Identifying Events

This topic discusses run control pages that are used in eSocial reporting.

See Also Understanding eSocial.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_ESOC_ILB |

Perform an initial load of basic table and employer data for eSocial reporting. |

|

|

GPBR_ESOC_ILE |

Perform an initial load of employee (active and terminated) data for eSocial reporting. |

|

|

GPBR_ESOC_MBT |

Process and load basic table data changes for eSocial reporting. |

|

|

GPBR_ESOC_MNP |

Process and load non-periodic data changes for eSocial reporting. |

|

|

GPBR_ES_P_HIRE |

Process and load employee’s pre-hiring data for eSocial reporting. |

|

|

GPBR_ES_PH_MONITOR |

View the list of generated pre-hiring events. |

|

|

GPBR_ES_HIRE_DET |

View event details. |

|

|

GPBR_ESOC_TER |

Process and load terminations for eSocial reporting. |

|

|

eSocial Processed Calendars - eSocial Termination Events Page |

GPBR_ES_IDCALT |

Review the list of identified calendars for termination event processing. |

|

eSocial Processed Employees - eSocial Termination Events Page |

GPBR_ES_IDTER_EMP |

Review the payroll status and termination event status of payees for the selected calendar. |

|

GPBR_ESOC_TAX_RE |

Enter payroll tax exemption information for companies. |

|

|

GPBR_ES_EUC |

Enter union contribution information for companies. |

|

|

GPBR_ESOC_PER |

Process and load payroll events. |

|

|

GPBR_ES_IDCAL |

Review the list of identified calendars for S-1200 and S-1210 event processing. |

|

|

GPBR_ES_IDEMP |

Review the payroll status and payroll event status of payees for the selected calendar. |

|

|

GPBR_ESOC_PER_CTRL |

Close or reopen assessment periods for processing periodic events. |

|

|

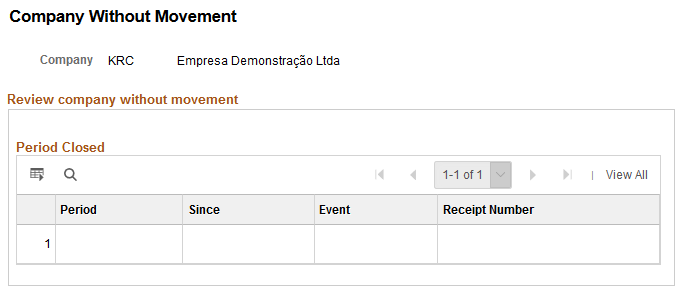

GPBR_ESOC_NOMOV |

Review, by company, a list of periods during which no periodic events are reported to the eSocial system. |

|

|

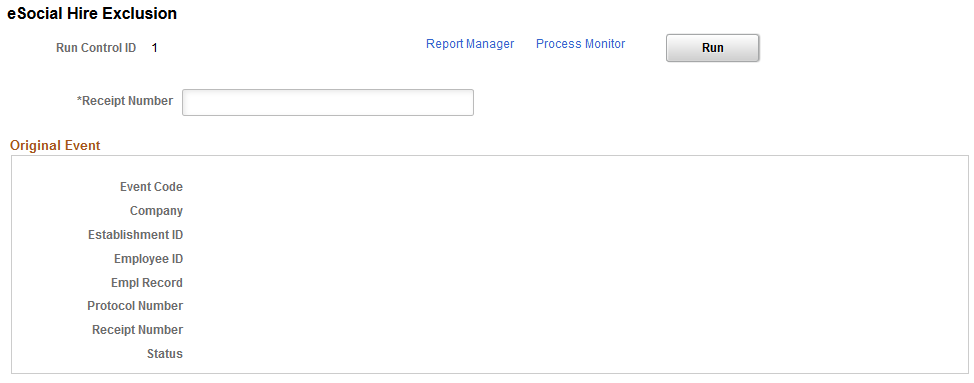

GPBR_RC_EVT_EXCL |

Generate driver information of exclusion events for hiring events. |

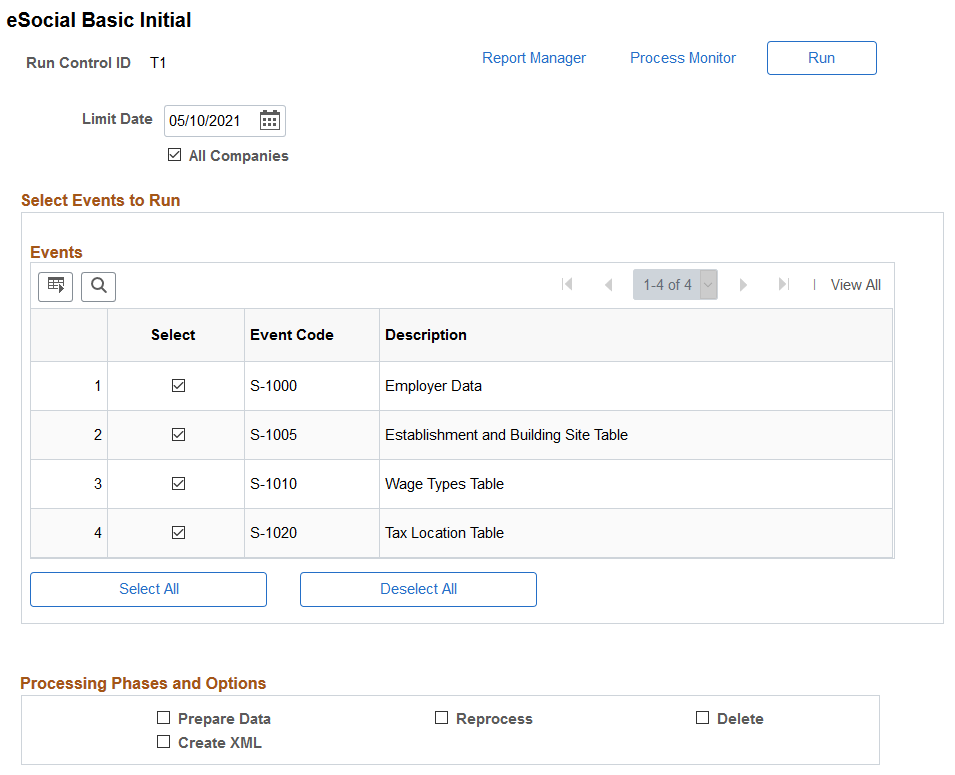

Use the eSocial Basic Initial page (GPBR_ESOC_ILB) to perform an initial load of basic table and employer data for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the eSocial Basic Initial page.

Run the eSocial Basic Tables Initial process (GPBR_ES_ILB) to perform an initial load of basic table and employer data for eSocial records. By default, events that are marked as initial events on the Events Setup page appear as selected in this section.

Field or Control |

Description |

|---|---|

Limit Date |

This field is not used in basic table initial loading events. |

All Companies or Company |

Click to include all companies that are enabled for eSocial reporting on the Company Parameters Page in the initial data loading process. Alternatively, you can add one or more companies manually by inserting rows to this page. Only eSocial-enabled companies are available for selection. |

Adhere to eSocial |

Displays the date the company is required to report data to eSocial. This date is entered on the Company Parameters Page. This field is not displayed if the All Companies field is selected. Date validation is performed when events are generated. |

Events

This section lists all the initial load events for basic tables that are enabled for eSocial reporting for the specified company. These events are categorized as basic table events and marked as Initial Events (on the Events Setup Page).

If applicable, you can clear the selection of any enabled events and remove them from the initial loading process. Doing so means that you opt to not use PeopleSoft HCM Global Payroll for Brazil to process those removed eSocial events.

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

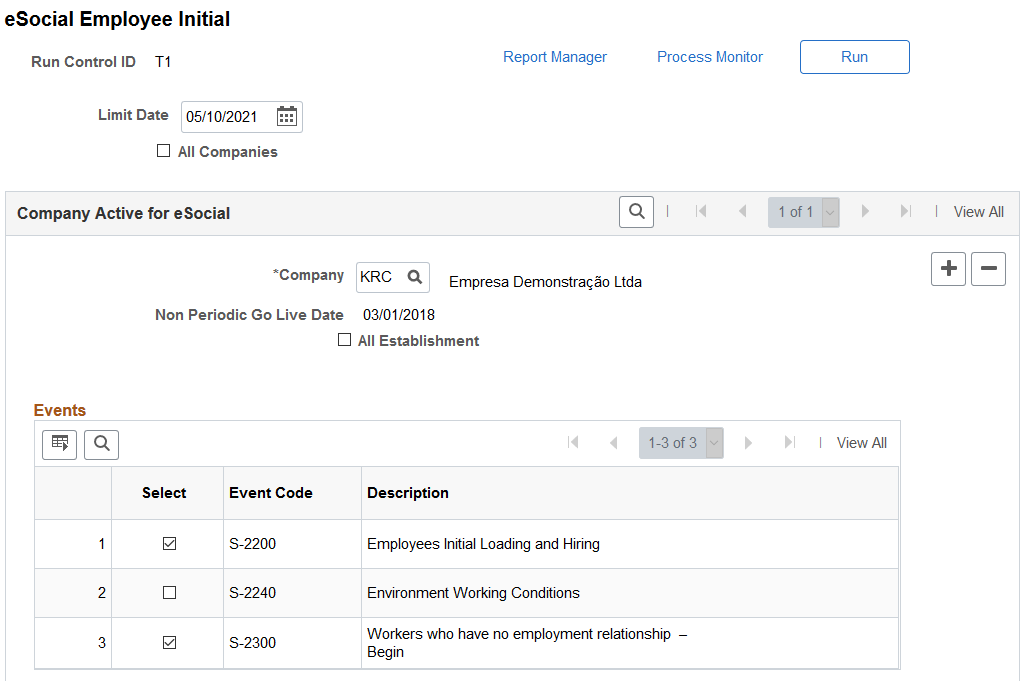

Use the eSocial Employee Initial page (GPBR_ESOC_ILE) to perform an initial load of employee (active and terminated) data for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the eSocial Employee Initial page (1 of 2).

