Loading Paysheet Transactions

This topic provides overviews of:

The Load Paysheets process (PYLOAD).

The Load Paysheets process for inactive employees.

The use of Load Paysheets process with rapid entry paysheets.

The use of Load Paysheets process with PeopleSoft applications and business processes.

The use of Load Paysheets process with sources other than PeopleSoft applications.

It also discusses how to set up and load paysheet transactions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTALLATION_PY |

Enable the Load Paysheets process for inactive employees. |

|

|

PSHUP_PROG_DEFN |

Define general information of paysheet update programs for inactive employees. |

|

|

PSHUP_EMPL_ST_DEFN |

Specify employee statuses used for loading paysheet transactions for inactive employees. |

|

|

PSHUP_SRC_DEFN |

Specify sources used for loading paysheet transactions for inactive employees. |

|

|

PSHUP_ERNS_DEFN |

Specify earnings codes used for loading paysheet transactions for inactive employees. |

|

|

PSHUP_DEDS_DEFN |

Specify deduction codes used for loading paysheet transactions for inactive employees. |

|

|

PSHUP_COMPANY_DEFN |

Associate paysheet update programs with companies and pay groups for inactive employees. |

|

|

RUNCTL_PSHUP |

Run the Load Paysheets (PYLOAD) process that loads transaction data into paysheets or resets transaction statuses before reloading data into paysheets. |

|

|

PY_PSHUP_TXN |

Review transaction data from the PSHUP_TXN record and optionally update transactions before loading them into paysheets. |

|

|

RUNCTL_PSHUPLD |

Generate the PAY305RT report that lists transactions loaded in the PSHUP_TXN record from supported sources. |

This topic discusses:

The Load Paysheets process.

On-cycle and off-cycle processing.

Reviewing and Inactivating transactions.

Resetting transactions.

Maintaining the PSHUP_TXN record.

The Load Paysheets Process

The Load Paysheets PSJob process (PYLOAD) consists of:

An Application Engine program (PYRE_PRELOAD) that validates rapid entry paysheet transactions and loads the valid transactions into the PSHUP_TXN record.

Transactions that are successfully loaded into the PSHUP_TXN record are then removed from the rapid entry transaction table (PYRE_DETAIL). Invalid transactions are marked as inactive and are available for review on the Validation Results page.

An Application Engine program (PSHUP_VALID) that prepares the transactions for loading. It:

Updates the status of transactions (which are selected based on the run control parameters) to In Progress.

Creates a temporary work file for inactive employees who are eligible for the load process.

This step applies only if the Load Paysheets process is enabled for inactive employees.

Performs validation against paysheet update program to determine the final list of transactions to be loaded into paysheets for eligible inactive employees.

This step applies only if the Load Paysheets process is enabled for inactive employees.

A COBOL SQL process (PSPPSHUP) that loads In Progress transactions that are in the PSHUP_TXN record into paysheets.

The PSHUP_TXN record includes transactions from other update sources besides rapid entry paysheets, such as Expenses, other PeopleSoft HCM applications, as well as third-party systems that load data to the record using the Excel to CI functionality.

After transactions have been loaded into paysheets, this process changes the transaction status from In Progress to Loaded (if the feature to support the Load Paysheets process for inactive employees is applied to the Payroll for North America system) or Inactive (if the feature is not applied to the system).

The Load Paysheets process supports the loading of data into paysheets for active employees, and can be set up to support inactive employees as well. See Understanding the Load Paysheets Process For Inactive Employees for more information.

On-Cycle and Off-Cycle Processing

When you enter parameters to run the Load Paysheets process, you specify whether you are loading on-cycle or off-cycle data.

When you load data from rapid entry paysheets, the choice of on-cycle or off-cycle controls which transaction rows are loaded. For example, if you choose to load rapid entry paysheets for on-cycle transactions, then only on-cycle transactions are loaded. If you choose to load rapid entry paysheets for off-cycle transactions, then only off-cycle transactions are loaded.

For all other sources, the transactions do not have their own on-cycle or off-cycle designation, so all transactions for that source are loaded, and they become on-cycle or off-cycle according to the parameters you selected on the Load Paysheet Transactions Page.

Reviewing and Inactivating Transactions

You can review transaction data that is available from the PSHUP_TXN record on the Update Paysheet Transactions Page. When you review active transactions (transactions that have not been loaded into paysheets), you can manually exclude or inactivate transactions to prevent them from being picked up and loaded by the process. The system updates the PSHUP_TXN record with the new status and with an indicator that the status has been manually changed.

You can only activate transactions that were manually excluded or inactivated.

Resetting Transactions

The Reset Transactions process option on the Load Paysheet Transactions page performs differently for rapid entry paysheets than for other transaction sources:

Rapid entry paysheets.

The Reset Transactions process option resets rapid entry paysheet transactions to Active, and then re-creates the paysheets.

Transaction sources other than rapid entry paysheets.

Use the Reset Transactions process option to reset transactions to Active, then run the Load Paysheets process again.

Note: To reload transactions from any of the sources including Rapid Paysheet, you must either unsheet the pay run or remove the previously loaded transactions from the paysheets. If you reset the transactions but do not delete the previously loaded transactions from the paysheets, the system will reload the transactions, resulting in duplicate rows.

Maintaining the PSHUP_TXN Record

Transaction records remain in the PSHUP_TXN record in the system until you delete them. When you run the load process and transactions are loaded into paysheets successfully, their status is updated to Loaded or Inactive.

You are responsible for deleting data in the PSHUP_TXN record according to your organization's business practices. You can archive the data that has been loaded into paysheets after a period of time that you determine based on such factors as:

The volume of transactions being processed.

Performance.

Disk storage requirements.

You can use Data Mover or PeopleSoft Archive Manager to manage the data.

Payroll for North America provides an option to extend the Load Paysheets process functionality to inactive employees who are eligible for pay.

The system can be set up to create paysheets and load transaction data (for example, payroll hours and amounts, taxes, deductions, garnishments, and so on) from supported sources into paysheets for eligible inactive employees based on company policies.

Suppose that your company uses a third-party system to administer short-term and long-term disability payments for employees who are on leave of absence. You can set up rules in the system to select matching transactions from the PSHUP_TXN record for eligible inactive employees and load the data into paysheets so they get paid per your company policy. Similarly, you can set up rules to create paysheets and make payments to employees who are suspended as a result of labor actions, but are eligible for benefits earnings per labor agreements.

