Setting Up the PeopleSoft Transaction Billing Processor

This section provides an overview of setting up the PeopleSoft Transaction Billing Processor and the accounting rules and discusses how to set up the PeopleSoft Transaction Billing Processor.

This section discusses how to set up installed products, define legal entities, define PeopleSoft Contracts business units, (Optional) Select combination editing, set up schedules, define proration options, define contracts GL options, define contract statuses, set up accounting rules for PeopleSoft CRM, set up accounting rules for PeopleSoft Lease Administration, create billing plan detail templates (optional for on-demand transactions), and (Optional for on-demand transactions) assign billing plan overrides.

Other optional setup includes how to:

Set up third-party tax.

Set up PeopleSoft simple tax.

Define the bill by identifier.

Set up VAT.

See Understanding VAT.

See Defining Customer Billing Contacts.

See Understanding PeopleSoft Lease Administration Business Units.

PeopleSoft Transaction Billing Processor Setup

The PeopleSoft Transaction Billing Processor shares architecture with PeopleSoft Contracts. Much of the setup for the PeopleSoft Transaction Billing Processor is the same as the setup for PeopleSoft Contracts. In addition, you may choose to set up optional global features such as VAT and features in PeopleSoft Billing.

Accounting Rules and Transaction Identifiers

You match accounting rules to transactions with identifier fields. The rate-based revenue accounting comes from the accounting distribution set up on the Accounting Rules for CRM and Accounting Rules for Lease Administration pages. If you do not define accounting rules for the identifier fields for the transactions, then the Rate-based Revenue process (Accounting Rules Engine) does not generate any accounting rows. You can establish the accounting rules across all identifiers, or define them specifically for one contract with different accounting rules for each identifier combination.

For all types of transactions, you must define the accounting rules:

Field or Control |

Description |

|---|---|

Recurring |

A DRV (contract liability) accounting row and a REV (revenue) accounting row must be entered. PeopleSoft Billing manages revenue for these transactions and both the DRV and REV accounting rows are sent to PeopleSoft Billing. |

One-time |

REV (revenue) accounting rows and the Contract Asset (Contract Asset) row can be defined. Since the PeopleSoft Transaction Billing Processor manages revenue with an as-incurred revenue method and books the revenue separately from the billing, you can enter multiple sets of debit and credit pairs as long as the Contract Asset is limited to one side of the entry. The system sends only the Contract Asset row to PeopleSoft Billing. |

On-demand (CRM) |

You must enter both sides of the entry a REV (revenue) accounting row and a Contract Asset) row. Since PeopleSoft Billing manages revenue for on-demand transactions only one REV row is sent to PeopleSoft Billing. |

On-demand (Lease Administration) |

You must define three sets of debit and credit pairs in the accounting rules for PeopleSoft Lease Administration:

|

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTALLATION_FS |

Select the Transaction Billing Processor check box to indicate that this product is installed on your system. |

|

|

CA_LEGAL_PNL |

Define legal entities to associate with Contract business units. You use legal entities on the Contract - General page to identify the legal entity within your company that owns (that signed) the contract. This value, once associated with a PeopleSoft Contracts business unit, automatically populates the appropriate field on the contract header. |

|

|

BUS_UNIT_TBL_CA |

Create a new PeopleSoft Contracts business unit definition or manage an existing business unit. |

|

|

BUS_UNIT_OPT_CA2 |

Select the Edit Combinations check box if you want the Accounting Rules process (PSA_ACCTGGL) to run combination editing. This step is optional. For recurring transactions, define the parameters in the Proration Options group box so that the PeopleSoft Transaction Billing Processor can process the PeopleSoft CRM recurring transactions. For on-demand transactions, select a bill plan detail template ID to use to override the fields on the billing plan (optional). If you select a template on this page, when the billing plan is created, the billing plan detail template overrides the corresponding fields on the billing plan. |

|

|

SCHEDULE |

Create schedules that automate and control the generation of recurring journal entries. |