This example illustrates the fields and controls on the eSocial Employee Initial page (2 of 2).

Run the eSocial Employee Initial process (GPBR_ES_ILE) to perform an initial load of employee data for eSocial records. By default, S-2200 and S-2300 events appear as selected in this section, if they are activated.

At initial implementation, customers have the option to load active employees as well as terminated employees depending on their business needs (for example, bonus payments for terminated employees through complementary termination).

Note: Run the initial load process for employees after the initial load process for basic tables has completed successfully.

Field or Control |

Description |

|---|---|

Limit Date |

This field is not used in employee initial loading events. |

All Companies or Company |

Click to include all companies that are enabled for eSocial reporting on the Company Parameters Page in the initial data loading process. Alternatively, you can add one or more companies manually by inserting rows to this page. Only eSocial-enabled companies are available for selection. |

Non Periodic Go Live Date |

Displays the go live date for non-periodic events that is specified for the selected company. This date is entered on the Company Parameters Page. This field is not displayed if the All Companies field is selected. Date validation is performed when events are generated. |

Health/Safety Go Live Date |

Displays the go live date for health and safety events (for example, S-2220 and S-2240) that is specified for the selected company. This date is entered on the Company Parameters Page. This field is not displayed if the All Companies field is selected. Date validation is performed when events are generated. |

All Establishment or Establishment ID |

Select to include all establishments of the specified company for eSocial reporting. When selected, the Establishment Selection section becomes invisible. Alternatively, you can add establishments manually by inserting rows in the Establishment Selection section. |

Events

This section lists all the initial load events for employees that are enabled for eSocial reporting for the specified company or all companies. By default, S-2200 and S-2300 events appear as selected and the S-2240 event deselected in this section. The S-2200 and S-2300 events are the prerequisites of the S-2240 event, and are deselected automatically when the S-2240 event is selected.

If applicable, you can clear the selection of enabled events and remove them from the initial loading process. Doing so means that you opt to not use PeopleSoft HCM Global Payroll for Brazil to process those removed eSocial events.

Establishment Selection

Use this section to manually add company establishments to be included in eSocial reporting.

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

Employees

Use this section to specify the group of employees for which the employee initial loading events are generated.

Field or Control |

Description |

|---|---|

Active and As of |

Select to generate specified events only for active employees. When selected, specify the Active as of date. Employees who remain active on this date will be included in the employee initial loading events. |

Inactive, From and To |

Select to generate specified events only for inactive employees (terminated employees). When selected, specify the termination period. Employees who were terminated during this period will be included in the employee initial loading events. |

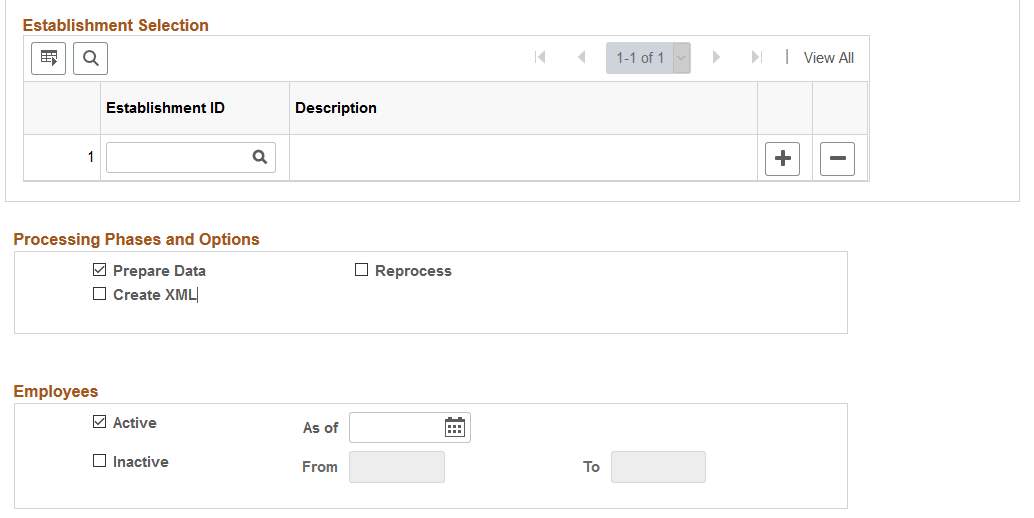

Use the eSocial Basic Table Event page (GPBR_ESOC_MBT) to process and load basic table data changes for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the eSocial Basic Table Event page.

Run the eSocial Basic Tables (GPBR_ES_MBT) process to load basic table and employer data changes for eSocial reporting.

Field or Control |

Description |

|---|---|

Limit Date |

Enter the date that is used to identify which data rows from the Driver record are to be processed. Driver record rows with an effective date later than this date will not be processed. By default, the current date is populated. |

All Companies |

Select to run the XML file creation process for all companies that are enabled for eSocial reporting. |

Company |

Select a company for which the process runs, if not all active companies are to be processed. You can add more companies to the process by inserting new rows. |

Events

This section lists all the events that are categorized as Basic Table on the Events Setup page. Select the ones to be processed.

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

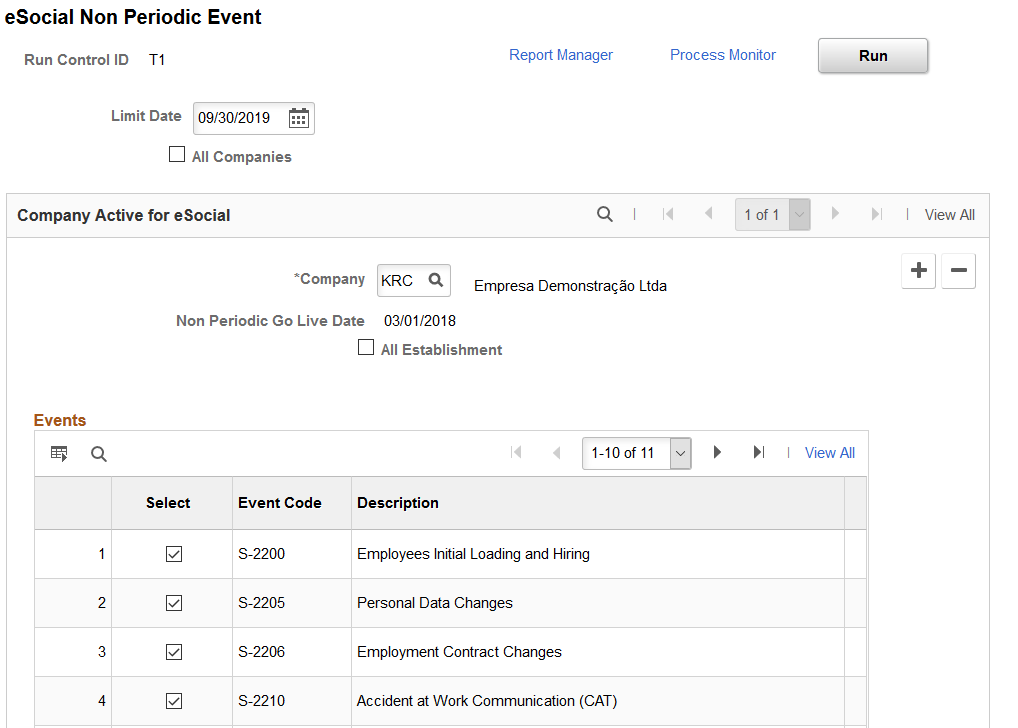

Use the eSocial Non Periodic Event page (GPBR_ESOC_MNP) to process and load non-periodic data changes for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the eSocial Non Periodic Event page (1 of 2).

This example illustrates the fields and controls on the eSocial Non Periodic Event page (2 of 2).

Run the eSocial Non Periodic Events (GPBR_ES_MNP) process to load non-periodic data for eSocial reporting.

Field or Control |

Description |

|---|---|

Limit Date |

Enter the date that is used to identify which data rows from the Driver record are to be processed. Driver record rows with an effective date later than this date will not be processed. By default, the current date is populated. |

All Companies |

Select to run the XML file creation process for all companies that are enabled for eSocial reporting. |

Company |

Select a company for which the process runs, if not all active companies are to be processed. You can add more companies to the process by inserting new rows. |

Non Periodic Go Live Date |

Displays the go live date for non-periodic events that is specified for the selected company. This date is entered on the Company Parameters Page. This field is not displayed if the All Companies field is selected. Date validation is performed when events are generated. |

All Establishment |

Select to run the XML file creation process for all establishments of the selected company. |

Events

This section lists all the events that are categorized as Non Periodic on the Events Setup page. Select the ones to be processed.

Establishment Selection

In this section, select one or more establishments for which the process runs, if not all establishments of the selected company are to be processed.

This section appears if the All Establishment field is not selected.