Additional setup is needed to enable the Load Paysheets process as well as transaction update and reporting capabilities for inactive employees. It includes:

Select the Inactive Employees option on the Payroll for NA Installation Page.

Define paysheet update programs.

A paysheet update program contains rules that the Load Paysheets process uses to determine which transactions get loaded into paysheets for inactive employees. From the paysheet update program definition, specify:

One or more inactive employee statuses. Transactions for employees in any of these statuses will be considered by the Load Paysheets process.

Employee status is also referred to as the payroll status in employee’s Job Data record.

One or more sources from where payment transactions are received. Transactions that originate from any of these sources for employees with matching inactive employee statuses will be considered by the Load Paysheets process.

One or more earnings codes for which eligible employees get paid. Transactions that contain any of these earnings codes and originate from any of the matching sources for employees with matching inactive employee statuses will be considered by the Load Paysheets process.

One or more deduction codes (for example, garnishments, medical premium) for which eligible employees are responsible. Transactions that contain any of these deduction codes and originate from any of the matching sources for employees with matching inactive employee statuses will be considered by the Load Paysheets process.

Company and paygroup combinations to which these paysheet update program rules apply.

When the Load Paysheets process runs for inactive employees, it looks up the paysheet update program that is associated with each of the company and pay group combinations (a pay run ID can be linked to more than one company and pay group pair) that is specified on the run control page, and selects the transactions (based on run control parameters) that match the program setup for processing.

Based on the process option specified, the process either creates paysheets and loads transaction data into these paysheets, or resets the status of selected transactions to Active for them to be loaded into paysheets again.

The Load Paysheets process supports transaction processing for inactive employees for both on-cycle and off-cycle runs.

Video: Image Highlights, PeopleSoft HCM Update Image 33: Paysheet Load Enhancements

Keep the following in mind if you're loading rapid entry paysheet records:

You must validate the earnings codes before running the Load Paysheets process; otherwise the load process will not select the rapid entry paysheets.

Use the Validate on Save check box on the Rapid Entry Paysheet Creation Page.

On-cycle paysheets must have been created prior to running an on-cycle load process.

For off-cycle processing, the Load Paysheet Transaction process will automatically create an off-cycle paysheet.

To create rapid entry paysheets for off-cycle processing, select the Off-Cycle? check box at the same time as you enter the key values for the new rapid entry paysheet. You cannot change this setting after you continue to the Rapid Entry Paysheet Creation page.

Then, when you load the off-cycle rapid entry paysheets, select Off-Cycle Checks in the On or Off Cycle field on the left side of the Load Paysheet Transactions page.

All valid employee-level rapid entry paysheet records are deleted at the end of the load process.

For on-cycle rapid entry paysheet records, invalid rows are deleted when the on-cycle payroll is being confirmed.

For off-cycle rapid entry paysheet records, invalid rows are deleted when the calendar is closed for off-cycle processing (at the confirm of the next on-cycle payroll).

Rapid entry paysheets are the only source where the earnings begin and end dates must match the existing pay earning row for the amount to be added to that Pay Earning record.

If there is not an exact match of earnings begin and end dates, then a new pay earnings row is added to the employee's existing paysheet pay line row with the new beginning and ending earnings dates from the rapid entry paysheet.

You can load transaction data into Payroll for North America from the following PeopleSoft applications and business processes:

Absence Management.

Expenses.

Manage Variable Compensation.

Talent Acquisition Manager.

Before you can load data into Payroll for North America, you must map items in the source application to payroll earnings or deduction codes. For example, if you use the Manage Variable Compensation business process of PeopleSoft HCM, you map each compensation plan to the appropriate earnings code. If you use Talent Acquisition Manager to pay employee referral awards, you provide an earnings code in the award schedule.

Mapping instructions and any other setup requirements that must be met before data can be loaded are discussed in the documentation for the source application.

Communication between Payroll for North America, Expenses, PeopleSoft HR, and Talent Acquisition Manager is accomplished through the use of PeopleSoft Integration Broker messaging, which works in the background to quickly transfer data back and forth. Communication with Absence Management is accomplished through the use of shared tables.

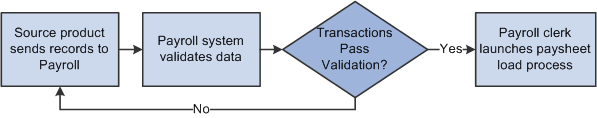

Expenses, Talent Acquisition Manager, and PeopleSoft HR always initiate communication with payroll by sending data, such as awards or expense advances, to a temporary file that can be accessed by payroll. Payroll validates the data and returns records that do not pass the validation process so they can be updated and resent. A payroll clerk then uses the Load Paysheet Transactions run control page to start a batch process that loads the validated records into existing paysheets or creates new paysheets, as needed.

This diagram illustrates how data is loaded into the payroll system and validated:

This diagram illustrates how data is loaded into the payroll system and validated.

When you run the Load Paysheets process, Payroll for North America selects Job data for each active employee in the transaction file. Regular pay and hours are not loaded from Job; instead, all amounts are pulled from the transactions created in the source application. For inactive employees, the process pulls information it needs from their Job records, but not from Additional Pay records. The contents of the transaction record determine whether the system creates a Pay Other Earnings record or a Tax/Deduction Override record. The system creates a new paysheet for the employee or loads data into the current paysheet, if one exists.

You can load paysheet data into Payroll for North America from sources outside of PeopleSoft applications, such as stock option payments, positive time reporting entries, or bonus payments.

Data Entry Requirements for Third-Party Transactions

If you plan to use the process to load third-party transactions without investing in customization, you must populate the PSHUP_TXN record following the data input requirements for a paysheet update source of Other Sources.

See Data Input Requirements for Third-Party Paysheet Data.

If you have third-party transaction data in a Microsoft Excel spreadsheet, you can use the CI_PY_PSHUP_LOAD component interface to load the data into the PSHUP_TXN record. The component interface simplifies the process of loading your data and performs certain validations during the process.

See PeopleTools: Component Interfaces.

