Setting Up Revenue Plans for Cost-Plus Contract Lines

This section provides an overview of cost-plus revenue plans, lists prerequisites and common elements and discusses how to define cost-plus revenue plans, define fixed fee revenue fee worksheets, define award fee revenue fee worksheets, define incentive fee revenue fee worksheets, define other fee revenue fee worksheets, create award schedules, create incentive fee schedules, adjust award fees, adjust incentive fees, and assign cost-plus contract lines to revenue plans.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CA_ACCTPLAN |

Define a revenue plan for cost-plus contract lines. For each revenue plan that you define, you select a revenue recognition method of as-incurred for the revenue plan, manage the revenue fee worksheet and define revenue fee events for fee types of award and incentive. |

|

|

CA_AP_FEE_WS |

Evaluate, manage, and generate revenue fee amounts for your cost-plus contract lines. |

|

|

CA_ACCTPLAN |

Define revenue fee events for award and incentive fee types. |

|

|

CA_AP_FEE_ADJ |

Enter fee adjustment amounts when fee amounts, percentages, or limits have changed over the life of the contract. |

|

|

CA_AP_LINK |

Assign or unassign contract lines to revenue plans. You can first define revenue plans and assign the contract lines to these existing revenue plans, or you can first assign the lines to a new revenue plan and then define the details of the revenue plan. |

A government contract can consist of multiple contract lines with complex and diverse revenue recognition requirements. To manage these requirements, PeopleSoft Contracts uses revenue plans. For cost-plus contract lines, revenue plans store the timing of when revenue recognition occurs, enable you to define revenue events to control the processing of fees, and enable you to calculate fee amounts using a revenue fee worksheet. Revenue fee worksheets display the data from the billing fee worksheet to enable you to perform a side-by-side comparison of your billing and revenue fee data when managing your revenue fees.

Revenue plans are required for every contract line to process revenue for those contract lines. For cost-plus contract lines, every contract line must be assigned to a unique revenue recognition plan as the revenue fee worksheet associated with the revenue plan is unique to the fee type associated with the contract line.

If you have not selected the option to apply separate rates for billing and revenue, you will not have a revenue fee worksheet associated with your revenue plans, but will still be required to define revenue plans for your contract lines. When billing and revenue rates are the same, the system uses the billing fee worksheet to calculate and manage both billing and revenue fees.

When defining revenue plans for your cost-plus contract lines, you can assign the contract lines to revenue plans manually or by using an as-incurred revenue plan template. If you use a revenue plan template to set up the revenue plans for the contract lines, you can select the template on the Add Contract Lines page when adding the products to your contract, or you can select the template on the Assign Revenue Plans page. If you assign the revenue plan template to the contract line on the Add Contract Lines page, the system will automatically create the revenue plan after the contract line is added to the contract and saved.

After the contract line is added to the contract and the revenue plan is created, you must complete the fields on the revenue plan to enable processing to occur. Award and incentive fees also have an award schedule that must be completed to recognize fee revenue for those fee types. The award schedule enables you to set up events, using milestones or dates, that enable you to control when the fee amounts are processed.

To generate revenue for the contract lines and any associated fees, the contract must be in an active processing status, the contract line must be active and the revenue plan and any associated events must have a status of Ready. If you are using milestones to control processing for award or incentive fee events, they must have a status of complete.

Before you can manage revenue for cost-plus contract lines, you must first create a contract with a contract classification of Government, add contract lines associated with fee types to the contract, and associate projects, activities and a rate plan to the contract line.

