Defining Deals

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRX_DETAIL_TR |

Enter commodity deal details. |

|

|

TRX_COMO_STL |

Set up the settlement of commodities. |

|

|

TRX_OPT_EXRCS_CASH |

Exercise an option or update or change the exercise status for an option. |

|

|

TRX_ROLL_PHYS_SP |

Enter information that is required to swap this foreign exchange deal forward or backward. |

|

|

Roll Specific Details - Interest Rate Physical |

TRX_ROLL_PHYS_SP |

Enter the investment terms for moving funds from one investment to another by clicking the Rollover link on the Deal Detail page for an IRP. |

The deal entry process can be complex. PeopleSoft Deal Management from Oracle takes a simplified approach to the deal entry process. You can define the type, level, and depth of risk-limit-validation processing that is necessary for the instruments that your organization uses. The deal entry process can handle the intricacies of deals and their underlying instruments, as well as the unique practices of any treasury organization. You can capture as many deals process as many trades as you need. For each deal, you can define transaction and counterparty information in addition to providing preapproval requirements.

In this topic, the individual deal types are discussed in order of their frequency of use.

To create deals:

Define deal details for each instrument type.

Define settlement instructions.

Using deal entry pages, you can do the following::

Enter commodity deal details.

Enter commodity settlement details.

Define futures deal details.

Enter equity deal details.

Enter generic deal details.

Define option and option - binary payoff deal details.

Update option exercise status.

Enter foreign exchange (FX) deal physical details.

Define roll-specific details.

Specify IRP deal details.

Define IR swap deal details.

Note: Examples of deal entry are available in this topic: Understanding Deals Capture Examples.

See also Maintaining Equities.

If you have implemented the Limit Checked workflow and established position limits, the system automatically routes notification of deals that exceed limits to a defined user (or users) work list when you test deal limits.

Use the Deal Detail page (TRX_DETAIL_TR) to enter deal details for each instrument type.

Note that the Deal Management pages are similar for all deal instrument types. In general, only the fields on the Deal Detail page vary. The overall deal capture process is described in the discussion of IRP deals. The deal input details for each instrument type are discussed in the respective discussions of the Deal Detail page.

Navigation:

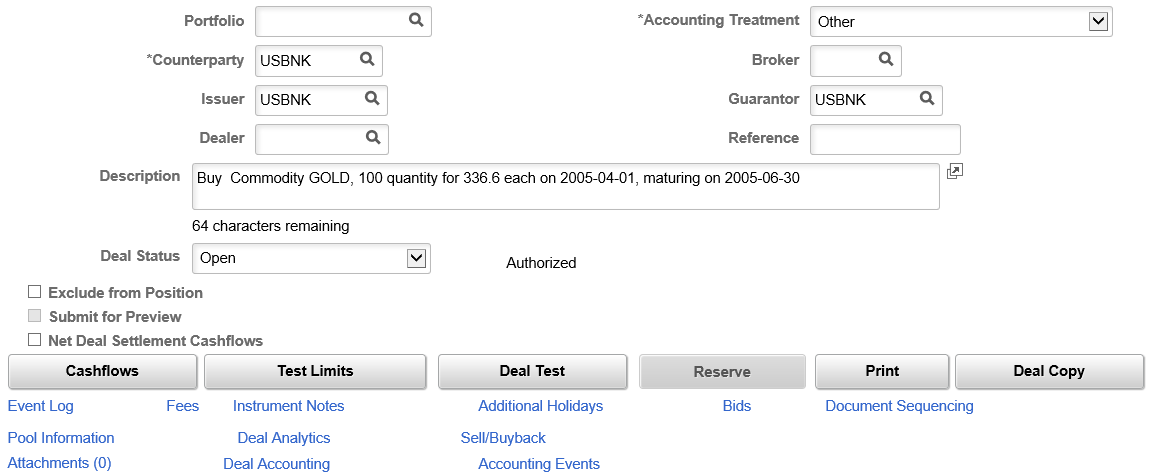

Use the Deal Detail page (TRX_DETAIL_TR) to enter commodity deal details.

Navigation:

This example illustrates the fields and controls on the Deal Detail page for commodity deals (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for commodity deals (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Spot Date |

The spot date is typically two working days after the current trading date. Certain currencies (Canadian dollar, Mexican peso, Hong Kong dollar, and Japanese yen) may clear one working day after the trade date. Holidays affect the spot date in various ways:

|

Settle |

Click to access the Commodities Settlement page to define commodity settlement information. |

|

Attachments |

Click to view/ add attachments. See Installation Options - Multiple Attachments Page to define the maximum attachment upload limit for various products. |

Deal Copy |

Click to copy the existing deal by changing the date, amount and rate field values with the required new values. The Deal Copy Details secondary page displays fields based on the Instrument Type of the original deal. |

This example illustrates the fields and controls on the Deal Copy Details page.