Multiple Third-Party Source Codes

Oracle delivers one source code for other sources: OT (Other Sources). If you load transactions from multiple third parties and you need the ability to tag those transactions with separate source codes, you can add additional translate values to the PU_SOURCE field. To prevent collisions between your custom source codes and any future enhancements to Payroll for North America, your custom source codes must begin with the uppercase letter O and may be followed by at most one alphanumeric character other than the letter T. Once a new translate value is added, it should not be deleted.

The payroll system processes these O% values exactly as it processes OT values. You still populate the PSHUP_TXN record following the same set of data input requirements. Also, O% transactions, like OT transactions, are excluded when you run the Load Paysheets process without selecting a specific transaction source.

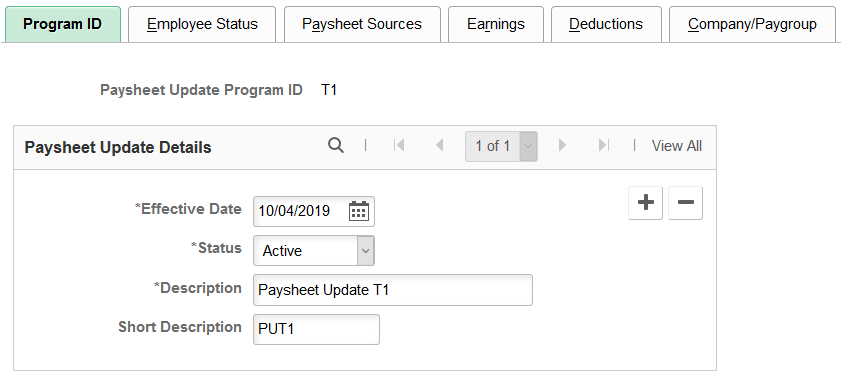

Use the Paysheet Update Program - Program ID page (PSHUP_PROG_DEFN) to define general information of paysheet update programs for inactive employees.

Navigation:

This example illustrates the fields and controls on the Paysheet Update Program - Program ID page.

Enter the basic information of paysheet update programs, for example, the effective date, status, and description.

A paysheet update program consists of rules that are used by the Load Paysheets process to select and load transaction data into paysheets (or reset transaction statuses) for inactive employees. In the paysheet update program setup, you specify:

Employee statuses to identify inactive employees.

Sources from where transaction data for inactive employees can be received.

Earning codes by which inactive employees can get paid.

Deduction codes to be loaded for inactive employees.

Company and paygroup combinations that use this paysheet update program setup.

You must define at least one active paysheet update program for the Load Paysheets process to process transactions for inactive employees.

Note: Paysheet update programs are only applicable to the loading or status resetting of paysheet transactions for inactive employees. They do not apply to transaction processing for active employees.

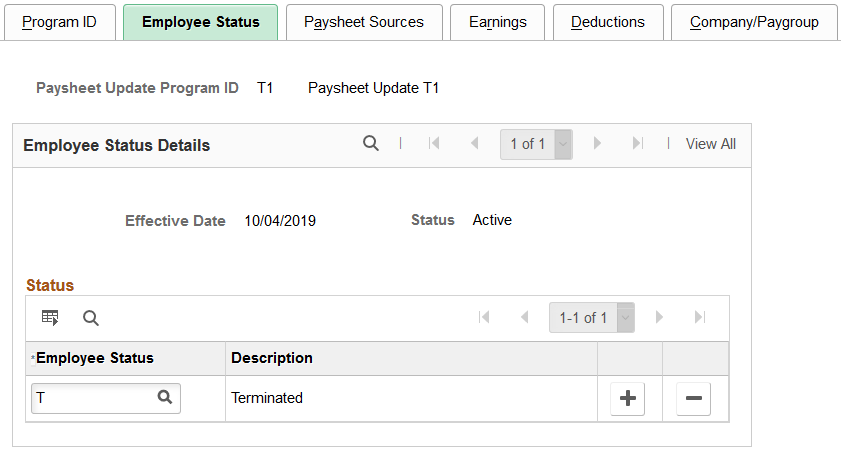

Use the Paysheet Update Program - Employee Status page (PSHUP_EMPL_ST_DEFN) to specify employee statuses used for loading paysheet transactions for inactive employees.

Navigation:

This example illustrates the fields and controls on the Paysheet Update Program - Employee Status page.

Field or Control |

Description |

|---|---|

Employee Status |

Enter at least one inactive employee status. Paysheet transactions for inactive employees that belong to statuses specified on this page will be considered by the Load Paysheets process. |

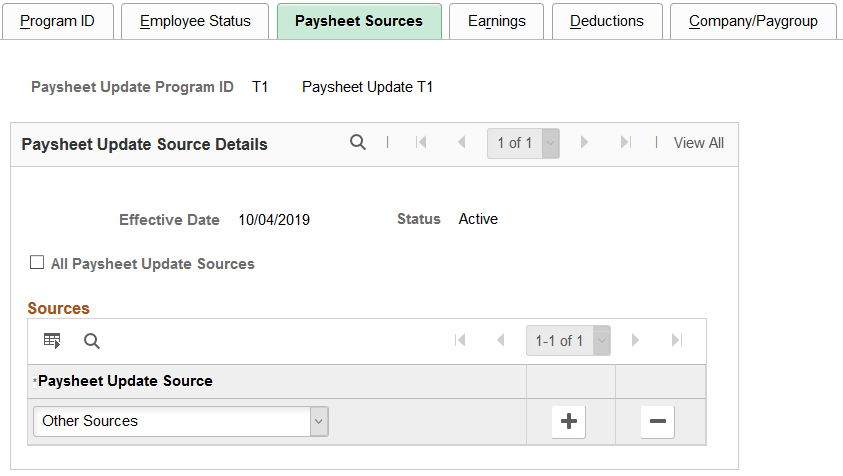

Use the Paysheet Update Program - Paysheet Sources page (PSHUP_SRC_DEFN) to specify sources used for loading paysheet transactions for inactive employees.

Navigation:

This example illustrates the fields and controls on the Paysheet Update Program - Paysheet Sources page.

