Defining System Settings for Payroll for North America

To set up implementation defaults for Payroll for North America, use the Payroll for NA Installation (INSTALLATION_PY) component.

This topic describes the Payroll for North America installation component. Other system-wide implementation defaults are set on the installation (INSTALLATION_TBL) component for Human Resources. See Setting Up Implementation Defaults in your PeopleSoft HCM Application Fundamentals product documentation. Also consult your PeopleSoft Human Resources installation product documentation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTALLATION_PY |

Define system-wide Payroll for North America settings. Note: Settings here are in addition to settings on pages in the Installation (INSTALLATION_TBL) component for HR. |

Use the Payroll for NA Installation page (INSTALLATION_PY) to Define system-wide Payroll for North America settings.

Note: Settings here are in addition to settings on pages in the Installation (INSTALLATION_TBL) component for HR.

Navigation:

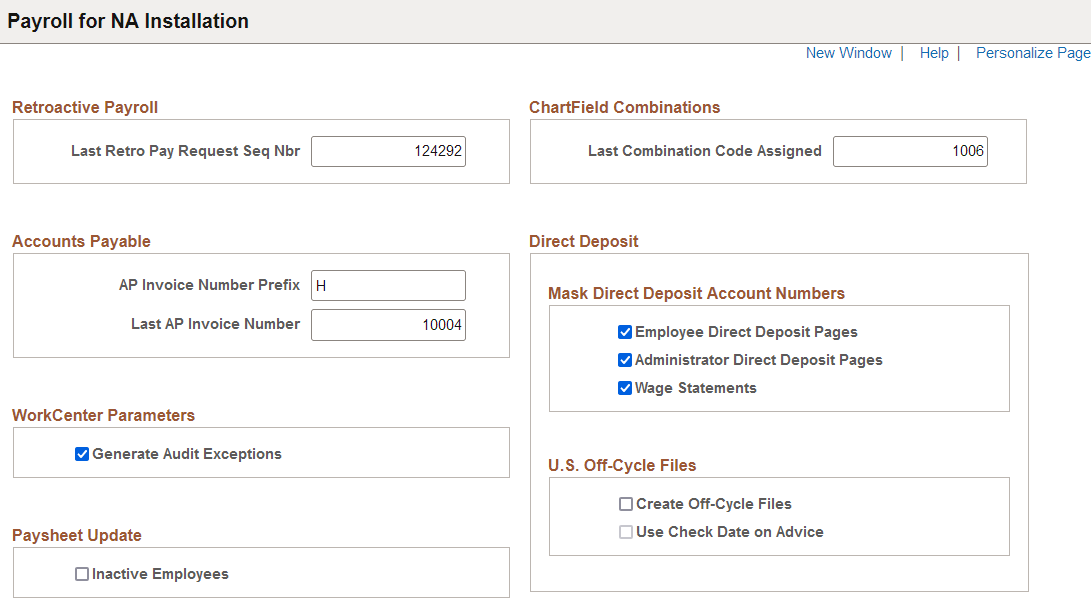

This example illustrates the fields and controls on the Payroll for NA Installation page (1 of 3).