|

|

CA_BUGL_OPT |

Select the TBP Revenue Doc. Type (TBP revenue document sequencing type) for the PeopleSoft General Ledger business unit. You must enter a document type if you are using the Document Sequencing feature for the PeopleSoft General Ledger unit. Set up the document sequencing type for one-time transactions only. |

|

|

CA_STATUS_PNL |

Define contract statuses and map them to processing statuses. The system uses the contract status to control all processing that can occur against a contract. |

|

|

CA_ACCT_RULES |

Define the accounting rules to apply to PeopleSoft CRM transactions. |

|

|

CA_ACCT_RULES |

Define the accounting rules to apply to PeopleSoft Lease Administration transactions. |

|

|

CA_BP_DTL_TMPL |

Capture detailed information for populating fields in the billing plan that do not appear by default from the contract business unit. Or, override existing billing plan fields. This applies to on-demand contracts only. |

|

|

Using the Data Migration Workbench for PeopleSoft Accounting Rules |

ACCOUNTING RULES |

PeopleSoft Contracts Accounting Rules are used to generate billing and revenue accounting entries. You can create and test Accounting Rules in test databases, and then use ADS definitions to move them to other databases or to the production database when finalized. |

Use the Installation Options - Installed Products page (INSTALLATION_FS) to select the Transaction Billing Processor check box to indicate that this product is installed on your system.

Navigation:

Click the Products link in the General Options group box.

Select the Transaction Billing Processor check box.

Use the Legal Entity page (CA_LEGAL_PNL ) to define legal entities to associate with Contract business units.

You use legal entities on the Contract - General page to identify the legal entity within your company that owns (that signed) the contract. This value, once associated with a PeopleSoft Contracts business unit, automatically populates the appropriate field on the contract header.

Navigation:

Use the Contracts Definition - BU Definition (contracts definition - business unit definition) page (BUS_UNIT_TBL_CA) to create a new PeopleSoft Contracts business unit definition or manage an existing business unit.

Navigation:

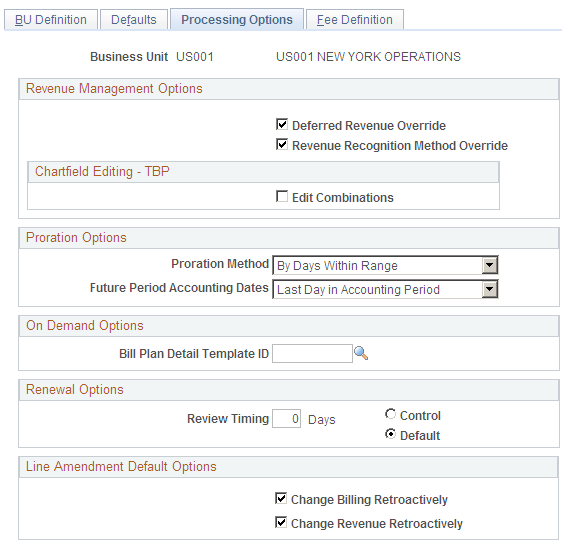

Use the Contracts Definition - Processing Options page (BUS_UNIT_OPT_CA2) to select the Edit Combinations check box if you want the Accounting Rules process (PSA_ACCTGGL) to run combination editing.

This step is optional. For recurring transactions, define the parameters in the Proration Options group box so that the PeopleSoft Transaction Billing Processor can process the PeopleSoft CRM recurring transactions. For on-demand transactions, select a bill plan detail template ID to use to override the fields on the billing plan (optional). If you select a template on this page, when the billing plan is created, the billing plan detail template overrides the corresponding fields on the billing plan.

Navigation:

ChartField Editing - CRM

Field or Control |

Description |

|---|---|

Edit Combinations |

Select this check box to indicate that you want the Accounting Rules process (PSA_ACCTGGL) to run combination editing. |

Note: This step is optional. If you want to use combination editing, set up the ChartField combination editing rules in PeopleSoft General Ledger.

Use the Schedules page (SCHEDULE) to create schedules that automate and control the generation of recurring journal entries.

Navigation:

Set up schedules for the PeopleSoft Transaction Billing Processor to use when processing recurring transactions from PeopleSoft CRM.