Field or Control |

Description |

|---|---|

All Paysheet Update Sources |

Click this option for the system to consider paysheet transactions that are sent to your system from all supported sources for inactive employees with matching inactive statuses. When selected, the Sources section is unavailable for entry. |

Paysheet Update Source |

Specify at least one source from where transactions are to be included in the Load Paysheets process for eligible inactive employees, if the all option does not apply. For example, if your system accepts payment data for inactive employees from two sources, but you only need to process pay for inactive employees from one of them, specify that source in this section. |

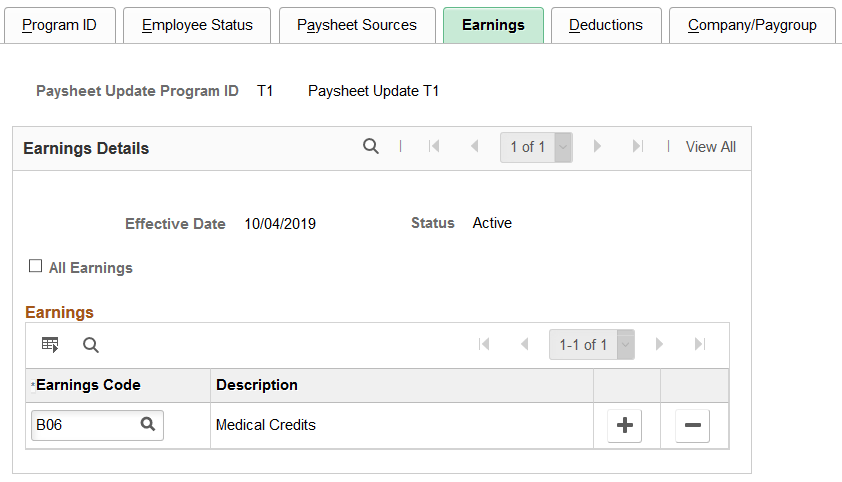

Use the Paysheet Update Program - Earnings page (PSHUP_ERNS_DEFN) to specify earnings codes used for loading paysheet transactions for inactive employees.

Navigation:

This example illustrates the fields and controls on the Paysheet Update Program - Earnings page.

Field or Control |

Description |

|---|---|

All Earnings |

Click this option for the system to select and process paysheet transactions that contain any earnings and originate from any of the matching sources for employees with matching inactive statuses. When selected, the Earnings section is unavailable for entry. |

Earnings Code |

Specify at least one earnings code to be paid to inactive employees, if the all option does not apply. |

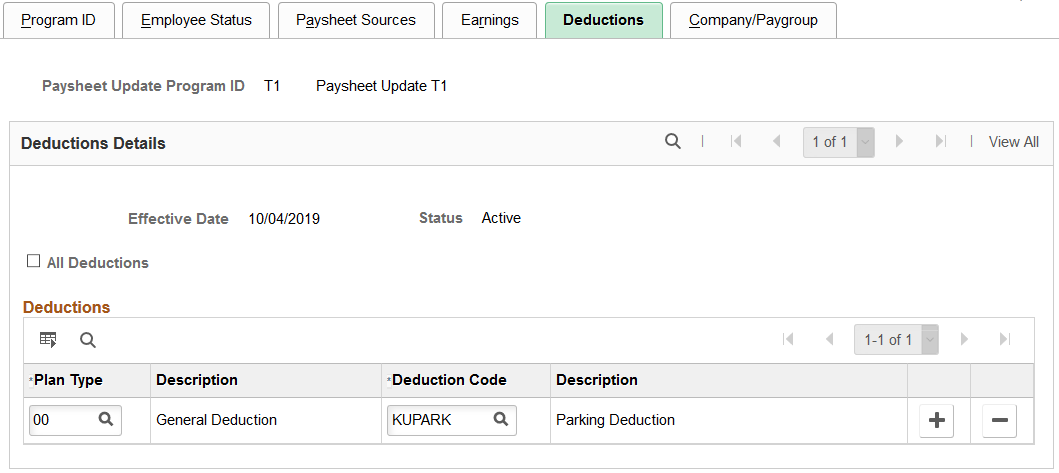

Use the Paysheet Update Program - Deductions page (PSHUP_DEDS_DEFN) to specify deduction codes used for loading paysheet transactions for inactive employees.

Navigation:

This example illustrates the fields and controls on the Paysheet Update Program - Deductions page.

Field or Control |

Description |

|---|---|

All Deductions |

Click this option for the system to select and process paysheet transactions that contain any deduction codes and originate from any of the matching sources for employees with matching inactive statuses. When selected, the Deductions section is unavailable for entry. |

Plan Type and Deduction Code |

Specify at least one plan type and deduction code combination, if the all option is not applicable. |

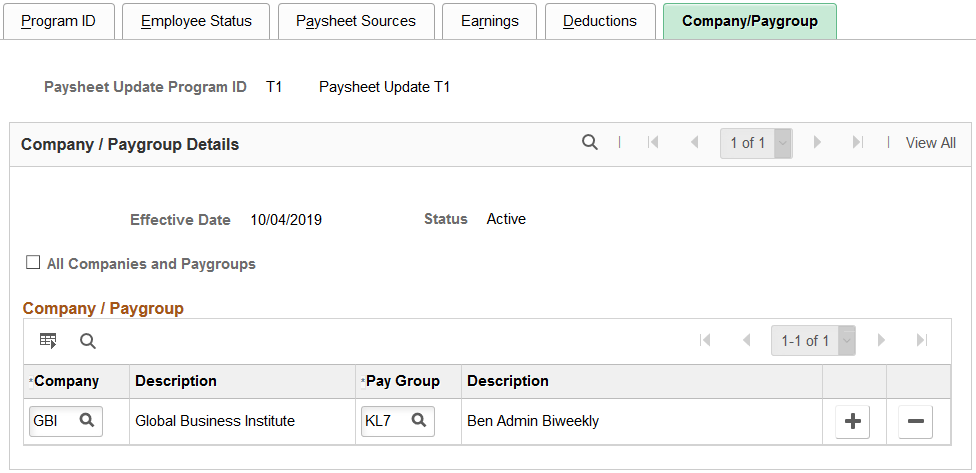

Use the Paysheet Update Program - Company/Paygroup page (PSHUP_COMPANY_DEFN) to associate paysheet update programs with companies and pay groups for inactive employees.

Navigation:

This example illustrates the fields and controls on the Paysheet Update Program - Company/Paygroup page.