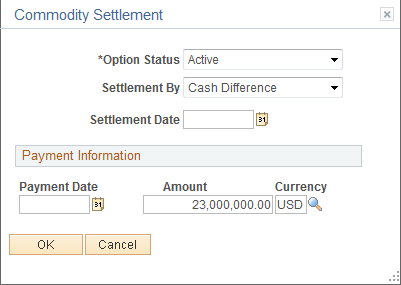

Use the Commodities Settlement page (TRX_COMO_STL) to set up the settlement of commodities.

Navigation:

Click the Settle button on the Deal Detail page for a commodity instrument deal.

This example illustrates the fields and controls on the Commodity Settlement page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Current Status |

Select the current status of the option. Values are:

|

Settlement by |

Values are:

|

Use the Deal Detail page (TRX_DETAIL_TR) to enter futures contract deal details.

Navigation:

This example illustrates the fields and controls on the Deal Detail page for futures deals (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for futures deals (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Buy or Sell |

Select whether the contract is a buy or sell contract. |

# of Contracts (number of contracts) |

Indicate the number of contracts that are held. |

Original Price |

Indicate the original price of the contract. |

Deal Copy |

Click to copy the existing deal by changing the date, amount and rate field values with the required new values. The Deal Copy Details secondary page displays fields based on the Instrument Type of the original deal. |

Note: Default display-only fields for futures contract information are defined on the instrument page.

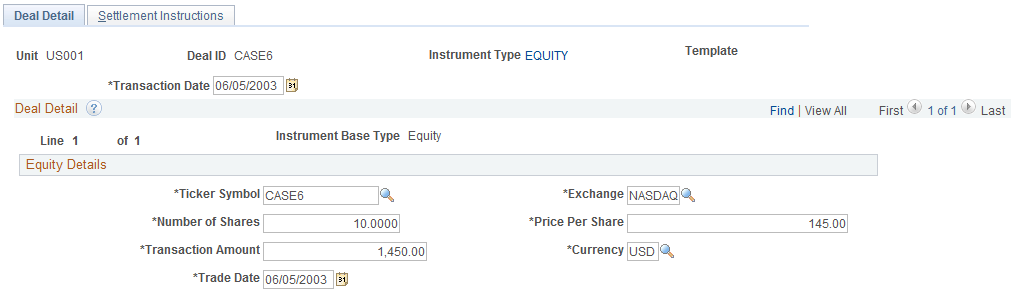

Use the Deal Detail page (TRX_DETAIL_TR) to enter equity instrument deal details.

Navigation:

This example illustrates the fields and controls on the Deal Detail page for equity deals. You can find definitions for the fields and controls later on this page.

Use this page to record a stock purchase transaction. For deals that involve selling stocks, use the Sale Details page that is accessible from the Sell link on the Equity Definition page.

Note: You must define the equity on the Equity Definition page before you can use it in a deal.

Field or Control |

Description |

|---|---|

Ticker Symbol |

Enter the stock exchange symbol that is used in trading the particular shares or the corporation. |

Exchange |

Enter the market exchange with which the corporation is listed. |

Number of Shares |

Enter the number of shares that are being traded. |

Price per Share |

Enter the price of a single share of stock. |

Transaction Amount |

Enter the monetary total of the transaction based on the number of shares that are being sold multiplied by the price per share. |

Currency |

Select the currency that is used by the country that is associated with the market exchange, entered in the Exchange field, on which the equity is traded. |

