Setting Up Entry Types and Reasons

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ENTRY_TYPE_TABLE1 |

Create and define entry types. |

|

|

ENTRY_TYPE_TABLE2 |

Specify the appropriate entry reasons for an entry type. |

To define entry types and reasons, use the Entry Type component (ENTRY_TYPE_TABLE1).

Use this component to:

Define entry types.

Define entry reasons.

Thinking through and defining a comprehensive set of entry types is second in importance only to defining business units and TableSets. An entry type categorizes your pending items and the system uses them to create or update items. The Receivable Update Application Engine process (ARUPDATE) uses pending items along with associated entry types and reasons to create or update items and to maintain customer balances.

During processing, you sometimes enter pending items directly—for example, when you enter an invoice, a debit memo, or a credit memo. Sometimes the system creates pending items for you based on commands that you provide. For example, it creates deductions and on-account payments in the background as you use the payment worksheet or the Payment Predictor process.

To use all of the PeopleSoft Receivables processing and payment features, at a minimum you must accommodate the following entry types. You can assign a single entry type to several functions and you can name them whatever you want.

Adjust underpayment.

Adjustment overpayment.

Credit memo.

Debit memo.

Deduction.

Earned discount.

Overdue charge.

Invoice.

Maintenance credit.

Maintenance debit.

Offset customer's debits and credits.

On-account.

Payment.

Prepayment.

Refund credit.

Refund remaining credit.

Unapplied cash.

Unearned discount.

Write-off.

Write off a credit.

Write off overpayment.

Write off remaining credit.

Write off remaining debit.

Write off underpayment.

This table lists the entry types that you must create if you process direct debits or drafts:

|

Direct debits |

Drafts |

|---|---|

|

Direct debit remitted to bank-cash clearing |

Draft remitted to bank |

|

Direct debit remitted to bank-cash |

Draft remitted with discount |

|

Direct debit canceled-cash |

Collect cash on discount draft |

|

Direct debit cash clearing |

Collect cash on draft |

|

Not applicable |

Reverse discount liability |

|

Not applicable |

Dishonored draft |

|

Not applicable |

Cancel remitted draft |

|

Not applicable |

Void draft |

|

Not applicable |

Bank fees (for discounted drafts) |

Note: You must create either an item entry type or automatic entry type for each entry type before you can use them.

If you use the vendor rebate claim functionality in PeopleSoft Purchasing or the claim back functionality in PeopleSoft Order Management, you might want to create unique entry types for the interface items to identify them on the payment worksheet or on inquiries and reports.

Entry Types and Reasons for Partial Payments

PeopleSoft Receivables delivers entry types and reasons in the sample database. If you use the Payment Predictor process to apply your payments, the #DTL_TLR algorithm group uses these entry types and reasons to determine how to create accounting entries for underpayment, overpayment, and discount conditions. You must use these entry types and reasons when you create your automatic entry types if you want to process partial payments and discounts correctly.

Important! If you cannot use these entry types and reasons due to your business practices, you need to change the SQL for the #DTL_TLR algorithm group. You should, however, avoid making these changes.

PeopleSoft delivers these entry types:

Term |

Definition |

|---|---|

PR |

Prepay an Item. |

OA |

On Account. |

AU |

Adjust Remaining Underpayment. |

AO |

Adjust Remaining Overpayment. |

DED |

Create a Deduction. |

WO |

Write-Off Item. |

WAO |

Write Off an Overpayment. |

WAU |

Write Off an Underpayment. |

PeopleSoft delivers these entry reasons:

Term |

Definition |

|---|---|

IOIT |

Invoice Overage Within Tolerance. |

IUIT |

Invoice Underage Within Tolerance. |

DOIT |

Discount Overage Within Tolerance. |

DUIT |

Discount Underage Within Tolerance. |

IOET |

Invoice Overage Exceeds Tolerance. |

IUET |

Invoice Underage Exceeds Tolerance. |

DOET |

Discount Overage Exceeds Tolerance. |

DUET |

Discount Underage Exceeds Tolerance. |

When you set up automatic entry types for these system functions, you must use these entry type and reason combinations:

|

System Function |

Entry Type and Reason |

|---|---|

|

WS-04 |

PR and IOET PR and DUET |

|

WS-05 |

OA and IOET OA and DUET |

|

WS-06 |

AO and IOET AO and IOIT AO and DUIT AO and DUET |

|

WS-07 |

AU and IUIT AU and DOIT |

|

WS-08 |

DED and IUET DED and DOET |

|

WS-09 |

WO and IOIT WO and IUIT WO and DOIT WO and DUIT |

|

WS-10 |

WAO and IOIT WAU and DUIT |

|

WS-11 |

WAU and IUIT WAU and DOIT |

The #DTL_TLR algorithm group uses a default system function for overpayments, underpayments, and unearned discounts. However, you can override the default system function for each business unit on the Predictor Detail Options page by assigning a different entry type and reason. The entry type and reason that you assign must be consistent with the intended usage of the system function. For example, adjust overpayment should not be used with an underpayment entry type and reason.

Use different entry reasons to set up different accounting entry templates for different conditions.

Some of the entry types that create entries in the background accommodate the use of an entry reason; others do not. Use entry reasons for:

Invoice or debit memos.

Credit memos.

Overdue charges.

Prepayments.

On-account payments.

Deductions.

Write-offs (debits and credits, remaining debits and credits, underpayments, and overpayments).

Adjustments for underpayments and overpayments.

Remaining credit refunds.

Credit refunds.

Creating new debits.

Creating new credits.

Offsetting items.

Draft bank fees.

Note: You specify whether entry reasons are required on the Item Entry Type - Selection page and the Automatic Entry Type - Selection page. If an entry reason is required for a credit write-off (MT-06) or a debit write-off (MT-07), you must choose one entry reason to be the default reason code.

You can also use entry reasons for reporting or inquiry purposes to further identify items.

Entry Reasons for Vendor Rebate and Claimback Processing

You must set up entry reasons for any entry types that you use to pay or offset items for vendor rebate and claimback processing.

For the entry types that you associate with the Pay an Item (WS-01 and DM-01), and Offset an Item (MT-01) system functions, you must create a minimum of two entry reasons:

An entry reason that is used to pay or offset the base amount of the item.

An entry reason that is used to pay or offset the VAT amount for an item.

You can create as many entry reasons as you want, but you must create at least one for the base amount and one for the VAT amount for each entry type that you use to pay or offset items for vendor rebate and claimback processing. When you create automatic entry types for the WS-01, DM-01, and MT–01 system functions, you must enter all of these entry reasons on the Automatic Entry Type - Selection page. When you apply a payment to a vendor rebate claim or claimback item on the payment worksheet, you create two entries in the payment worksheet for each item if the business unit for the item requires VAT. One entry is for the base amount of the item and one entry is for the VAT amount. You assign the appropriate entry reason to each line. When you apply a draft to a claimback or vendor rebate claim on the draft worksheet or offset a claimback or vendor rebate claim on the maintenance worksheet, you follow the same procedure.

Note: If you have no business units that require VAT, you do not need to create an entry reason to record the VAT amount for an item and you do not need to create two entries on the worksheets.

Note: If the receivables business unit does not require VAT, you create only one entry for the base amount. You must enter the entry reasons to use for the business unit on the AR Integration page. The system enables you to select only the entry reasons associated with the item's business unit on the worksheets.

When you run the AR Rebate Notification Application Engine process (AR_REBATE) to update the claim management workbench, the process sends the base amount and the VAT amount for each item paid or offset. When you run the Claim Settlement process for AP Application Engine process (PO_CLMSETTLE_AP) on the claim management workbench, the process uses this information to generates the base and VAT distribution lines when it creates adjustment vouchers or claimback vouchers.

See Running the AR Rebate Notification Process.