Field or Control |

Description |

|---|---|

All Companies and Paygroups |

Click this option if you wish to use this paysheet update program for all companies and paygroups in the system. When selected, the Company / Paygroup section is unavailable for entry. Note: You can select this option for only one active paysheet update program. |

Company and Pay Group |

Specify at least one company and paygroup combination that uses this paysheet update program to process paysheet transactions for inactive employees, if the all option is not applicable. Note: You can associate any company and paygroup combination with only one active paysheet update program at a time. |

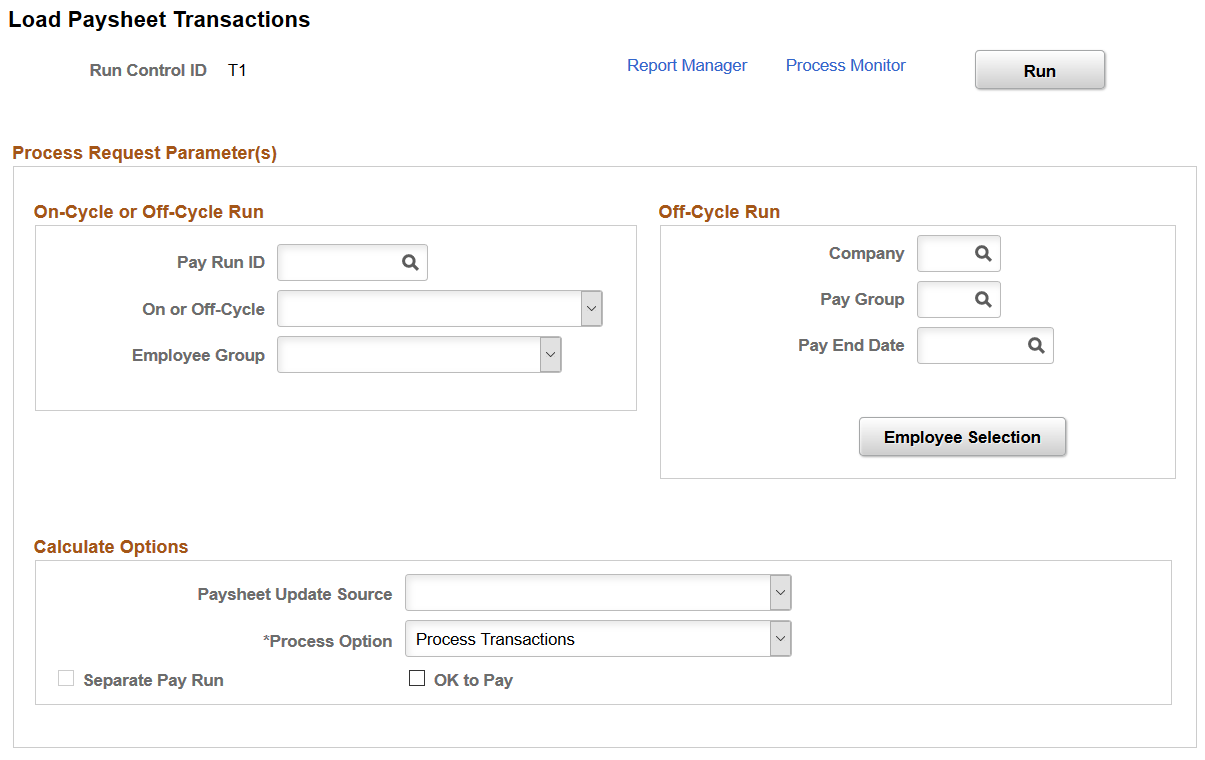

Use the Load Paysheet Transactions page (RUNCTL_PSHUP) to run the Load Paysheets (PYLOAD) process that loads transaction data into paysheets or resets transaction statuses before reloading data into paysheets.

Navigation:

This example illustrates the fields and controls on the Load Paysheet Transactions page when the option to support the loading of transaction data into paysheets for inactive employees is disabled.

This example illustrates the fields and controls on the Load Paysheet Transactions page when the option to support paysheet update for inactive employees is enabled.

Note: The layout of this page is different depending on whether the feature to support paysheet update and loading for inactive employees is enabled.

If the Inactive Employees option for Paysheet Update is selected on the Payroll for NA Installation Page, additional fields and options become available to support the feature.

On-Cycle or Off-Cycle Run

Use this group box or the Off-Cycle Run group box to the right to specify which transactions you want to load into paysheets or reset transaction statuses. For on-cycle runs, you must use the On-Cycle or Off-Cycle Run group box; for off-cycle runs, use this group box if you want to process data for employees in batch by pay run ID.

Field or Control |

Description |

|---|---|

Pay Run ID |

Select the pay run ID that identifies the pay calendars for which you want to load data. The system loads data for employees in the companies and pay groups represented by the pay run ID. |

On or Off-Cycle |

Your selection here performs differently depending on whether you're loading rapid entry paysheet transactions or transactions from other sources. |

Employee Group |

Specify whether to load data into paysheets for active employees or inactive employees for the selected pay run ID and cycle type. Leave this field blank to include both active and inactive employees in the Load Paysheets process. This field appears if the Inactive Employees option is selected on the Payroll for NA Installation Page. |

Off-Cycle Run

For off-cycle runs, use this group box if you want to load data or reset transaction statuses for individual employees. If you complete the fields in this group box, you cannot use the On-Cycle or Off-Cycle Run group box to the left.

Note: Do not use the fields in this group box when loading data from rapid entry paysheets.