Trade Date |

Enter the date of stock purchase. |

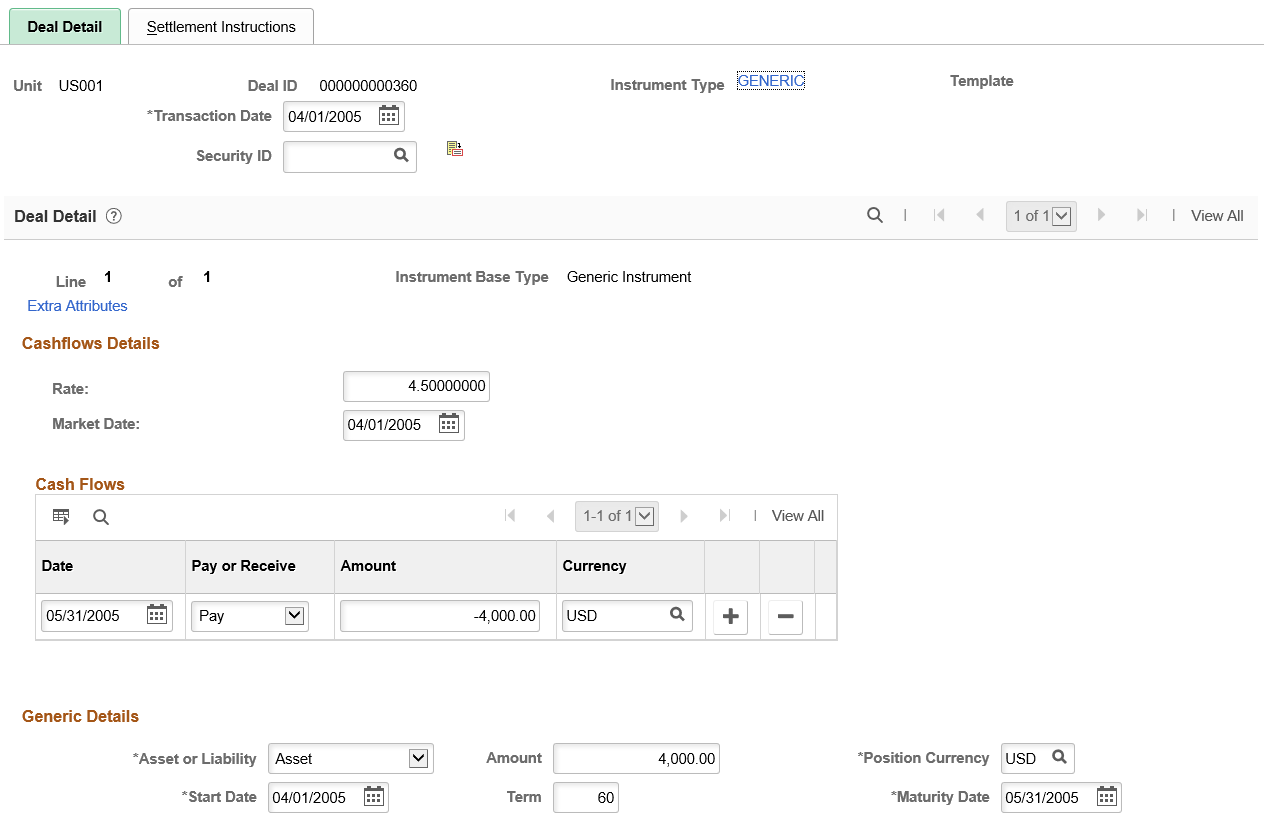

Use the Deal Detail page (TRX_DETAIL_TR) to enter generic deal details.

Navigation:

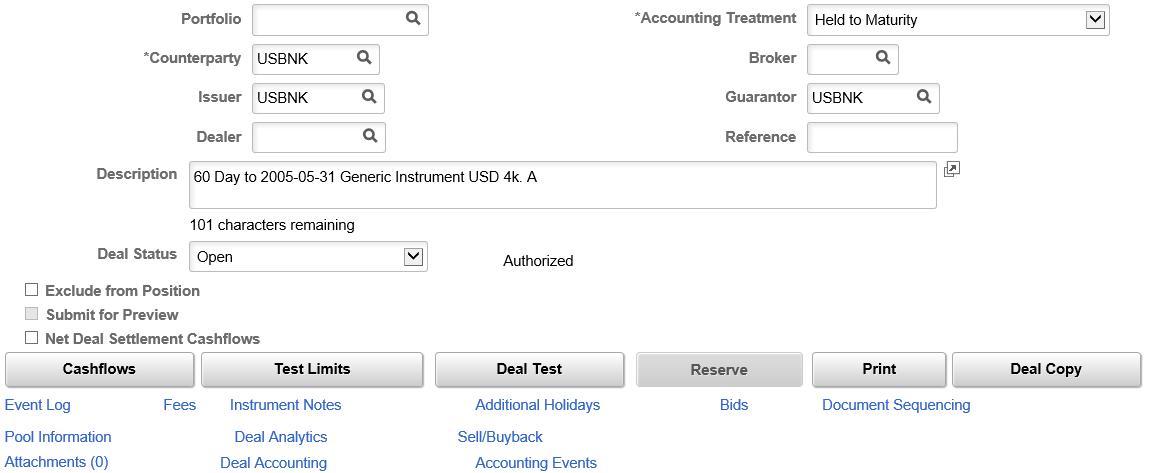

This example illustrates the fields and controls on the Deal Detail page for generic deals (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for generic deals (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Pay or Receive |

Specify whether the cash-flow line value is to be paid or received. |

Asset or Liability |

Indicate whether you are capturing data on an asset or liability. |

Term |

The term is the number of days between the specified start and maturity dates. If you enter a start date and term, the system calculates the maturity date. If you enter a start date and maturity date, the system calculates the term. |

Deal Copy |

Click to copy the existing deal by changing the date, amount and rate field values with the required new values. The Deal Copy Details secondary page displays fields based on the Instrument Type of the original deal. |

Use the Deal Detail page (TRX_DETAIL_TR) to enter option and option - binary payoff deal details.

