Inquiring and Reporting on Budget Closing Results

After running the Budget Close process, you can view the process results by performing either of these tasks:

Inquire and report on the budget closing calculation log.

Inquire and report on the budget close status.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

KK_INQ_CLOSE |

View the Calculation Log, which records the results of the Budget Close process. |

|

|

Target/Source Page |

KK_INQ_CLS_SEC |

The Target page and the Source page are identical in all but their page name and content. Use the Target page to view the balance forward entry that is directly related to the source entry selected on the Review Calculation Log page. Use the Source page to view the source transaction associated with the target entry selected on the Review Calculation Log page. |

|

Budget Close Calculation Log Report Page |

RUN_GLS1222 |

Request a run of the Budget Close Calculation Log report (GLS1222) . This SQR report displays the results of the Budget Close process. |

|

KK_CLOSING_STATUS |

View the budget close status of the budgets you select. Search by business unit, Commitment Control ledger group, budget period, fiscal year, and budget close status. The budget close status is updated by both the Closing Run Control Validation process (GLS1211) and the Budget Close process (FSPYCLOS). |

|

|

Budget Close Status Report Page |

RUN_GLS1220 |

Request a run of the Budget Close Status report (GLS1220). This SQR report displays the budget close status of the budgets you request. The budget close status is updated by both the Closing Run Control Validation process (GLS1211) and the Budget Close process (FSPYCLOS). |

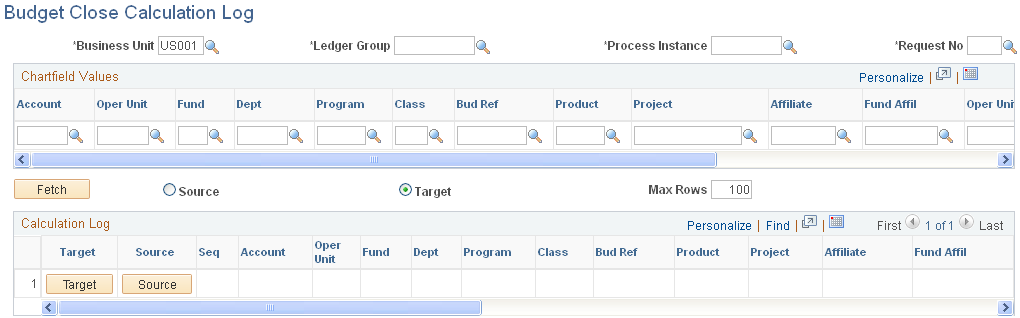

Use the Budget Close Calculation Log page (KK_INQ_CLOSE) to view the Calculation Log, which records the results of the Budget Close process.

Navigation:

Commitment Control, Close Budget, Review Calculation Log, Budget Close Calculation Log

This example illustrates the fields and controls on the Review Calculation Log page.

The Source option and the Target option are used to access the associated source or target rows in the calculation log. For example, when you click the Fetch button and you have selected the Target, the scroll is populated with the roll forward (target) amounts in the calculation log. You can then click one of the Source buttons that appears to access a secondary page to see the associated source budget rows stored in the calculation log and determine from where the target amount is coming. The same applies if you elect to display the source amounts first.

Use the Budget Close Status page (KK_CLOSING_STATUS) to view the budget close status of the budgets you select.

Search by business unit, Commitment Control ledger group, budget period, fiscal year, and budget close status. The budget close status is updated by both the Closing Run Control Validation process (GLS1211) and the Budget Close process (FSPYCLOS).

Navigation:

Commitment Control, Close Budget, Review Closing Status, Budget Close Status

Access the Budget Close Status Report page to request a report.

The closing process status can be one of these values:

Field or Control |

Description |

|---|---|

All |

Returns all statuses. |

Closed |

Budget is validated for the run control, and all budgets in the business unit, Commitment Control ledger group, Ruleset, budget period, and fiscal year are successfully closed. Note: This status is different from the budget close status on the Budget Attribute page. |

Invalid |

Closing Run Control Validation process has been run with errors. |

No Status |

Budget Close process has not been run on this budget. |

Partial |

Commitment Control ledger group is partially closed; that is, not all budgets in the budget ledger were covered by the Budget Close process. |

Unclosed |

Budget has been closed and reopened. |

Validated |

Closing Run Control Validation process has been run with no errors but Budget Close process has not been run. |

The functionality, which can also be termed Reduce Budget Without Closing, supports the reduction or withdrawing of uncommitted and unobligated budgets and is particularly applicable to United States Government accounting requirements to automatically withdraw all uncommitted and unobligated allotments and suballotments. This functionality can be used to reduce the budgetary amount equal to gross obligations so that the remaining balance is zero. The amounts that are automatically withdrawn can then be reallocated as necessary.

