Setting Up Agreements

To set up agreements, use the Define Agreement component (WP_AGREEMENT). This section lists prerequisites, common elements, and discusses how to define agreement, calculations, investment methods, details and company investment details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WP_AGREEMENT_TBL |

Define basic details of the agreement, such as agreement type, status, scope, and agreement duration. You can also attach the agreement document to the agreement from this page. |

|

|

WP_AGRT_COMP_TBL |

Define how the global fund is calculated and distributed to employees at the end of a reference period. |

|

|

WP_AGRT_INVEST_TBL |

Define the investment methods for the agreement. |

|

|

WP_AGRT_INVES3_SEC |

Enter the interest rate paid on the company investment. |

|

|

Bond, FCP, or SICAV |

WP_AGRT_INVES2_SEC |

Specify the ISIN number for the investment and the financial organization that manages the global fund. |

|

WP_AGRT_INVES4_SEC |

Enter the name and address of the financial organization that manages the investment. |

|

|

WP_AGRT_INVES1_SEC |

Enter details of the company stock ticker symbol and the financial organization name and address. |

Before you can set up agreements you must define the following:

Variables and formulas for global fund calculations.

(Optional) Agreement groups if your agreement is for a group of companies or establishments.

Field or Control |

Description |

|---|---|

ISIN Code (International Securities Identification Number code) |

Enter the number for the FCP (Fond Commun de Placement) or SICAV (Société d'Investissement à Capital Variable) investments. |

Financial Organization |

Enter the name of the company that manages the investment of the global funds. Enter the company's address in the Financial Organization Address field. |

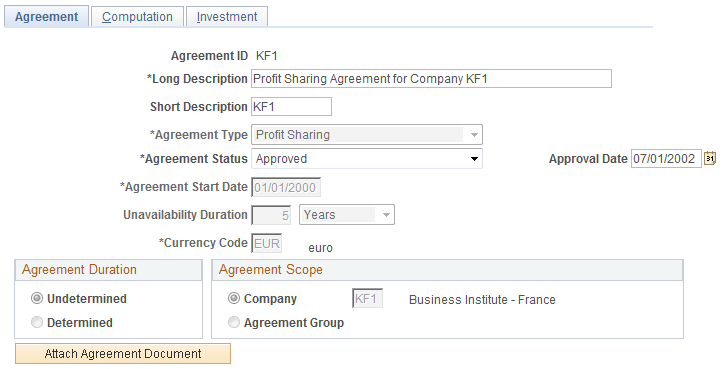

Use the Agreement page (WP_AGREEMENT_TBL) to define basic details of the agreement, such as agreement type, status, scope, and agreement duration.

You can also attach the agreement document to the agreement from this page.

Navigation:

This example illustrates the fields and controls on the Agreement page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Agreement Type |

Select Profit Sharing or Worker's Participation. The system hides or displays fields depending on the agreement type you select. |

Agreement Status |

Select a status. Values are: Construction in Progress: Denotes an agreement that is under discussion and not yet agreed. Employees can't view details of agreements with this status. Approved: Denotes an agreement that has been signed by all relevant organizations. Employees can view and adjust details of agreements with an Approved status. On Hold: Denotes an agreement that has been started but is not in use. Use this status if, for example, an agreement is rejected by an organization that is involved in the discussion process. Employees can't view details of agreements with this status. |

Approval Date |

Enter the date when the agreement was signed. Normally, agreement approved within one year of the reference period end date. If this date is passed, legal requirements can affect the definition of some fields in the agreement. The system checks the Approval Date and issues a warning message if it is more than a year after the reference period end date. However, the system does not change the agreement definition. Update the agreement, if necessary, to meet the legal requirements. This field appears only if you select Approved in the Agreement Status field. |

Unavailability Duration |

Enter the number of days, months, or years after the reference period end date that profit sharing funds are unavailable to employees. This field determines the availability and payment date for funds. This field appears only if you select Profit Sharing in the Agreement Type field. |

Agreement Start Date |

Enter the date when the agreement is effective. |

Agreement End Date |

Enter the date on which the agreement expires. This field appears only if you select Determined in the Agreement Durationgroup box. |

Attach Agreement Document |

Click to attach the agreement document to the agreement. The system displays a search page on which you enter the document path and file name or browse for the document. When the agreement is approved, employees can view the attachment online. |

Agreement Duration

Complete this group box for profit-sharing agreements only. For worker's participation agreements the duration is set to Determined by the system and can't be changed.

