Defining Tax Locations

To define tax locations, use the Tax Location Table component (TAX_LOCATION_TBL). Use the TAX_LOCATION_TBL component interface to load data into the tables for this component.

These topics provide an overview of tax locations and discuss how to define tax locations.

Note: The tax tables discussed in these topics are required for both the Payroll for North America and Payroll Interface applications. The documentation for each of these applications discusses additional tax data setup that is specific to the application.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_LOCATION_TBL1 |

Establish the locations for which you process payroll and taxes. |

|

|

TAX_LOCATION_TBL2 |

Associate a province or any number of states, localities, and linked localities with the tax location code. |

|

|

Tax Location Report Page |

PRCSRUNCNTL |

Generate PAY718 that lists information from the Tax Location table. |

The system sets up federal, state, and local employee tax data and tax distribution data according to the information you specify in the Tax Location table.

In this table, you establish each of your locations with a Tax Location ID and identify the work states, provinces, and localities associated with each tax location.

Note: If you've selected Automatic Employee Tax Data on the Product Specific Page of the Installation table, the system automatically sets up tax data for each work and resident state and locality of each of your employees. Tax distribution records are created for the work state/locality if the tax location represents a single state/locality.

Note that if the Use State Residence for Local option is selected, the system does not select the Resident check box automatically on the newly added local tax data row when 1) an employee transfers to a different work location in the same resident state, or 2) a new employment instance is added for a different work location in the same resident state. Refer to the Understanding Resident Locality in Local Tax Data for more information.

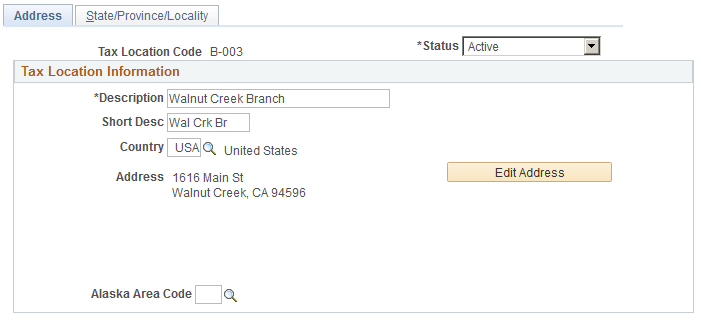

Use the Tax Location Table - Address page (TAX_LOCATION_TBL1) to establish the locations for which you process payroll and taxes.

Navigation:

This example illustrates the fields and controls on the Tax Location Table - Address page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Location Code |

Establish a tax location code for each location for which you process payroll and tax data. You can associate any number of states and localities with each code. |

Alaska Area Code |

If applicable, select an Alaskan area code. |

Note: If you select Automatic Employee Tax Data on the Installation table and assign a Tax Location ID to each employee in the Job data, each employee's tax data is set by default on the Employee Tax Data page and the Employee Tax Distribution page.

Note that if the Use State Residence for Local option is selected, the system does not select the Resident check box automatically on the newly added local tax data row when 1) an employee transfers to a different work location in the same resident state, or 2) a new employment instance is added for a different work location in the same resident state. Refer to the Understanding Resident Locality in Local Tax Data for more information.

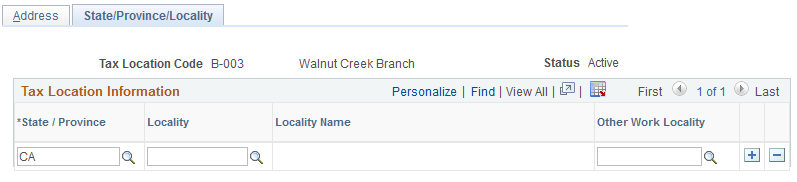

Use the Tax Location Table − State/Province/Locality page (TAX_LOCATION_TBL2) to associate a province or any number of states, localities, and linked localities with the tax location code.

Navigation:

This example illustrates the fields and controls on the Tax Location Table - State/Province/Locality page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

State / Province |

Use to identify each state that is associated with the tax location code. You can associate any number of states with a single tax location. For each state, identify each taxing locality, if any. The states you associate with this tax location code must be defined on the Company State Tax table and the Company Local Tax table. This value is set by default to the Employee Tax Data pages and the Employee Tax Distribution page for employees you assign to this tax location. |

Locality |

The localities you associate with this tax location code must be defined on the Company State Tax table and the Company Local Tax table. This value is set by default to the Employee Tax Data pages and the Employee Tax Distribution page for employees you assign to this tax location. |

Other Work Locality |

Use this field only where multiple local taxes apply in one location, such as:

Note: You should never attempt to enter multiple Indiana localities. Regardless of the number of Indiana locations in which an employee may work, either simultaneously or over the course of the year, the employee is liable for Indiana county tax for only one Indiana county per calendar year. This is the Indiana county of residence as of January 1, if that county imposes a tax, or the Indiana county of principal work activity as of January 1, if the residence county does not impose a tax. |

Note: Locality and Other Work Locality are not required in Canada, because a Canadian employee can be taxed in only one province at a time, and there are no locality taxes in Canada.