In PeopleSoft, appropriation, apportionment, allotment, and suballotment may be defined as distinct Commitment Control budget ledger groups that are related in a parent-and-child hierarchical structure. The following example illustrates a possible ledger group hierarchy and the associated key ChartFields:

Appropriation ledger, with a key ChartField of Fund.

Apportionment ledger, with a key ChartField of Fund.

Allotment ledger, with key ChartFields of Fund and Dept ID.

Suballotment ledger, with key ChartFields of Fund, Dept ID, and Class.

Without closing any of these budgets you can automatically withdraw or reduce all uncommitted and unobligated budget amounts, leaving the budget at its then existing status. By selecting the appropriate budget key values based on your established budget criteria, the system calculates the remaining budget balances. The system then generates Commitment Control budget adjustment journals by using Entry Event functionality to reduce any available budget to zero. The functionality is predicated on the following assumptions:

The process executes on one Commitment Control ledger at a time, beginning with the lowest-level child budget ledger.

The criteria for budget reduction are established by using business unit, ledger group, budget period, and ChartField values.

Amounts that are to be reduced are remaining balances, that are uncommitted (pre-encumbrance), unobligated (encumbrance), and unexpended amounts.

The process ignores budgets with negative balances.

All budget statuses are ignored, such as hold and close.

The process generates budget adjustments journals that reduce the balances for the selected budgets to zero.

Entry event codes are configured for the related business units and automatically default to the budget adjustments based on the setup to perform the required accounting.

Setting Up for Budget Withdrawal or Reduction Without Closing

The Budget Close COBOL process (FSPYCLOS) also supports the Reduce Budget Without Closing functionality. The pages used, the required setup, and the reports produced are shared.

See Understanding Commitment Control Budget Closing and Withdrawal Without Closing.

To reduce or to withdraw uncommitted Commitment Control budgets do the following:

Define ChartField value sets.

If you previously defined ChartField values sets for closing, you can use these, and the reduction process ignores roll forward related setup.

You define ChartField value sets on the ChartField Value Set page.

Define budget closing rules.

Here you specify budget journal ID mask and entry event codes for budget reduction adjustment journals (if you have Entry Events enabled).

You define closing rules on the Define Closing Rule component.

Define budget closing sets.

Set the Purpose to Reduce Budget Without Closing and specify which ledger amount types (pre-encumbrances, encumbrances, expenses, and so on) are to be applied toward calculating the remaining budget balances to be reduced. You select budget closing sets when you run budget reduction. Specify all budgets that you want to close without including a budget more than once in a closing rule.

You define budget closing sets on the Budget Closing Set page.

Run the Closing Set Validation report (GLS1210.)

Run the report for each budget closing set to display (depending on your requirements) any error or warning messages for the following conditions:

Remaining balance calculation ledgers do not match the affect spending authority ledgers.

Closing rules overlapped on budget row coverage.

Child budgets are not in the closing set.

Parent budgets are not in the closing set.

Entry Event is required for the budget ledger, but is not specified in the rule.

Create and save a Budget Close run control to be validated before running.

Include all closing sets for all budgets that you want to reduce. You specify the following:

Budget closing sets.

Business units for the reduction.

As of date for the reduction.

Output options, such as whether to generate a log file.

Create the budget closing, or reduction run control on the Budget Close page.

See Running and Validating the Budget Close Process to Close and Reopen Budgets.

Run the Closing Run Control Validation process (GLS1211).

Use the report to validate that the closing sets on the run control for the Budget Close process that you created are complete and do not overlap. Specifically, this validation process creates a report that displays error or warning messages (depending on your requirements) for the following conditions:

Remaining Balance Calculation ledgers do not match the Affect Spending Authority ledgers.

Closing rules overlapped on budget row coverage.

Child budgets are not in the closing set.

Parent budgets are not in the closing set.

Not all Associated Budgets are included in the closing set.

Some budget balances are not covered by any of the closing rules.

Entry Event is required for the budget ledger but is not specified in the rule.

Note: You cannot run the Budget Close process without first running this report free of errors.

Review the budget close status on the Closing Status inquiry page or the Budget Close Status Report (GLS1220) to confirm that the Closing Run Control Validation process marked all business unit, ledger group, and Ruleset combinations in the run control as Valid.

Run the Budget Close process using a run control that returns no errors for the Closing Run Control Validation process.

Run the Budget Close process from the Budget Close page.

Check the results of the Budget Close process on the Review Calculation Log page; check to see that the balance of selected budgets is zero.

See Inquiring and Reporting on Budget Closing Results.

You can undo a budget reduction or withdrawal just as you can a budget close.

See Reopening Closed or Reinstating Reduced Commitment Control Budgets.

If you undo the reduction process, validate the results by using the calculation log report and the budget status report to see that the balances are reinstated.