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

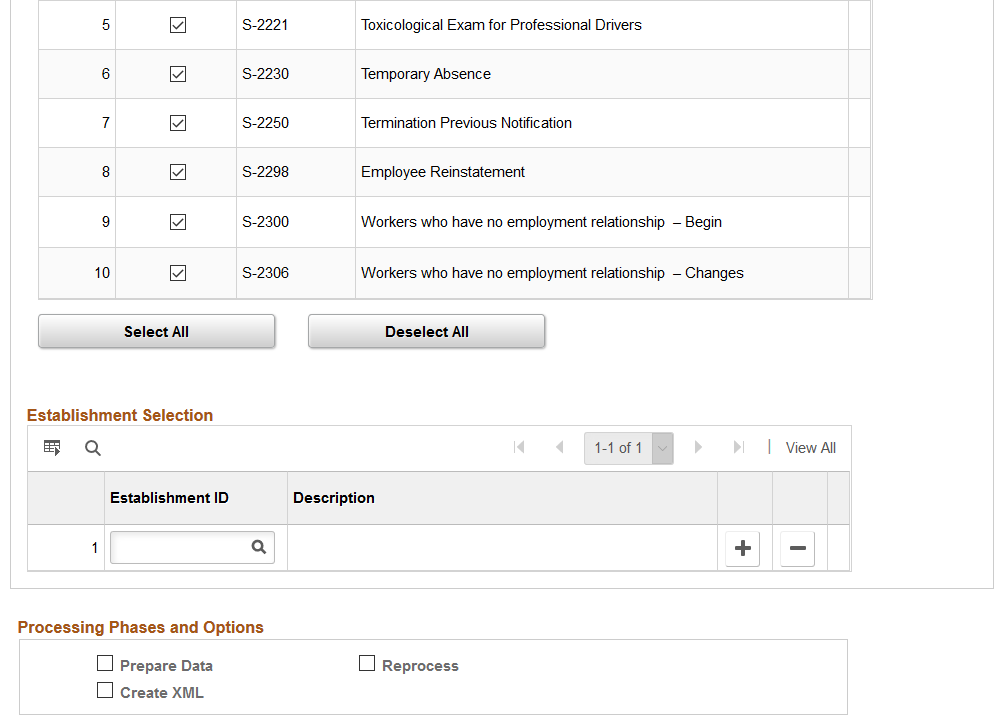

Use the eSocial Pre-Hiring Event page (GPBR_ES_P_HIRE) to process and load employee’s pre-hiring data for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the Preliminary Info tab of the eSocial Pre-Hiring Event page (1 of 2).

This example illustrates the fields and controls on the Digital CTPS tab of the eSocial Pre-Hiring Event page (2 of 2).

Default Parameters

Field or Control |

Description |

|---|---|

Company |

Select a company for the pre-hiring event. The selected company becomes the default value that is populated in the Employees section. |

Hire Date |

Select the estimated hire date, which cannot be earlier than the current date. The specified date becomes the default value that is populated in the Employees section. |

Employees - Preliminary Information

Information entered in this section is used by the GPBR_E_PHIRE application engine process to generate pre-hiring event XML files. All fields are required.

Field or Control |

Description |

|---|---|

Employee ID |

Select the employee or individual for which the pre-hiring event is launched. You can select from:

Note: You may enter the same ID more than once as long as the ID is associated with different companies. However, you may not enter the same ID for more than one run control ID. |

Company |

Select the company for the selected individual. Companies that are enabled on the Company Parameters Page for eSocial reporting are available for selection. |

Reg Region (regulatory region) |

Select the regulatory region to determine the setID for the Empl Class field. |

Empl Class (employee class) |

Select the applicable employee class for the employee. The same list of values is also used on the Job Information page (JOB_DATA_JOBCODE). |

Hire Date |

Select the estimated hire date for the selected individual. This date is sent to eSocial as the hire date and it cannot be earlier than the current date. |

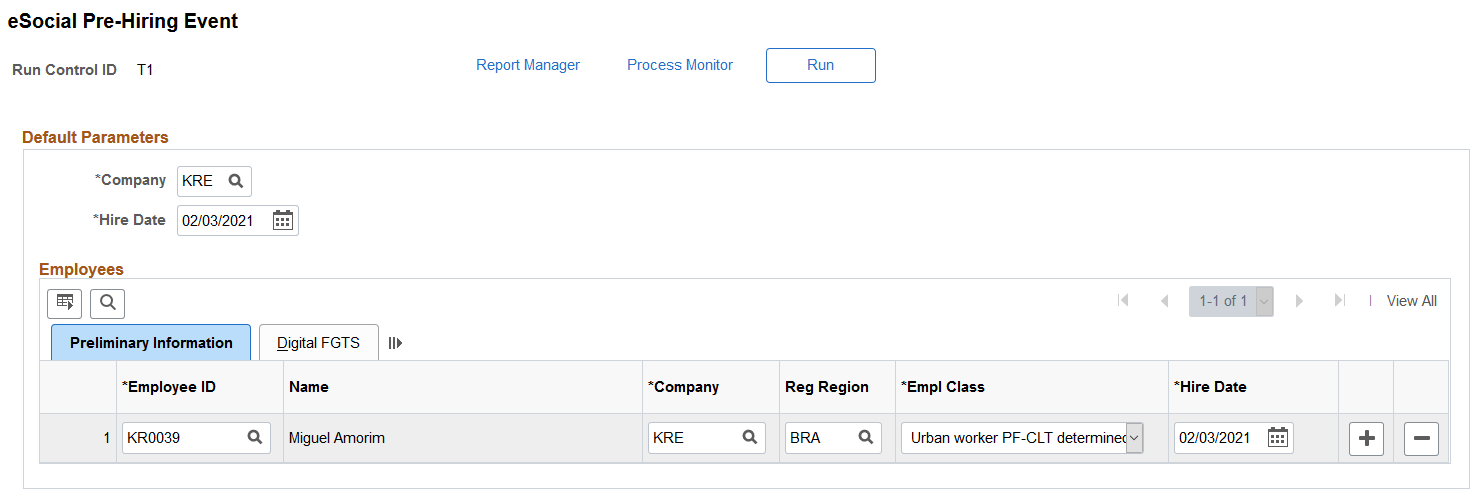

Employees - Digital FGTS

Field or Control |

Description |

|---|---|

Business Unit |

Select the business unit to determine the setID for the Job Code field. |

Job Code |

Select the job code used to populate the Brazilian Occupation Cd field automatically. |

Brazilian Occupation Cd (Brazilian occupation code) |

The system populates this field automatically when you select a job code. This field value is required for eSocial. |

Comp Rate and Contract Salary Type |

Enter the salary amount of the job, and the salary type of the amount, for example, Monthly, Weekly, Per Task. |

Contract Type |

Select the type of employment contract for this hire. |

Contract End Date |

Specify the end date of the employee’s contract. This field appears when the selected contract type is Determinate. |

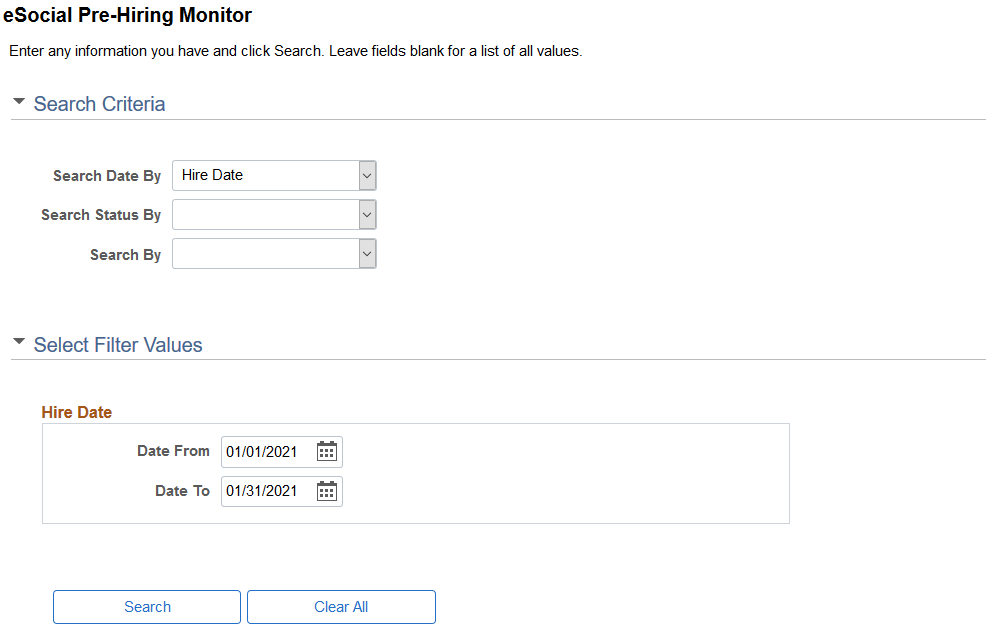

Use the eSocial Pre-Hiring Monitor page (GPBR_ES_PH_MONITOR) to review statuses of the list of generated pre-hiring events.

Navigation:

This example illustrates the fields and controls on the eSocial Pre-Hiring Monitor page.

This example illustrates the eSocial Pre-Hiring Monitor page where search results are displayed.

Use this page to search for and review the list of submitted pre-hiring events and event details. You can perform searches by dates, company, employee, and statuses. The search results help you monitoring the current status of hiring-related events, and decide if additional ones need to be reported.

Search Criteria

Use this section to look up hiring-related events using at least one search criterion. Corresponding search sections and fields (except searching by status) appear in the Select Filter Values section based on the selected search criteria.

