Administering Pay Caps and Limits

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_PAY_LIMITS |

(USF) View the results and status of pay limits transactions. This page is display-only. |

|

|

Pay Plan Process Control Page |

GVT_PAYPLAN_TBL2 |

(USF) Establish pay caps and limits, specify disposition of reduced pay, and change to and from emergency limit. |

|

GVT_EARN_RE_USF |

(USF) Define earnings that can be reduced when pay limits/caps are reached. If earnings are not defined here, earnings over the limits will not be reduced. |

|

|

GVT_EARN_PO_USF |

(USF) Assign a Payout Earnings Code to each Pay Limit Earnings Code within a pay plan to facilitate the payout of earnings during the first pay period of a calendar year, and for termination payouts. |

|

|

GVT_LIMIT_PAYOUT |

(USF) Extract a terminated employee’s lifetime balances prior to loading payout earnings to paysheets. |

|

|

GVT_EE_PY_PROC |

(USF) Apply termination payout rules or emergency pay cap rules to override the Premium Pay (bi-weekly) pay cap limit at the employee level. |

|

|

Other Pay Information Page |

GVT_OTH_PAY_SEC |

(USF) Warning is issued if the additional pay is applicable for pay limits. |

|

Expected Pay Page |

GVT_LOC_PAY_SEC |

(USF) View the message indicating that pay has been reduced due to the pay cap on base pay. |

|

Review Payroll Error Messages Page |

PAY_MESSAGES |

(USF) View messages about pay limits that are applied during payroll processing. |

The system processes the following earning process types, which are used to set up pay caps and limits:

Danger Pay: Earnings are capped to a defined percentage of Basic Pay per period.

Pay Limit -Total Annual: Total annual earnings are subject to an annual pay limit.

Pay Cap - Basic Pay: The sum of base pay, law enforcement officer pay, and locality pay is subject to a defined limit.

Pay Limit - Premium Pay: Earnings are subject to a pay period limit.

Overtime: Base pay plus overtime is subject to a pay period limit. Overtime hourly rate is subject to an hourly rate limit.

Pay Caps and Limits for LEO Employees

The system applies pay cap and limit rules defined on the USF Pay Plan Table for Law Enforcement Officer (LEO) employees only if the employee’s LEO Status from the job record is either Primary FEPCA or Secondary FEPCA.

The system does not apply cap and limit rules for the other delivered statuses (5USC 5305 LEO, D.C. Police Forces, Fire Fighter, or Not Applicable).

Pay Caps and Limits in Pay Calculation

During Pay Calculation, the system calculates the sum of each earnings process type in an employee’s pay plan and compares each sum to the applicable pay caps and limits for that earnings process type.

Pay Calculation processes earning process type pay caps and limits in order of the sequence that is specified on the Pay Plan Process Control Page (GVT_PAYPLAN_TBL2). However, the Overtime Cap calculation is done before any other caps and limits are calculated. The Overtime Cap process therefore ignores the Sequence Numbers..

Pay limit calculation stops when Total Annual, Pay Cap – Basic Pay, or Pay Limit – Premium Pay is reached. Danger Pay is excluded from this rule. When a pay plan is defined with Pay Limit – Premium Pay caps, the system evaluates limits from the two applicable caps (GS/0000/15/10 versus EX 0000/V) to determine if one or both limits have been reached before calculating the pay limit amount. These earnings are set up on the Pay Plan Process Control Page of the USF Pay Plan component.

When a pay limit is reached, the system reduces the reducible earnings subject to that pay limit by the amount exceeding the pay limit. (It does not reduce it from all earnings that the employee is paid.) These earnings are set up on the Pay Limit Reducible Earnings Page of the USF Pay Plan component.

Danger Pay

Danger Pay is applied during pay calculation. The Pay Calculation COBOL SQL process (PSPPYRUN) calculates the sum of the employee’s Danger Pay process type earnings, and compares it to the percentage specified on the Pay Plan Table USF. If the danger pay earnings exceed the maximum percentage per pay period, the system does the following:

Reduces earnings if earnings are defined on the Pay Limit Reducible Earnings page of the Pay Plan Table USF component.