Field or Control |

Description |

|---|---|

Undetermined |

Select if the agreement duration is not fixed. |

Determined |

Select if the agreement is valid for a fixed period. |

Agreement Scope

Field or Control |

Description |

|---|---|

Company |

Select if the agreement applies to a single company. Select the company name from the available options. |

Agreement Group |

Select if the agreement applies to a group of companies or establishments and select the Agreement Group. Define agreement groups before you set up the agreement. |

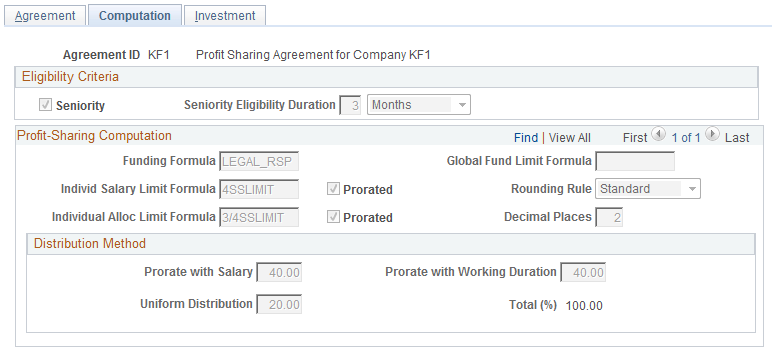

Use the Computation page (WP_AGRT_COMP_TBL) to define how the global fund is calculated and distributed to employees at the end of a reference period.

Navigation:

This example illustrates the fields and controls on the Computation page. You can find definitions for the fields and controls later on this page.

Eligibility Criteria

Field or Control |

Description |

|---|---|

Seniority |

Select this check box if employee eligibility is determined by length of service. If the check box is not selected, anyone employed by the companies and establishments defined on the Agreement page is eligible for profit sharing. |

Seniority Eligibility Duration |

Enter the minimum period that employees must be employed by the organization before they are eligible to share in the funding available. This field is available if you select the Seniority check box. |

Profit-Sharing Computation

Use this group box to define the formulas that are used to calculate the funding and distribution for the agreement. Define formulas on the Agreement Formulas page.

Field or Control |

Description |

|---|---|

Computation Level |

For profit-sharing agreements Computation Level doesn't appear because formulas and distribution methods are always defined at the agreement level. Select a value for worker's participation agreements. Values are: Agreement Level: Indicates that the formulas and distribution method apply to all establishments and employees covered by the agreement. The Agreement Scope group box on the Agreement page defines the companies and establishments covered by the agreement. You must define formulas at the Agreement Level in addition to any establishment or work unit level calculations. This provides default formulas for employees who don't belong to any establishments or work units specified in this group box. Establishment Level: Enables you to define different formulas and distribution methods for each establishment. Formulas defined at this level apply to employees within the establishment only. Select the establishment from the available options. Work Unit Level: Enables you to define different formulas and distribution methods for groups of employees. Formulas defined at this level apply to employees within the work unit only. Use the group build functionality to define work units. |

Funding Formula |

Select the formula that calculates the global fund amount. The legal formula delivered by PeopleSoft, LEGAL_RSP, is for profit-sharing agreements. Note: For profit-sharing agreements if you don't use the LEGAL_RSP formula, make sure that your organization's formula does not produce a result that is less than that of the legal formula. |

Global Fund Limit Formula |

Select the formula that defines the global fund limit. The Compute Global Fund process uses this formula to limit the global fund amount. PeopleSoft delivers the following statutory formulas: LEGAL_MAX1, LEGAL_MAX2, LEGAL_MAX3, and LEGAL_MAX4: These formulas may be useful for profit-sharing agreements, if you haven't selected the legal formula LEGAL_RSP in the Funding Formula field. If the global fund calculated using the Funding Formula exceeds the maximum defined by the Global Fund Limit Formula, the process reduces the global fund to the maximum. KF20PCTMS: This formula may be used for worker's participation agreements. |

Individ. Salary Limit Formula (individual salary limit formula) |

Select the formula that defines the maximum salary amount used in the distribution calculation. Some distribution calculations use employees' salaries to determine their share of the funding. Use this field to force a limit on the salary amount used in the calculation. Select the Prorate check box if you want to prorate the limit for employees who did not work for the whole reference period. For example, if the limit is 20,000 EUR and an employee worked only half of the reference period, if you select Prorate, the limit applied to the employee's salary is 10,000 EUR. |

Individual Alloc Limit Formula (individual allocation limit formula) |

Select the formula that defines the maximum amount that each employee receives from profit sharing. For example, if the system calculates that an employee's allocation is 2000 EUR, but this formula sets the limit to 1500 EUR, then the employee will receive 1500 EUR. Select the Prorate check box if you want to prorate the limit for employees who did not work for the whole reference period. |

