Tax Withholding page displays the employee’s federal and state tax information.

If an employee works for only one company, the Company field is read-only. If the employee works for more than one company, the Company field is editable, and the page initially displays information related to the employee’s primary job.

The jurisdictions that appear are based on the employee’s PeopleSoft Tax Data table pages (Federal Tax Data and State Tax Data) and Job Record, including whether the employee is assigned to more than one company or has withholding in more than one state, in which case the employee can choose which one to view.

Each jurisdiction’s withholding form is updated independently. When one jurisdiction has requirements based on another jurisdiction, the employee must update the forms in the correct order.

For example, Idaho and South Carolina do not allow the number of state allowances to exceed the number of federal allowances. So employees who want to increase the number of state allowances might need to first increase their federal withholding allowances. Similarly, employees who want to decrease their federal allowances might need to first decrease their state allowance. If an employee attempts to make an invalid change, the changes are not submitted and the employee receives a message that explains the validation error.

Data here also indicates if the employee has special tax withholding situations, such as if they have claimed exemption from withholding or have an IRS Lock In Letter indicating the maximum number of withholding allowances they are permitted. Updateable PDF forms are available or unavailable based on those situations.

A chevron appears in rows where updateable PDF tax forms are available.

When the employee has submitted a tax withholding change request and the request is in pending approval, selecting the row displays a modal page that shows the current withholding details and the values that were changed (with a color indicator) in the submitted request.

For more information about the setup of the Tax Withholding page, see Setting Up Updateable PDF Tax Forms.

Note: Payees in 1099-R companies are not allowed to update their Federal Tax Data on the Tax Withholding page.

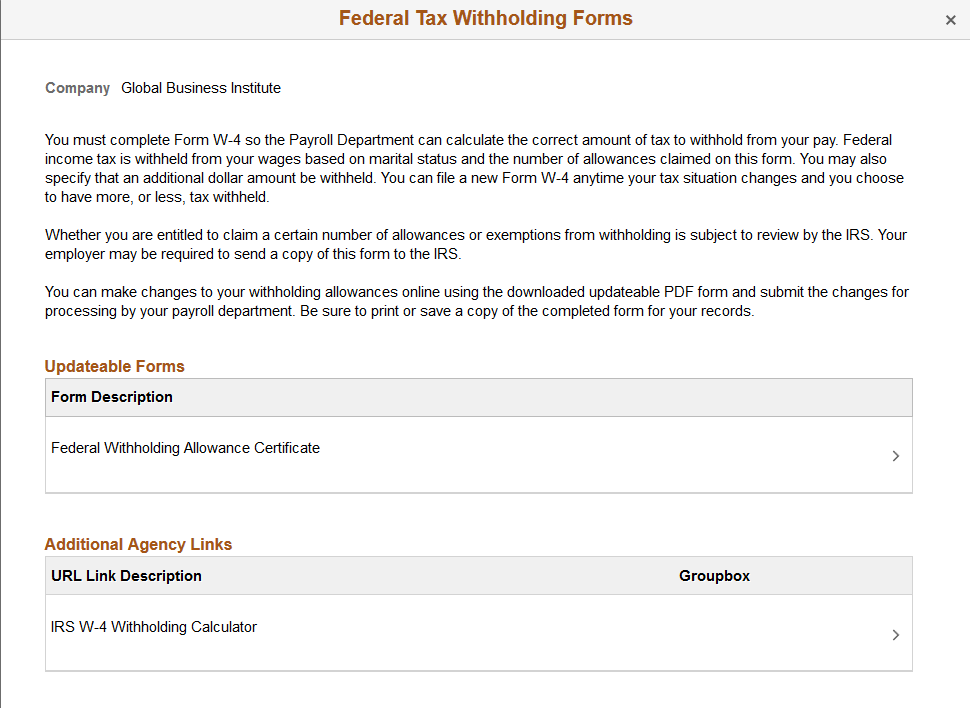

Use the Federal Tax Withholding Forms page (PY_W4_MAIN_FED_SCF) to view a list of updateable federal tax forms and additional agency links, if any, and access the form or URL.

Navigation:

Click the Federal row with a chevron on the Tax Withholding page.

Note: The State Tax Withholding Forms page (PY_W4_MAIN_ST_SCF) is similar to the Federal Tax Withholding Forms page (PY_W4_MAIN_FED_SCF). To access, click a state tax row with a chevron on the Tax Withholding page.

This example illustrates the Federal Tax Withholding Forms page for USA.

Payroll Administrators can configure and control text on the Federal Tax Withholding Forms and the State Tax Withholding Forms pages to meet your organization’s needs.

