Extracting Deductions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Non Commitment Accounting Information Page |

RUNCTL_PAYGL01 |

If you use non-commitment accounting with PeopleSoft general ledger, prepare ChartField information for each deduction transaction and store it in tables for the tax and non-tax deduction extraction processes to access. |

|

Payroll Data Distribution for AP Page |

RUNCTL_PAYGL01 |

If you use PeopleSoft Payables but not PeopleSoft General Ledger, prepare ChartField information for each deduction transaction and store it in tables for the tax and non-tax deduction extraction processes to access. |

|

GL Interface - Commitment Accounting Actuals Page |

RUNCTL_PAYGL02 |

If you use commitment accounting with PeopleSoft general ledger, prepare ChartField information for each deduction transaction and store it in tables for the tax and non-tax deduction extraction processes to access. |

|

RC_X_DEDS |

(USA) Select the nontax deductions to send to Payables for payment and start the PY-AP Extraction - Deductions (payroll-accounts payable extraction - deductions) Application Engine process (PYAP_XDEDN). |

|

|

CA Non-Tax Deductions Extract Page (commitment accounting non-tax deductions extract) |

RC_X_DEDS |

(CAN) For commitment accounting, select the nontax deductions to send to Payables for payment and start the PY-AP Extraction - Deductions (payroll-accounts payable extraction - deductions) Application Engine process (PYAP_XDEDNCA). Note: The CA Non-Tax Deductions Extract page is identical to the Non-Tax Deductions Extract Page. |

|

Extract AP Federal Taxes Page (extract accounts payable federal taxes) |

RC_X_TAX_FEDERAL |

(USA) Select the federal tax deductions to send to Payables for payment and to start the U.S. Tax Extract Program Application Engine process (PYAP_XTAX). |

|

Extract AP State Taxes Page extract accounts payable state taxes) |

RC_X_TAX_STATE |

(USA) Select the state tax deductions to send to Payables for payment and start the U.S. Tax Extract Program process (PYAP_XTAX). |

|

Extract U.S. Local Taxes Page (extract United States local taxes) |

RC_X_TAX_LOCALITY |

(USA) Select the local tax deductions to send to Payables for payment and start the U.S. Tax Extract Program process (PYAP_XTAX). |

|

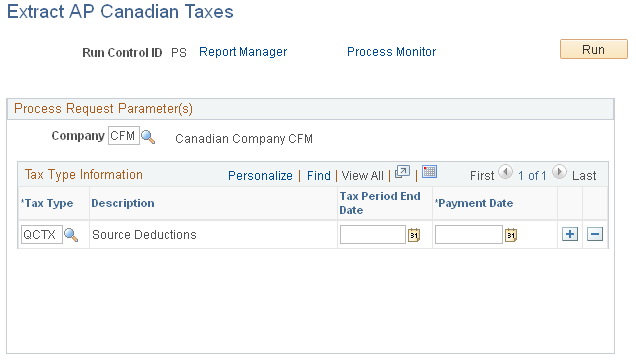

Extract AP Canadian Taxes Page (extract accounts payable Canadian taxes) |

RC_XTAX_CAN |

Select the tax deductions to send to Payables for payment and to start the Canadian Tax Extract Program Application Engine process (PYAP_XCTAX). |

Before you can extract deductions, you must:

Confirm the pay run.

Run GL interface processing to prepare the data.

The process you run to prepare the data depends upon your organization's system of accounting and general ledger system.

This table describes the processing that is required under various conditions:

Your Organization Uses

Required Processing

Processing Description

Non-commitment accounting with PeopleSoft GL Interface.

Run the Non Commitment Accounting Information PSJob process (PAYGL01 - E&G, or PAYGL01A), after each pay run is confirmed.

Prepares ChartField information for each deduction transaction and stores it in tables such as PAY_NA_DED_LIAB, PAY_NA_TAX_LIAB, and PAY_NA_CTX_LIAB for the tax and non-tax deduction extraction processes to access.

Commitment accounting with PeopleSoft GL Interface.

Run the Commitment Accounting Actuals PSJob process (PAYGL02 - E&G, or PAYGL02A) Actuals GL Interface) after each pay run is confirmed.

Prepares ChartField information for each deduction transaction and stores it in tables such as PAY_DED_LIAB_AP, PAY_TAX_LIAB_AP, and PAY_CTX_LIAB_AP for the tax and non-tax deduction extraction processes to access.

See Running the Commitment Accounting Actuals GL Interface Process.

PeopleSoft Payables but does not use PeopleSoft GL Interface.

Run the Distribute Payroll Data for AP SQR process (General Ledger Interface - PAYGL01) after each pay run is confirmed.

Prepares ChartField information for each deduction transaction and stores it in tables such as PAY_NA_DED_LIAB, PAY_NA_TAX_LIAB, and PAY_NA_CTX_LIAB for the tax and non-tax deduction extraction processes to access.