Rounding Rule |

Select a rounding rule if you want the system to round employees' profit-sharing amount, deductions, and interest. The system rounds both gross and net amounts. Values are: Standard: Rounds the results up or down. For example, if you specify 2 in the Decimal Places field, the result is rounded up if the digit in the third decimal place is 5 or more and it is rounded down if the digit is 4 or less. Therefore, 5154.525 is rounded to 5154.53 and 5154.523 is rounded to 5154.52. Up: Rounds the result up to the number of decimal places specified in Decimal Places field. Down: Rounds the result down to the number of decimal places specified in Decimal Places field. |

Decimal Places |

Enter the number of decimal places to which amounts are rounded. The system rounds the final amount only; all other intermediate calculations are not rounded. |

Distribution Method

This group box defines how the global fund is distributed. Enter percentages of up to 2 decimal places. If you are setting up a worker's participation agreement, you can define different distribution methods at the agreement, establishment, or work unit level.

You can divide the global fund between employees based on one or more of the criteria described below:

Field or Control |

Description |

|---|---|

Prorate with Salary |

Enter the percentage of employees' funds that are based on their salaries. This part of each employee's fund is calculated with the following formula: global fund x (employee

annual salary / total annual payroll)

For worker's participation agreements, the system uses the variable KFMS to determine the total annual payroll of all employees. This variable is also used by the Compute Global Fund process if you specify the KF20PCTMS formula as the global fund limit formula. If you want the formula and the process to be based on different totals, you must create a new global fund limit formula for your worker's participation agreement which doesn't reference the KFMS variable. |

Prorate with Working Duration |

Enter the percentage of employees' funds that are based on the number of days they worked during the reference period. This part of an employee's fund is calculated with the following formula: global fund x (employee

work days / total days in the reference period)

The number of employee work days excludes most unpaid absence. However, some unpaid absence days, including maternity leave are included in the work day count. |

Uniform Distribution |

Enter the percentage of employees' funds that are based on the number of eligible employees. This part of an employee's fund is calculated with the following formula: global fund / total

eligible employees

|

Total (%) (total percentage) |

Displays the total of all three distribution methods. Note: To save this page, the total must be 100 percent. |

You can use a mixture of all these methods to calculate the final profit share amount. Consider the following example:

|

Total fund |

10,000 EUR |

|

Total eligible employees |

10 |

|

Total payroll for reference period |

240,000 EUR |

|

Total days in reference period |

1000 |

|

Distribution Method: |

|

|

Prorate with Salary |

30% |

|

Prorate with Working Duration |

30% |

|

Uniform Distribution |

40% |

For an employee with an annual salary of 15000 EUR and 100 days worked, the employee's fund is calculated as follows:

Note: The example shown assumes that the salary does not exceed the individual salary limit and is not prorated.

|

Profit share based on employee salary: |

10000 * (15000 / 240000) * (30/100) = 187.5 |

|

Profit share based on days worked: |

10000 * (100 / 1000) * (30/100) = 300 |

|

Profit share based on eligible employees: |

(10000 / 10) * (40 / 100) = 400 |

|

Employee's Total Profit Share: |

187.5 + 300 + 400 |

Use the Investment page (WP_AGRT_INVEST_TBL) to define the investment methods for the agreement.

Navigation:

This example illustrates the fields and controls on the Investment page. You can find definitions for the fields and controls later on this page.

Proposed Investments

Field or Control |

Description |

|---|---|

Investment Method |

Select the investment methods available for the agreement type. Bonds: For profit-sharing agreements only. Company Investment: For profit-sharing agreements only. Company Savings Account (Plan Epargne Entreprise [PEE]). Company Stock: For profit-sharing agreements only. Employee's Bank Account: For worker's participation agreements only. Funds are transferred to the employee's bank account which is defined on the Bank Accounts page. FCP (Fond Commun de Placement): For profit-sharing agreements only. SICAV (Société d'Investissement à Capital Variable): For profit-sharing agreements only. Time Saving Account: For worker's participation agreements only. If an agreement has multiple investment methods, employees can select their investment method using the Agreement Personalization component or the Agreement Personalization self-service transaction. |

Details |

Click to access an investment detail page on which you enter details about the investment method. This button is hidden for some investment methods. |

Proposed by Default |

Select if the investment method is the default value. The default investment method is applied, unless an employee selects a different investment. |

Profit Sharing Surplus

A surplus may occur when some funds remain after the initial distribution is calculated, due to limit formulas being applied. Use this group box to specify how the system manages surplus amounts.