Field or Control |

Description |

|---|---|

Updateable Forms |

If a chevron appears in a row for the Federal jurisdiction, then an updateable PDF tax form is available. Click the row to access the updateable PDF tax form |

Additional Agency Links |

If your Payroll Administrator has attached any links to third-party resources, they will appear in this group box. PeopleSoft does not provide or maintain the third-party links. It is up to your Payroll Administrator to add and maintain them. |

For more information, see Setting Up Updateable PDF Tax Forms.

For information on using the Text Catalog to configure text, see Configuring the Text Catalog in your PeopleSoft HCM Applications Fundamentals product documentation.

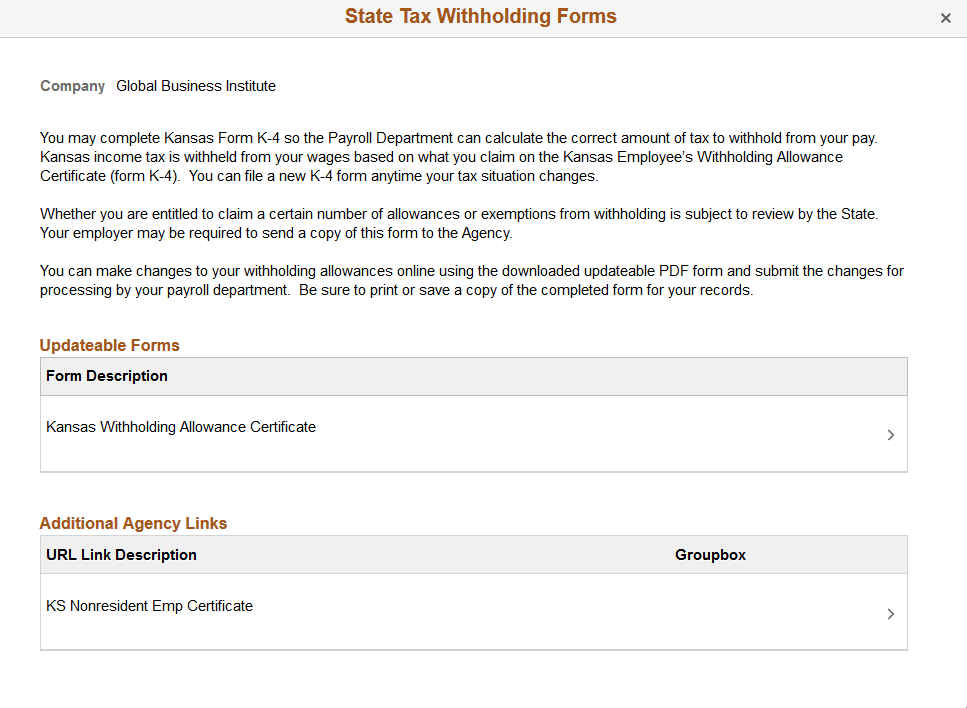

Use the State Tax Withholding Forms page (PY_W4_MAIN_ST_SCF) to view a list of updateable state tax forms and additional agency links, if any, and access the form or URL.

Navigation:

Click the State row with a chevron on the Tax Withholding page.

Note: The State Tax Withholding Forms page (PY_W4_MAIN_ST_SCF) is similar to the Federal Tax Withholding Forms page (PY_W4_MAIN_FED_SCF). To access, click a state tax row with the chevron on the Tax Withholding page.

This example illustrates the State Tax Withholding Forms page.

PeopleSoft delivers basic instructions relevant to for the respective state jurisdiction. Payroll Administrators can configure and control the text to meet your organization’s needs.

Note: Certain states use the Federal W-4 form for state tax withholding and require that the form indicates that is to be used for state purposes. PeopleSoft delivers the updateable PDF tax W-4 form with the text required by that state in the upper left of the form.

For information on using the Text Catalog to configure text, see Configuring the Text Catalog in your PeopleSoft HCM Applications Fundamentals product documentation.

Field or Control |

Description |

|---|---|

Updateable Forms |

If a chevron appears in a row for a jurisdiction, then an updateable PDF tax form is available. Click the row to access the updateable PDF tax form. |

Additional Agency Links |

If your Payroll Administrator has attached any links to third-party resources, they will appear in this group box. PeopleSoft does not provide or maintain the third-party links. It is up to your Payroll Administrator to add and maintain them. |

