Running and Reviewing Retro Pay Calculations

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_RTROPAYCALC |

Run the Retroactive Pay Calculations process. |

|

|

RETROPAY_EARNS |

Check the results of the Retroactive Pay Calculations process, and override the results if necessary. |

|

|

RETROPAY_SUMMARY |

Review a summary of the retro pay requests of an individual employee. |

|

|

RETROPAY_MESSAGES |

Review retro pay messages. |

This overview describes retro pay calculations.

The Calculation Process

When you run the Retroactive Pay Calculations process, it processes retro requests with a process flag of either Not Processed, Recalculate Request, or Extracted.

The Retroactive Pay Calculations process performs these steps for each retro request:

Extracts the original pay data for the affected pay periods.

If an error occurs during this step, the retro request process flag for the partially processed request is set to Extracted.

Performs the retro calculation.

During this step, the process:

Performs FLSA calculations, if necessary.

Calculates retro pay.

Updates the retro pay earnings table with the retro calculation results.

Note: The compensation Rate Code and Frequency values on the Job Data Compensation Page should either be the pay period or Annual. They must not be Hourly. Using an hourly rate code and frequency can adversely impact calculations for Retro Pay and FLSA.

Updates the retro request process flag for each calculated request to Calculated.

Pay Period Retro Amount

Here is the formula for calculating the retro pay amount for a specific earnings code for a pay period:

New Earnings Amount – Original Earnings Amount – Prior Retro Paid

In this formula:

The Original Earnings Amount is the amount that was paid on the employee's original pay check.

It is not adjusted for any previous retro payments.

The New Earnings Amount is the amount that the employee should have received if the retro changes had been in effect at the time of the original paycheck.

The system uses the changed employee data to determine the new earnings amount. It does not incorporate any pay rate overrides that were entered on the paysheet for the original paycheck.

To determine the Prior Retro Paid, the system looks for retro requests that resulted in retro pay for the same pay period (the pay period dates must match exactly).

Retro requests are assumed to have resulted in retro pay if the process flag is Loaded to Paysheets, Manually Loaded to Paysheets, or Confirmed Payment.

For example, in one pay period, an employee was paid 1,000 USD of regular pay (his original earnings amount). He received a retroactive pay increase resulting in recalculated pay of 1,100 USD (the new earnings amount), which produced 100 USD of retro pay.

The employee then received another increase for the same period, resulting in recalculated pay of 1,300 USD (the new earnings amount in a new retro request). The original earnings amount is still 1,000 USD, but this time there is also a prior retro paid amount of 100 USD. Therefore the retro pay for this second retro request is 1,300 USD – 1,000 USD – 100 USD, or 200 USD.

Note: If you enter an earnings override while reviewing the calculation results, the system substitutes the override amount for the new earnings amount. The system recalculates the current retro pay amount when you save the override.

Use the Calculate Retroactive Pay page (RUNCTL_RTROPAYCALC) to run the Retroactive Pay Calculations process.

Navigation:

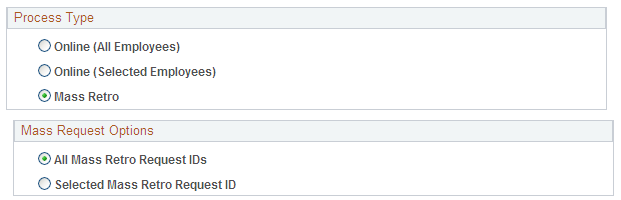

This example illustrates the fields and controls on the Calculate Retroactive Pay page.

Note: When you run the Retroactive Pay Calculations process, it processes retro requests with a process flag of either Not Processed, Recalculate Request, or Extracted. After it processes these requests, the Retroactive Pay Calculations process changes the retro request process flag for each calculated request to Calculated.

Process Type

Select one of these options to indicate how you will choose which retro requests to process.

Field or Control |

Description |

|---|---|

Online (All Employees) |

Select this option if you want to calculate retro pay for all requests that were created by trigger processing. This includes requests that were generated by online data changes and by changes that came from a component interface. |

Online (Selected Employees) |

Select this option if you want to calculate retro pay for retro requests that were generated online, but you want to narrow the process to include only selected employees. When you select this option, the Employees Selected for Processing grid appears so that you can enter the employees to process. |

Mass Retro |

Select this option if you want to calculate retro pay for requests that were created by the Retroactive Pay Mass Process. When you select this option, the Mass Request Options grid appears so that you can choose which mass retro request IDs to process. |

Online Request Options

This group box appears if the process type is either of the online options.