Note: Use this page when setting up recurring transactions from PeopleSoft CRM. This page is not used for one-time and on-demand transactions.

Note: PeopleSoft Transaction Billing Processor supports the following schedules: annually, daily, monthly and weekly.

See Schedules Page.

Use the Contracts Definition - Processing Options page (BUS_UNIT_TBL_CA2) to define processing attributes to incorporate flexibility and automation in your PeopleSoft Contracts system when managing revenue, or performing billing and revenue credits and adjustments.

Navigation:

This example illustrates the fields and controls on the Contracts Definition - Processing Options page. You can find definitions for the fields and controls later on this page.

Proration Options

Field or Control |

Description |

|---|---|

Proration Method |

Values are:

|

Future Period Accounting Dates |

Values are:

|

Note: Use this page when setting up recurring transactions from PeopleSoft CRM. This page is not used for one-time and on-demand transactions.

Use the Contracts GL Options (Contracts General Ledger Options) page (CA_BUGL_OPT) to designate journal templates and document types for a business unit.

Navigation:

Set up the TBP Revenue Doc. Type (TBP revenue document sequencing type) for one-time transactions only.

Note: This page is not used for recurring and on-demand transactions as revenue for those transactions is managed by PeopleSoft Billing.

TBP Revenue Doc. Type

Field or Control |

Description |

|---|---|

Revenue |

Select the document sequencing document type for the PeopleSoft General Ledger business unit. You must enter a document type if you are using the Document Sequencing feature for the general ledger business unit. Document types represent the business purpose of a financial transaction. Within the domestic sales journal code, for example, you may have document types such as domestic customer invoices, customer credit memos, and customer debit memos. Document types are assigned to one and only one journal code. This field appears on this page only if you have installed the PeopleSoft Transaction Billing Processor. |

See Defining Document Sequencing Options.

See PeopleSoft General Ledger documentation.

Use the Contract Status page (CA_STATUS_PNL) to define contract statuses and map them to processing statuses.

The system uses the contract status to control all processing that can occur against a contract.

Navigation:

Select the processing status to which the contract status should be mapped.

You must define a default active status.

Use the Accounting Rules for CRM page (CA_ACCT_RULES) to define the accounting rules to apply to PeopleSoft CRM transactions.

Navigation:

This example illustrates the fields and controls on the Accounting Rules for CRM page. You can find definitions for the fields and controls later on this page.

Note: You can select or deselect combination editing for the Accounting Rules process (PSA_ACCTGGL) on the Contracts Definition - Processing Options page.

Note: Wildcarding—use of the percent sign symbol to indicate any possibility (%)—is supported on this page. Partial wildcarding—the use of alphanumeric symbols in combination with the percent sign symbol—is not.

The fields and functionality of this page are similar to those on the Accounting Rules page in the PeopleSoft Project Costing documentation.

Field or Control |

Description |

|---|---|

Contract Business Unit |

Displays the PeopleSoft Contracts business unit. |

Description |

Enter a description for the accounting rules. |

GL Business Unit (PeopleSoft General Ledger business unit) |

Displays the PeopleSoft General Ledger business unit (GLBU) of the sending application. The GLBU defines where the accounting entry is booked. This field is display-only. |

Status |

Displays the status of the accounting rules. The user controls this status. |

From GL Unit (from general ledger unit) |

Displays the source PeopleSoft General Ledger business unit. With the exception of employee-related transactions (service orders), this value should always be the same as the value in the GL Business Unit field. This field is display-only. This field applies to PeopleSoft FieldService and PeopleSoft Support only. This flexibility exists to enable cross-charging revenue to the PeopleSoft General Ledger business unit of the resource who performed the service. |

Journal Template |

Enter the journal template to attach to accounting entries when they are sent to the PeopleSoft General Ledger system. |

Copy Accounting Entries to |

Click to copy the accounting entries that you specify in the Accounting Entries group box for use with another set of header criteria. |

Accounting Entries

Use this grid to define the accounting debits and credits to create for the specified PeopleSoft CRM transaction. There must be an equal number of debits and credits. When defining accounting rules for billable activity for one-time transactions, you must specify one Contract Liability) accounting distribution. This accounting distribution is stamped on the row when it is sent to PeopleSoft Billing. If you do not establish an Contract Asset, the system does not send the row to PeopleSoft Billing.