Field or Control |

Description |

|---|---|

Company and Pay Group |

Select the company and pay group of the employees to be selected. |

Pay End Date |

Select the pay end date through which you want to retrieve data for the employee. The date that you select in this field appears as the pay end date on the paysheet. |

Empl ID (employee ID) |

Enter the ID of the employee for whom to load data for the off-cycle run. Only active employees are available for selection. (You must complete the Company, Pay Group and Pay End Date fields before you can enter the employee ID). This field appears if the Inactive Employees option is deselected on the Payroll for NA Installation Page. |

Empl Record (employee record number) |

Enter the employee's record number. (You must fill out the Empl ID field before you can enter the employee record number). This field appears if the Inactive Employees option is deselected on the Payroll for NA Installation Page. |

Employee Selection |

Click to access the Employee Selection Details modal page (PSHUP_RNCL_EMP_SEC) and select one or more employees and their employee records to load data for the off-cycle run. You must complete the Company, Pay Group and Pay End Date fields before selecting employees. This field appears if the Inactive Employees option is selected on the Payroll for NA Installation Page. |

Calculate Options

Field or Control |

Description |

|---|---|

Paysheet Update Source |

Select the source of the transaction data to be included in the Load Paysheets process. These sources are available:

Note: Leave this field blank to load data from all sources except Rapid Paysheets, Variable Compensation, and Other Sources (including any custom sources that you define with O% source codes). These types of transactions must always be loaded separately. |

Process Option |

Select how to process the transaction data. Valid values are:

|

Separate Pay Run |

If you select Expense Interface or Variable Compensation as the paysheet update source, and you're running an off-cycle process, select this check box to create a separate pay run for expense or variable compensation payments. |

OK to Pay |

Select if you want the Load Paysheets process to automatically mark the paysheets as OK to Pay. The Pay Calculation process processes only those transactions that are marked OK to Pay. Leave this check box deselected to review the paysheets and manually mark them OK to Pay. |

Use the Update Paysheet Transactions page (PY_PSHUP_TXN) to review transaction data from the PSHUP_TXN record and optionally update transactions before loading them into paysheets.

Navigation:

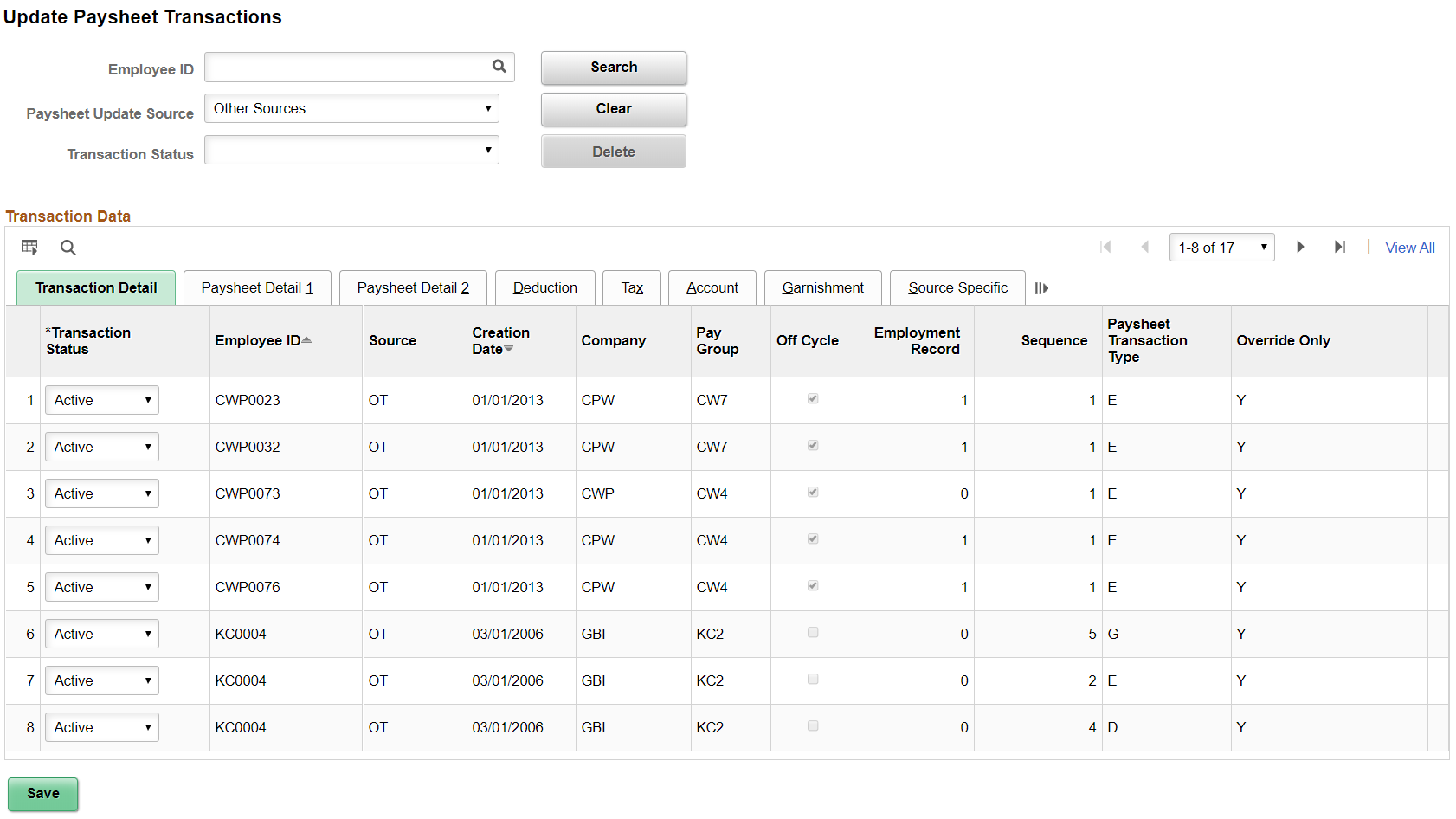

This example illustrates the fields and controls on the Update Paysheet Transactions page when the option to support the loading of transaction data into paysheets for inactive employees is disabled.

