Viewing Depreciation-Related Information

You can view depreciation-related information for both regular assets and parent-child assets online.

This topic discusses how to view asset and depreciation-related information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEPR_ALL_MAIN |

View a summary of basic asset and depreciation information. |

|

|

DEPR_ALL_YEAR |

For regular assets, calculate an asset's net book value and view its depreciation information for the year. For parent-child assets, calculate net book value. Depreciation information by year does not appear. |

|

|

DEPR_ALL_PERIOD |

View depreciation for the periods that you specified when you entered the asset. |

|

|

CHILD_ASSETS |

Specify child assets to include in a parent asset's net book value calculation. |

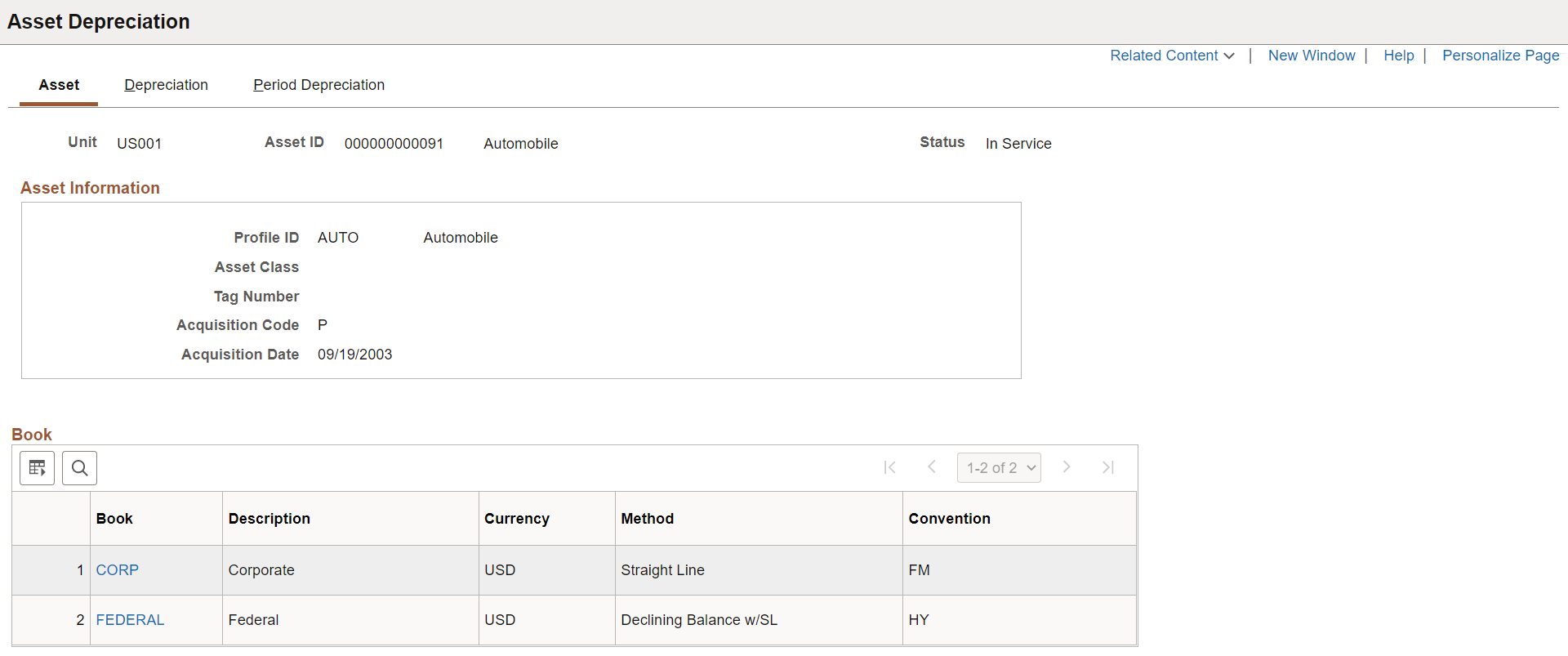

Use the Asset Depreciation - Asset page (DEPR_ALL_MAIN) to view a summary of basic asset and depreciation information.

Navigation:

This example illustrates the fields and controls on the Asset Depreciation - Asset page. You can find definitions for the fields and controls later on this page.