Lists a payroll error message - “Pay Limit has been exceeded.”

Note: The message does not appear if the Only Calculate Where Needed option is used and the employee was not calculated.

Creates a Pay Limit record that displays the limit and earnings reduced.

Pays the deferred earnings in the first pay period of the next calendar year if the Disposition field on the Pay Plan Table USF is set to Defer to following Year.

Pay Limit – Total Annual

Total annual earnings are subject to an annual pay limit.

The pay limit is applied during pay calculation. The Pay Calculation process estimates total annual Pay Limit - Total Annual process type earnings and compares that to the annual limit defined on the Pay Plan Table USF. If the estimated total annual earnings are greater than the limit, the system:

Reduces earnings if earnings are defined on the Pay Limit Reducible Earnings page of the Pay Plan Table USF component.

Lists a payroll error message - "Pay Limit has been exceeded."

Note: This message does not appear if you use the Only Calculate Where Needed option and the employee was not calculated.

Creates a Pay Limit record that displays the limit and earnings reduced.

Deferred earnings will be paid out in the first pay period of the next calendar year if the Disposition field on the Pay Plan Table USF is set to Defer to following Year.

Pay Cap – Basic Pay

The cap is applied when you change the Pay Plan/Table/Grade/Step values on the Compensation Data page in PeopleSoft HR. If compensation reaches the defined cap, the system:

Reduces base, law enforcement officer, or locality pay.

Issues a message on the Expected Pay page - "Pay Cap has been reached. Pay was reduced."

Pay Limit – Premium Pay

The pay limit is applied during pay calculation. The Pay Calculation COBOL SQL process (PSPPYRUN) sums up the employee's Pay Limit - Premium Pay process type earnings and compares the pay period earnings to the pay limit defined on the Pay Plan Table USF. If the pay period earnings exceed the maximum per pay period, the system:

Reduces earnings if earnings are defined on the Pay Limit Reducible Earnings page of the Pay Plan Table USF component.

Lists a payroll error message - "Pay Limit has been exceeded."

Note: This message does not appear if you use the Only Calculate Where Needed option and the employee was not calculated.

Creates a Pay Limit record that displays the limit and earnings reduced.

Deferred earnings will be paid out in the first pay period of the next calendar year if the Disposition field on the Pay Plan Table USF is set to Defer to following Year.

When employees have two premium pay limits, and the employees' earnings are greater than both limits, the highest limit will be used to reduce the paycheck. If the earnings are greater than only one limit, that limit will be processed.

Overtime

Overtime hourly rate is subject to an overtime rate limit.

During pay calculation the system reduces pay to the limit.

No message is issued.

The Overtime Cap calculation is done before any other caps and limits are calculated.

To calculate annual total pay caps and limits, the system does the following:

Determines the total YTD earnings for the Calendar Balance ID by adding earnings balances for all earnings codes for which Adds to Projected Pay check box is selected on the Additional Earnings page on the Earnings Table.

Calculates Projected/Future pay by multiplying the employee's regular biweekly pay, times the number of remaining pay periods in the calendar year. The Adds to Projected Pay check box must be selected on the Additional Earnings page on the Earnings Table for each earnings code (including regular earnings codes) to be included in the Projected/Future pay calculation.

For example, an employee’s Projected/Future pay would be calculated as $1,500.00 * 10 = $15,000.00, under the following conditions:

Regular earnings code has the Adds to Projected Pay check box selected.

Employee's regular biweekly pay is $2,000.00.

Employee's actual pay period regular earnings are $1,500.00.

Ten pay periods remain in the year.

Determines the total current pay period earnings that are identified with Earnings Process Type of Tot Annual (total annual) on the Pay Limit page of the Earnings Table.

Adds the results of steps 1 through 3, and compares that total against the annual limit amount.

Reduces the employee’s pay period earnings it the total in step 4 is greater than the annual limit.