Navigation:

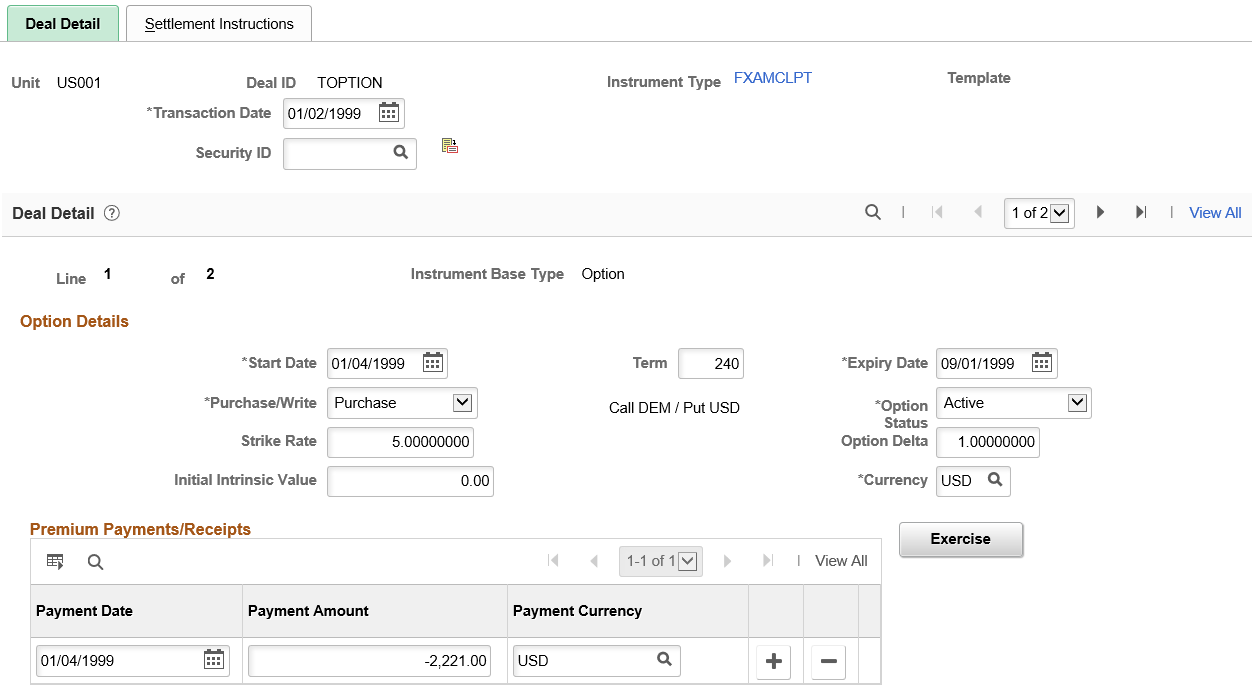

This example illustrates the fields and controls on the Deal Detail page for an option (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for an option (2 of 2). You can find definitions for the fields and controls later on this page.

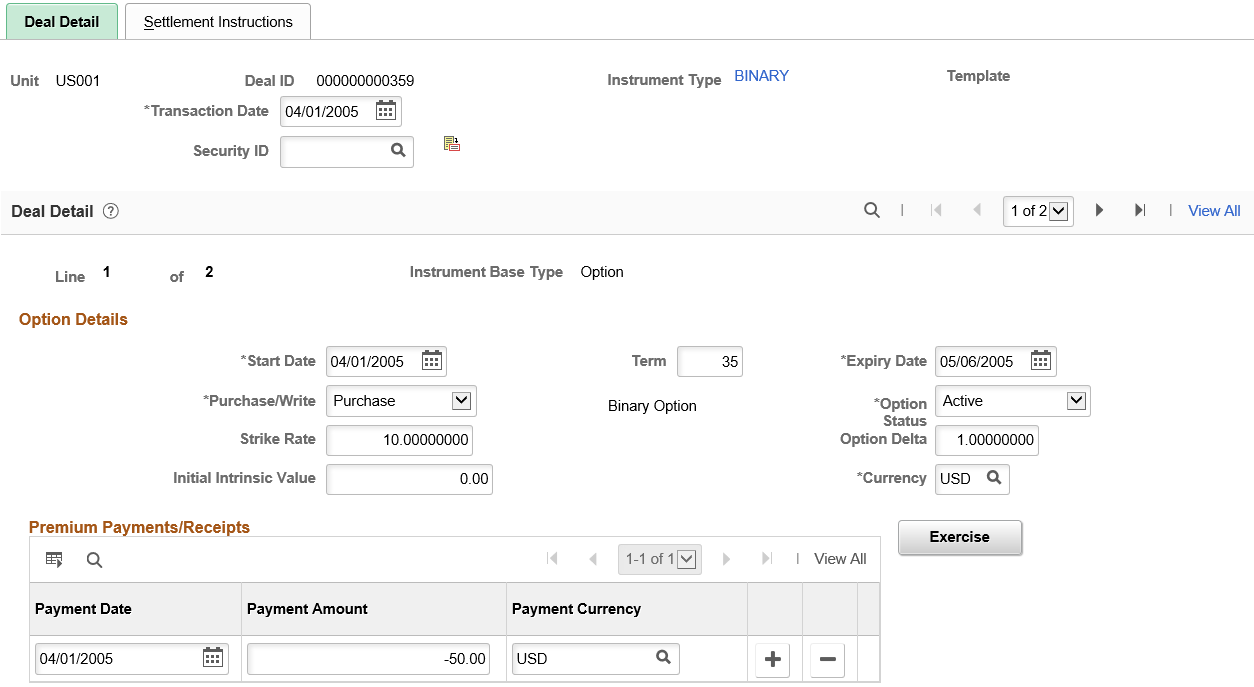

This example illustrates the fields and controls on the Deal Detail page for options with binary payoff (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for options with binary payoff (2 of 2). You can find definitions for the fields and controls later on this page.