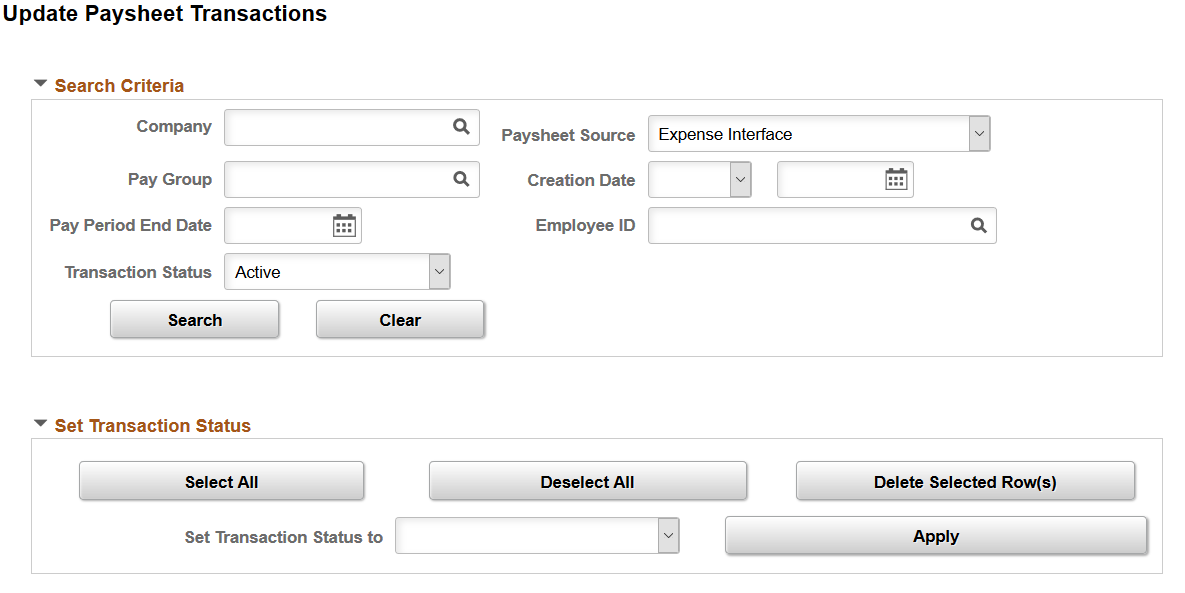

This example illustrates the fields and controls on the Update Paysheet Transactions page when the option to support the loading of transaction data into paysheets for inactive employees is enabled (1 of 2).

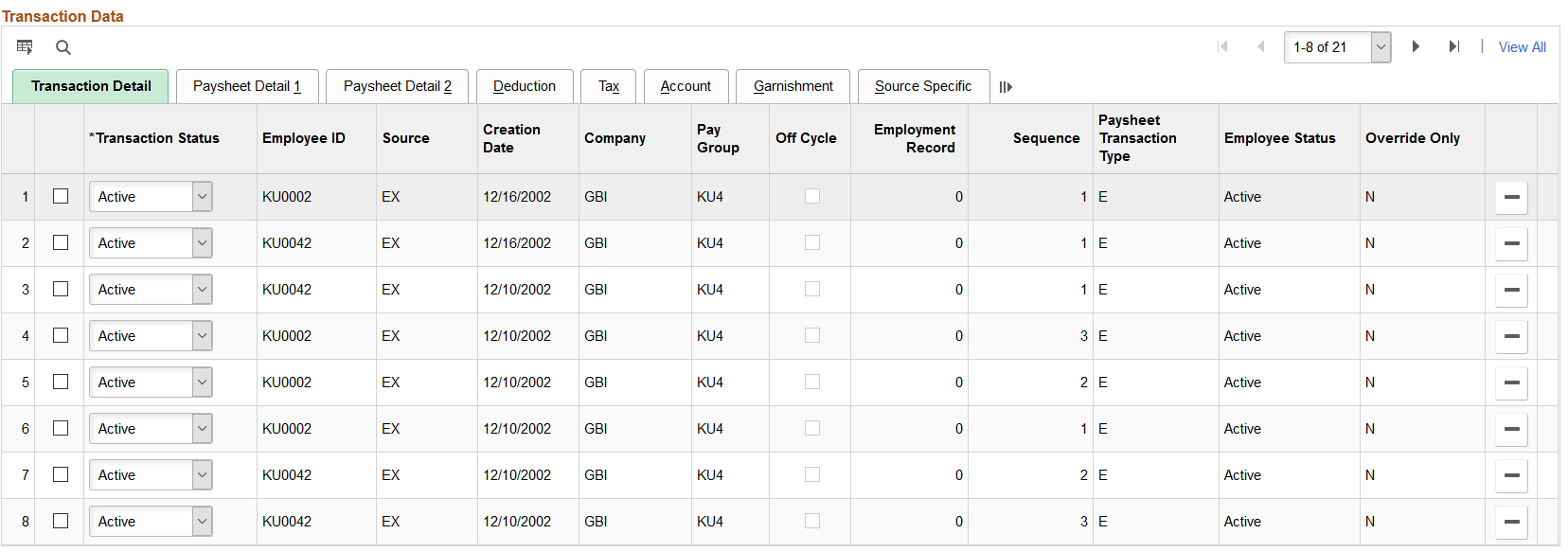

This example illustrates the fields and controls on the Update Paysheet Transactions page when the option to support the loading of transaction data into paysheets for inactive employees is enabled (2 of 2).

Note: The layout of this page is different depending on whether the feature to support paysheet update and loading for inactive employees is enabled. If the Inactive Employees option for Paysheet Update is selected on the Payroll for NA Installation Page, additional fields and options become available to support the feature.

If you have previously run the Load Paysheets process to either load transaction data into paysheets or reset transaction statuses, you can review the result of the process on this page. You can also update transaction statuses manually and delete transaction rows.

Page Elements for Filtering Transactions

Note: This section appears if the Inactive Employees option is deselected on the Payroll for NA Installation Page.

To populate the Transaction Data grid, search for transactions for any combination of employee ID, paysheet update source, and transaction status.

Field or Control |

Description |

|---|---|

Transaction Status |

Values are: Active: Select

to search for transactions that are ready to be loaded into paysheets.

This is the initial status for transactions when they were first sent

from their sources.

Exclude: Select to search for transactions that are inactive temporarily and not to be processed in the Load Paysheets process. In Progress: Select to search for transactions that are in the Load Paysheets process. When the process selects transactions to work on based on the run control parameters, it changes their status to In Progress. Transactions will be in this status until the completion of the Load Paysheets process. Loaded or Inactive: Select to search for transactions that are already loaded into paysheets. These transactions will not be processed by the Load Paysheets process. The Loaded status appears if the feature to support the Load Paysheets process for inactive employees is applied to the Payroll for North America system, but is not enabled. The Inactive status is shown, if the feature is not applied to the system (in this case, the Inactive Employees option is not available for selection). |

Delete |

Click to remove transactions that appear in the Transaction Data section. This button is available when Inactive or Loaded only transactions are displayed for a selected source. |

Search Criteria

Note: This section appears if the Inactive Employees option is selected on the Payroll for NA Installation Page.