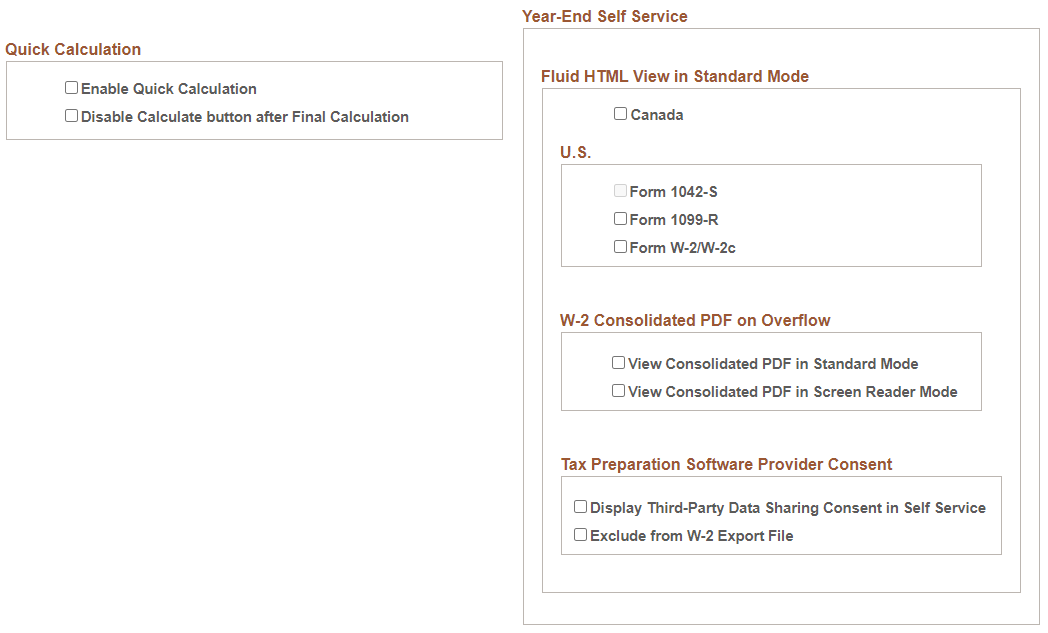

This example illustrates the fields and controls on the Payroll for NA Installation page (2 of 3).

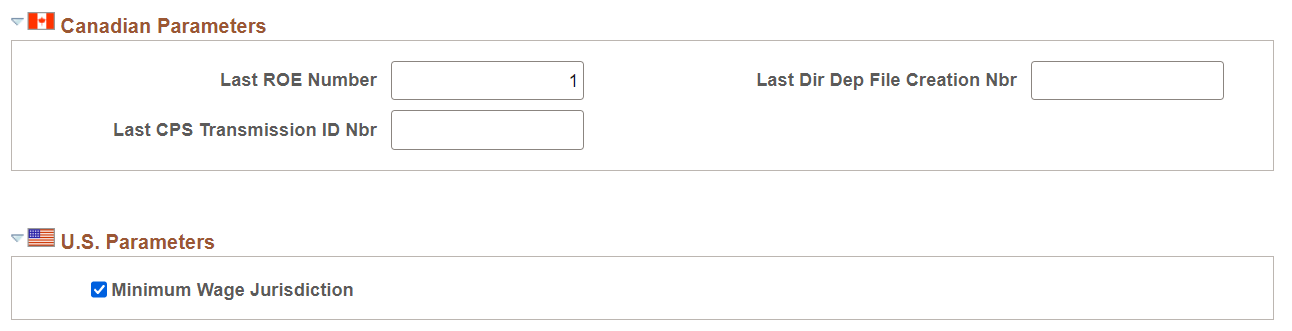

This example illustrates the fields and controls on the Payroll for NA Installation page (3 of 3).

To understand last number assigned functionality, see documentation for the Last ID Assigned page (INSTALLATION_TBL2) of the Installation Table component for HR, provided in the Setting Up Implementation Defaults topic of your PeopleSoft HCM Application Fundamentals product documentation.

Retroactive Payroll

|

Field or Control |

Description |

|---|---|

|

Last Retro Pay Request Seq Nbr (last retroactive pay request sequence number) |

The system generates the Retro Pay Request Sequence Number from which to incrementally increase Retro Pay Request sequence numbers as they are added to transactions in the system. |

See Reviewing Retro Pay Requests in this document.

Accounts Payable

|

Field or Control |

Description |

|---|---|

|

AP Invoice Number Prefix and Last AP Invoice Number |

The system generates the AP Invoice Number Prefix and Last AP Invoice Number from which to incrementally increase the same items as they are added to AP transactions in the system. |

See Setting Up Implementation Defaults in your PeopleSoft HCM Application Fundamental product documentation.

WorkCenter Parameters

|

Field or Control |

Description |

|---|---|

|

Generate Audit Exceptions |

Select this check box to display audit links in the Audit Exceptions folder on the My Work Pagelet of Payroll WorkCenter and to display the WorkCenter group box on the PAY011, PAY034, PAY035, and PAY036 run control pages. |

See Using the Payroll WorkCenter in this document.

Paysheet Update

|

Field or Control |

Description |

|---|---|

|

Inactive Employees |

Select this check box to enable the loading of transaction data into paysheets for inactive employees. |

See Loading Paysheet Transactions in this document.

