Defining URSSAF Rates and Additional Parameters

To define URSSAF rates and additional parameters, use the URSSAF Rates FRA (GPFR_URS_RATES) component.

This section provides an overview of URSSAF rates and ceilings.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_URS_RATES |

Review the URSSAF rates for illness, old age, family benefits, FNAL Employer, and Retirement rates. PeopleSoft delivers the rates that appear on the URSSAF Rates page. However, you can adjust them if necessary to meet legal requirements. |

|

|

GPFR_URS_GENERAL |

View (and if necessary, modify) additional URSSAF parameters. |

Global Payroll for France uses variables to define the rates for the different URSSAF contributions. Although PeopleSoft populates these variables with the correct rates, you can update them on the URSSAF Rates page to comply with changing laws and regulations. In addition, you can update the ceilings that apply to the bases used to calculate these contributions. This section explains how to view the delivered rates and ceilings for URSSAF. It also explains how you can adjust rate and ceiling values if necessary.

To view and adjust rates and ceilings:

View the ceilings for URSSAF rates.

Use the Limits page to view the ceilings that apply to the URSSAF rates. The ceilings that appear on this page (URSSAF uses only Ceiling A) also appear on the URRSAF Rates page with the actual ceiling values.

Note: The Limits page is documented in the topic on setting up country data.

View and maintain the ceilings for the URSSAF contribution rates.

Many URSSAF contribution rates apply only to a portion of an employee's funding base—in other words, they apply to the portion of the funding base that falls within a limit or ceiling. PeopleSoft has defined a specific variable to store the ceiling used in URSSAF: Ceiling A. Use the Ceilings page to update the value of this variable.

Note: This page is documented in the topic on setting up country data.

View and maintain the rates for the different contribution classes.

After reviewing and (if necessary) adjusting the ceilings used for URSSAF, go to the URSSAF Rates page to view and adjust the contribution rates for the different contribution classes. The ceilings that appear on this page are dynamically displayed based on the values on the Ceilings page. For example, if you enter a new ceiling on the Ceilings page, the ceiling data also changes on the URSSAF Rates page.

See URSSAF Rates Page.

Note: PeopleSoft maintains the rates and ceilings for URSSAF; however, you can adjust the rates and ceilings without having to wait for PeopleSoft to issue updates when there are statutory changes.

Define additional URSSAF parameters on the URSSAF Additional Setup page. This page is discussed in detail in the subsequent topic on viewing and modifying URSSAF parameters.

Use the URSSAF Rates page (GPFR_URS_RATES) to review the URSSAF rates for illness, old age, family benefits, FNAL Employer, and Retirement rates.

Navigation:

This example illustrates the fields and controls on the URSSAF Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Illness Rate |

Displays the illness contribution rates for Payee and Employer. |

Family Allowance |

Displays the rate for family allowance. |

Retirement Rate |

Displays the two contributions towards the retirement rate. The employer pays a rate based on the entire funding base. This is displayed opposite No Limit. The second contribution, paid by both payee and employer, is applied to a funding base limited to Ceiling A. |

Oldness Rate |

Displays the contribution rate for old age benefits. |

FNAL Employer Rate |

Displays the rate that applies to a funding base limited to Ceiling A. Note: FNAL contributions not limited to Ceiling A are maintained on the Variables By Category page. Only FNAL contributions limited to Ceiling A are maintained on the URSSAF Rates page. |

Solidarity Employer Rate |

Displays the solidarity contribution rate. |

Note: Several of the contribution sections on this page display the comment No limit. This means that the contributions for each section are not based on an earning ceiling. They are calculated from the entire funding base, with no limit.

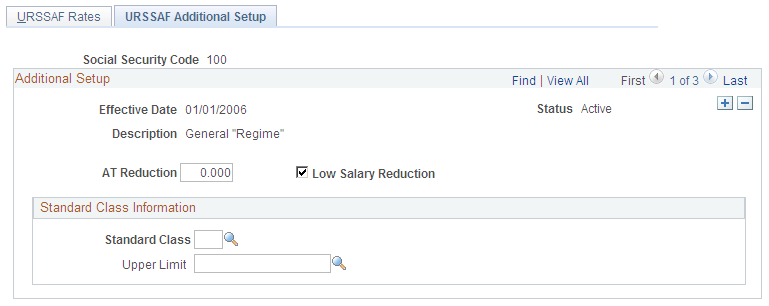

Use the URSSAF Additional Setup page (GPFR_URS_GENERAL) to view (and if necessary, modify) additional URSSAF parameters.

Navigation:

This example illustrates the fields and controls on the URSSAF Additional Setup page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Social Security Code |

Displays the payees' existing contribution class—not that of the standard class. |

AT Reduction |

Displays the percentage amount of the reduction in the work accident rate if the contribution class (régime) qualifies for a reduction. You can adjust this amount if necessary. |

Low Salary Reduction |

Select this check box to trigger the Fillon reduction if the payee earns a low salary. |

Standard Class |

Displays the standard class to which payees are assigned if they become ineligible for their original class. For example, payees in some contribution classes contribute using the rates for their class if their monthly salary is less than or equal to the SMIC (minimum monthly salary). When payees belonging to one of these classes earn more than the SMIC, they automatically begin contributing using the rates in effect for the standard class. These rates apply only to the portion of the salary that exceeds the earning limit. |

Upper Limit |

Displays the value of the variable GEN VR SMIC L VG P that stores the hourly SMIC rate. To calculate the maximum payees can earn and remain within their normal régime, Global Payroll for France multiplies the value of this variable by the number of paid hours. If earnings go over this amount, a change in régime is triggered. The payee then moves to the rates for the contribution class specified in the Standard Class field and deductions are made at the new rate for earnings over the limit. |