Field or Control |

Description |

|---|---|

Search Date By |

Select to look up events by: Hire Date Transaction Date Then, enter a date range to search for events with hire or transaction dates that fall between the specified date range. |

Search Status By |

Select to look up events by status. Values are: Await Exclusion: Select to search for S-2190 events with S-3000 events that are in the XML Create status. Canceled: Select to search for events that are canceled. Complete: Select to search for events that are completed successfully. Error: Select to search for events that encountered errors at any stage of the eSocial report process (for example, mapping process, XML file generation, or web service communication). Error codes are defined on the eSocial Error Catalog Page. Hired: Select to search for S-2200 events that are associated with pre-hiring protocol numbers. Hiring in Progress: Select to search for S-2190 events with S-2200 events that are in the XML Create status. Pending Hiring: Select to search for S-2190 events with receipt numbers and are associated with S-2200 events. Wait for Return: Select to search for events (S-2190, S-2200 and S-3000) that are awaiting protocol numbers to be returned from the government. Withdraw Hiring: Select to search for S-2200 events, which reference S-2190 events, that have been excluded. Withdraw Pre-Hiring: Select to search for S-2200 events that have been sent as part of employee initial loading and have been excluded, and corresponding receipt numbers returned from the government. |

Search By |

Select to look up events by: Company. Select one or more companies, which are enabled in the Company Parameters Page. Employees. Select one or more employee IDs that are either inactive, or do not have employment relationships in job data. |

Select Filter Values

Use this section to enter search values based on the selected search criteria, which can be date range, companies, and employees

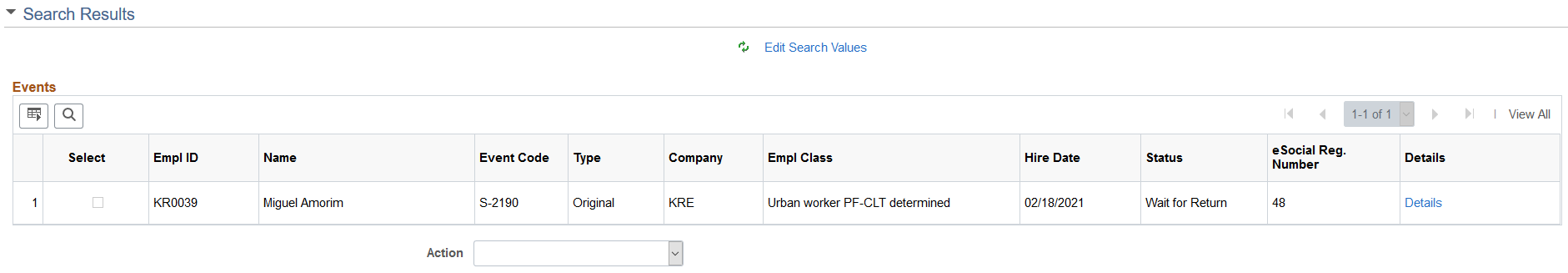

Search Results - Events

This section displays the search result.

Field or Control |

Description |

|---|---|

Select |

Select one or more events for an action (already selected) to be performed. Note: Specify an action before selecting any event. The system refreshes the search result and displays events that are eligible for the selected action. |

Type |

Indicates the type of the event, Original or Rectifier. |

Empl Class |

Displays the employee class of the employee. |

eSocial Reg. Number (eSocial register number) |

Displays the eSocial register number generated for the employee. |

Details |

Click to view additional details of the selected event on the Search Results - Details page (GPBR_ES_HIRE_DET). |

Action and Process |

Select an action to perform. Values are: Cancel: Select to set the statuses of selected events to Canceled. Cancelled events can be reprocessed. Exclude: Select to generate S-3000 events for selected S-2190 events that are in the Pending Hiring status. Rectify: Select generate rectification drivers for the selected events. Only events with a receipt number can be rectified. When an event is selected for the Rectify action, you can update the employee class and hire date as needed. According to the S-1.0 version requirement, the information (for example, CPF, birthdate, hire date, register number, and employee class) sent to the Government by the S-2190 event and its associated S-2200 or S-2300 event must match. If the information (employee class and hire date) was sent incorrectly using the S-2190 event, the event needs to be rectified before sending the S-2200 or S-2300 event. If the CPF or birthdate was sent to the Government using the S-2190 event and the information was incorrect, you need to first update it from the source (the Personal Data component) and rectify the S-2190 event before sending the S-2200 or S-2300 event. Reprocess: Select to run the pre-hiring AE process again on selected events. This action is available to events that have encountered error. The Process button appears when an action is selected. Click to process selected events with the selected action. |

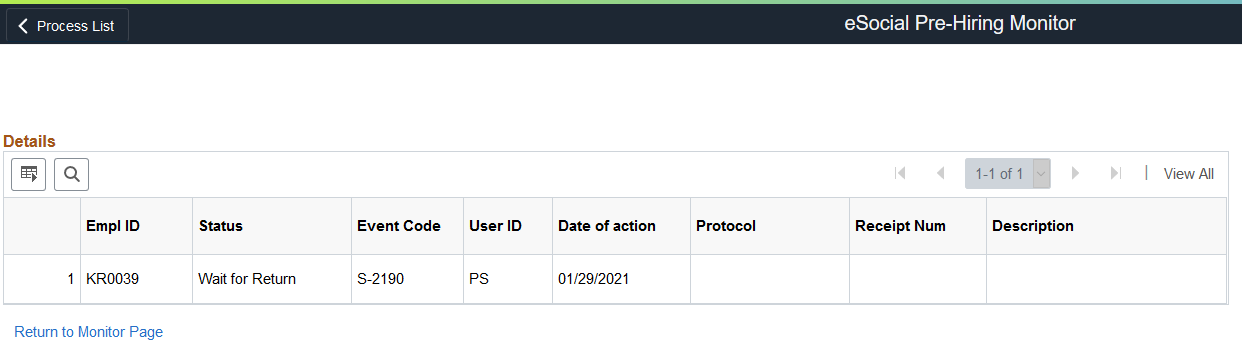

Use the eSocial Pre-Hiring Monitor - Details page (GPBR_ES_HIRE_DET) to view event details.

Navigation:

Click the Details link of an event from the search result on the eSocial Pre-Hiring Monitor page.

This example illustrates the fields and controls on the eSocial Pre-hiring Monitor - Details page.

This page displays additional information about the event being viewed, including information about related events. For example, if you click to view the details of a hiring event for a person, the information for the associated pre-hiring event (if available) is also available for viewing.

Field or Control |

Description |

|---|---|

Date of action |

Displays the date when the event was processed. |

Protocol |

Displays the associated protocol number that is returned from eSocial. |

Receipt Num (receipt number) |

Displays the associated receipt number that is returned from eSocial. |

Description |

Displays error description if applicable, for example: Event S-2190 already exist for this Emplid Other Company indicated in event S-2200 Other Hiring Date indicate in event S-2200 Other Labor Category indicate in event S-2300 |

Return to Monitor Page |

Click to go back to the eSocial Pre-Hiring Monitor page. |

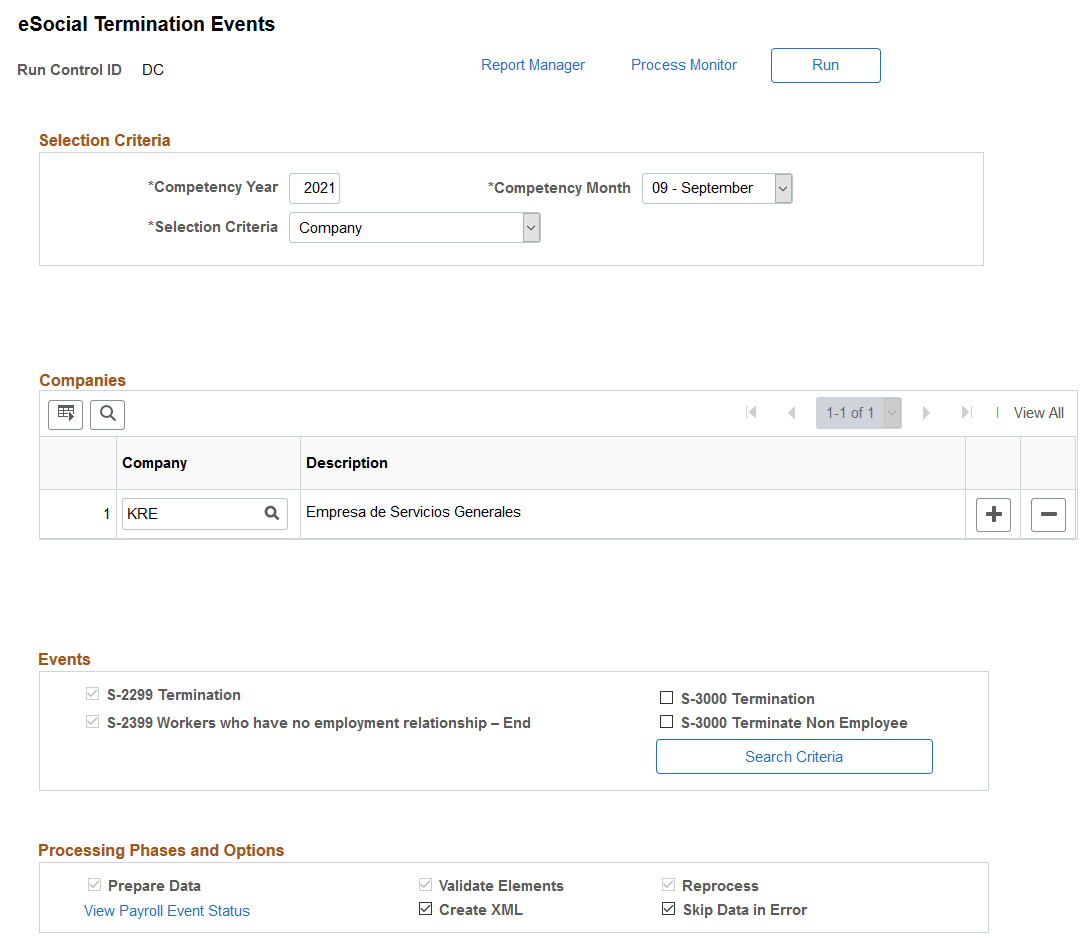

Use the eSocial Termination Events page (GPBR_ESOC_TER) to process and load terminations for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the eSocial Termination Events page.