Quick Calculation

|

Field or Control |

Description |

|---|---|

|

Enable Quick Calculation |

Select this check box to enable calculation of checks for individual employees using the Quick Calculation feature. |

|

Disable Calculate button after Final Calculation |

Select this check box to disable the Calculate button on the Quick Calculation Page after the final calculation run is completed. |

ChartField Combinations

|

Field or Control |

Description |

|---|---|

|

Last Combination Code Assigned |

The system generates the ChartField combination code from which to incrementally increase ChartField combination codes as they are added to transactions in the system. |

See Entering and Maintaining Valid ChartField Combinations in your PeopleSoft HCM Application Fundamentals product documentation.

Direct Deposit - Mask Direct Deposit Account Numbers

|

Field or Control |

Description |

|---|---|

|

Employee Direct Deposit Pages, Administrator Direct Deposit Pages, and Wage Statements |

The system can, for security purposes, mask all but the last four characters of a paycheck direct deposit account on all employee pages that show direct deposit information, all administrator pages that show direct deposit information, and all PDF and non-PDF wage statements (paychecks and payslips). Masking does not occur for an item unless the check box is selected here. |

See Setting Up Direct Deposits in this document.

Direct Deposit - U.S. Off-Cycle Files

|

Field or Control |

Description |

|---|---|

|

Create Off-Cycle Files |

Select this check box to enable the creation of direct deposit transmittal files for off-cycle payments that are tied to unconfirmed on-cycle calendars. |

|

Use Check Date on Advice |

Select this check box to use the check date on the advice as the effective entry date (the date to post funds to employees’ accounts) of the direct deposit file. This option is only applicable to off-cycle pay runs. Clear this check box to use the paycheck issue date of the pay calendar instead. This field becomes editable when the Create Off-Cycle Files field is selected. |

See Understanding the Create Direct Deposit Transmit Process.

Year-End Self Service

|

Field or Control |

Description |

|---|---|

|

Canada |

Select for Canadian employees to be able to view their year-end slips in screen reader format (HTML) when the system is not in screen reader mode. |

|

(U.S.) Form 1042-S, Form 1099-R, and Form W-2/W-2c |

Select one or more U.S. year-end forms that can be viewed in screen reader format (HTML) when the system is not in screen reader mode. |

|

View Consolidated PDF in Standard Mode |

(For overflow W-2 forms) Select for employees to be able to view all pages of an overflow year-end form in a single consolidated PDF in standard mode. Overflow is supported in W-2 forms only. |

|

View Consolidated PDF in Screen Reader Mode |

(For overflow W-2 forms) Select for employees to be able to view all pages of an overflow year-end form in a single consolidated PDF in screen reader mode. Overflow is supported in W-2 forms only. |

|

Display Third-Party Data Sharing Consent in Self Service |

Select to display a section on the W-2/W-2c Consent Page where employees can provide or withdraw the consent to share their W-2 or W-2c data with tax preparation providers in Employee Self-Service. If the employee withdraws the consent, the Create W-2 Import File process excludes the employee’s data from the import file that it creates. This field is deselected by default. See Understanding Employee Consent for Tax Data Export and Understanding W-2 Import Files. |

|

Exclude from W-2 Export File |

Select to exclude the W-2 or W-2c data of all employees from the import files generated by the Create W-2 Import File process. This field is deselected by default, which means that the tax data for all employees is included in the import files. |

See (USA) Using the PeopleSoft Fluid User Interface to Manage Consent and View Electronic Year-End Forms and (CAN) Using the PeopleSoft Fluid User Interface to Manage Consent for Electronic Year-End Forms.

Canadian Parameters

Enter controls in this group box to use for the transmission of Canada’s Record of Employment (ROE) to Service Canada.

|

Field or Control |

Description |

|---|---|

|

Last ROE Number |

The system generates the Last ROE Number from which to incrementally increase ROE numbers as they are added to ROE transactions in the system. |

|

Last Dir Dep File Creation Nbr (last direct deposit file creation number) and Last CPS Transmission ID Nbr (last Canada Processing Service transmission identification number) |

Enter the Last Direct Deposit File Creation number and the Last CPS Transmission ID number from which to incrementally increase the same as they are added to ROE transactions in the system. |

See Generating and Auditing ROEs in this document.

U.S. Parameters

|

Field or Control |

Description |

|---|---|

|

Minimum Wage Jurisdiction |

Select this check box to enable the use of jurisdiction minimum wage rates in payroll calculations. To disable this functionality, you need to disable it for all pay groups first. |