Other earnings that should be included in the future pay calculation (for example, lump-sum payments, non-discretionary payments, or discretionary payments), and for which the Adds to Projected Pay check box is selected on the Additional Earnings page on the Earnings Table, are also annualized based on the remaining payrolls in the year.

For example, if the Adds to Projected Pay check box is selected on the Additional Earnings page on the Earnings Table for earnings code LEA, and the employee is paid $1,000 for earnings code LEA on a biweekly paysheet, then the employee's Projected/Future pay will be increased by $10,000.00 ($1000 * 10). If that same earnings code LEA is not paid in the next payroll, then earnings code LEA will be excluded from the next payroll's future pay calculation.

The annual total pay caps and limits process does not evaluate Additional Pay transactions for other earnings paid every payroll; the process evaluates only earnings paid on Payline transactions.

Note: When no Adds to Projected Pay check boxes are selected, the system reverts to using the employee’s regular biweekly pay for projected and future pay calculation. To continue using only biweekly regular pay for projected or future pay calculations, deselect all Adds to Projected Pay check boxes for all earnings codes.

Important! Prior to applying the changes, customers who are currently utilizing the informational only ”Adds to Pay Limit" (GVT_PREM_PAY) field in any customized processes will need to evaluate their current processing to determine if additional customizations may be required for their particular environment.

Lifetime balances can be paid with first pay period of a calendar year payouts or with terminated employee payouts.

First Pay Period Payouts

The Create Paysheets process loads paysheets with lifetime balances for the first pay period of a calendar year when the Calendar Year Begins check box is selected on the Pay Status page of the Pay Calendar Table. (You must click the Federal button to access the Pay Status page.)

See Understanding Pay Calendar Date Fields.

Note: If the Create Paysheets process finds that an employee has a pay limit balance to be paid out, but the payout earnings code is not defined on the Pay Limit Payout page, an error message appears.

Pay Calculation continues to verify that an employee’s earnings have not exceeded the defined pay caps/limits, and the system does not generate pay limit balances for payout earnings in excess of the pay caps/limits. If an employee’s earnings, including the payout earnings, exceed the pay cap/limit, and the payout earnings are defined as reducible on the Pay Plan Table USF, Pay Calculation reduces the payout earnings to prevent overpayment.

Termination Payouts

The Create Paysheets process does not create paysheets for employees who were terminated (in JOB) prior to the Pay Begin Date.

To facilitate payout of lifetime balances for a terminated employee, you must select the Apply Termination Payout check box on the Update Process Controls Page page, verify that the status of the payroll controls is Active as of the Pay End Date and the OK to Pay check box is selected on the Load Paysheets Transaction page. You must then use the Extract Pay Limit Payout Page page to run the extract process to extract the lifetime balances for the termination payouts, and then select the Pay Sheet Update Source of Lifetime Balance Payout USF on the Load Paysheet Transactions Page run control page. When these conditions are met, Pay Calculation bypasses pay caps and limit processing and includes the lifetime balance when calculating the employee’s payout.

Note: If the Load Paysheet Transactions process is set to load Pay Limit Payout transactions to an On-Cycle pay run, the system creates a paysheet containing Job Pay, and the pay limit payout transactions for the employee. If the Load Paysheet Transactions process is set to load Pay Limit Payout transactions to an Off-Cycle pay run for terminated employees, and the OK to Pay check box is selected, the system creates a paysheet containing job pay and the lifetime balances payout. You must review the terminated employee’s paysheet and deselect the OK to Pay check box on the appropriate paylines to prevent the employee from being over paid.

For more information, see:

Pay Confirmation

During the Pay Confirmation process, pay limit balances are updated with the deferred pay limits that are generated for a pay period. A deferred pay limit is a pay limit with its Disposition set to Defer to following Year on the Pay Plan Table USF during Pay Calculation. (The Disposition value that is used also appears on the Review Paycheck Pay Limits page.)

In addition, Pay Confirmation searches for a match between the earnings code on the pay line and the payout earnings code on the employee’s Pay Plan Table USF. If the process finds a match, it reduces the pay limit balances of the pay limit earnings code by the amount of the payout earnings code.

