Setting Up FAK_CAF Reports

This topic discusses how to set up FAK_CAF reports.

Global Payroll for Switzerland supports the legal FAK_CAF reporting requirements for all cantons. You may need to manage the following setup pages to adjust the reporting to your local requirements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_SI_PROVDR |

Define provider for the GE and VD cantons only. See also Generating and Managing Dashboard XML. |

|

|

GPCH_SI_COMPANY1 |

Use the FAK Default Pct check box to indicate whether contribution rates shall be taken from the system level or the company level. If FAK Default Pct check box is selected, then the contribution percentage comes from the system. |

|

|

GPCH_TX_FAK |

This page is maintained by Oracle. If there are no special conditions for your company, you might use the rates that are displayed. If the FAK Default Pct check box is selected on the Rates page, then the contribution percentage comes from this page. |

|

|

GPCH_TX_FAK_STAX |

Use this page to enter the FAK_CAF account assigned to your company by the FAK_CAF administration. If the FAK Default Pct check box is not selected on the Rates page, then the contribution percentages come from this page. If the language on the run control page is blank, you need to select languages for specific cantons on this page, especially if you run one report that contains several cantons with different languages. Supported languages include English, French, German and Italian. |

|

|

GP_PIN |

This page is used for informational purposes only. The standard setup should cover all your requirements. |

Use the Providers page (GPCH_SI_PROVDR) to define provider for the GE and VD cantons only (see also dashboard).

Navigation:

Set Up HCM, Product Related, Global Payroll & Absence Mgmt, Social Security/Insurance, Providers CHE

For information on defining insurance providers refer to the chapter on Managing Social Insurance for Switzerland.

Use the Rates page (GPCH_SI_COMPANY1) to use the FAK Default Pct check box to indicate whether contribution rates shall be taken from the system level or the company level.

If FAK Default Pct check box is selected, then the contribution percentage comes from the system.

Navigation:

For information on defining FAK default percentages, refer to the chapter on Managing Social Insurance for Switzerland.

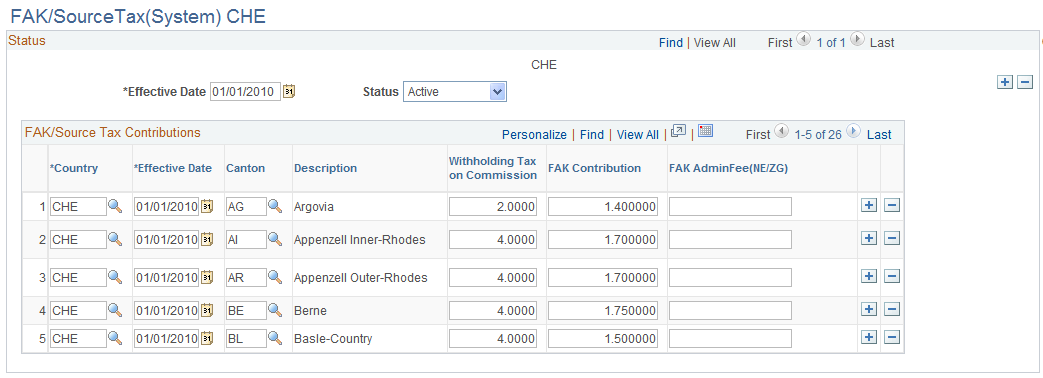

Use the FAK/Source Tax (System) CHE page (GPCH_TX_FAK) to this page is maintained by Oracle.

If there are no special conditions for your company, you might use the rates that are displayed. If the FAK Default Pct check box is selected on the Rates page, then the contribution percentage comes from this page.

Navigation:

FAK/Source Tax (System) CHE page

This table is maintained by Oracle. If there are no special conditions for your organization, you can use these rates. If the FAK Default Pct check box is selected on the Rates page, the system uses the contribution percentages entered here.

