Creating W-2 Import Files

This topic provides an overview of creating files to import W-2 data for employees and discusses how to create these files.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_TAX960TI |

Produce files that import W-2 or W-2c information for employees. |

Payroll for North America provides the ability to create files that can be used to import employee's year-end data into a tax preparation software provider. Once the files are uploaded to the tax preparation provider’s site, employees can import their individual W-2 data as they prepare their tax returns.

Steps to Create Import Files

To create import files with employees' W-2 or W-2c data:

Review these sections in the Year End Processing <Tax Year>, U.S., Puerto Rico, and U. S. Territories document to prepare the data needed for the Create W-2 Import File process:

Preparing for <Tax Year> Year End Processing

Preparing Tax Data and Year End Forms

Access the Create W-2 Import File Page. Select:

The All Employees import type to create W-2 files for all employees.

The Corrections import type to create W-2c files for employees specified in the Selected Employees section.

Select the W-2 Import File Audit option if you want to create an audit file that reports the amounts of additional boxes 12 and 14 for employees.

Run the Create W-2 Import File process (TAX960TI).

When the process completes successfully, report files are available from the Details link of the corresponding process instance on the Process List page. Select the View Log/Trace link to access them.

Files may include:

The W-2 Import File Audit Report For Additional Box 12 & 14 Data audit report, if the W-2 Import File Audit option is selected.

The W-2 Import File Excluded Employee report, if there are employees with a W-2 box amount that exceeds $9,999,999.99. These employees are excluded from the import file creation process because the tax preparation software provider does not process any amount that is $10 million or higher.

W-2 (or W-2c) import files can be found in the regular path where other PeopleSoft files are created.

The naming of import files follows this convention: W2IMP<nnn>, where nnn represents the volume identifier. For example, if there are two import files created by the process, their file names are W2IMP001 and W2IMP002.

If you have Process Scheduler configured to run your processes, use the process instance number to identify the import files you wish to review. The TAX960TI process generates a folder to store import files it creates in each process instance. The naming of folders follows this convention: TI<nnnnnn>, where nnnnnn represents the process instance number.

Important! If Process Scheduler is not configured in your environment, import files can be found in the regular path where other PeopleSoft files are created, not residing in any process-generated folders.

Follow the instructions of the tax preparation software provider to submit import files.

Video: Image Highlights, PeopleSoft HCM Update Image 44: U.S. Tax Preparer Import File

Employee Consent To Include W-2 Data in Import Files

The Create W-2 Import File process (TAX960TI) takes employee consent into account when deciding whether to include employees’ W-2 or W-2c data in the import files it generates.

Note: Oracle highly recommends that the W-2/W-2c Consent Page (component name: PY_W2_CONSENT_FL) be locked down for the TAX960TI process to ensure that the import file will accurately report data as of the time the report is run.

Keep in mind that if the W-2/W-2c Consent page is locked down while the TAX960TI process is running, users cannot update their consent statuses on that page.

For more information about component lockdown, see Understanding HCM Lockdown Framework.

The process includes the employee’s W-2/W-2c data in the import file, if the consent status of an employee is:

Consent Granted, which is set after the employee provided consent on the W-2/W-2c Consent page in Employee Self-Service, or

Consent Reset by Employer to Include in Import File, which is set after the administrator ran the reset process to include the data of identified employees in the import file. This is also the default status.

Employee’s data will be excluded from the import file if the consent status is:

Consent Withdrawn, which is set after the employee declined to share data with any tax preparation provider, or

Consent Reset by Employer to Exclude from Import File, which is set after the administrator ran the reset process to exclude the data of identified employees from the import file.

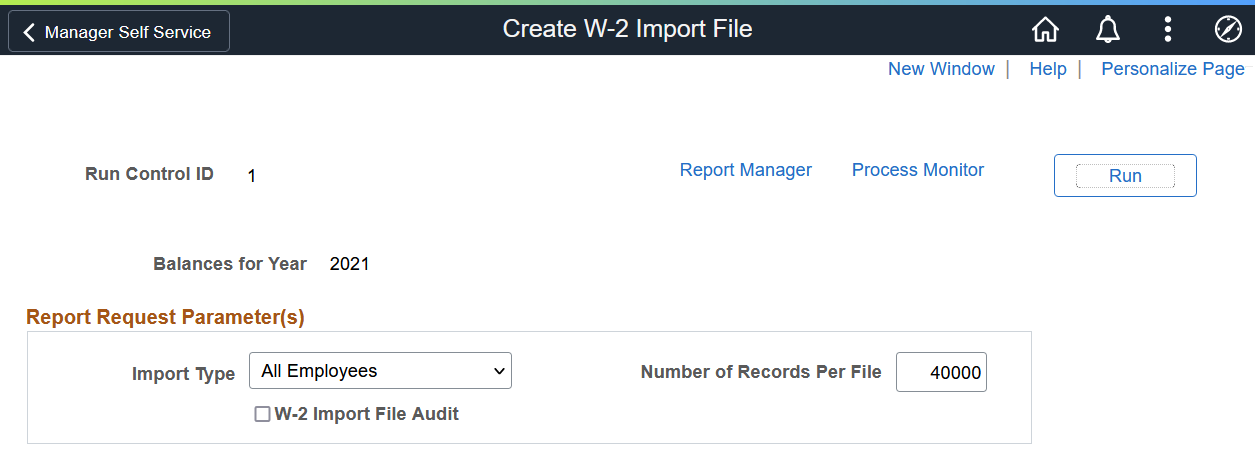

Use the Create W-2 Import File page (RUNCTL_TAX960TI) to produce files that import W-2 or W-2c information for employees.

Navigation:

This example illustrates the fields and controls on the Create W-2 Import File page.

|

Field or Control |

Description |

|---|---|

|

Balances for Year |

Displays the reporting period (year) of the W-2 data to be imported. |

|

Import Type |

Specify the type of data you want to include in the file(s) to import. Values are: All Employees: Select this option to include W-2 information in the file(s). Corrections: Select this option to include W-2c information in the file(s). |

|

Number of Records Per File |

Enter the maximum number of records that a file can hold. The default value is 40000. Important! Use compression software to zip up import files before submitting them to the tax preparation software provider. To ensure a successful import, the size of the zip files must not exceed the maximum limit specified by the tax preparation software provider. |

|

W-2 Import File Audit |

Select this option to create an audit report with the amounts of additional boxes 12 and 14 that are available in the import file(s). These boxes are not reported in the EFW2 electronic file, but are required by the tax preparation provider. Note: If you want to create additional audit files for the rest of the amounts reported in the import file(s), review the Year End Processing <Tax Year>, U.S., Puerto Rico, and U. S. Territories document that is available on MOS and follow the instructions to run TAX962FD - Federal W-2 File Audit, TAX962ST - State W-2 File Audit Report, and TAX962LC - Local W-2 File Audit. |

Selected Employees

This section appears if the selected import type is Corrections.

The system creates files to include the W-2c information of employees that are selected in this section. All employees with W-2c data are included if no employees are specified.

Note: The All Employees option references YE_DATA and YE_AMOUNTS, whereas the Corrections option references YE_W2C_DATA and YE_W2C_AMOUNTS.