For example, the payout earnings code PO1 (Payout for Danger Pay) is mapped to pay limit earnings code DP1 (Danger Pay). The employee has $2,000.00 MTD (month-to-date), $5,000.00 QTD (quarter-to-date), $20,000.00 YTD (year-to-date), and $50,000.00 of lifetime balances in the current balance period. $50,000.00 of PO1 earnings is paid out to the employee who has resigned. The resulting DP1 pay limit balances and PO1 earnings balances are shown in the following Before Pay Confirmation and After Pay Confirmation tables.

Before Pay Confirmation:

|

Balance |

Pay Limit Balance Earnings Code DP1 |

Earnings Balance Earnings Code PO1 |

|---|---|---|

|

MTD Balance |

2,000.000 |

0 |

|

QTD Balance |

5,000.00 |

0 |

|

YTD Balance |

20,000.00 |

0 |

|

Lifetime Balance |

50,000.00 |

N/A |

After Pay Confirmation:

|

Balance |

Pay Limit Earnings Code Earnings Code DP1 |

Earnings Code Earnings Code PO1 |

|---|---|---|

|

MTD Balance |

-48,000.00* |

50,000.00 |

|

QTD Balance |

-45,000.00* |

50,000.00 |

|

YTD Balance |

-30,000.00* |

50,000.00 |

|

Lifetime Balance |

0 |

N/A |

*Negative amounts in the pay limit balances indicate payout in the balance period.

Standard earnings balances are maintained for the payout earnings code (DP1).

Pay limit balances are not created for the payout earnings code (PO1).

Pay limit balances can reflect negative MTD, QTD or YTD balances. For example, an employee would have negative MTD, QTD and YTD pay limit balances in January of 2013 if the employee had a lifetime balance of $5,000 at the end of 2012, no earnings in 2013, and the employee was paid out in January of 2013.

To set up for administering pay caps and limits by pay plan, and define payout and reducible earnings, you must:

Set up pay caps and limits by pay plan.

Define the earnings codes that are subject to the caps and limits.

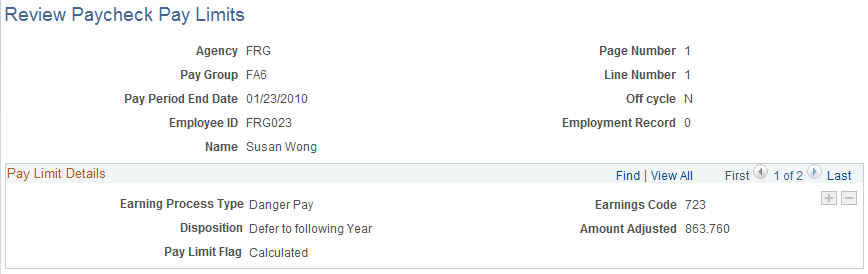

(USF) Use the Review Paycheck Pay Limits page (GVT_PAY_LIMITS) to view the results and status of pay limits transactions.

Navigation:

This example illustrates the fields and controls on the Review Paycheck Pay Limits page.

Field or Control |

Description |

|---|---|

Earnings Code |

The page displays a row of data for each earning code that has been reduced during the pay period. |

Disposition |

Values are Forfeit or Defer to Following Year, as defined on the Pay Plan table. |

Amount Adjusted |

The reduction in earnings. |

Pay Limit Flag |

The status of the limit. The values are Calculated, Confirmed, Processed, or Calendar Year Unconfirm. |

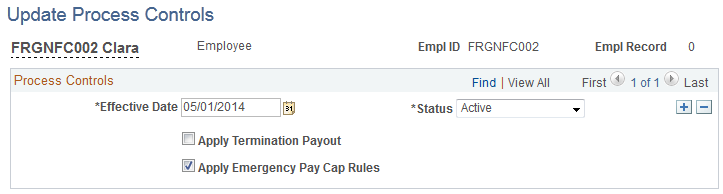

(USF) Use the Update Process Controls page (GVT_EE_PY_PROC) to apply termination payout rules or emergency pay cap rules to override the Premium Pay (bi-weekly) pay cap limit at the employee level.