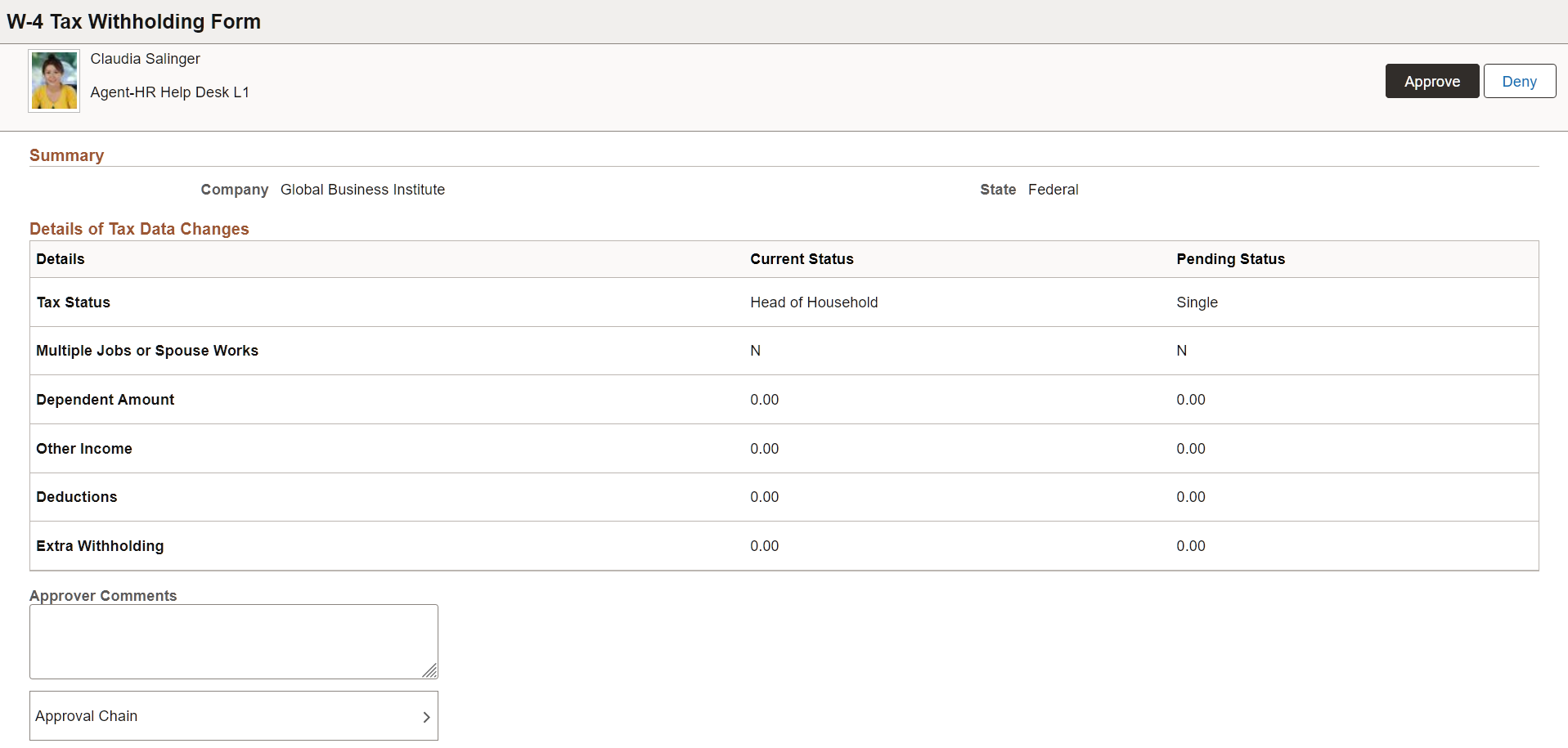

Use the Pending Approvals - W-4 Tax Withholding From page (EOAWMA_TXNHDTL_FL) to approve tax withholding changes that employees submitted using Employee Self-Service.

Navigation:

On the Manager Self-Service home page, select the Approvals tile to access the Pending Approvals page. Then select a W-4 Tax Withholding Form entry on the Pending Approvals page.

Select the push notification (or the link from an email notification) of a tax withholding change, if notifications are enabled in the setup.

(Desktop) This example illustrates the Pending Approvals - W-4 Tax Withholding Form page.

Approval Options

The approval options on this page are common to all fluid approval transactions, as described in the documentation for the Pending Approvals - <Transaction Details> Page.

Field or Control |

Description |

|---|---|

Approve and Deny |

Use these buttons to take action on the requested approval. |

Approver Comments |

Enter any comments related to the approval action you take. |

Approval Chain |

Click this item to open the Approval Chain page, where you can review information about all approvers for the transaction. |

Summary

This section displays the company name and the name of the tax jurisdiction.

Details of Tax Data Changes

This section displays the current status and pending status of the fields that the employee updated on the withholding form.

All fields are listed, including those that the employee did not change. The specific fields can vary according to the tax jurisdiction.