Field or Control |

Description |

|---|---|

Job |

Select this check box to process retro requests that were triggered by changes to the job record. |

Additional Pay (additional pay) |

Select this check box to process retro requests that were triggered by changes to the additional pay data record. Note: The sequence number for an earnings on the Create Additional Pay and Paysheets pages must match for the system to initiate a retro pay request for the additional pay earnings. The pay request must exist to be included and calculated in the Retroactive Pay Calculations process. |

Employees Selected for Processing

This group box appears if the process type is Online (Selected Employees).

Field or Control |

Description |

|---|---|

Employee ID |

Enter the employee IDs for one or more employees to process. |

Mass Request Options

Use this group box to process retro requests that created by the Retroactive Pay Mass Process.

This example illustrates the fields and controls on the The Mass Request Options group box appears when you choose to process mass retro requests.

Field or Control |

Description |

|---|---|

All Mass Retro Request IDs |

Select this option to process all retro requests that were created by the Retroactive Pay Mass Process. |

Selected Mass Retro Request ID |

Select this option to process the retro requests that were created for a particular mass retro request, and use the Mass Retro Request ID field to identify the mass retro request to process. |

Use the Retro Pay Calculation Results page (RETROPAY_EARNS) to check the results of the Retroactive Pay Calculations process, and override the results if necessary.

Navigation:

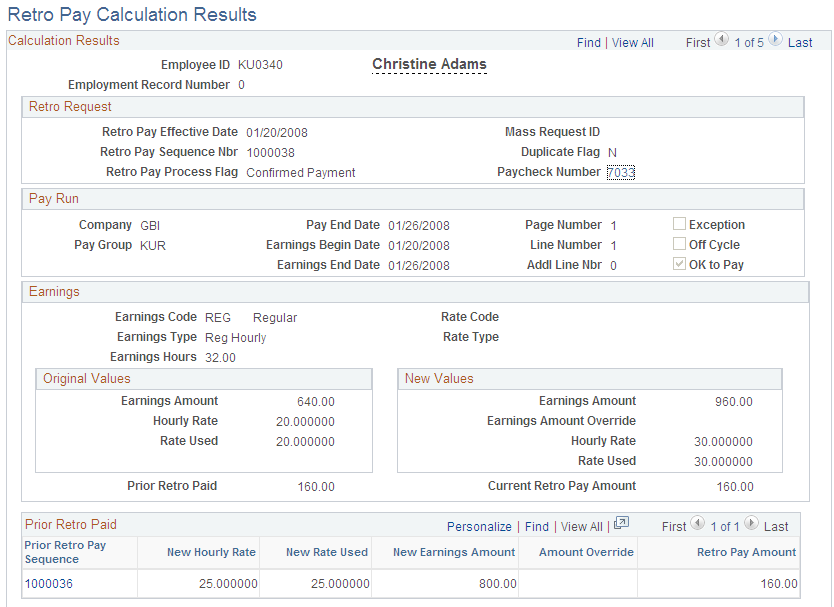

This example illustrates the fields and controls on the Retro Pay Calculation Results.

Note: This page displays retro requests that have a process flag of Calculated, Loaded to Paysheets, Confirmed Payments, Action Required, Paycheck Reversed, and Manually Loaded to Paysheet.

Note: Except for the OK to Pay and Earnings Amount Override fields, which are editable in certain circumstances, all fields on this page are display-only.

Calculation Results

This page displays the results for a single retro request. There are separate rows of data for each earnings code in each pay period.

For example, an employee gets a retroactive pay increase that affects two pay periods. During the first of those pay periods, the employee had only regular earnings. During the other pay period, the employee had both regular and holiday earnings. There will be three rows of data on the Retro Pay Calculation Results page: one row for the first pay period, and two rows for the second pay period.

Retro Request

This group box displays information that identifies and describes the retro request. All rows of data have the same retro request information.

Field or Control |

Description |

|---|---|

Duplicate Flag |

Displays N (no) or Y (yes) to indicate whether this is a duplicate retro request. Normally, there can only be one open retro request for an employee and job number. However, duplicate requests can occur when changes made online are also processed in batch. Therefore, when the system creates a new online retro request, it checks to see if there is an open mass retro request. If there is, the system selects the Duplicate Flag for both the mass retro request and the online retro request. |

Paycheck Number or Paycheque Number |

After the retro pay is paid (the retro request process flag is Confirmed Payment or Paycheck Reversed), this field displays the check number of the check that includes the retro pay. The check number is a link that you select to access the Review Paycheck component, where you can review complete payment details. In the Review Paycheck component, retro earnings appear in the Other Earnings grid. The detail information for the retro earnings codes includes the retro pay sequence number; the sequence number is a link back to the Retro Pay Calculation Results page. |

Pay Run

This group box displays information about the pay run that is affected by the retro request.