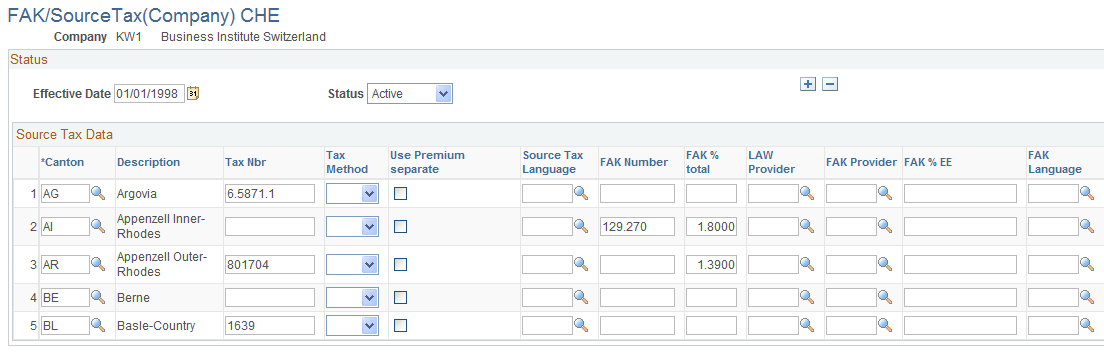

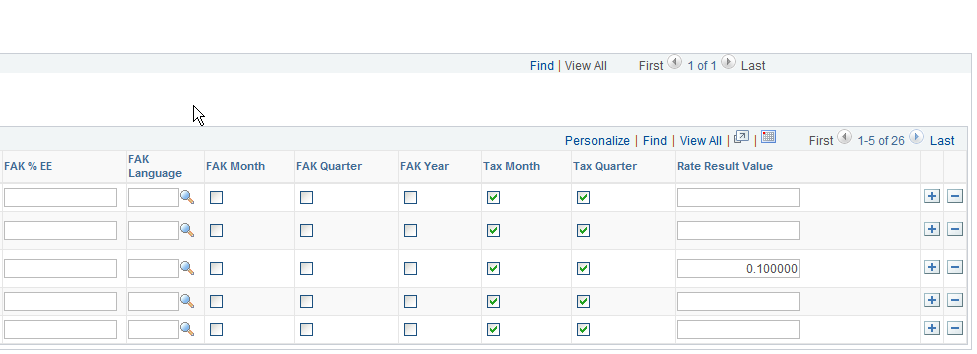

Use the FAK/Source Tax (Company) CHE page (GPCH_TX_FAK_STAX) to use this page to enter the FAK_CAF account assigned to your company by the FAK_CAF administration.

If the FAK Default Pct check box is not selected on the Rates page, then the contribution percentages come from this page. If the language on the run control page is blank, you need to select languages for specific cantons on this page, especially if you run one report that contains several cantons with different languages. Supported languages include English, French, German and Italian.

Navigation:

FAK/Source Tax (Company) CHE page (1 of 2)

FAK/Source Tax (Company) CHE page (2 of 2)

Field or Control |

Description |

|---|---|

FAK Nbr |

Enter the FAK_CAF account as assigned to your company by the FAK_CAF administration. |

FAK% Total |

If the FAK Default Pct is deselected on the Rates page, the system uses the contribution percentages entered here. |

FAK Language |

If you run one report for several canton with different languages, select the language for the canton. The system supports these languages: English, French, German and Italian. |

FAK Provider |

Assign FAK_CAF provider for cantons, where you want to create AK Banken and AK Versicherungen XML. This is the provider that gets mapped in Company Provider mapping. |

FAK Month, FAK Quarter, and FAK Year |

Not currently supported. |

Use the Accumulators page (GP_PIN) to this page is used for informational purposes only.

The standard setup should cover all your requirements.

Navigation:

Set Up HCM, Product Related, Global Payroll & Absence Mgmt, Elements, Supporting Elements, Accumulators

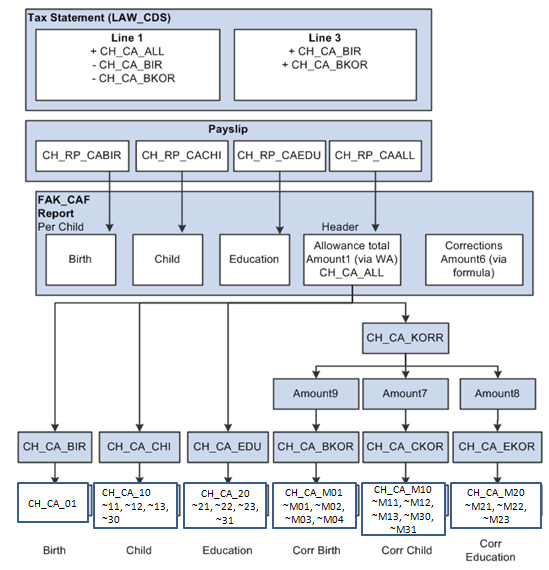

Here are the accumulators the system uses for the Tax Statement (LAW_CDS):

|

Line 1 |

Line 3 |

|---|---|

|

+ CH_CA_ALL - CH_CA_BIR - CH_CA_BKOR |

+ CH_CA_BIR + CH_CA_BKOR |

Here is a graphical representation of how information flows from the payslip to the FAK_CAF report:

Graphical representation of how information flows from the payslip to the FAK_CAF report

Note: Since child allowance reporting is controlled by existing accumulators, we do not expect that you will have to make changes to child allowance accumulators.

Use the steps below to generate the FAK_CAF interface files by dashboard (AKB and eAHV):

|

Step |

Action |

Navigation |

|---|---|---|

|

1 |

Create a new provider for FAK_CAF |

|

|

2 |

Add the new provider you created in step 1 to a company. |

|

|

3 |

Create a new domain for FAK_CAF AKB = FAK_CAF mode AKB eAHV = FAK_CAF mode eAHV |

This needs to be a domain with a single Provider Type FAK_CAF. This XML cannot coexist with any other Provider Type in same domain. |

|

AKB user needs to map required cantons in FAK/Source Tax(Company) CHE page |

|

|

|

4 |

Assign child data to employees. |

|

|

5 |

Run the payroll for the company. |

|

|

6 |

Prepare Dashboard for FAK_CAF domain. At the bottom of the Dashboard page (Prepare Files) make sure the monthly value appears in the drop-down menu list for the Report Period field. |

|

|

7 |

Click Run. Then check the Process Monitor to make sure the process runs to success. |

|

|

8 |

Validate the created file. |

|

|

9 |

Review validation results. |

|

|

10 |

Save file to a directory of your choice. |

See Also Robust File Management |

|

11 |

Upload file to AK Portal |