Field or Control |

Description |

|---|---|

Acct Date Opt (accounting date option) |

Accounting date option. |

All Recognizable Costs |

Displays the total of all cost rows assigned a revenue (REV) analysis type from the contract line's inception to the current date. This total comes from the revenue rows stored in the Project Costing Project Transactions tables. |

Calculated Revenue Fee Ceiling |

Displays the calculated total of the total contract line value (the sum total of the funded and revenue limit amounts) less all recognizable costs to date, less the estimated costs to complete, less fees already recognized. |

Costs Used In Fee Calculation (Project Costing-Revenue) |

Displays the total of all revenue rows from the contract line's inception to the current date that have been assigned a fee status of one (1). To ensure that cost rows are not used multiple times for fee calculations, they are assigned a fee status. A fee status of 1 indicates that the cost row has been used for fee calculations. The minimum valid value for this field is zero, and the maximum valid value for this field is the total of all revenue rows from the contract line's inception to the current date. This total comes from the revenue rows stored in the Project Costing Project Transactions tables. |

Cur Period Recognizable Costs (current period recognizable costs) |

Displays the total of all revenue rows with a blank fee status value. A blank fee status indicates that the revenue row has not been used for fee calculations. This total comes from the revenue rows stored in the Project Costing Project Transactions tables. |

Estimated Run Rate |

Displays the computed value of all recognizable costs divided by the sum total of all recognizable costs plus the total of the estimated costs to complete. |

Estimated Cost to Complete |

Displays the sum total of transactions with a date that is greater than the current date and are assigned analysis types associated with the PeopleSoft Estimated Cost to Complete Analysis group (PSECC). Estimated costs to complete are generally budgeted costs to complete the contract. These transactions are stored in the Project Costing Project Transaction tables. |

Revenue Cost Limit |

Displays the revenue limit amount entered on the Contract Amounts page for the contract line. The minimum valid value for this field is the inception to date actual costs that have been recognized as revenue. The maximum valid value for this field is the revenue limit amount entered on the Contract Amounts page. |

Revenue Fee Limit |

Displays the revenue fee limit amount for the contract line using the amount of the funded fee limit. However, you can override this amount if needed. This amount is managed in the individual fee worksheet and can be changed outside of amendment processing. |

Use the Revenue Fee Worksheet page (CA_AP_FEE_WS) to evaluate, manage, and generate revenue fee amounts for your cost-plus contract lines.

Navigation:

Click the Revenue Plans link. Click the link for the revenue plan ID, Revenue Fee Worksheet.

This example illustrates the fields and controls on the Revenue Fee Worksheet page (fixed fee type). You can find definitions for the fields and controls later on this page.

When you define a revenue plan for a cost-plus contract line associated with a fee type of Fixed, the system automatically creates a revenue plan with a revenue fee worksheet containing fields that are specific to fixed fee processing.

Revenue Fee Calculation

Field or Control |

Description |

|---|---|

Fixed Fee Already Created |

Displays the total for the fixed fee revenue rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the fixed fee revenue rows that are assigned the analysis type specified in the Revenue Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Fixed Fee Percent |

Displays the calculated total of the revenue fee limit divided by the sum of all recognizable costs plus the estimated cost to complete. This amount can be overridden if needed. |

Proposed Fixed Fee |

Displays the calculated total of the current period's recognizable costs (all revenue cost rows for the contract line with a blank fee status) multiplied by the revenue fixed fee percent. In calculating the proposed fee amount, the system evaluates current period costs, fee percentages, the fee limit, the fees created to date, and any changes or adjustments made. You can accept the proposed fee or override it by entering a different fee amount and selecting the Override option. Note: If you select the processing option of Process Automatically, the system uses the fee amount proposed by the system. |

Current Period Fixed Fee |

Displays the fixed fee total for the current period after the fee limits process has run. |

Billing Amounts - Amounts from Contract Amt Page

Field or Control |

Description |

|---|---|

Fixed Fee Percent |

Displays the fixed fee percentage entered on the Contract Amounts page for the contract line. |

Billing Fee Calculation

Field or Control |

Description |

|---|---|

Fixed Fee Already Created |

Displays the total for the fixed fee billing rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the fixed fee billing rows that are assigned the analysis type specified in the Billing Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Proposed Fixed Fee |

Displays the proposed fixed fee amount from the billing worksheet for the contract line. |

Use the Revenue Plan page (CA_ACCTPLAN) to define a revenue plan for cost-plus contract lines.

