Maintaining Payee Tax Information

To maintain payee tax information, use the Maintain Tax Profile USA (GPUS_EE_TAX), Maintain Tax Data USA (GPUS_EE_FWT), and W-4 Tax Information USA (GPUS_W4_DATA) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_EE_TAX |

Create and maintain payee tax profiles. |

|

|

GPUS_FWT_EE |

Maintain federal tax information for individual payees. |

|

|

GPUS_SWT_EE |

Maintain state tax information for individual payees. |

|

|

Arizona Withholding Update USA Page |

GPUS_AZ_WHLD_UPD |

Run the Arizona Withholding Update Application Engine (GPUS_AZ_WHLD) process. For payees with Arizona SWT data, this process updates the Arizona percentage of federal withholding based on the current state-defined values. |

|

GPUS_W4_DATA |

Maintain W-4 tax information. |

|

|

W-4P Employee's Withholding Certificate for Periodic Pension or Annuity Payments Page |

GPUS_W4_DATA |

Maintain W-4P tax information. |

|

Submit Confirmation Page |

EO_SUBMIT_CONFIRM |

Confirm changes to W-4 tax information. |

|

URL_TABLE |

Maintain the URLs for links that access official tax forms on third-party servers. |

Global Payroll for United States supports these Form W-4 versions:

W-4 - 2020 or Later: For payees who are either hired, or wish to make withholding adjustments on or after January 1, 2020.

With Form W-4 (2020), allowances are no longer used to calculate federal income tax withholding.

W-4P - 2022 or Later: For payees (with the 1099-R tax report type selected on the Maintain Tax Profile USA Page) who are either hired, or wish to make withholding adjustments on or after January 1, 2022.

With Form W-4P (2022), Withholding Certificate for Periodic Pension or Annuity Payments, allowances are no longer used to calculate federal income tax withholding.

For payments made on or after January 1, 2022, payees should complete Form W-4P in order to have the correct amount of federal tax from periodic pension, annuity, profit-sharing and stock bonus plan, or individual retirement arrangement (IRA) payments.

W-4 - 2019 or Earlier: For payees who completed Form W-4 before year 2020 and do not wish to make changes.

When adding or updating tax data for a payee, it is very important to select the right Form W-4 version and fill out the rest of the W-4 tax information on the Federal Tax Data Page based on the Form W-4 that the payee filed or has on file, so the federal income tax withholding will be withheld correctly.

Note: The method used to calculate the federal income tax withholding is determined by the form version, and not necessarily by the effective date of the Employee Tax Data record. For example, the payee may have submitted an updated state withholding form without submitting a new Form W-4 for 2020 (or Form W-4P for 2022). This would add a new effective-dated row to Employee Tax Data in 2022, but federal tax will still be calculated using the old formula because the current federal form version has not changed, which is W-4 - 2019 or Earlier.

Example: Updating Federal and State Tax Data Effective 01/01/2022 or Later

In this example, a payee requests an update to the federal and state tax data, effective 01/01/2022. The payee is currently set up with federal form version W-4 - 2019 or Earlier.

To update the tax data for this payee, insert a new row effective 01/01/2022. In this row, change the federal form version to W-4 - 2020 or Later. Complete the other fields as indicated on the Form W-4 2020. Make the changes to the state tax page as needed.