Specify one or more search values to filter transactions to be displayed in the Transaction Data grid.

Field or Control |

Description |

|---|---|

Transaction Status |

Values are: Active: Select to search for transactions that are ready to be loaded to paysheets. This is the initial status for transactions when they were first loaded to the staging record from their sources. Excluded: Select to search for transactions that are inactive temporarily and not to be processed in the Load Paysheets process. In Progress: Select to search for transactions that are in the Load Paysheets process. When the process selects transactions to work on based on the run control parameters, it changes their status to In Progress. Transactions will be in this status until the completion of the Load Paysheets process. Loaded: Select to search for transactions that were loaded successfully into paysheets. The Loaded status is reserved only for use by the Load Paysheets process; transactions cannot be manually updated to this status. Manually Paid: Select to search for transactions that were added manually into paysheets. The Manually Paid status is used for audit purposes only. Transactions in this status are not processed in the Load Paysheets process. Rejected: Select to search for transactions that did not match the paysheet update program rules and therefore could not be loaded into paysheets. |

Set Transaction Status

Note: This section appears if the Inactive Employees option is selected on the Payroll for NA Installation Page.

Use options in this section to update transactions in bulk, if needed.

Field or Control |

Description |

|---|---|

Select All or Deselect All |

Click Select All to select all transactions in the Transaction Data grid. Click Deselect All to deselect all transactions in the Transaction Data grid. |

Deleted Selected Rows |

Click to delete one or more selected transactions permanently from the Transaction Data grid. |

Set Transaction Status To |

Select the new status to which selected transactions will be updated. Values are: Active: Select for transactions to be picked up by the Load Paysheets process. Exclude: Select for transactions not to be picked up by the Load Paysheets process. Manually Paid: Select to indicate that transactions were added into paysheets manually, and not to be picked up by the Load Paysheets process. |

Apply |

Click to update selected transactions with the new status and save the change. |

Transaction Data

This grid displays complete data from the PSHUP_TXN record so that you can review the data and optionally update its status.

Field or Control |

Description |

|---|---|

Transaction Status |

Displays the current status of the transaction. Select a new status for the transaction to update to, if needed. When you change the status of a transaction, the system updates the PSHUP_TXN record with the new status and with an indicator that the status has been manually changed (by setting the Y value in the PU_TXN_MANUAL_CHG field for that transaction). Note: (Applicable if the Inactive Employees option is deselected) Because transactions can be set to Inactive or Loaded by the system when the Load Paysheets process completes, you can change transaction status from Inactive, Exclude or In Progress back to Active, if the PU_TXN_MANUAL_CHG field indicator has a Y (yes) value. |

Paysheet Transaction Type |

Displays the type of the paysheet transaction. Valid values are:

|

(PA) PSD Earned Income Tax Codes

For Pennsylvania, you must enter or verify the Political Subdivision (PSD) Earned Income Tax (EIT) codes for work and residence on the Tax subtab of the Update Paysheet Transactions page.

Field or Control |

Description |

|---|---|

PA EIT Work PSD Code and PA EIT Resident PSD Code (Pennsylvania Earned Income Tax work and residence Political Subdivision code) |

Under PA Act 32, you must identify the employee's work locality and residence locality for each Pennsylvania local Earned Income Tax (EIT) amount withheld from an employee. These codes must be entered or verified for the following transactions:

Note: To save the page, you must enter both codes when conditions are as follows: the paycheck date on the calendar is 01/01/2012 or after, Locality is not blank, and Tax Class is Withholding. For more information about Pennsylvania locality codes, see (USA) Viewing Local Tax Tables. |

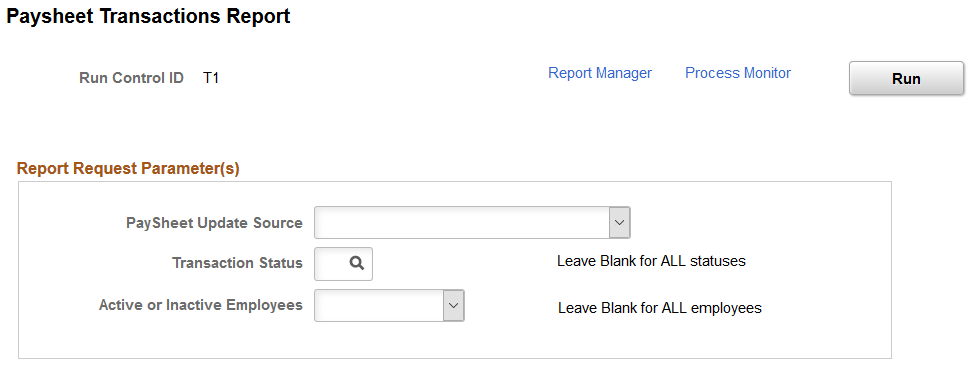

Use the Paysheet Transactions Report page (RUNCTL_PSHUPLD) to generate the PAY305RT report that lists transactions loaded in the PSHUP_TXN record from supported sources.

Navigation:

This example illustrates the fields and controls on the Paysheet Transactions Report page.

Use the Paysheet Transactions report to see the transaction contents that are available in the PSHUP_TXN record. You can run this report before the Load Paysheets process to see the list of transactions that are going to be loaded into paysheets by source.

Field or Control |

Description |

|---|---|

PaySheet Update Source |

Select the source of the transactions to be included in the report. Leave the field value blank to include all sources. Note: For rapid entry paysheet transactions, you must load the transactions to paysheets before running this report. |

Transaction Status |

Select the status of the transactions to be included in the report. Leave the field value blank to include all statuses. For example, select Active to view the list of transactions that have not yet been and are going to be loaded into paysheets when the Load Paysheets process runs. (If the Inactive Employees option is selected) Valid values are: Active Exclude Loaded Manually Paid Rejected (If the Inactive Employees option is deselected) Valid values are:

Active Exclude Inactive In Progress |

Active or Inactive Employees |

Select if you wish to see transactions of Active or Inactive employees to be included in the report. Leave the field value blank to include both types of employees. This field appears if the Inactive Employees option is selected on the Payroll for NA Installation Page. |