For each revenue plan that you define, you select a revenue recognition method of as-incurred for the revenue plan, manage the revenue fee worksheet and define revenue fee events for fee types of award and incentive.

Navigation:

This example illustrates the fields and controls on the Revenue Fee Worksheet page (award fee type). You can find definitions for the fields and controls later on this page.

When you define a revenue plan for a cost-plus contract line associated with a fee type of Award, the system automatically creates a revenue plan with a revenue fee worksheet containing fields that are specific to award fee processing. Award fees are managed using milestone or date events. You define your events using the award schedule.

Billing Base Fee Calculation

Field or Control |

Description |

|---|---|

Base Fee Already Created |

Displays the total for the award base fee revenue rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the award base fee revenue rows that are assigned the analysis type specified in the Revenue Target Fee Attributes group box on the Fee Definition page for this fee type. The Fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Base Fee Percent |

Displays the calculated total of the revenue fee limit divided by the sum of all recognizable costs plus the estimated cost to complete. This amount can be overridden if needed. |

Proposed Base Fee |

Displays the calculated total of the current period's recognizable costs (all revenue cost rows for the contract line with a blank fee status) multiplied by the revenue base fee percent. You can accept the proposed fee or override it by entering a different fee amount and selecting the Override option. Note: If you select the processing option of Process Automatically, the system uses the fee amount proposed by the system. |

Current Period Base Fee |

Displays the award base fee total for the current period after the fee limits process has run. |

Revenue Award Fee Calculation

Field or Control |

Description |

|---|---|

Award Fee Already Created |

Displays the total for the additional award fee revenue rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the additional award fee revenue rows that are assigned the analysis type specified in the Revenue Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Additional Award Fee Limit |

Displays the additional award fee limit based on the amounts defined on the Contract Amounts page for the contract line. You can override this value if needed. |

Award Fee Amount Proposed |

Displays the calculated total of the current period's recognizable costs (all revenue cost rows for the contract line with a blank fee status) multiplied by the revenue award fee percent. |

Current Period Award Fee |

Displays the additional revenue award fee total for the current period after the fee limits process has run. |

Billing Amounts - Amounts from Contract Amt Page

Field or Control |

Description |

|---|---|

Base Fee Percent |

Displays the award base fee percentage entered on the Contract Amounts page for the contract line |

Billing Base Fee Calculation

Field or Control |

Description |

|---|---|

Base Fee Already Created |

Displays the total for the award base fee billing rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the award base fee billing rows that are assigned the analysis type specified in the Billing Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Proposed Base Fee |

Displays the proposed award base fee amount from the billing worksheet for the contract line. |

Billing Award Fee Calculation

Field or Control |

Description |

|---|---|

Award Fee Already Created |

Displays the total for the additional award fee billing rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the additional award fee billing rows that are assigned the analysis type specified in the Billing Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Additional Award Fee Limit |

Displays the additional award fee limit defined in the Contract Amounts page for the contract line. |

Award Fee Amount Proposed |

Displays the proposed additional award fee amount from the billing worksheet for the contract line. |

Current Period Award Fee |

Displays the additional billing award fee total for the current period after the fee limits process has run. |

Use the Revenue Plan page (CA_ACCTPLAN) to define revenue fee events for award and incentive fee types.

Navigation:

Click the Revenue Plans link. Click the link for the revenue plan ID, Revenue Fee Worksheet. Click the Award Fee Amount Proposed link or the Proposed Incentive Fee link, Revenue Plan.