Note: This section discusses deal details for both options and options - binary payoff. The application pages for these deals are identical, exception for the second line of Option Details. In the preceding example, Details Line 1 of 2 is an option, and line 2 of 2 is an option - binary payoff.

Option Barriers

Field or Control |

Description |

|---|---|

Barrier |

You can define none, single, or double barriers. If the option has a single barrier, a single row exists with the Barrier field set to 1. If the option has double barriers, two rows exist, the first row with the Barrier field set to 1 and the second set to 2. |

Period Start and Period End |

Enter the specified date range for the barriers by entering dates in these boxes. Often, the period start date is the same as the option start date on the Deal Detail page, and the period end date is the same as the option expiry date on the Deal Detail page. |

Barrier Type |

Select the type of barrier. Possible values are: Up and In: The option that is currently inactive. If the underlying price exceeds the barrier, the option becomes active, and the payoff equals the payoff of a standard option. Up and Out: The option that is currently active with a payoff that is identical to a standard option. If the underlying price exceeds the barrier, the option becomes inactive and worthless. Down and Out: The option that is currently active with a payoff that is identical to a standard option. If the underlying price falls below the barrier, the option becomes inactive and worthless. Down and In: The option that is currently inactive. If the underlying price falls below the barrier, the option becomes active, and the payoff equals the payoff of a standard option. |

Barrier Level |

Enter the barrier breach rate. |

Breached |

If, during the life of the option, one of the barriers is breached, select this check box to indicate a breached barrier. This causes the current date to be the default value in the Breach Date field. Adjust the date to reflect the date on which the breach occurred. |

Rebate Paid When |

If you pay a rebate, select from the following values:

|

Rebate Amount |

Enter the rebate amount. If the option barrier does not pay a rebate, select No Rebate Paid. |

Interest Date Rule

Field or Control |

Description |

|---|---|

Purchase/Write |

Values are: Purchase: Select if you are purchasing the option; this means that you pay premiums. Write: Select if you are selling the option; this means that you receive premiums. |

Option Status |

Select the status of the options. Values are: Inactive: The option is ineligible for exercise due to an Up and Out or Down and Out option barrier breach or cancellation. Options with Down and In or Up and In barriers start with Inactive selected in the Option Status field. If the option breaches the barrier, then the current option status becomes Active. Active: The option is eligible for exercise. Options with Down and Out or Up and Out barriers start with Active selected in the Current Option Status field. If the option breaches the barrier, then the current option status becomes Inactive. Exercised: The option is exercised. Expired: The option exceeded its expiry date and is no longer eligible for exercise. See Defining Option and Option - Binary Payoff Deal Details. |

Strike Rate |

Enter the rate at which the stock or commodity that underlies a put or call option can be purchased (call) or sold (put) over the period that is specified by the start and expiry dates. |

Option Delta |

Enter the absolute value, a number between 0.00 and 1.00, of the option delta. Do not enter a negative value for a put option. |

Initial Intrinsic Value |

Enter the difference between the strike price of an option and the market value of the underlying security. A purchased option that is in the money has a nonzero, positive intrinsic value. A written option that is in the money has a nonzero, negative intrinsic value. An option that is purchased (or written) that is out of the money has zero intrinsic value. |

Start Date |

Enter the first date that an option is eligible for exercise (for American or Bermudan options), and the first date on which accrual on the option premium begins. |

Expiry Date |

Enter the last day that an option is eligible for exercise or conversion into the underlying common stock. You can enter a value, or the system calculates the expiry date based on the term that you enter. |

Term |

Enter a value to establish the contractual period for the option agreement. |

Exercise Dates |

This link is available if the exercise type on the Instrument Detail page is Bermudan, or if the Strike Rate Varies Over Time check box is selected on the Instrument Detail page. If the option has a European exercise type, then the option can be exercised only on the expiry date. If the option has an American exercise type, then the option exercise can occur on any date between the start and expiry dates. |

Enter the appropriate period start and expiry dates and a valid value in the Strike Rate field. To enter a one-day period, set the period end date equal to the period start date.

Premium Payment/Receipts

Field or Control |

Description |

|---|---|

Payment Date |

Enter a date for the premium payment. |

Payment Amount |

Enter an amount for the premium payment. |

Use the Settle Option by Cash Difference page (TRX_OPT_EXRCS_CASH) to exercise an option or update or change the exercise status for an option.