Run the GPBR_ES_TER process to load employee and non-employee terminations for eSocial reporting.

The process takes in all terminations (with and without payment) that occurred in the specified time period for selected companies, and have not yet been processed for eSocial reporting.

For terminations with payment, the process identifies all applicable calendars automatically based on the selection criteria. These calendars are listed on the eSocial Processed Calendars - eSocial Termination Events Page for reference.

Selection Criteria

Field or Control |

Description |

|---|---|

Competency Year and Competency Month |

Specify the time period that is being assessed for termination reporting. |

Selection Criteria |

Select to process terminations for all companies, or a selection of companies that are selected in the Companies section that appears. |

Events

Field or Control |

Description |

|---|---|

S-2299 Termination and S-2399 Workers who have no employment relationship – End |

Displays the two system-delivered termination events (S-2299 and S-2399) that are used for reporting employee and non-employee terminations to the government’s eSocial system. They are preselected in the process and cannot be deselected. |

S-3000 Termination and S-3000 Terminate Non Employee |

If applicable, select to prepare and generate exclusion events for terminations (employee, non-employee, or both) that match the specified search criteria. Submit a termination exclusion event if your wish to remove from the government’s eSocial system termination information that was submitted by mistake. |

Search Criteria |

Click to search for all finalized termination calendars for employees that were terminated during the specified competency period for the selected companies. Employees and calendars that are identified for termination are available for viewing by clicking the View Payroll Event Status link that appears. |

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

Field or Control |

Description |

|---|---|

View Payroll Event Status |

Click, if available, to access the eSocial Processed Calendars - eSocial Termination Events page to review a list of payroll calendars that have been identified for S-2299 and S-2399 events. |

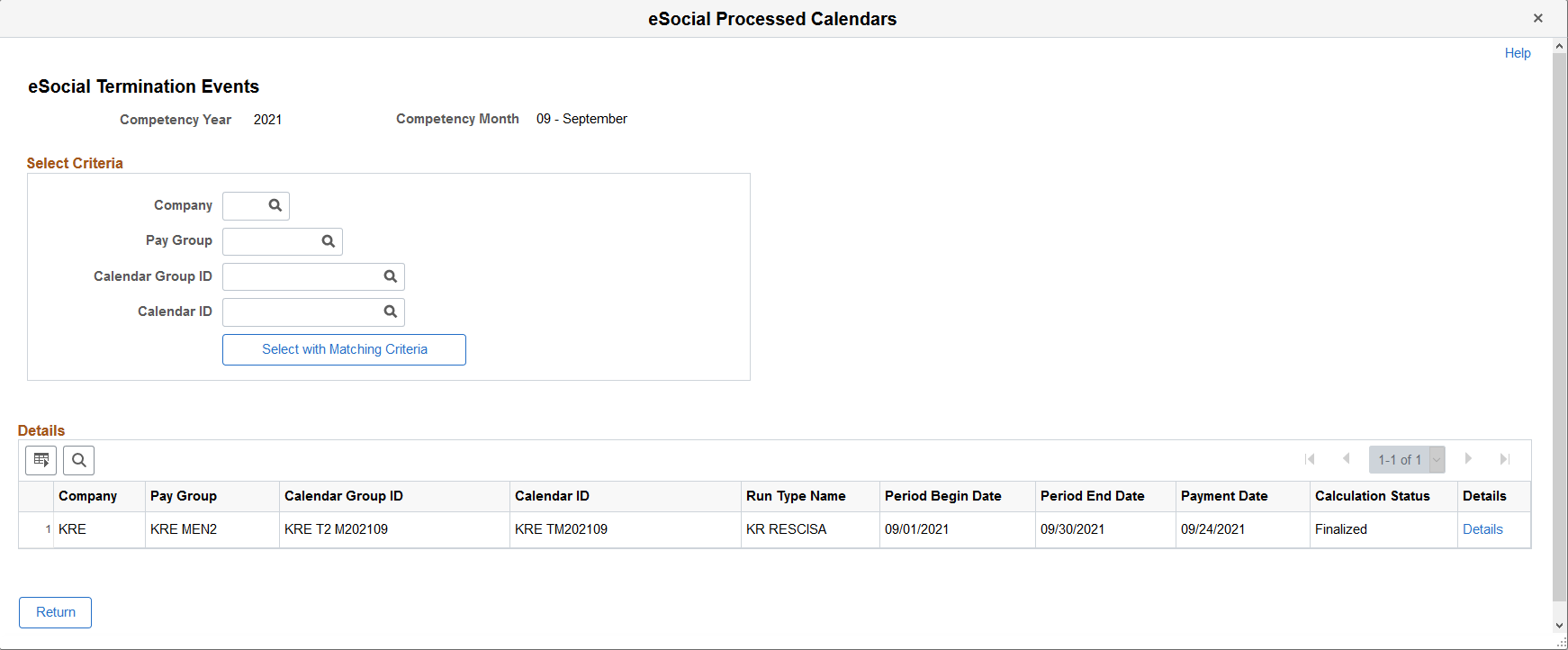

Use the eSocial Processed Calendars - eSocial Termination Events page (GPBR_ES_IDCALT) to review the list of identified calendars for termination event processing.

Navigation:

Click the View Payroll Events Status link on the eSocial Termination Events page.

This example illustrates the fields and controls on the eSocial Processed Calendars - eSocial Termination Events page.

Use this page to review the list of finalized payroll calendars that are identified based on the specified competency period, active run types in that period and specified companies. Both regular and off-cycle calendars are included. Calendar information is used in the mapping process for termination events.

Field or Control |

Description |

|---|---|

Select with Matching Criteria |

Click to refine the search result based on the selected search criteria. |

Details |

Click to access the eSocial Processed Employees - eSocial Termination Events page to review the termination event status (S-2299 and S-2399) for each payee included in the selected competency period and calendar entry. |

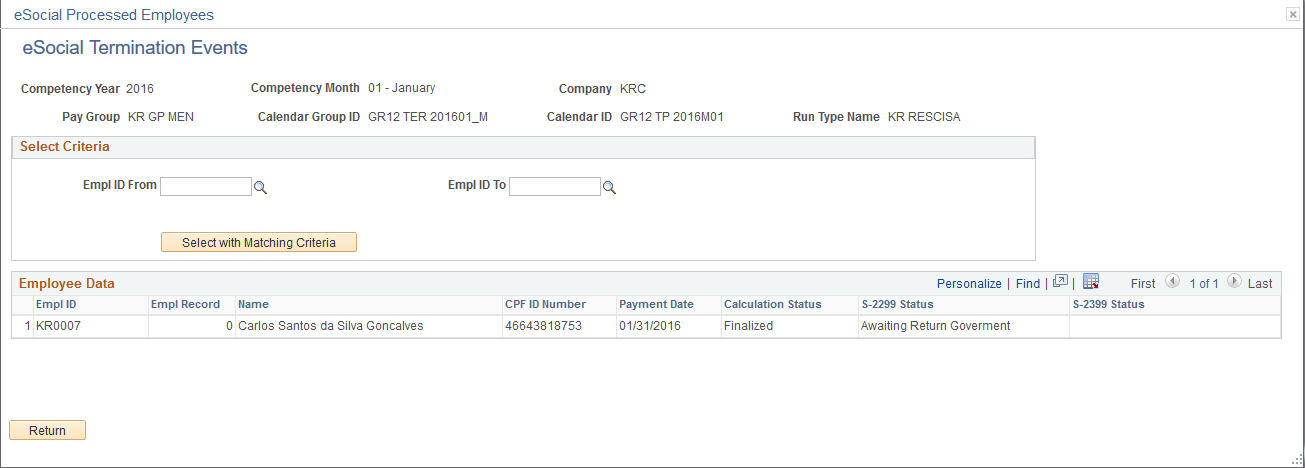

Use the eSocial Processed Employees - eSocial Termination Events page (GPBR_ES_IDTER_EMP) to review the payroll status and termination event status of payees for the selected calendar.

Navigation:

Click the Details link of a calendar entry on the eSocial Processed Calendars - eSocial Termination Events page.

This example illustrates the fields and controls on the eSocial Processed Employees - eSocial Termination Events page.

Use this page to review the list of payees that are included in the specified competency period, company, pay group, calendar group, calendar, and run type. Specify additional selection criteria to refine the search result if needed. As a payroll clerk, you can review the current statuses of payees’ termination events, compare information on this page with your payroll reports, and verify that the information looks good.