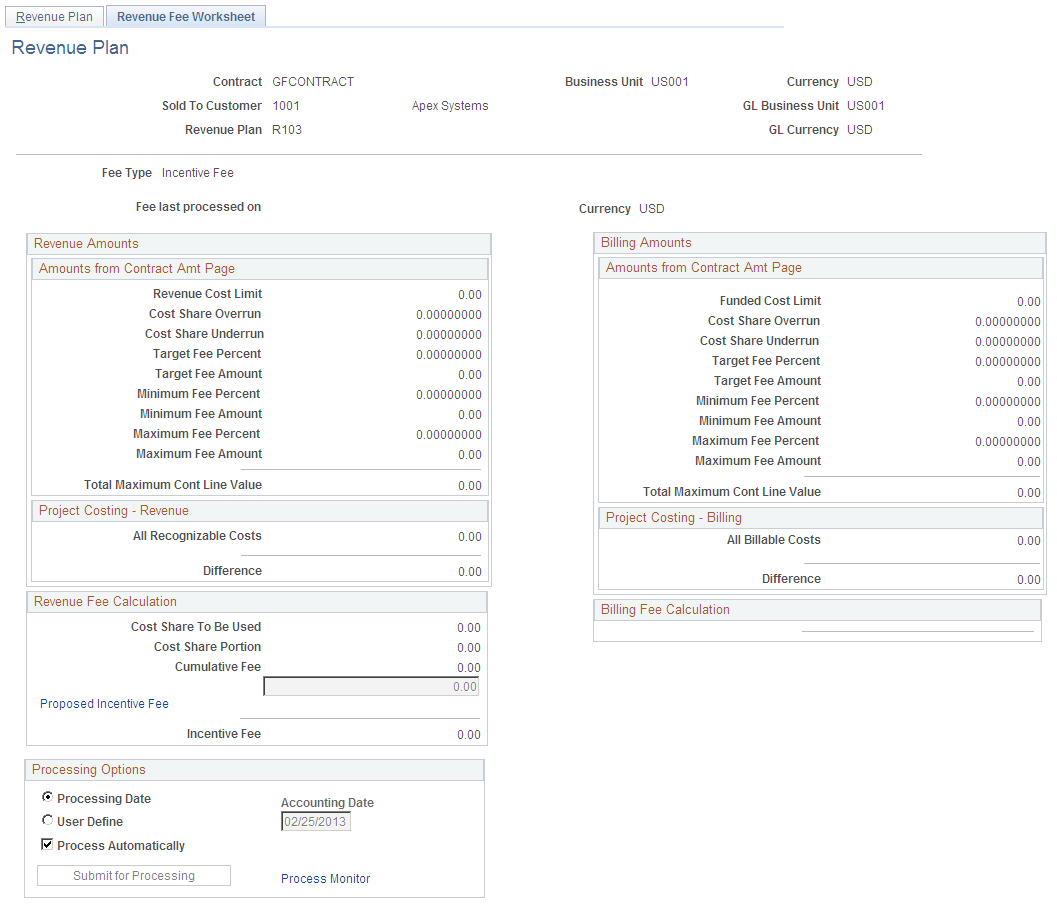

This example illustrates the fields and controls on the Revenue Fee Worksheet page (incentive fee type). You can find definitions for the fields and controls later on this page.

When you define a revenue plan for a cost-plus contract line associated with a fee type of Incentive, the system automatically creates a revenue plan with a revenue fee worksheet containing fields that are specific to incentive fee processing. Incentive fees are managed using milestone or date events. Define your events using the Award Schedule page. When entering in your fee percentages, zero is the lowest value that can be entered.