Navigation:

Click the Exercise button on the Deal Detail page for an options deal.

This example illustrates the fields and controls on the Settle Option by Cash Difference page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Current Option Status |

Select the status of the option. Values are: Active: The option is eligible for exercise. Exercised: The option is exercised. Expired: The option exceeded its expiry date. It is no longer eligible for exercise. Inactive: The option is ineligible for exercise due to an Up and Out or Down and Out option barrier breach or cancellation. |

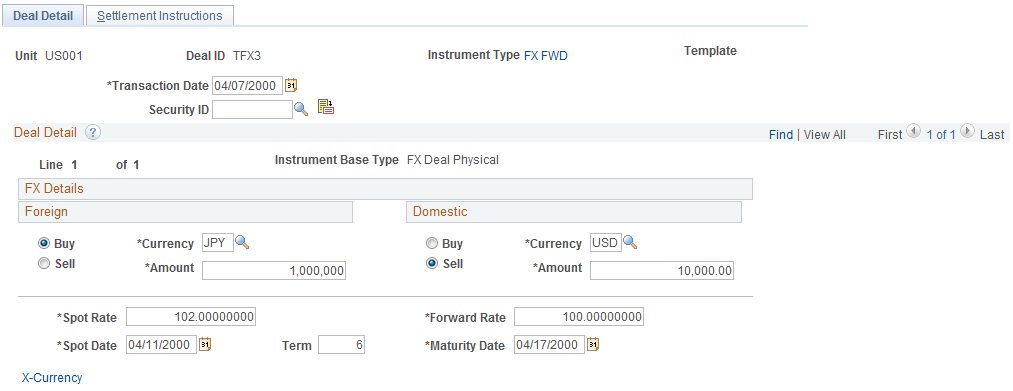

Use the Deal Detail page (TRX_DETAIL_TR) to enter deal details for foreign exchange physical deals.

Navigation:

This example illustrates the fields and controls on the Deal Detail page for FX physical deals. You can find definitions for the fields and controls later on this page.

Note: An FX physical deal has a buy side and sell side. When you select the Buy or Sell option for one currency, the system selects the corresponding value for the other currency. If you are entering a cross-currency deal, change the domestic currency field to a foreign currency. The system changes the label for that region to Foreign. Enter the monetary amount of the traded currency. When you enter the amount and rate for one currency, the system calculates the other amount and rate.

Field or Control |

Description |

|---|---|

Spot Rate |

Enter the spot rate for the deal. |

Spot Date |

Enter the spot date. The default value is two working days after the current date, but you can override this value. |

Term |

Enter the term of the deal. If you enter a spot date and a maturity date, the system calculates the value in this field. If you enter a value in this field, then the system calculates the maturity date by adding the term to the spot date. |

Forward Rate |

Specify the contracted forward rate for this deal. You can enter the quoted rate, or the system calculates the rate based on the data that you enter in the Amount fields. |

Swap Cash |

Click to access the Roll Specific Details - Swap FX page to specify information that is required to swap this foreign exchange forward or backward. |

Use the Roll Specific Details - Swap FX page (TRX_ROLL_PHYS_SP) to enter information that is required to swap this foreign exchange deal forward or backward.

Navigation:

Click the Swap Cash link on the Deal Detail page for an FX deal physical.

To enter the roll details for a foreign exchange swap:

Specify to swap the foreign exchange at the historic rate or the current rate in the FX Swap at region.

Enter the spot and forward rates.

From these values, the system calculates the points.

Click OK.

Use the Deal Detail page (TRX_DETAIL_TR) to specify IRP deal details.

Navigation:

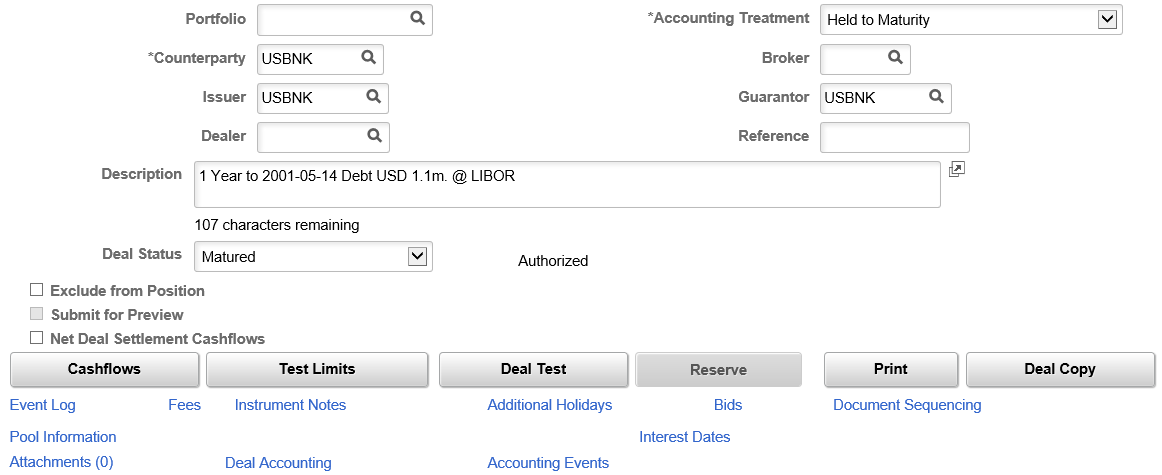

This example illustrates the fields and controls on the Deal Detail page for IRP deals (1 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for IRP deals (2 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for IRP deals (3 of 3). You can find definitions for the fields and controls later on this page.