During the Accounting Rules process (PSA_ACCTGGL), all transactions are converted to currency based on the PeopleSoft General Ledger currency.

Note: The As Incurred revenue recognition process (PSA_ACCTGGL) is only applicable to one-time transactions.

Field or Control |

Description |

|---|---|

Seq Nbr (sequence number) |

Displays the sequence in which these accounting lines are applied. The sequence number groups the debit and credit together and is used to determine whether interunit entries should be created. |

Debit/Credit |

Displays whether this accounting line is a debit or credit. |

Account Type |

Select the type of accounting entry. |

Billing Business Unit |

Enter a business unit that matches the business unit entered in the GL Business Unit field. This ensures that the receivables accounting entries are booked to the same PeopleSoft General Ledger business unit as the contract asset account. This field appears only if the account type is Contract Asset. |

Organization to Book |

Values are:

|

Use the Accounting Rules for Lease Administration page (CA_ACCT_RULES) to define the accounting rules to apply to PeopleSoft Lease Administration transactions.

Navigation:

This example illustrates the fields and controls on the Accounting Rules for Lease Administration page. You can find definitions for the fields and controls later on this page.

Note: You can select or deselect combination editing for the Accounting Rules process (PSA_ACCTGGL) on the Contracts Definition - Processing Options page.

Note: Wildcarding—use of the percent sign symbol to indicate any possibility (%)—is supported on this page. Partial wildcarding—the use of alphanumeric symbols in combination with the percent sign symbol—is not.

The fields and functionality of this page are similar to those on the Accounting Rules page in the PeopleSoft Project Costing documentation.

Field or Control |

Description |

|---|---|

LA Business Unit |

Displays the PeopleSoft Lease Administration business unit that was entered when creating the accounting rules. |

Description |

Enter a description for the accounting rules. |

GL Business Unit (PeopleSoft General Ledger business unit) |

Displays the PeopleSoft General Ledger business unit (GLBU) of the sending application. The GLBU defines where the accounting entry is booked. This field is display-only. |

Status |

Displays the status of the accounting rules. The user controls this status. Inactive rules are not used during rules matching. |

Transaction Destination |

Identifies where the system sends the transaction. If the value in the Transaction Destination field is BI (PeopleSoft Billing), then PeopleSoft Billing manages revenue for on-demand transactions. PeopleSoft Billing uses the accounting rule to retrieve the revenue credit side of the accounting entry that it needs to offset the Accounts Receivable side of the entry. If the value in the Transaction Destination field is AP (Accounts Payable manages expense) or GL (PeopleSoft General Ledger), during processing, PeopleSoft Lease Administration calls the accounting rules to populate specific accounting rule entries in the PeopleSoft Lease Administration tables. PeopleSoft Lease Administration then sends the accounting entries in this table to either Accounts Payable or PeopleSoft General Ledger. Note: You select the transaction destination value when adding a new accounting rule prior to reaching the Accounting Rules for Lease Administration page. You cannot change this value. This field is not enterable. |

Transaction Group |

Select a transaction group to indicate the type of PeopleSoft Lease Administration transaction. The system uses the value in this field to create journal entries. Possible field values include: Base Rent, Security Deposit, Straight-line Accounting, Operating Expense, Percent Rent, Miscellaneous Rent, and Manual Fee. |

Transaction Routing Code |

Select a transaction routing code. You can define unique accounting rules by specifying the transaction routing code for a specific transaction group. |

Copy Accounting Entries to |

Click to copy the accounting entries that you specify in the Accounting Entries group box for use with another set of header criteria. |

Accounting Entries

Use this grid to define the accounting debits and credits to create for the specified PeopleSoft Lease Administration transaction. There must be an equal number of debits and credits.