Field or Control |

Description |

|---|---|

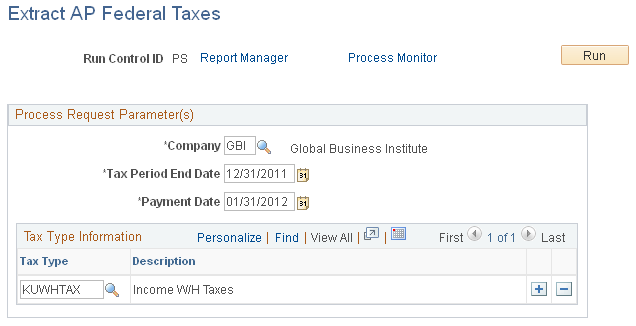

Tax Period End Date |

Enter the end date for the tax period. To be selected for payment, the paycheck date for tax deductions must be equal to or before the tax period end date. (The paycheck date populates the Pay Tax records after a pay run is confirmed). |

Payment Date |

Enter the date to appear on the voucher in Payables. This is the date when AP actually pays the taxes. |

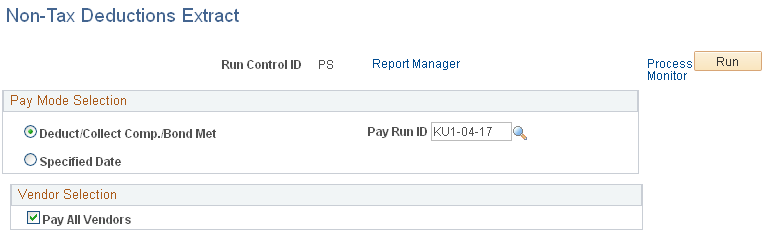

(USA) Use the Non-Tax Deductions Extract page (RC_X_DEDS) to select the nontax deductions to send to Payables for payment and start the PY-AP Extraction - Deductions (payroll-accounts payable extraction - deductions) Application Engine process (PYAP_XDEDN).

Navigation:

Note: (CAN) The CA Non-Tax Deductions Extract page is, except for title, identical to the page shown here.

This example illustrates the fields and controls on the Non-Tax Deductions Extract page.

Use the parameters to extract nontax deductions for the pay run ID that you specify or extract just those deductions with a pay mode set to the date that you select. You can limit your selection further by specifying particular vendors you want to pay.

Pay Mode Selection

Field or Control |

Description |

|---|---|

Deduct/Collect Comp./Bond Met (deducted/collection completed/bond price met) |

This option is applicable if you selected Pay as Deducted, Pay when Collection Completed, or Pay When Bond Price met as the pay mode on the General Deduction table, Benefit Plan table, or Garnishment Spec (garnishment specification) table and you selected either Check Date or Pay Period End Date as the AP payment date type. |

Pay Run ID |

This field works in conjunction with the Deduct/Collect Comp./Bond Met option. It enables you to limit the extract process to a single pay run that is associated with this run control ID. Select the pay run. If the pay mode is Pay When Collection Completed or Pay When Bond Price met, deductions that meet the criteria by the end date of the pay period represented by the pay run ID are extracted. |

Specified Date |

Select to send only those nontax deductions with a check date that's before or the same as the date that you enter in the Payment Due Date field. This option is appropriate when deductions for more than one pay period must be extracted (for example, benefit deductions that are withheld every pay period and sent to the vendor at the end of the month). |

Payment Due Date |

This field appears only when you select the Specified Date option. Enter the date that you want to appear on the voucher. This is the date on which the Payables system pays the vendor. |

Vendor Selection

Field or Control |

Description |

|---|---|

Pay All Vendors |

By default, the system selects deductions for all vendors. To pay selected vendors only, deselect this check box. The SetID, Vendor ID, and Name fields then become available. |

Vendor Info

This group box appears only if you deselect the Pay All Vendors check box. Select the vendors that you want to pay.

(USA) Use the Extract AP Federal Taxes (extract accounts payable federal taxes) page (RC_X_TAX_FEDERAL) to select the federal tax deductions to send to Payables for payment and to start the U.S. Tax Extract Program Application Engine process (PYAP_XTAX).

Navigation:

This example illustrates the fields and controls on the Extract AP Federal Taxes page.

Specify which tax types to include in the extract. Only those tax deductions with a tax class that belongs to a tax type that you specify are selected for payment through Payables.