Navigation:

This example illustrates the fields and controls on the Update Process Controls page.

Field or Control |

Description |

|---|---|

Apply Termination Payout |

Select to apply lifetime lump sum payout for an employee’s termination or transfer. If the Apply Termination Payout check box is selected here, and the status is Active as of the pay end date on the Extract Pay Limit Payout run control page, then the system extracts the employee’s deferred earnings lifetime balances, and Load Paysheet Transactions inserts them into the Paysheet Transactions record. Note: You must run the pay limit payout extract process before running the load paysheets process to include lifetime balances in terminated employee’s payout. If the Apply Termination Payout check box is selected here, and the status is Active as of the pay end date on the Update Payroll Controls run control page, then the Pay Calculation process bypasses pay cap/limit checking when calculating the employee’s paycheck. |

Apply Emergency Pay Cap Rules |

Select to apply the employee’s annual pay cap instead of the employee’s Premium Pay (bi-weekly) pay limit-premium pay for an employee performing work associated with an organization’s emergency situation. See the table below to determine conditions for bypassing Premium Pay (bi-weekly) limits for emergency situation pay. |

This table shows conditions under which the system bypasses Premium Pay (bi-weekly) pay caps for emergency situation pay.

|

Emergency Check Box (Pay Plan Process Control Page*) |

Apply Emergency Pay Cap Rules Check Box (Update Process Controls Page) |

Status (Update Process Controls Page) |

Emergency Cap Rules Applied During Pay Calculation? |

|---|---|---|---|

|

Selected |

Update Process Controls page does not exist for the employee. |

NA |

Y (apply annual cap) |

|

Selected |

Selected |

Active |

Y (apply annual cap) |

|

Selected |

Selected |

Inactive |

Y (apply annual cap) |

|

Selected |

Deselected |

Active |

N (apply bi-weekly cap) |

|

Deselected |

Update Process Controls page does not exist for the employee. |

NA |

N (apply bi-weekly cap) |

|

Deselected |

Selected |

Active |

Y (apply annual cap) |

|

Deselected |

Selected |

Inactive |

N (apply bi-weekly cap) |

|

Deselected |

Deselected |

NA |

N (apply bi-weekly cap) |

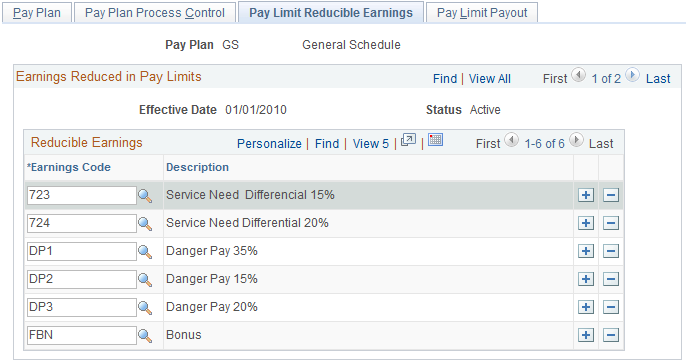

(USF) Use the Pay Limit Reducible Earnings (GVT_EARN_RE_USF) page to specify earnings codes of all earnings that are eligible for reduction if employee’s earning exceed pay cap/limit amounts.

Navigation:

This example illustrates the fields and controls on the Pay Limit Reducible Earnings page.

All earnings that should be reduced must be defined on the Pay Limit Reducible Earnings page. If not defined here, the earnings will be paid even if they are over the limits.

Note: Do not define regular pay on the Pay Limit Reducible Earnings page. Regular pay is not reducible per the regulations.