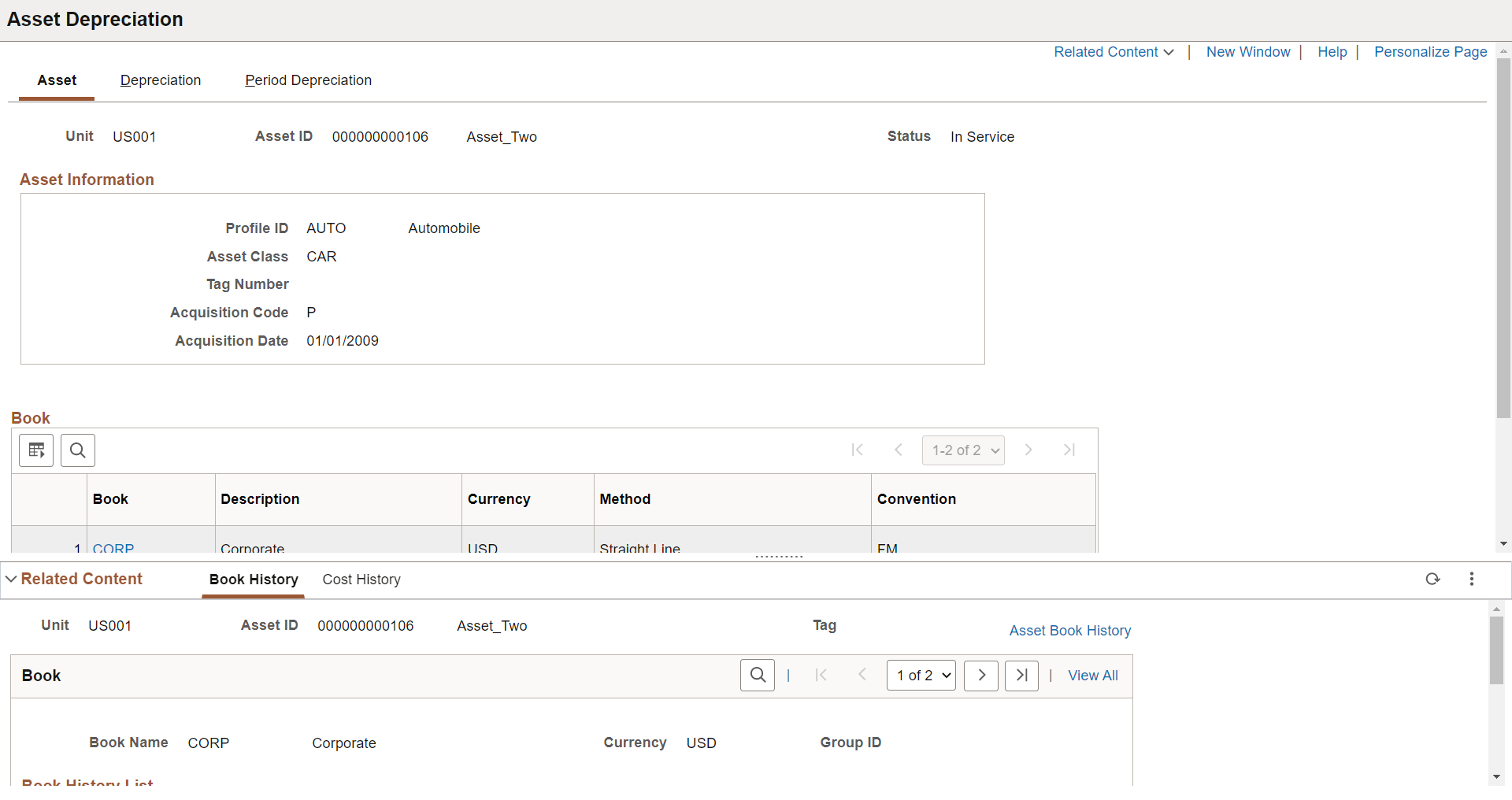

This example illustrates the fields and controls on the Asset Depreciation - Asset page.with Book History related content.

|

Field or Control |

Description |

|---|---|

|

Related Content |

Select the Related Content drop-down to view book or cost history information related to the asset. Related content displays below the transaction page in split-screen format. For information about cost and book history, see: You can access related content from all the pages within the Review Depreciation component. To manage related content, see Working with Related Content in Asset Management. |

Parent assets that are created on the Parent Asset page (parent-only assets) do not have cost or basic information. They cannot be viewed in the Parent Child Basic Information component. Also, you cannot view them or perform transactions on them in the Asset Cost/Adjust Transfers component, the Asset Retirements component, or the Parent-Child NBV component.

If you want to use a parent asset as an umbrella asset for reporting purposes only and access these components to manipulate child assets in mass, create a zero-cost parent asset as opposed to a parent only asset. Also, to transact against parent and child assets at once, parent and child must use the same asset profile.

Use the Asset Depreciation - Depreciation page (DEPR_ALL_YEAR) to for regular assets, calculate an asset's net book value and view its depreciation information for the year.