Tax Type Information

Field or Control |

Description |

|---|---|

Tax Type |

Select the tax type. The prompt table includes only those tax types that you defined on the Tax Type Table page. You can add as many tax types as you like. |

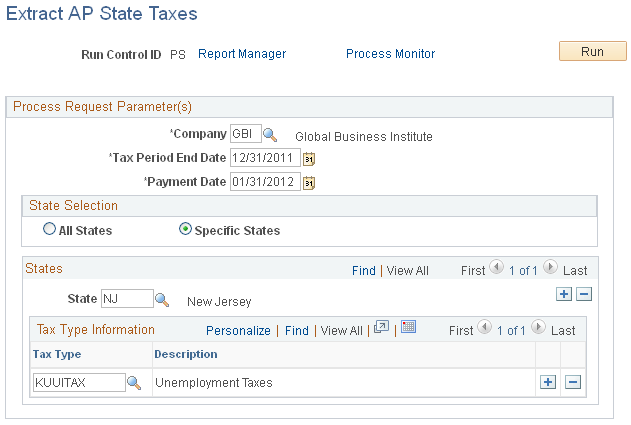

(USA) Use the Extract AP State Taxes (extract accounts payable state taxes) page (RC_X_TAX_STATE) to select the state tax deductions to send to Payables for payment and start the U.S. Tax Extract Program process (PYAP_XTAX).

Navigation:

This example illustrates the fields and controls on the Extract AP State Taxes page.

You can extract deductions for all or specific states. If you choose to extract deductions for a particular state, you can also limit the selection to certain tax types.

State Selection

Field or Control |

Description |

|---|---|

All States |

Select to extract state tax deductions for all states. |

Specific States |

Select to extract state tax deductions for a particular state. When you select this option, the States group box appears. |

States

This group box appears only when you select the Specific States option.

Field or Control |

Description |

|---|---|

State |

The states for which you defined tax types are available in the prompt. |

Tax Type |

Select the tax type. The prompt table includes only those tax types that you entered for the state on the Fed/State Tax Types/Classes table. |

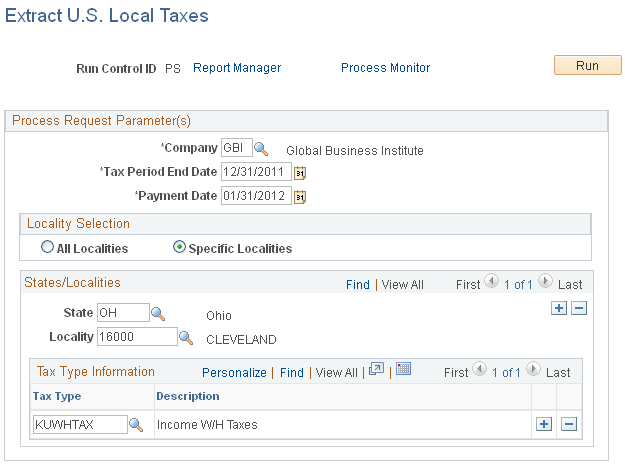

(USA) Use the Extract U.S. Local Taxes (extract United States local taxes) page (RC_X_TAX_LOCALITY) to select the local tax deductions to send to Payables for payment and start the U.S. Tax Extract Program process (PYAP_XTAX).

Navigation:

This example illustrates the fields and controls on the Extract U.S. Local Taxes page.

You can extract tax deductions for all localities or a subset of localities. As with state tax processing, processing a subset requires that you specify one or more states, one or more localities within each state, and the specific tax types to process.

Locality Selection

Field or Control |

Description |

|---|---|

All Localities |

Select to extract local tax deductions for all localities in all states. |

Specific Localities |

Select to extract tax deductions for specific localities within the specified state. When you select this option, the State/Localities group box appears. |

State/Localities

This group box appears only when you select the Specific Localities option. Select the localities and tax types for which you want to extract tax deductions.

Field or Control |

Description |

|---|---|

State |

The states for which you defined tax types are available in the prompt. |

Locality |

The localities for which you defined tax types are available in the prompt. |

Tax Type |

Select the tax type. The prompt table includes only those tax types that you entered for the state on the Local Tax Types/Classes table. |

(CAN) Use the Extract AP Canadian Taxes (extract accounts payable Canadian taxes) page (RC_XTAX_CAN) to select the tax deductions to send to Payables for payment and to start the Canadian Tax Extract Program Application Engine process (PYAP_XCTAX).

Navigation:

This example illustrates the fields and controls on the Extract AP Canadian Taxes page.

You can extract tax deductions for a single company or all tax deductions for all companies. Indicate the tax types to extract and enter a tax period end date and a period end date for each tax type specified.

Process Request Parameter(s)

Field or Control |

Description |

|---|---|

Company |

Select a company to extract taxes for a single company. To extract tax deductions for all companies, leave this field blank. |

Tax Type Information

In this group box, select the tax types for which you want to extract tax deductions and the associated dates. For example, if you select CTAX as the tax type and enter a tax period end date of January 1, 2000, the system extracts all tax deductions with a tax class or sales tax class belonging to the CTAX tax type and with a pay check date of January 1, 2000 or earlier.

Field or Control |

Description |

|---|---|

Tax Type |

Select the tax type. The prompt table includes only those tax types that you defined on the Tax Type Table page. You can add as many tax types as you like. |