Revenue Amounts - Amounts from Contract Amt Page

Field or Control |

Description |

|---|---|

Cost Share Overrun |

Displays the cost share overrrun percentage entered on the Contract Amounts page. The overrun percentage is used to adjust the target fee percentage that can be recognized as revenue. |

Cost Share Underrun |

Displays the cost share underrun percentage entered on the Contract Amounts page. The overrun percentage is used to adjust the target fee percentage that can be recognized as revenue. |

Target Fee Percent |

Displays the target fee percentage entered on the Contract Amounts page. The target fee percentage is used to calculate the target fee amount. |

Target Fee Amount |

Displays the calculated total of the revenue cost limit amount multiplied by the target fee percent. |

Minimum Fee Percent |

Displays the minimum fee percentage entered on the Contract Amounts page. This value represents the minimum fee percentage that can be recognized as revenue for the contract line. |

Minimum Fee Amount |

Displays the calculated total of the revenue cost limit amount multiplied by the minimum fee percent. |

Maximum Fee Percent |

Displays the maximum fee percentage entered on the Contract Amounts page. This value represents the maximum fee percentage that can be recognized as revenue for the contract line. |

Maximum Fee Amount |

Displays the calculated total of the revenue cost limit amount multiplied by the maximum fee percent. |

Total Maximum Cont Line Value (total maximum contract line value) |

Displays the calculated total of the revenue cost limit amount plus the maximum fee amount. |

Project Costing - Revenue

Field or Control |

Description |

|---|---|

Difference |

Displays the calculated total of the revenue cost limit amount less the total actual revenue costs to date for the contract line. |

Revenue Fee Calculation

Field or Control |

Description |

|---|---|

Cost Share To Be Used |

Displays the cost share overrun or underrun percentage entered on the Contract Amounts page. If the actual revenue costs from the contract line's inception to date are greater than the revenue cost limit amount, then the cost share overrun percentage is used. If the actual revenue costs from the contract line's inception to date are less than the revenue cost limit amount, then the cost share underrun percentage is used. |

Cost Share Portion |

Displays the calculated total of the value displayed in the Project Costing-Revenue Difference field multiplied by the percentage in the Cost Share To Be Used field. |

Cumulative Fee |

Displays the calculated total of the cost share portion plus the target fee amount. |

Proposed Incentive Fee |

Displays the proposed incentive fee amount calculated by the system for the contract line. If the actual revenue costs to date are less then or equal to the revenue cost limit, the system uses the lesser of the cumulative fee amount or the maximum fee amount for the proposed incentive fee. If the actual revenue costs to date are greater then the revenue costs limit, then the system uses the greater of the cumulative fee amount or the minimum fee amount for the proposed incentive fee. |

Incentive Fee |

Displays the revenue incentive fee total for the current period after the fee limits process has run. |

Billing Amounts - Amounts from Contract Amt Page

Field or Control |

Description |

|---|---|

Cost Share Overrun |

Displays the cost share overrrun percentage entered on the Contract Amounts page. The overrun percentage is used to adjust the billable target fee percentage. |

Cost Share Underrun |

Displays the cost share underrun percentage entered on the Contract Amounts page. The overrun percentage is used to adjust the billable target fee percentage. |

Target Fee Percent |

Displays the target fee percentage entered on the Contract Amounts page. The target fee percentage is used to calculate the target fee amount. |

Target Fee Amount |

Displays the calculated total of the funded cost limit amount multiplied by the target fee percent. |

Minimum Fee Percent |

Displays the minimum fee percentage entered on the Contract Amounts page. This value represents the minimum fee percentage that can be billed for the contract line. |

Minimum Fee Amount |

Displays the calculated total of the funded cost limit amount multiplied by the minimum fee percent. |

Maximum Fee Percent |

Displays the maximum fee percentage entered on the Contract Amounts page. This value represents the maximum fee percentage that can be billed for the contract line. |

Maximum Fee Amount |

Displays the calculated total of the funded cost limit amount multiplied by the maximum fee percent. |

Total Maximum Cont Line Value (total maximum contract line value) |

Displays the calculated total of the funded cost limit amount plus the maximum fee amount. |

Project Costing - Billing

Field or Control |

Description |

|---|---|

Difference |

Displays the calculated total of the funded cost limit amount less the total actual billing costs to date for the contract line. |

Billing Fee Calculation

Displays the billing incentive fee total for the current period after the fee limits process has run.