Many of the deals that you enter into are IRP deals—for example, loans, bonds, and deposits—that represent actual payments of principal and interest that occur in generally predictable amounts at fixed points in time.

Field or Control |

Description |

|---|---|

Settlement Date |

The system populates this field with a date after the specified transaction date. The value in the Time to Settlement field on the instrument determines the number of days after the transaction date. You can edit this field. |

Issue Date |

Displays the first day that an IRP deal begins accruing interest. The value of this field by default becomes the settlement date for both investments and debt. This value can be overwritten for investments. |

Classification |

Identifies whether the instrument is for Debt raising or an Investment. This is determined on the Instrument Detail page. If you select Investment, you can complete the Issuer and Guarantor fields on the Deal Detail page. |

Issuer and Guarantor |

These fields are active only if the following conditions are met:

|

Par Amount |

This is the amount that is paid or received when the IRP matures. For Debt, the settlement amount is the amount that is borrowed on the settlement date. For Investment, the settlement amount is the amount that is invested on the settlement date. If the amount of the deal is amortized, the amortization conditions must be defined. See Defining Amortization Functionality for IRP and IR Swap Deals. |

Price % (percent) of Par |

The system uses the values in the Par Amount and Settlement Amount fields to calculate the displayed value. |

Settlement Amount |

If this deal is a Debt, the settlement amount is the amount that is borrowed on the settlement date. If this deal is an Investment, the settlement amount is the amount that is invested on the settlement date. |

Purchased Interest |

Displays the accrued interest as calculated from the interest-period start date to the maturity date. |

Discount/Premium |

This field is available when the Interest Calculation field is set to Interest Bearing. It dictates how to account for and treat any discount or premium that is associated with an interest rate physical. Select whether you use a straightline or constant yield method to amortize the bond's discount (or premium). This also affects the calculation method for calculating interest accruals. Values are: None (blank): The discount amount is added to the interest amount (or the premium is deducted), and that total is accounted for by using the Treasury accounting event Interest Accrual. Constant Yield Method: The discount (or premium) amount is separately amortized (accounted for) using the Discount Accrual accounting event. The discount amount (or premium) that is amortized in each period is set so that the sum of the amortization amount plus the interest that is accrued provides a constant rate of interest (yield) when applied to the amount outstanding at the beginning of a period. Straightline Method: The discount (or premium) amount is separately amortized (accounted for) using the Discount Accrual accounting event. The discount amount (or premium) that is amortized in each period is set so that the total amortized portion equals the total amount of the discount (or premium) divided by the total life of the deal (term) in days, multiplied by the number of days that the deal is outstanding (by using 30/360-day counts if appropriate). See Accounting Events. |

Yield |

Enter the annual rate of return on the investment, expressed as a percentage. This field is calculated for interest bearing IRPs. |

Initial Reset Rate |

This field appears only for floating-rate deals. When you enter a rate in the Rate field the system updates the Initial Reset Rate value, inclusive of the index margin, after you run cash flows. The system stores and displays it here for the life of the deal. You cannot edit this field. |

Estimated Maturity Date |

This field appears only for interest-bearing debt instruments. Use this field to amortize the discount or premium to a different schedule based on an estimated maturity date. For fixed-rate deals that use the straightline discount or premium method, enter the estimated maturity date and click the Cash Flows button. The system builds a table containing two sets of information. The first set is the payment schedule and contains information regarding cash flows, positions, and accounting events data for both the maturity date and estimated maturity date. The second set contains information that is segregated by source code. When the accounting module calculates discount accrual for an estimated maturity date, it uses information from the estimated maturity date side of the table. |

Next Interest Payment |

Specify whether the next interest payment is:

|

Deal Copy |

Click to copy the existing deal by changing the date, amount and rate field values with the required new values. The Deal Copy Details secondary page displays fields based on the Instrument Type of the original deal. |

