Understanding Trigger Setup for France

This section discusses:

Generate Triggers PeopleCode for dependent beneficiary and other French records.

Segmentation triggers with earning and deduction assignments.

Offset days for retro triggers.

Global Payroll for France delivers the DEP_BENEF_FRA record with the standard Generate Triggers PeopleCode attached. This is to enable you to set up iterative, segmentation, and retro triggers for this record and to initiate iterative, segmentation, and retroactive processing in response to changes to benefits data.

The standard Generate Triggers PeopleCode follows this general format:

Declare Function Generate_Triggers PeopleCode FUNCLIB_GP.TRGR_FUNCTIONS FieldFormula;

Local date &L_DT;

/*****************************************************************/

/* Begin: Generate Triggers for Global Payroll */

/*****************************************************************/

Generate_Triggers(RECORD_NAME.EMPLID, &L_DT);

/*****************************************************************/

/* End: Generate Triggers for Global Payroll */

/*****************************************************************/

For example, the Generate Triggers PeopleCode for the DEP_BENEF_FRA record is constructed as follows:

Declare Function Generate_Triggers PeopleCode FUNCLIB_GP.TRGR_FUNCTIONS FieldFormula;

Local date &L_DT;

If %Component = Component.DEPEND_BENEF Then

Generate_Triggers(DEP_BENEF_FRA.EMPLID, &L_DT);

End-If;

Note: Global Payroll for France does not deliver trigger definitions for the DEP_BENEF_FRA record. The Generate Triggers PeopleCode associated with this record prepares the system to respond correctly to any trigger definitions you create yourself using the Trigger Definitions (GP_TRGR_SETUP) component.

You can add the Generate Triggers PeopleCode to other French-specific records as needed and then set up your trigger definitions using the trigger definition pages in the core Global Payroll application.

In Global Payroll you can define segmentation triggers only for effective dated records, with one exception: you can define segmentation triggers for the begin and end dated earning and deduction assignment record GP_PYE_OVRD. This exception enables you to assign an earning or deduction to a payee on the Element Assignment by Payee (GP_ED_PYE) or Payee Assignment by Element (GP_ED_ELEM) components, and segment—and prorate—the element when the assignment begin date comes after the pay period begin date, and/or the assignment end date comes before the period end date.

Global Payroll for France has set up the following earnings so that they are automatically segmented and prorated (using the proration factor defined on the earning definition pages) when the assignment period covers only a portion of the pay period:

|

Element Name |

Type |

Description |

|---|---|---|

|

SALAIRE BASE |

Earning |

Base Salary. |

|

IND KILOMETR |

Earning |

Mileage Allowance. |

|

AN NOURRITUR |

Earning |

Meal Benefit in Kind. |

|

AN AUTRES |

Earning |

Other Benefits in Kind. |

|

AN VEHIC REG |

Earning |

Car Benefit in Kind Regular. |

|

AN AUTRE REG |

Earning |

Other Benefit in Kind Regular. |

|

PANIER J I |

Earning |

Day Meal Allowance. |

|

PANIER N I |

Earning |

Night Meal Allowance Liable to Contributions. |

|

AN VEHICULE |

Earning |

Car Benefit in Kind. |

|

STG OBL AT |

Earning |

Mandatory Training Allowance. |

|

STG OBL NAT |

Earning |

Mandatory Training Allowance. |

|

STG NOBL |

Earning |

Non-Mandatory Training Allowance. |

|

AFB SAL 12M |

Earning |

Base Salary–12 Months. |

|

AFB SAL 13M |

Earning |

Base Salary–13 Months. |

If you want to set up additional earnings and deductions to trigger segmentation and proration when they are assigned to payees and the assignment period covers only a portion of the pay period, access the Trigger Definitions component and add these elements to the segmentation trigger definition for the GP_PYE_OVRD record.

When you define retro triggers on the Trigger Definitions-Field Values page, you can enter a positive or negative number in the Offset Days field to increase or decrease the retro trigger effective date in relation to the date of a field value change. For example, if you enter -1 in the Offset Days field for one of the values listed in the Field Values group box, and you retroactively enter that value into the database with an effective date of January 1, 2000, the system automatically adjusts the trigger effective date to December 31, 1999 (one day earlier). The system then processes pay periods going back to December 1999 rather than January 2000.

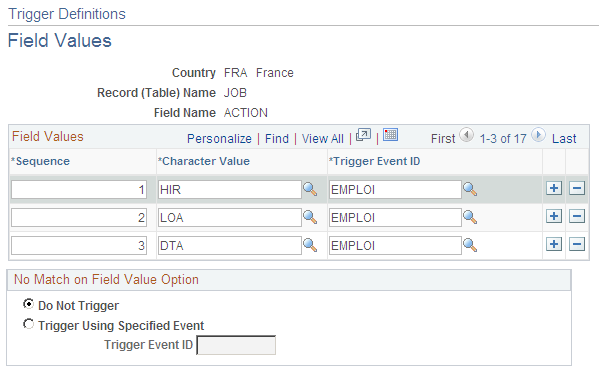

Global Payroll for France uses the offset days feature to define the triggers for retroactive terminations entered in the JOB record using the Action field:

Trigger Definitions-Field Values page showing JOB actions that trigger retroactive termination processing for France

Note that the offset for the termination triggers is -1.

The reason for this offset is that the PeopleSoft system considers the effective date of a termination entered in the Action field in JOB to be the first day that a payee is no longer working (in other words, the day before the termination is the last day the payee is considered active); however, the effective date of the trigger generated in response to this termination is identical to the termination date. This can create problems when the termination date in the JOB record is equal to the pay period begin date (meaning, the last day worked is the last day of the prior pay period). For example, assume that you enter a termination in JOB on February 1 after processing and closing the January calendar. In this situation, the system generates a trigger with an effective date of February 1, which is within the current period—a period in which the payee is inactive and is not picked up for processing. Because there is no trigger in the prior, closed period (January), this period will not be recalculated and any rules set up to generate termination payments will not be processed. To avoid this problem, Global Payroll for France sets the offset days for the TER, RET, XFR, and TWP action values in the JOB record equal to -1.

Important! If you define additional action values to trigger retroactive termination payments, you should set the offset days to -1.