Use the Revenue Fee Worksheet page (CA_AP_FEE_WS) to evaluate, manage, and generate revenue fee amounts for your cost-plus contract lines.

Navigation:

Click the Revenue Plans link. Click the link for the revenue plan ID, Revenue Fee Worksheet.

This example illustrates the fields and controls on the Revenue Fee Worksheet page (other fee type). You can find definitions for the fields and controls later on this page.

When you define a revenue plan for a cost-plus contract line associated with a fee type of Other, the system automatically creates a revenue plan with a revenue fee worksheet with fields that are specific to award fee processing.

Revenue Fee Calculation

Field or Control |

Description |

|---|---|

Other Fee Already Created |

Displays the total for the other fee revenue rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the other fee revenue rows that are assigned the analysis type specified in the Revenue Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Proposed Other Fee |

Enter the proposed other fee amount. When you save the page or submit the worksheet, the system will evaluate the proposed fee amount against the revenue fee limit to determine if it is within the limit amount. The proposed billing other fee amount appears in this field by default when the revenue fee worksheet is first created. Note: The proposed fee amount that you enter will be the proposed other fee amount for future periods until you manually change the value. After you change the value, the newly entered value will be the new proposed other fee amount for future periods, until you manually change it again, or until the revenue other fee limit is reached. |

Current Period Other Fee |

Displays the revenue other fee total for the current period after the fee limits process has run. |

Billing Fee Calculation

Field or Control |

Description |

|---|---|

Other Fee Already Created |

Displays the total for the other fee billing rows created to date for the contract line. This data is retrieved for the Project Costing Project Transaction table. Note: For this value, the system retrieves the other fee billing rows that are assigned the analysis type specified in the Billing Target Fee Attributes group box on the Fee Definition page for this fee type. The fee definition is defined on the Contracts Business Unit component (BUS_UNIT_TBL_CA). |

Proposed Other Fee |

Displays the billing other fee total for the current period after the fee limits process has run. |

Access the Revenue Plan page for the award fee schedule.

This example illustrates the fields and controls on the Revenue Plan page (award fee schedule). You can find definitions for the fields and controls later on this page.

The Revenue Plan – Award Schedule page is used to define events for award fees. The events fields appear when you navigate to the Revenue Plan page from the Revenue Fee Worksheet for Award fees. You can define milestone or date event types to control the timing of when revenue is recognized for award fees. You can enter multiple event rows, but only one event can be set to a Ready status at a time, including adjustment fee events.

Note: Before creating an adjustment fee event using this page, all other events defined on this page must have a status of completed or pending.

Award Fee Detail

Field or Control |

Description |

|---|---|

Additional Award Fee Limit |

Displays the additional award fee limit amount defined on the Contract Amounts page for the contract line assigned to this revenue plan. |

Award Fee Already Created |

Displays the total for the award fee revenue rows created to date for the contract line assigned to this revenue plan. This data is retrieved for the Project Costing Project Transaction table. |

Available Award Fee |

Displays the calculated total of the additional award fee limit less the award fee amount already created. |

Adjustment Fee |

Click to access the Fee Adjustment page where you can enter a fee adjustment event. Fee adjustments cannot be set to Ready status if a fee event on the Revenue Plan page is set to Ready status. |

Access the Revenue Plan page for the incentive fee schedule.

This example illustrates the fields and controls on the Revenue Plan page (incentive fee schedule). You can find definitions for the fields and controls later on this page.

The Incentive schedule page is used to define an event for incentive fees. The events fields appear when you navigate to the Revenue Plan page from the Revenue Fee Worksheet for incentive fees. You can define a milestone or date event type to control the timing of when revenue is recognized for incentive fees. You can only enter one event row in this schedule, including adjustment fee events.

Note: Before creating an adjustment fee event using this page, all other events defined on this page must have a status of completed or pending.

