Setting Up Bank Transfer Charges

To set up your bank transfer charges, use the following components:

Bank Transfer Charge Code (BCH_CHARGE_CD).

Bank Transfer Charge (BCH_BANK_CHRG).

External Accounts (BANK_EXTERNAL).

Supplier Information (VNDR_ID).

This section provides an overview of bank transfer charge setup and discusses how to enable bank transfer charge processing at the bank level and define bank charge options at the supplier level.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BCH_CHARGE_CD |

Define a set of bank charge amounts to be used in the Bank Transfer Charge table. The bank charge amounts are set up according to the bank account of the addressee and the range of payment amounts. |

|

|

BCH_BANK_CHRG |

Define the bank charge code according to the interbank and intrabank remittance. |

|

|

BANK_PNL2 |

Set up external accounts. |

|

|

VNDR_PAY_OPT_SEC |

Define the party to whom the bank transfer charge is charged. |

To set up bank transfer charge processing:

Create bank transfer charge codes (which are used to create the Bank Transfer Charge table) on the Bank Transfer Charge Code page.

Define charge codes according to the interbank and intrabank remittance on the Bank Transfer Charge page.

Define the processing options at the external bank account level.

Define the processing options at the supplier location level.

Use the External Accounts page (BANK_PNL2) to set up external accounts.

Navigation:

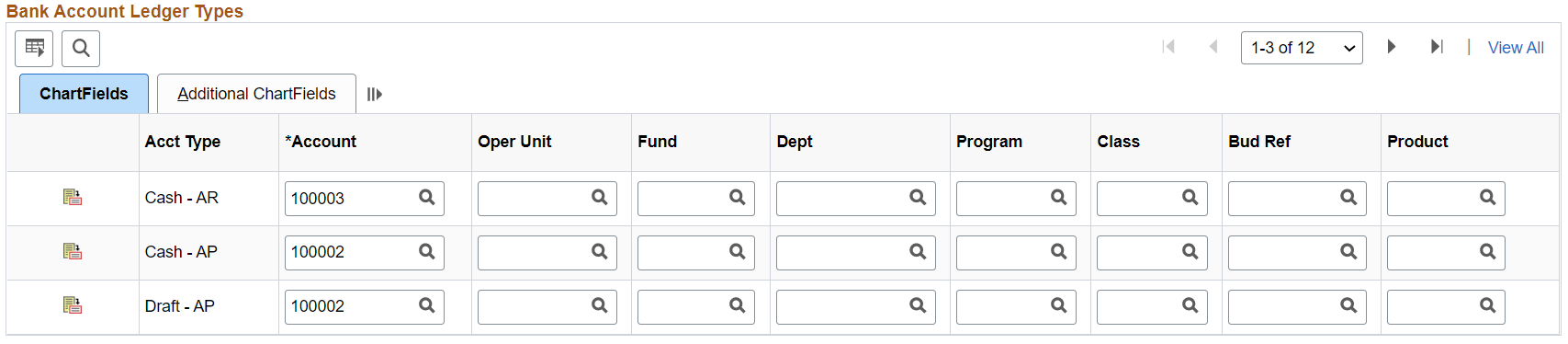

This example illustrates the fields and controls on the External Accounts (1 of 2) page.

This example illustrates the fields and controls on the External Accounts (2 of 2) page.

To enable bank transfer charge processing:

Select the TRF Charge check box in the Account Use group box.

The system inserts a new row in the Chartfields tab.

Bnk Charge (bank charge) appears by default as the account type in the Acct Type (account type) field in the Chartfields tab.

Enter the account code for suspense accounting for the bank transfer charge in the Account field in the Chartfields tab.

During payment posting, the system uses this code to hold the bank transfer charge deducted from the supplier payment.

Use the Supplier Information - Location: Payables Options page (VNDR_PAY_OPT_SEC) to define the party to whom the bank transfer charge is charged.

Navigation:

Click the Payables link on the Supplier Information - Location page and expand the Electronic File Options section.

Expand the Electronic File Options collapsible section.

Use this page to define the party to whom the bank transfer is charged. Bank transfer charges are based on either the Classified Charge Amount table or a user-specified amount.

Field or Control |

Description |

|---|---|

Transfer Cost Code |

Select from the following options: Payee: If you select this option, one of two things happens depending on the option you select in the Bank Charge source field. Payer: If you select this option, this function is not activated regardless of the Bank Charge source. The bank transfer charge is not considered during payment processing, and no accounting entry for the bank transfer charge is generated. |

Bank Charge source |

Select from the following options: Table: If you select this field in conjunction with the Payee option in the Transfer Cost Code field, the system looks for the amount of charge defined in the table based on the payment condition and deducts that amount from the payment. The system also creates an accounting entry for this charge at the time of payment posting. User: If you select this field in conjunction with the Payee value in the Transfer Cost Code field, the system deducts the amount that you entered in the Amount field. |

Warning! When the bank charge source is User, the bank transfer charge setting is not mandatory because the payment process does not access the Bank Transfer Charge table. However, the system uses the table to output the difference between the assumable charge, which is calculated from the table, and the actual deducted amount of the payment. For reporting purposes, the Bank Transfer Charge table must exist even though the bank charge source is User. Otherwise, the assumable charge amount appears as 0.

Note: Within the pay cycle, the system does not select scheduled payment when the amount of the charge exceeds the amount of the remittance.