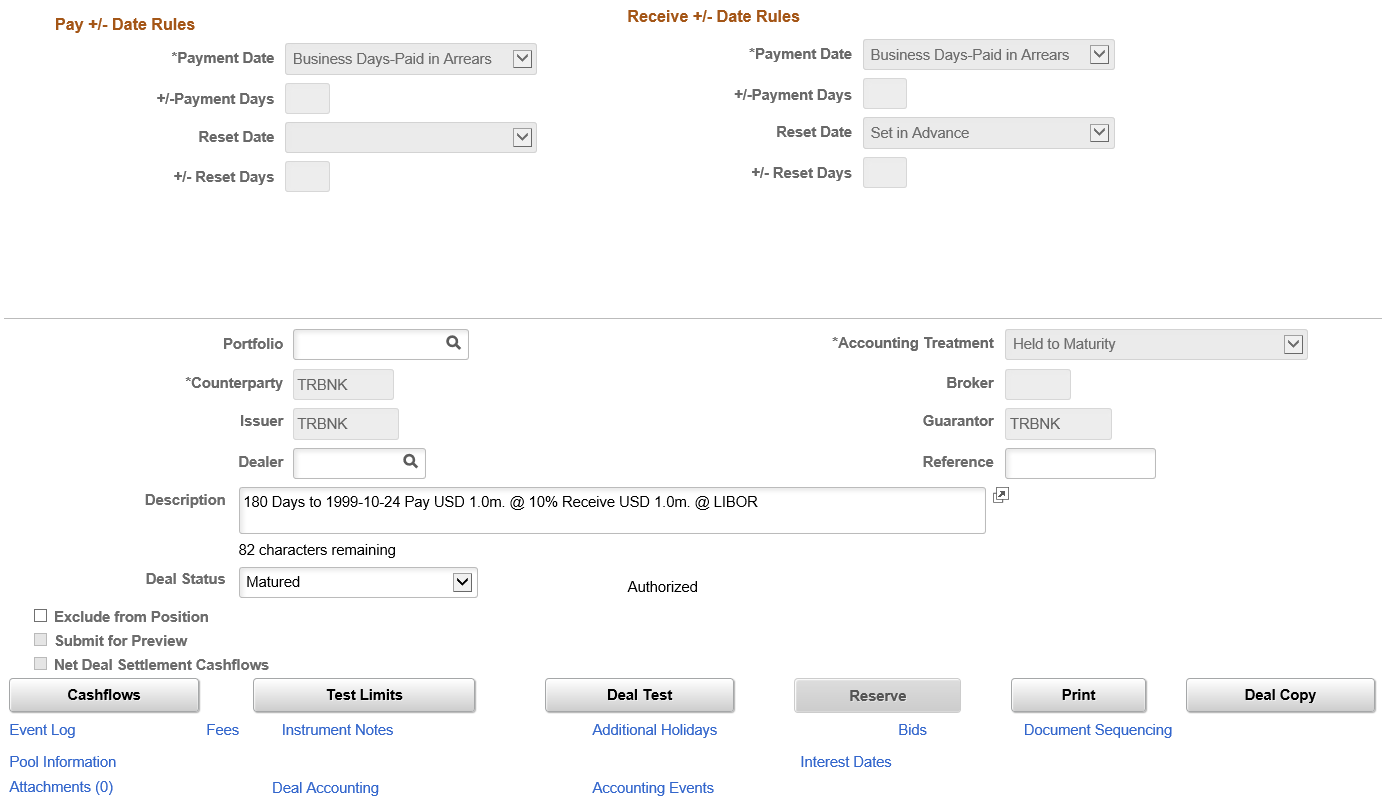

Use the Deal Detail page (TRX_DETAIL_TR) to define IR swap deal details.

Navigation:

This example illustrates the fields and controls on the Deal Detail page for IR swap deals (1 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for IR swap deals (2 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deal Detail page for IR swap deals (3 of 3). You can find definitions for the fields and controls later on this page.

Note: In addition to all other IR swap instruments that you define, you should define two instruments to handle IR swap, cash-flow, and processing scenarios. Associate each instrument with its respective preconfigured accounting template.

Also, IR swap fields exist for both the Pay and Receive regions, but they are described only once in this section. The PeopleSoft system requires data entry for both sets of fields.

Field or Control |

Description |

|---|---|

Amount |

Enter the monetary amounts for this instrument. These amounts are the principal amounts that the system uses to calculate interest payments for an interest rate swap. |

Term |

If you entered the commencement and maturity dates, the system calculates the term. If you enter a term value, then the system calculates the maturity date by adding the term to the commencement date. |

Swap Principals |

Select an option to exchange principal amounts on the commencement date of the swap and on the maturity date. Specify Don't Swap, At Commencement, At Commencement and Maturity, or At Maturity. |

Amort Method (amortization method) |

Select to indicate how the deal is amortized. See Defining Amortization Functionality for IRP and IR Swap Deals. Note: Defining deal amortization is an optional step, depending on certain deal conditions. As such, establishing deal amortization is discussed in a separate section. However, it is a part of setting up deal detail information. When you have entered deal amortization information, you should continue capturing the deal by entering settlement instructions. |

Deal Copy |

Click to copy the existing deal by changing the date, amount and rate field values with the required new values. The Deal Copy Details secondary page displays fields based on the Instrument Type of the original deal. |