Field or Control |

Description |

|---|---|

S-2299 Status or S-2399 Status |

Displays the current status of the termination event (S-2299 or S-2399) for the corresponding payee. Values are: Awaiting Return Government: Indicates that the event is already submitted and is awaiting a receipt number from the government. Error Event: Indicates that an error was found in processing. Finalized: Indicates that a receipt number for the payroll event has been given from the government. Identified: Indicates that the event is currently in the mapping process, or it is in the RDY status (the event has been identified, but no data preparation is done on it yet). |

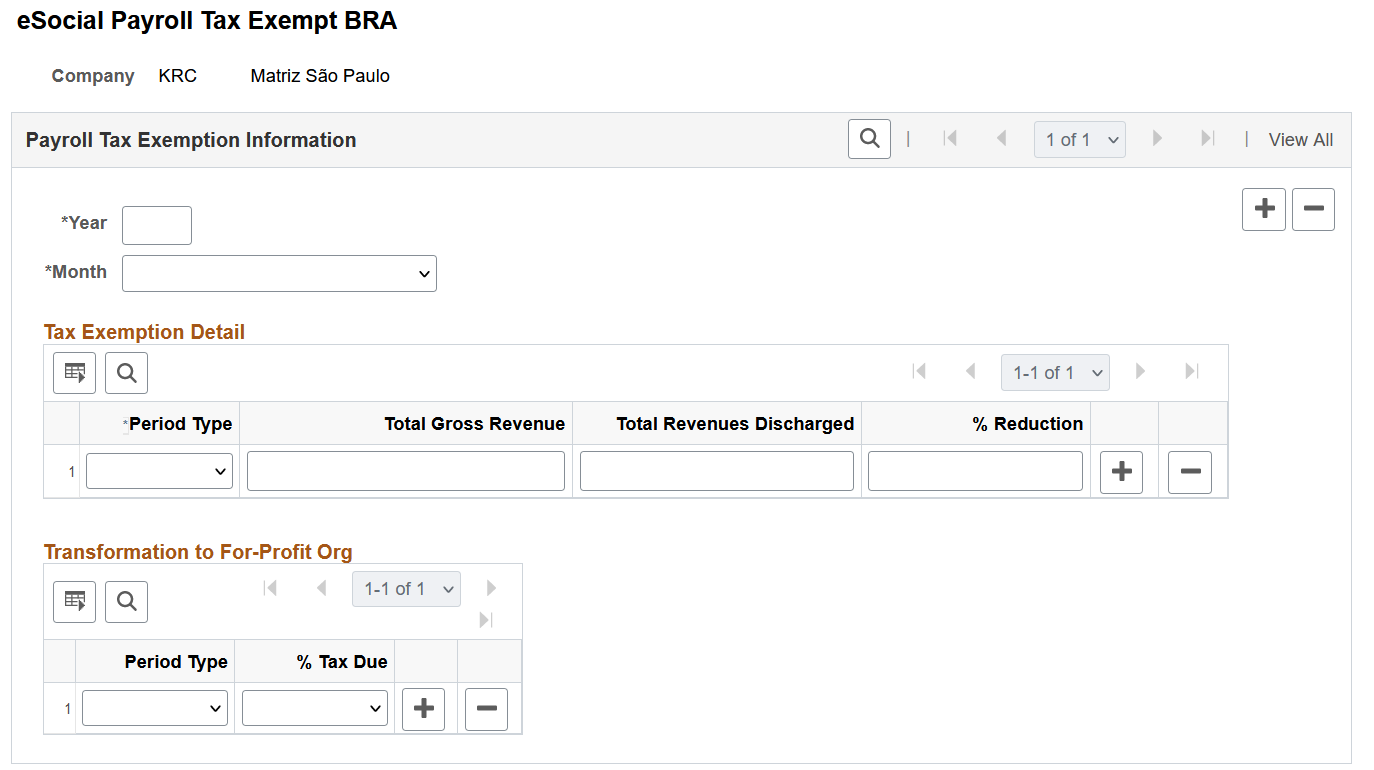

Use the eSocial Payroll Tax Exempt BRA page (GPBR_ESOC_TAX_RE) to enter payroll tax exemption information for companies.

Navigation:

This example illustrates the fields and controls on the eSocial Payroll Tax Exempt BRA page.

Use this page to report company’s payroll tax exemption to the government. This page is applicable to companies that have Partially Replaced selected in the Other Sectors field on the Additional Info - Brazil Page for their establishment headquarters. Companies need to provide this information for S-1280 (Complementary Information to Periodic Events) event reporting.

Note: A headquarter must already be defined for a company (only one for each company) in order for payroll tax exemption to be reported for that company. If the headquarter is missing, it will be logged, and the tax exemption information that is specified on this page will not be reported to the government.

Tax Exemption Detail

|

Field or Control |

Description |

|---|---|

|

Period Type |

Specify whether this payroll tax exemption is monthly or annually in nature. If payroll tax exemption entries are entered both monthly and annually for the same company and competency period, two S-1280 events will be created after validation checks are passed. If the selected period type is Annual, an S-1280 event will be created regardless of whether the selected month is December. |

|

% Reduction |

Enter a positive non-zero tax reduction percentage number. This is required if the Other Sectors field value is set as Partially Replaced on the Additional Info - Brazil Page for the establishment headquarter of the selected company. |

Transformation to For-Profit Org

Note: If the company has become a for-profit organization and the date of the conversion is specified on the (BRA) Company Details BRA Page, information in this section is required.

|

Field or Control |

Description |

|---|---|

|

Period Type |

Specify the applicable period type, Monthly or Annual. Do not specify the same period type more than once. |

|

% Tax Due |

Specify the percentage of INSS contribution due for the selected period type. |

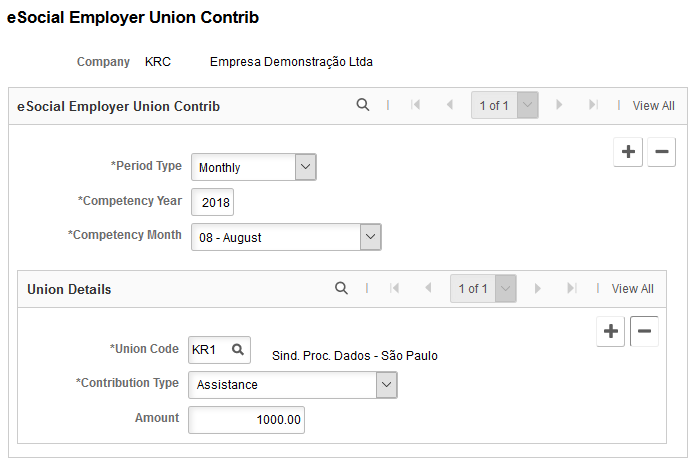

Use the eSocial Employer Union Contrib page (GPBR_ES_EUC) to enter union contribution information for companies.

Navigation:

This example illustrates the fields and controls on the eSocial Employer Union Contrib page.

Note: This page is not used.

Use this page to report company’s union contribution to the government.

Field or Control |

Description |

|---|---|

Period Type |

Select if the union contribution is a compulsory annual payment or an optional monthly payment. |

Union Details

Enter all union contributions that were made for the specified company, competency period and period type.

Field or Control |

Description |

|---|---|

Union Code |

Select an applicable union code. Union codes are set up using the Unions component. See Also Setting Up Unions |

Contribution Type |

Select the type of the union contribution to be reported. Values are: Assistance. The period type for this contribution type is Monthly. Associative. The period type for this contribution type is Monthly. Compulsory. The period type for this contribution type is Annually. Confederative. The period type for this contribution type is Monthly. |

Amount |

Enter positive non-zero union contribution amount. |

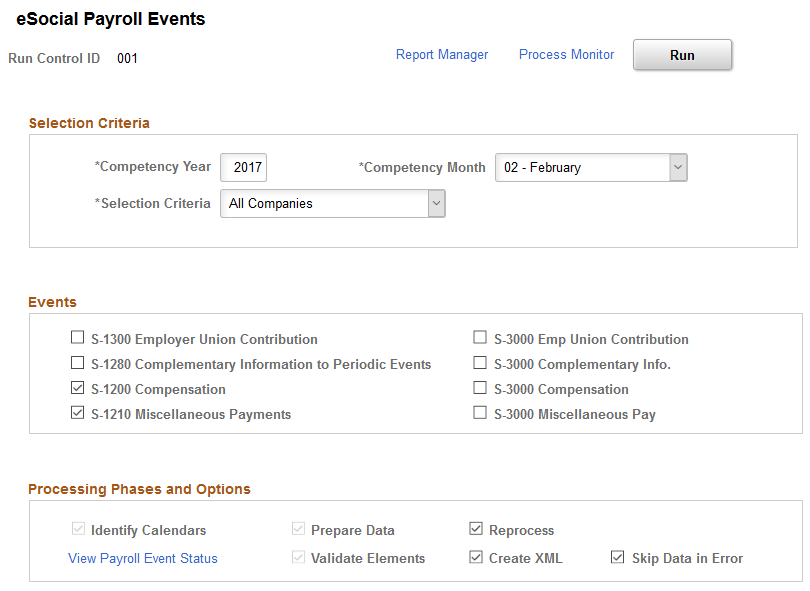

Use the eSocial Payroll Events page (GPBR_ESOC_PER) to process payroll events for eSocial reporting.

Navigation:

This example illustrates the fields and controls on the eSocial Payroll Events page.

Run the GPBR_ES_PER process to load payroll data for eSocial reporting.

Selection Criteria

Field or Control |

Description |

|---|---|

Competency Year and Competency Month |

Specify the period that is being assessed for eSocial reporting. This period is considered valid if it is equal to or after the Adhere to eSocial date (its month and year) that is specified for each company included in this payroll event process. If the period is invalid, the process stops and an error “Period selected in Run Control page isn't valid” is logged. If an S-1299 event (Closing Periodic event) exists in the system for the same period and company that is specified on this page, and the event is not cancelled or excluded, the payroll event process stops and an error “Event S-1299 created for this Company in this Period” is logged. However, if an S-1298 event (Reopening Periodic event) also exists for the same period and company, and is associated with a receipt number, which voids the S-1299 event, the payroll event process continues. |

Selection Criteria |

Select to process payroll events for: Note: Companies must be activated on the Company Parameters Page to support payroll event reporting in eSocial. All Companies Company: A list of companies that are selected in the Companies section. Employee: A list of employees that are selected in the Employee Selection section. |

Period Type |

Select: Annual to generate the selected payroll events for the specified year. Month to generate the selected payroll events for the specified year and month. This field appears if the selected competency month is 12 - December. |

Company |

Specify a company of which employees can be picked for the selected payroll events. This field appears if the Selection Criteria field is set to Employee. |

Companies

This section appears if the Selection Criteria field is set to Company. Select a list of companies for which selected events are generated.

