Deduction Processing

Customers may take deductions for any of these reasons:

A product discount resulting from damaged goods or a late delivery.

A reason of their choosing.

For example, they are penalizing you because you sent a hard copy bill when they requested an electronic bill.

PeopleSoft Receivables provides several tools to help you track all deductions, collect unauthorized deductions, and offset deductions taken for legitimate reasons.

This topic discusses the process flow.

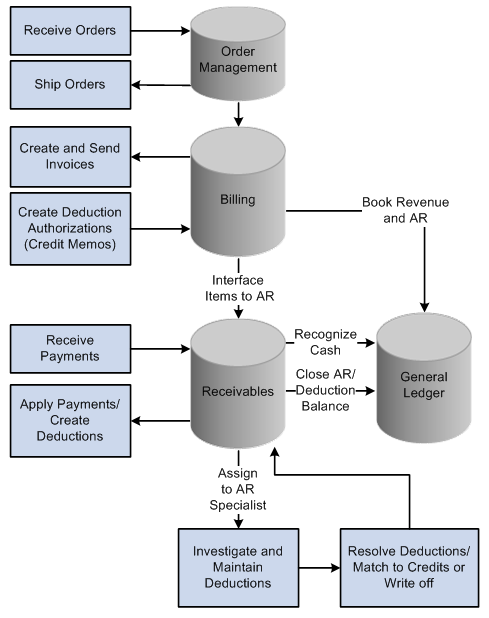

PeopleSoft Receivables integrates with PeopleSoft Order Management, PeopleSoft Billing, and PeopleSoft Contracts to facilitate the deduction management process. This section describes the process flow for deduction processing in these applications:

Create sales orders in PeopleSoft Order Management.

You can view information about sales orders associated with deductions directly from PeopleSoft Receivables.

Create invoices in PeopleSoft Billing and use the Load AR Pending Items Application Engine process (BILDAR01) to interface the items to PeopleSoft Receivables.

You can view information about invoices associated with a deduction directly from PeopleSoft Receivables.

Note: If you use a third-party billing application, you can interface items to PeopleSoft Receivables, but you cannot view the original invoice information for an invoice associated with a deduction.

Create deductions in PeopleSoft Receivables in three ways.

When you create the deduction, the system automatically assigns an AR specialist to manage the deduction.

When you apply the payment to the item on the payment worksheet, you can create a deduction for the difference between the item and the payment.

When you run the Payment Predictor Application Engine process (ARPREDCT), the system automatically creates a deduction if you use a payment predictor method with instructions to create deductions for underpayments.

Note: If you create a deduction after a payment is applied and posted, you must either unpost the payment group or apply a credit item to the deduction to reverse the deduction.

You can manually mark an item as a deduction and assign a deduction reason on the View/Update Item Details - Detail 1 page.

Important! If you mark an item as a deduction manually, the system does not generate any accounting entries to indicate that the item is a deduction.

Run the Condition Monitor Application Engine process (AR_CNDMON) to put deductions on the action list for the assigned AR specialists and notify the specialists.

The AR specialist investigates the reason for the deduction and determines whether it is for a legitimate deduction due to error in your organization or that it needs to be collected.

During the investigation process, the AR specialist may perform these tasks to help determine how to handle the deduction:

View or change details for the deduction, using the View/Update Item Details component (ITEM_MAINTAIN).

Drill down to see details about contracts, invoices, and sales orders related to the item.

Assign an action and action owner to the deduction item for further research, such as asking a broker to obtain a copy of the proof of delivery slip.

Create a conversation entry and attach documents, if needed, for a broker or sales person, or enter comments about a conversation with the customer concerning the deduction.

Split the deduction into multiple deductions because the deduction amount is actually for two types of deductions.

If you plan to match the deduction with an offset item, either enter a credit memo in PeopleSoft Billing and run the Load AR Pending items process to send the credit memo to PeopleSoft Receivables, or enter the credit memo directly in PeopleSoft Receivables.

Use the maintenance worksheet or the Automatic Maintenance Application Engine process (AR_AUTOMNT) to resolve the deduction by either matching it with a credit item or writing it off.

Run the Receivables Update Application Engine process (ARUPDATE) to update the customer balances, update the item activity, and create accounting entries.

This diagram shows the deduction process flow. Customer orders are received and shipped in PeopleSoft Order Management, and invoices are created and sent and deductions authorizations (credit memos) are created in PeopleSoft Billing. PeopleSoft Billing books invoice revenue and accounts receivable in General Ledger and updates the items in PeopleSoft Receivables, where payments are received and the cash is recognized in PeopleSoft General Ledger. The payments are applied to the items in PeopleSoft Receivables, deductions are created, the transaction is closed and updated in the PeopleSoft General Ledger along with the deduction balance. An AR specialist is then assigned to investigate and maintain the deductions, where they are resolved by either matching them to credits or writing them off.

Deduction process flow from receiving customer orders in PeopleSoft Order Management to closing the Receivables transactions and resolving the deductions