Incentive Fee Detail

Field or Control |

Description |

|---|---|

Cumulative/Proposed Fee |

Displays the cumulative or proposed fee amount from the incentive fee worksheet. |

Minimum Fee Amount |

Displays the calculated minimum fee amount from the incentive fee worksheet. |

Maximum Fee Amount |

Displays the calculated maximum fee amount from the incentive fee worksheet. |

Fee Used |

Displays the minimum, maximum or cumulative fee amount used by the system for incentive fee revenue. |

Adjustment Fee |

Click to access the Fee Adjustment page where you can enter a fee adjustment event. Fee adjustments cannot be set to Ready status if a fee event on the Revenue Plan page is set to Ready status. |

Access the Fee Adjustment page for award fees.

This example illustrates the fields and controls on the Fee Adjustment page (award fee type). You can find definitions for the fields and controls later on this page.

The Fee Adjustment page enables you to adjust fee amounts that have been processed. You can enter either a negative or positive amount, up to the fee amount that has been recognized to date. Revenue fees that have not yet been processed are adjusted using the revenue fee worksheet, Proposed Amount field. Adjustments to your award fees are not controlled by amendment processing.

Award Fee Details

Field or Control |

Description |

|---|---|

Additional Award Fee Limit |

Displays the additional award fee limit amount defined on the Contract Amounts page for the contract line assigned to this revenue plan. |

Award Fee Already Created |

Displays the total for the additional award fee revenue rows created to date for the contract line assigned to this revenue plan. This data is retrieved from the Project Costing Project Transaction table. |

Available Award Fee |

Displays the calculated total of the additional award fee limit less the award fee amount already created. |

Adjustment Detail

Field or Control |

Description |

|---|---|

Adjustment |

Displays the sequence number automatically assigned to the adjustment row. |

Event Status |

Select the status of the event. The event status controls the timing of when the event can be processed. Select from the following statuses:

|

Amount |

Enter a positive or negative fee adjustment amount. The amount that you enter cannot be greater or less than the fee amount that has been recognized to date and cannot exceed the fee limit amount. |

Access the Fee Adjustment page for incentive fees.

This example illustrates the fields and controls on the Fee Adjustment page (incentive fee type). You can find definitions for the fields and controls later on this page.

The Fee Adjustment page enables you to adjust fee amounts that have been processed. You can enter either a negative or positive amount, but it cannot adjust it such that the fee amount would be higher than the fee limit and it also cannot be an overall negative fee (cannot be less than zero). Revenue fees that have not yet been processed are adjusted using the revenue fee worksheet, Proposed Amount field. Adjustments to your incentive fees are not controlled by amendment processing.

Incentive Fee Detail

Field or Control |

Description |

|---|---|

Cumulative/ Proposed Fee |

Displays the cumulative or proposed fee amount from the incentive fee worksheet. |

Minimum Fee Amount |

Displays the calculated minimum fee amount from the incentive fee worksheet. |

Maximum Fee Amount |

Displays the calculated maximum fee amount from the incentive fee worksheet. |

Fee Used |

Displays the minimum, maximum or cumulative fee amount used by the system for incentive fee revenue. |

Adjustment Detail

Field or Control |

Description |

|---|---|

Adjustment |

Displays the sequence number automatically assigned the adjustment row. |

Event Status |

Select the status of the event. The event status controls the timing of when the event can be processed. Select from the following statuses:

|

Amount |

Enter a positive or negative fee adjustment amount. The amount that you enter cannot be greater or less than the fee amount that has been recognized to date and cannot exceed the fee minimum and maximum amounts. |

You can assign cost-plus contract lines to as-incurred revenue plans using the Assign Revenue Plans page. If you add a cost-plus contract line to a contract with an incorrect fee type, and a revenue plan has already been assigned to the contract line, you must first unassign the contract line from the revenue plan using the Unassign button on this page and then delete the contract line, and re-add it with the correct fee type assigned to the contract line.