During the Accounting Rules process (PSA_ACCTGGL), all transactions are converted to currency based on the PeopleSoft General Ledger currency.

Note: The As Incurred revenue recognition process (PSA_ACCTGGL) is only applicable to one-time transactions.

Field or Control |

Description |

|---|---|

Seq Nbr (sequence number) |

Displays the sequence in which these accounting lines are applied. The sequence number groups the debit and credit together and is used to determine whether interunit entries should be created. |

Debit/Credit |

Displays whether this accounting line is a debit or credit. This field corresponds with your Account Type field selection. Note: For PeopleSoft Lease Administration, the system allows a credit entry only if the value in the Transaction Destination field is BI and a debit entry only if the value is AP. |

Account Type |

Select the type of accounting entry. |

Account |

Select the account for this transaction. |

Alternate Account |

Select the alternate account for this transaction. |

Note: Select optional ChartField values for additional fields on this page. The values that you select here override the values in the transaction record.

Use the Billing Plan Detail Template page (CA_BP_DTL_TMPL) to capture detailed information for populating fields in the billing plan that do not appear by default from the contract business unit.

Or, override existing billing plan fields. This applies to on-demand contracts only.

Navigation:

Note: Selecting the Pre Approved and Direct Invoicing check boxes have no processing effect for on-demand contracts. The system processes all on-demand contracts with the pre approved and direct invoicing functionality whether or not you select the option here.

Note: This page is available for on-demand transactions only.

Billing Default Overrides

For the fields in this group box, select from the list of values (optional). If PeopleSoft CRM or PeopleSoft Lease Administration do not send these values over as part of the transactions and if you leave these fields blank, when you run the Contracts Billing Interface process, the system populates the values by default according to the bill to customer. If PeopleSoft CRM or PeopleSoft Lease Administration do not send these values to the PeopleSoft Transaction Billing Processor and you populate these fields for the billing plan, the system uses the values that you enter here on the billing plan. However, if you enter values here and PeopleSoft CRM or PeopleSoft Lease Administration Management do send billing defaults, the system uses the defaults sent from PeopleSoft CRM or PeopleSoft Lease Administration.

Use the Contracts Definition - Processing Options page (BUS_UNIT_TBL_CA2) to define processing attributes to incorporate flexibility and automation in your PeopleSoft Contracts system when managing revenue, or performing billing and revenue credits and adjustments.

Navigation:

On Demand Options

Field or Control |

Description |

|---|---|

Bill Plan Detail Template ID |

Select a bill plan detail template ID to use to override the fields on the billing plan. If you select a template on this page, when the billing plan is created, the billing plan detail template overrides the corresponding fields on the billing plan. |

Note: This page is available for on-demand transactions only.

PeopleSoft Contracts Accounting Rules are used to generate billing and revenue accounting entries. You can create and test Accounting Rules in test databases, and then use ADS definitions to move them to other databases or to the production database when finalized.

The following table lists the delivered ADS definitions (delivered in Data Set Designer) to support the migration of PeopleSoft Accounting Rules configuration data:

|

Delivered ADS to Support PeopleSoft Accounting Rules |

Application Data Set (ADS) Usage |

|---|---|

|

ACCOUNTING RULES |

This data set includes the records that store the Accounting Rules for PeopleSoft Contracts. Select this data set on the Data Migration Workbench - Project Definition page to move the Accounting Rules from one database to another. |

PeopleSoft delivers an ADS Administrator permission list. For access, the GENERAL_TABLES access group should be included on the Data Migration page within the Access Group Permissions and the proper access is granted on the Copy Compare Permissions.

Note: The data that is entered using this component can also be loaded as an Application Data Set using the Data Migration Workbench. For more information about ADS and the Data Migration Workbench for accounting rules, see Understanding the PeopleSoft Data Migration Workbench.

See PeopleTools: Security Administration, Permission Lists.

All relevant records are included in the Query Access Tree, QUERY_TREE_CA within the GENERAL_TABLES access group (PeopleTools, Security, Query Security, Query Access Manager).

See also the product documentation for PeopleTools: Lifecycle Management.