Field or Control |

Description |

|---|---|

Carryover |

Select to add the surplus to the global fund for the next reference period. This option is available for profit-sharing agreements only. View the surplus using the Review Reference Period component. |

Immediate Re-share |

Select if you want to distribute the surplus among the eligible employees for the current reference period. The system recalculates the employees' fund to include a share of the surplus. |

None |

Select to ignore any surplus. If you select this option, the system doesn't distribute the surplus nor carry the surplus over to the next reference period. This option is available for worker's participation agreements only. |

Interest Re-investment Option

This group box is for profit-sharing agreements with Company Investment selected as the investment method. Use it to specify how the interest earned on global funds is managed. Global funds accrue interest during the period that the funds are unavailable to employees. This period is defined on the Agreement page by the Unavailability Duration field.

Field or Control |

Description |

|---|---|

Immediate |

Select to pay interest to eligible employees. Interest is paid yearly on the first day of the fourth month after the end of the fiscal year. For example, for the reference period 2001, interest is calculated as of April 1, 2002 and paid on April 1, 2003, April 1, 2004, and so on until funds are released. |

Re-Invest |

Select to add the interest to the global fund. At the end of each interest period calculation, interest is added to the global fund. The next interest period calculation is based on this increased global fund. |

Note: Employees can change this setting, using the Agreement Personalization component or the Agreement Personalization self-service transaction, when the agreement status is Approved.

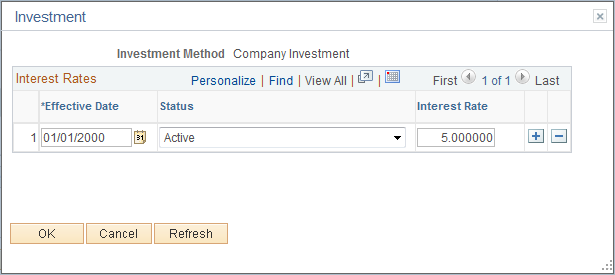

Use the Company Investment page (WP_AGRT_INVES3_SEC) to enter the interest rate paid on the company investment.

Navigation:

Click the Details button on the Investment page with Company Investment selected as the investment method.

This example illustrates the fields and controls on the Company Investment page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Interest Rate |

Enter the interest rate (percent) for the company investment. Interest rates are effective-dated so that you can track interest rate history. |

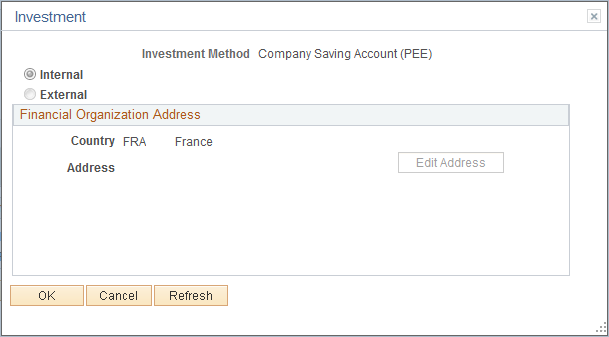

Use the Company Saving Account page (WP_AGRT_INVES4_SEC) to enter the name and address of the financial organization that manages the investment.

Navigation:

Click the Details button on the Investment page with Company Savings Account selected as the investment method.

This example illustrates the fields and controls on the Company Savings Account page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Internal |

Select if the company saving account is owned by your organization. |

External |

Select if the company savings account is managed by a different organization |

Edit Address |

Click this link to access the Edit Address page where you enter the address of the organization that manages the company saving account. The address information is included in the agreement profit sharing report and administrators use this information when transferring funds. |

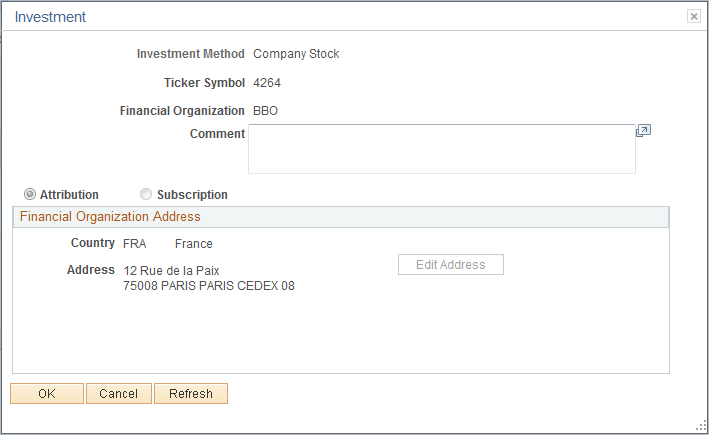

Use the Company Stock page (WP_AGRT_INVES1_SEC) to enter details of the company stock ticker symbol and the financial organization name and address.

Navigation:

Click the Details button on the Investment page with Company Stock selected as the investment method.

This example illustrates the fields and controls on the Company Stock page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Ticker Symbol |

Enter the symbol used for your company's stock. |

Attribution |

Select if employees receive company stock from the investment. |

Subscription |

Select if the investment provides employees with the right to buy company stock. |