See Understanding PeopleSoft Claimbacks.

See Understanding Vendor Rebates.

See Defining Account Receivables Integration Options for Vendor Rebates.

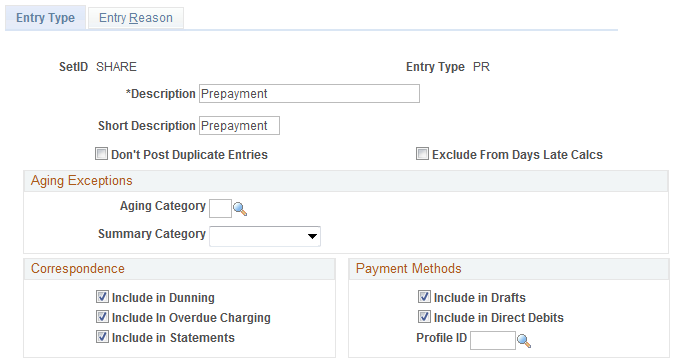

Use the Entry Type page (ENTRY_TYPE_TABLE1) to create and define entry types.

Navigation:

This example illustrates the fields and controls on the Entry Type page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Don't Post Duplicate Entries |

This check box handles:

Select when you post a subsequent event—such as a debit memo or a credit memo—that has the same business unit, customer ID, item ID, and item line as the invoice before you post the invoice. This occurs if:

Normally, the system creates an Item record for each new item with its entry type. Subsequent entries create item activity lines but do not alter the entry type on the Item table (PS_ITEM). If the original item is a debit or credit memo instead of an invoice, then the debit or credit memo entry type will be on the Item record. What you really want is the invoice entry type. You need to have the appropriate entry type on the Item record, because entry types determine aging redirection, correspondence inclusion, and weighted average days late calculations. If a prepayment or credit memo posts first and the invoice posts second, you need to update the Item record with the entry type and date of the invoice. Selecting the Don't Post Duplicate Entries check box for an entry type means that:

Note: Be sure that you select this check box only for invoice type or dominant transaction types and that only dominant entry types can be posted against an item. |

Exclude From Days Late Calcs (exclude from days late calculations) |

Select to exclude items with this entry type from history calculations for average days late and weighted average days late. |

Aging Category |

Enter an aging category in which to place items, rather than aging them normally. Note: If you define a rule for aging deductions, disputes, or collections in an aging ID other than aging normally, that rule takes precedence over a category that you select here. |

Summary Category |

Select a summary category to place items in a different summary category from the one associated with the aging category. |

Include in Dunning, Include in Overdue Charging, and Include in Statements |

Select to include items with the entry type in dunning letters, on overdue charge invoices, and on statements. In the delivered system, all entry types are included; deselect the check boxes to exclude those that you do not want to appear in correspondence. This applies only to the entry type on the item itself, not to item activities. |

Include in Drafts, Include in Direct Debits, and Profile ID |

Select to include items of this entry type in drafts and direct debits. If you select Include Direct Debits, enter a profile ID to use a specific direct debit profile for all items using this entry type. Otherwise, leave Profile ID blank to use the profile ID assigned to the customer. If you enter a profile ID, you must select the Use Entry Type field on the Direct Debit Profile page. |

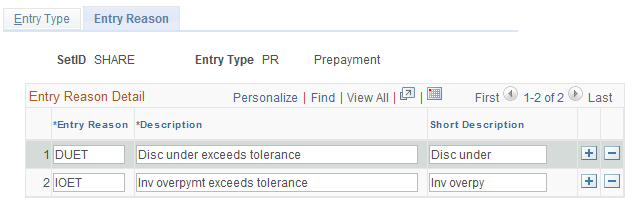

Use the Entry Reason page (ENTRY_TYPE_TABLE2) to specify the appropriate entry reasons for an entry type.

Navigation:

This example illustrates the fields and controls on the Entry Reason page.

For each entry type that you define, you can set up as many valid entry reasons as needed.