Employee Selection

This section appears if the Selection Criteria field is set to Employee and a company is specified. Select a list of company employees for which selected events are generated.

Events

This section displays these payroll-specific events to be identified and processed. These events need to be activated at setup so that valid event reports can be generated for companies and submitted to the government.

Field or Control |

Description |

|---|---|

S-1300 Employer Union Contribution |

Note: This field is not used. The S-1300 report is no longer required and therefore has been inactivated in the new version. |

S-1280 Complementary Information to Periodic Events |

Select to process and generate S-1280 event reports in the payroll event process. See Also S-1280 - Complementary Information to Periodic Events |

S-1200 Compensation |

Select to process and generate S-1200 event reports in the payroll event process. Both S-1200 or S-1210 events are processed together. If either one of them is selected, the system selects the other one automatically and makes it unavailable for edits. Additionally, the system also selects the Identify Calendars option to be included in the run control process for these two events. See Also S-1200 - Compensation |

S-1210 Miscellaneous Payments |

Select to process and generate S-1210 event reports in the payroll event process. See Also S-1210 - Miscellaneous Payments |

S-3000 Emp Union Contribution, S-3000 Complementary Info., S-3000 Compensation and S-3000 Miscellaneous Pay |

If applicable, select to prepare and generate exclusion events for corresponding payroll events. Submit a payroll exclusion event if you wish to remove from the government’s eSocial system corresponding payroll data that was submitted by mistake. Note: Do not use the S-3000 Emp Union Contribution field. The S-1300 report is no longer required and therefore has been inactivated in the new version. See Also S-3000 - Event Exclusion |

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

Field or Control |

Description |

|---|---|

View Payroll Event Status |

Click to access the eSocial Processed Calendars - eSocial Payroll Events page to review a list of payroll calendars that have been identified for S-1200 and S-1210 events. This link appears after the Identify Calendars processing option is run successfully for S-1200 and S-1210 events. |

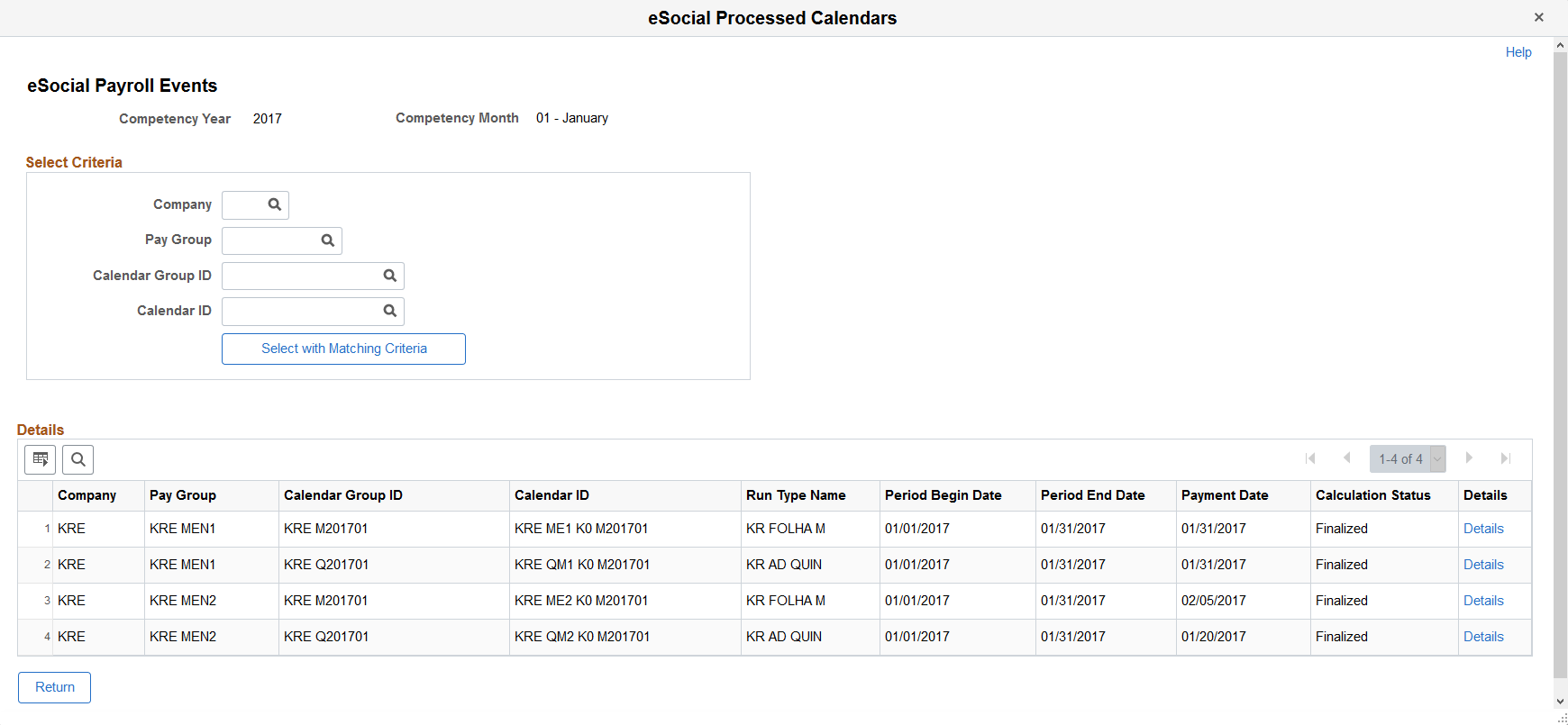

Use the eSocial Processed Calendars - eSocial Payroll Events page (GPBR_ES_IDCAL) to review the list of identified calendars for S-1200 and S-1210 event processing.

Navigation:

Click the View Payroll Events Status link on the eSocial Payroll Events page.

This example illustrates the fields and controls on the eSocial Processed Calendars - eSocial Payroll Events page.

Use this page to review the list of finalized payroll calendars that are identified based on the specified competency period, active run types in that period and specified companies. Both regular and off-cycle calendars are included. Calendar information is used in the mapping process for payroll events.

All calendars that are identified for the specified period must be finalized in order for the payroll process to proceed to subsequent phases.

Field or Control |

Description |

|---|---|

Select with Matching Criteria |

Click to refine the search result based on the selected search criteria. |

Details |

Click to access the eSocial Processed Employees - eSocial Payroll Events page to review the payroll event status (S-1200 and S-1210) for each payee included in the selected competency period and calendar entry. |

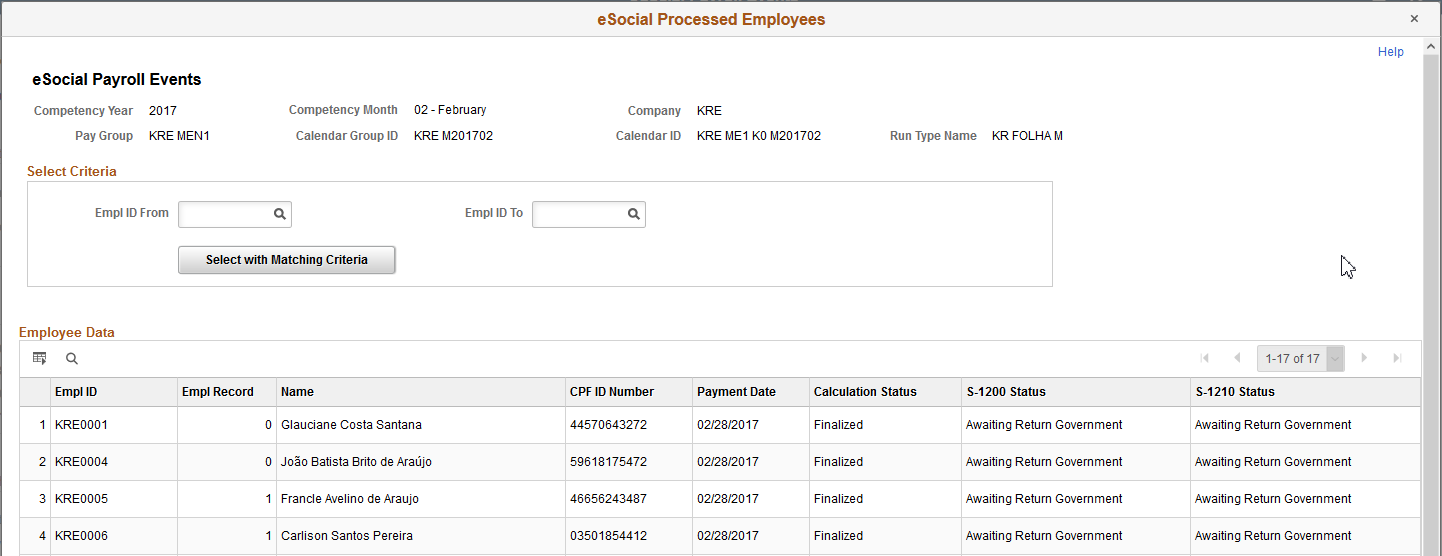

Use the eSocial Processed Employees - eSocial Payroll Events page (GPBR_ES_IDEMP) to review the payroll status and payroll event status of payees for the selected calendar.