For parent-child assets, calculate net book value. Depreciation information by year does not appear.

Navigation:

This example illustrates the fields and controls on the Asset Depreciation - Depreciation page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Asset Depreciation - Depreciation page. You can find definitions for the fields and controls later on this page

Field or Control |

Description |

|---|---|

Depr Status |

Displays the depreciation status of the asset. For a finance lease, during reclassification the underlying asset depreciation will be adjusted to reflect the change in the depreciation status. Also for lease reclassification from operating to finance and asset recategorization from non-depreciable to depreciable, depreciation is applicable for the leased asset. |

Net Book Value |

To calculate the net book value of the asset, enter values in the As Of Fiscal Year field and the Period field, and click the Calculate NBV (calculate net book value) button. The system displays the cost, salvage value, accumulated depreciation, and net book value for the selected asset, fiscal year, and accounting period. |

Accum Amort |

Displays the accumulated amortization amount. This value is displayed only for asset that has been reclassified. The amortization amount is considered for the calculation of net book value. |

Operating Lease Asset Amortization |

Click to open the Operating Lease Asset Amortization page. This page displays the operating asset’s accumulated amortization details. The amortization schedule can be downloaded to the local system for further review and analysis. |

Yearly Depreciation |

Displays depreciation amounts by year through the last year of the asset's life. |

Note: Yearly depreciation amounts are not shown for parent-child assets.

Use the Asset Depreciation - Period Depreciation page (DEPR_ALL_PERIOD) to view depreciation for the periods that you specified when you entered the asset.

Navigation:

This example illustrates the fields and controls on the Asset Depreciation - Period Depreciation page. You can find definitions for the fields and controls later on this page.

Get Period Depreciation

Field or Control |

Description |

|---|---|

Expense |

Select to view depreciation expense for the year that is specified. |

Accum (accumulated) |

Select to view accumulated depreciation for the year that is specified. |

Note: If you do not select Expense, but you do select Accum, only the amounts that affected accumulated depreciation appear. The system does not show the expense for that year. For example, when an asset is added with accumulated depreciation, no corresponding expense amount exists. If you do not select Accum, but you do select Expense, the system displays the amounts that affected the expense account, but not the accumulated depreciation for that year.

Field or Control |

Description |

|---|---|

Year |

Select a year to display its period depreciation entries. |

Get Period Depr (get period depreciation) |

Click to have the system calculate depreciation that was allocated to each period for the year specified and display the information. You can change the period depreciation amounts. Note that when you modify the period depreciation, you change the depreciation method to manual depreciation. |

Period Depreciation

Click the Depr. Accum Adjustment (depreciation accumulated adjustment) link to make adjustments to accumulated depreciation.

Note that if you perform two transfers on the same asset in the same accounting period (on the same set of ChartFields), the Asset Depreciation - Period Depreciation page displays only a net result of both transfers. For example, suppose that an asset with an actual month convention is added to department 12000 on August 31, 2006, with a cost of 10,000.00 JPY and a life of five years. On September 30, 2006, the asset is transferred to department 14000 using the same convention. The asset is then transferred again on the same day to department 21100. The Asset Depreciation - Period Depreciation page displays the following entries for the transfers:

12000 2006 8 DPR 166.6612000 2006 9 TFR -166.6621100 2006 9 TFR +166.66No entry exists for the transfer in and out of department 14000 on the same day, as this is a net 0. Note, however, that the depreciation table has two additional rows for both transfer out and transfer in.

Use the Child Assets page (CHILD_ASSETS) to specify child assets to include in a parent asset's net book value calculation.

Navigation:

Click the Select All button to include all child assets with the parent in the net book value calculation.

To include particular child assets, select the Selected check box for a row.

Field or Control |

Description |

|---|---|

Tag Number |

Displays the tag that is assigned to the child asset. Parent and child assets can share the same tag number. |

Description |

Displays the child asset description. |

Child Asset ID |

Displays the asset ID that is assigned to the child asset. |

Asset Status |

Displays the asset status of the child asset. |

Capitalized Asset |

Indicates whether the child asset is capitalized or non capitalized. |

Cost |

Displays the cost of the child asset. |

Currency |

Displays the currency in which child asset costs are stored. |

Acq Date (acquisition date) |

Displays the date that the asset was acquired. |

In Service Date |

Displays the In Service date of the child asset. |

Asset Information |

Click to open a new Asset page in the Asset Depreciation component. The page is populated with the child asset. |

The Include Parent Asset check box is selected by default. Deselecting it enables you to calculate net book value at once for all or selected child assets while excluding the parent asset from the calculation.