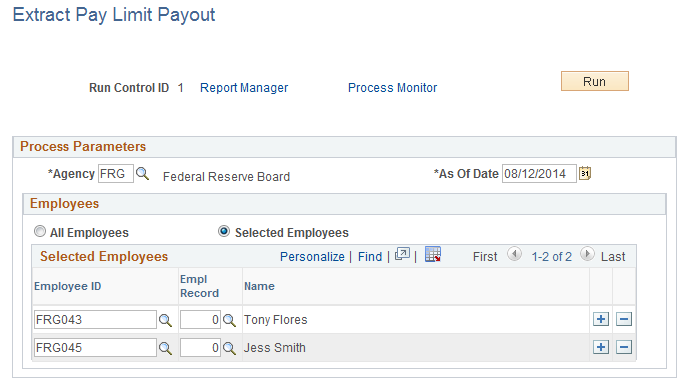

(USF) Use the Extract Pay Limit Payout Page (GVT_LIMIT_PAYOUT) page to extract a terminated employee’s lifetime balances prior to loading payout earnings to paysheets.

Navigation:

To load an employee’s lifetime balances to the Paysheet Transactions record, the employee must have at least one lifetime balance and the lifetime balance must be greater than zero. Also, in addition to the settings that you select here on the Extract Pay Limit Payout run control page, the following conditions must be met on the Update Process Controls Page .

The Apply Termination Payout check box must be selected as of the As Of Date that you select on the Extract Pay Limit Payout run control page.

The payroll controls status must be Active as of the As of Date that you select on the Extract Pay Limit Payout run control page.

This example illustrates the fields and controls on the Extract Pay Limit Payout page.

Field or Control |

Description |

|---|---|

Agency |

Select the agency to process. |

As Of Date |

Enter the date to use for processing. Note: Do not run the extract more than once for an As Of Date. Running the extract for a second time for the same As Of Date will result in the creation of additional transactions, which if loaded to the paysheet, can result in duplicate payments to the employee. |

All Employees or Selected Employees |

Identify the employees to process. You can choose to process all employees in the agency as of the date specified, or select the Selected Employees option to identify only specific employees to process. Note: If the specific employees that you select are not in the specified agency on the As Of Date, they will not be processed. |

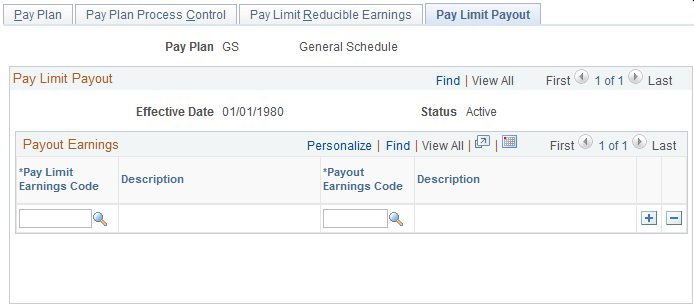

(USF) Use the Pay Limit Payout Page (GVT_EARN_PO_USF) page to assign a Payout Earnings Codes to each Pay Limit Earnings Code within a pay plan to facilitate the payout of earnings during the first pay period of a calendar year, and for termination payouts.

Navigation:

This example illustrates the fields and controls on the Pay Limit Payout page.

Field or Control |

Description |

|---|---|

Pay Limit Earnings Code |

Enter the earnings code of the pay limit to use. Assign a Payout Earnings Code for each Pay Limit Earnings Code within a pay plan to facilitate the payout of earnings during the first pay period of a calendar year and for termination payouts. |

Payout Earnings Code |

Specify the Payout Earnings Code from which to pay the pay limit earnings, subject to the specified pay limit. Note: A unique Payout Earnings Code is required for each Pay Limit Earnings Code within a Pay Plan. If a Payout Earnings Code is not unique, an error message appears. Also, the Payout Earnings Code cannot be the same as the Payout Limit Earnings Code. If the two earnings codes are the same, an error message appears. The Create Paysheets process loads paysheets with lifetime balances for the first pay period of a calendar year, and for terminated employees. (For terminated employees, the lifetime balances must first be extracted.) If the process finds a Payout Earnings Code on the Pay Limit Payout page, it loads payout earnings into the Other Earnings section of a paysheet. Manual updates by the users to the payout earnings on an employee’s paysheet could result in the payout amount being greater than the employee’s lifetime balances. Use caution in updating the paysheets manually. |