Navigation:

Click the Details link of a calendar entry on the eSocial Processed Calendars - eSocial Payroll Events page.

This example illustrates the fields and controls on the Processed Employees - eSocial Payroll Events page.

Use this page to review the list of payees that are included in the specified competency period, company, pay group, calendar group, calendar, and run type. Specify additional selection criteria to refine the search result if needed. As a payroll clerk, you can review the current statuses of payees’ payroll events, compare information on this page with your payroll reports, and verify that the information looks good.

Field or Control |

Description |

|---|---|

Calculation Status |

If one or more of the listed calendars are not finalized, no triggers can be created and no payroll reporting will occur for the corresponding company and competency period. |

S-1200 Status or S-1210 Status |

Displays the current status of the Compensation event (S-1200) or the Miscellaneous Payments event (S-1210) for the corresponding payee. These event statuses are updated in these columns, as different processing options (Identify Calendars, Prepare Data, and so on) are selected to run in different payroll event process instances for the same search criteria. Values are: Awaiting Finalize Calendar: Indicates that the calculation status of the calendar that is associated with the payee is not Finalized (70) or Finalized with Bank (75). Awaiting Return Government: Indicates that the event is already submitted and is awaiting a receipt number from the government. Awaiting Return Termination: (For S-1210) Indicates that a Termination event is already submitted and is awaiting a receipt number from the government. Error Event: Indicates that an error was found in processing. Finalized: Indicates that a receipt number for the payroll event has been given from the government. Identified: Indicates that the event is currently in the mapping process, or it is in the RDY status (the event has been identified, but no data preparation is done on it yet). Next Competency: Indicates that either the Period ID or the payment date of the payroll entry falls after the competency period. Not Eligible: Indicates that the event is not applicable in the competency period. Suppose that in the run type setup, the KR FERIAS run type is configured for the S-1210 event but not the S-1200 event. In this case, the S-1200 status is set to Not Eligible in the Employee Data section. Previous Competency: Indicates that either the Period ID or payment date of the payroll entry falls before the competency period. Termination in Progress: (For S-1200) Indicates that a termination event (S-2299 or S-2399) has been identified in the competency period, and as a result, no S-1200 will be generated. |

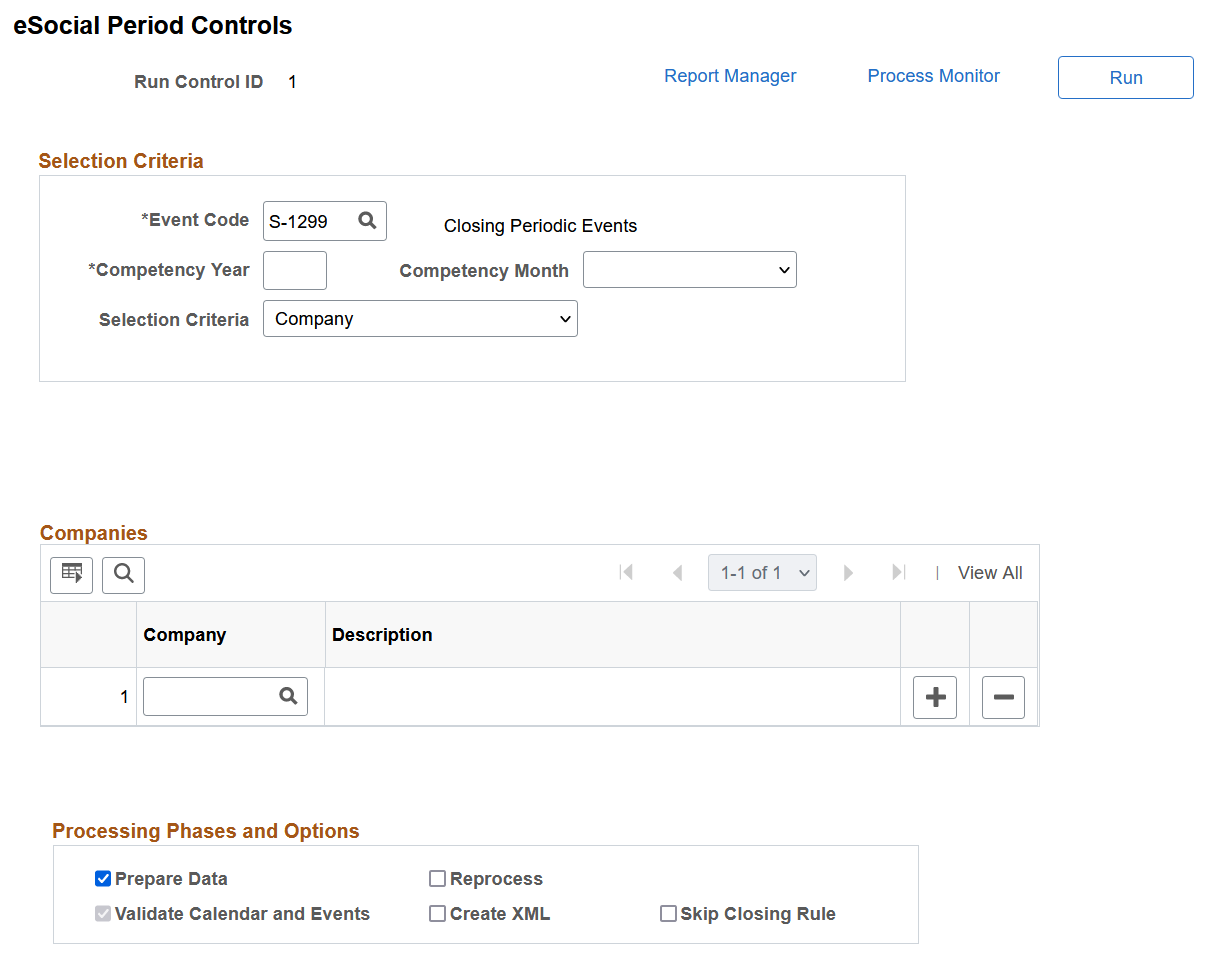

Use the eSocial Period Controls page (GPBR_ESOC_PER_CTRL) to close or reopen assessment periods for processing periodic events.

Navigation:

This example illustrates the fields and controls on the eSocial Payroll Controls page.

Run the GPBR_ES_PERC process to close or reopen assessment periods for payroll and payment information submission.

Selection Criteria

|

Field or Control |

Description |

|---|---|

|

Event Code |

Select a periodic control event to, for example, reopen or close a period. As delivered, S-1298 and S-1299 are available for selection. |

|

Competency Year and Competency Month |

Specify the period to be reopened or closed. |

|

Selection Criteria |

Select: All Companies to process payroll events for all eSocial-active companies, or Company to manually select eSocial-active companies from the Companies section that appears for processing. |

|

Period Type |

Select the period type of the specified period to reopen. Values are Annual and Monthly. This field appears if the selected competency month is December. |

Companies

This section appears if the Selection Criteria field is set to Company. Select a list of companies for which the selected event generates.

Processing Phases and Options

For more information about processing options that are listed in this section, see Processing Phases and Options.

Use the Company Without Movement page (GPBR_ESOC_NOMOV) to review, by company, a list of periods during which no periodic events are reported to the eSocial system.

Navigation:

This example illustrates the fields and controls on the Company Without Movement page.

A company that does not have any of S-1200, S-1210 or S-1280 reporting processing for any given competency period is considered a company without movement for that period.

Field or Control |

Description |

|---|---|

Period |

Displays the competency period during which no S-1200, S-1210 and S-1280 events are processed for the selected company. |

Since |

Displays the competency period when the selected company becomes a company without movement. Usually, this field displays the same value that is shown in the Period field. In the case where a company is no longer active with periodic report processing, an S-1299 event is reported annually in January of each year. If the corresponding period is January of a year, this field displays the last competency period when the company became a company without movement. |

Event Code |

Displays the S-1299 event. |

Receipt Number |

Displays the receipt number of the corresponding S-1299 event returned from the government. |

Use the eSocial Hire Exclusion page (GPBR_RC_EVT_EXCL) to generate driver information of exclusion events for hiring events.

Navigation:

This example illustrates the fields and controls on the eSocial Hire Exclusion page.

Access to the eSocial Hire Exclusion page is restricted to administrator users with the GP Administrator BRA role.

There are times when companies need to delete hiring events that were submitted to the government, for example when corresponding hires fail to go through successfully. When that happens, the administrator can run the eSocial Hire Exclusion process that generates S-3000 (Event Exclusion) events to remove unwanted hiring information of individuals from the government.

Specify the receipt number of a submitted hiring event (S-2200 for employees or S-2300 for non-employees) you wish to delete the information of from the government. When this process runs, it creates the driver information of an S-3000 event for the hiring event. After the process completes successfully, be sure to access the eSocial Non Periodic Event Page to prepare data (generate mapping) and create an XML file for the S-3000 event to be submitted to the government.

Field or Control |

Description |

|---|---|

Receipt Number |

Enter the receipt number of an S-2200 or S-2300 event for which to generate the driver information of an S-3000 (Event Exclusion) event. You must enter a valid receipt number for this process to run properly. A number is considered valid if it is the latest receipt number of the S-2200 or S-2300 event that was returned successfully (hiring event status = GSUC) to PeopleSoft from the government. |

Original Event

This section displays the hiring event information associated with specified receipt number.