Field or Control |

Description |

|---|---|

Exception |

The system selects this check box if the retro pay calculation is based on a mid-pay period change. This informs you that the system prorates the retroactive pay amount. Run the Retro Pay Summary report (PAY302RT) to verify the proration calculation. Exception processing can also generate Retro Pay messages that you should review and validate prior to loading the retro calculations to paysheets. |

OK to Pay |

The system initially selects this check box for active employees and deselects it for terminated employees. The system also initially deselects this check box if the Duplicate Flag is Y (yes). You can change this setting only if process flag is Calculated. |

Earnings

This group box displays information about an earnings code for which the employee received retro pay during the pay period.

Original Values and New Values

These group boxes show pay-period specific information about a particular retro-eligible earnings code.

Field or Control |

Description |

|---|---|

Earnings Amount |

The original value is the amount that was paid on the employee's original pay check. It is not adjusted for any previous retro payments. The new value is the amount that the employee would have received if the retro changes had been in effect at the time of the original paycheck. |

Earnings Amount Override |

To override the calculation, enter the desired new earnings amount. The system uses the manually entered override amount rather than the (calculated) new earnings amount to determine the amount of retro pay. The system recalculates the Current Retro Pay amount when you save the page. The calculated new earnings amount is not updated. You can only enter an override while the retro request is open. |

Prior Retro Paid |

Displays the sum of all prior retro payments for the employee record number, pay period, and earnings code. If this is non-zero, the Prior Retro Paid grid appears so that you can review the supporting details. |

Current Retro Pay Amount |

Displays the amount of retro earnings to be paid for this employee record number, pay period, and earnings code. The system calculates the amount as follows: New Earnings Amount – Original Earnings Amount – Prior Retro Paid If you entered an earnings override, the system substitutes the override amount for the new earnings amount: Earnings Amount Override – Original Earnings Amount – Prior Retro Paid |

Prior Retro Paid

If the Prior Retro Paid field shows a non-zero amount, this group box appears.

Field or Control |

Description |

|---|---|

Prior Retro Pay Sequence |

Displays the ID of the retro request for the previously paid retro earnings. Select the link to view the calculation details for that retro request. |

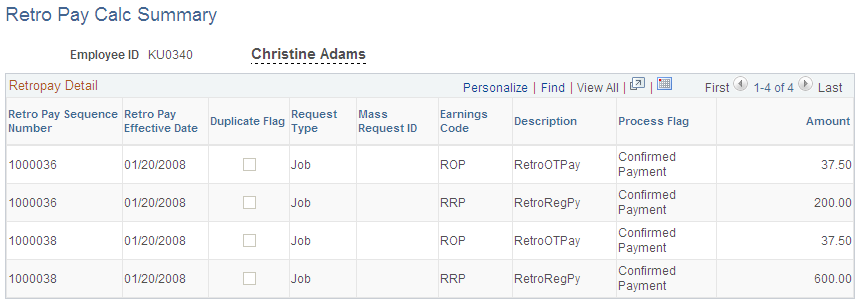

Use the Retro Pay Calc Summary page (RETROPAY_SUMMARY) to review a summary of the retro pay requests of an individual employee.

Navigation:

This example illustrates the fields and controls on the Retro Pay Calc Summary page.

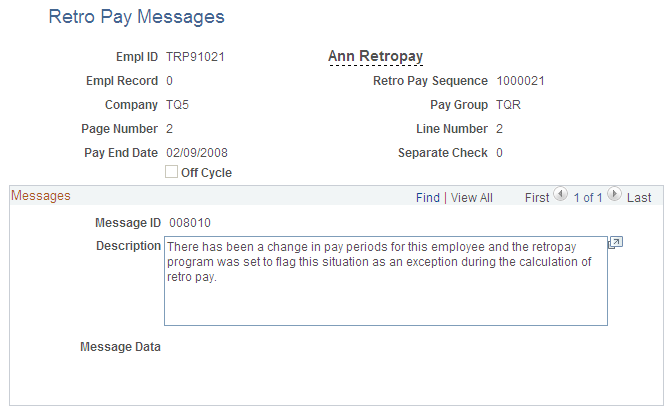

Use the Retro Pay Messages page (RETROPAY_MESSAGES) to review retro pay messages.

Navigation:

This example illustrates the fields and controls on the Retro Pay Messages page.

The system deletes calculation messages when:

The retro request is cancelled.

To cancel a retro request after it has been calculated, use the Retroactive Pay Undo (PSPRPUND) COBOL SQL process.

The results of the retro calculation are loaded to paysheets.

Warning messages do not prevent the paysheet load.

When there are errors that do prevent the system from loading retro to paysheets, the retro request pay flag is set to Action Required to indicate that you must review the messages for more information about why the paysheet load failed.

Note: Although the Retroactive Pay Calculations process is the source of most messages that you see on this page, certain other processes also insert messages occasionally. For example, the Payroll Unsheet process creates a message if it processes a retro request that did not start out with the process flag Loaded to Paysheets.