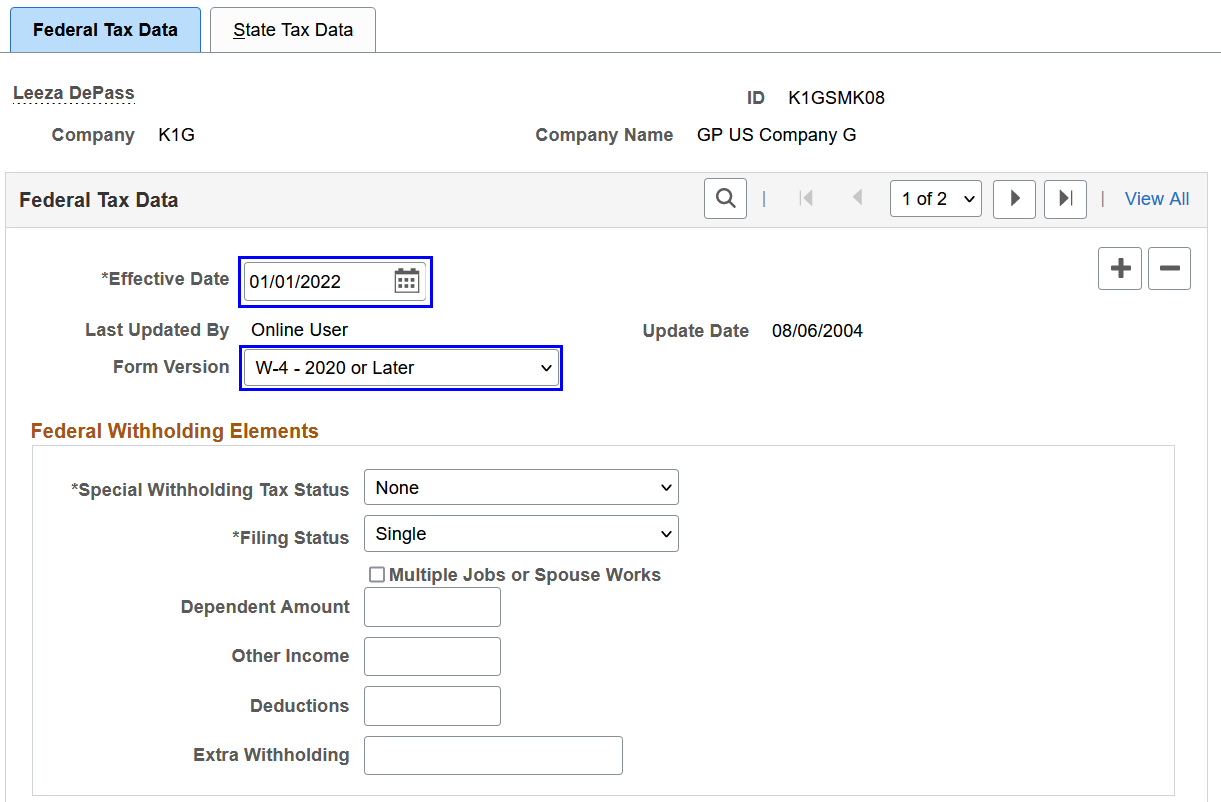

This example displays the new Form W-4 version selection when updating the federal and state tax data for a payee on or after January 1, 2020 (January 1, 2022 in this example) on the Federal Tax Data page.

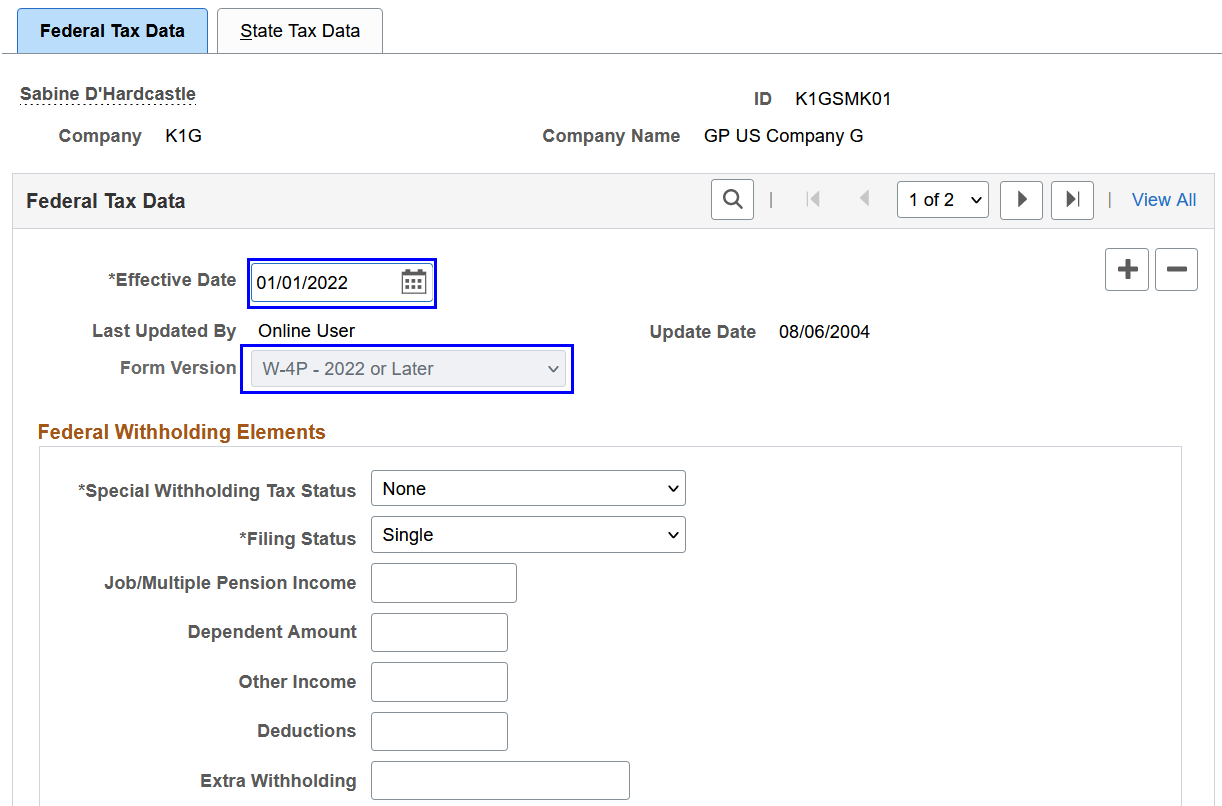

In this example, a payee with the 1099-R tax reporting type requests an update to the federal and state tax data, effective 01/01/2022. The payee is currently set up with federal form version W-4 - 2019 or Earlier.

To update the tax data for this payee, insert a new row effective 01/01/2022. In this row, the federal form version is set to W-4P - 2022 or Later automatically, which is the only applicable value. Complete the other fields as indicated on the Form W-4P 2022. Make the changes to the state tax page as needed.

This example displays the new Form W-4 version selection when updating the federal and state tax data for a payee on or after January 1, 2022 on the Federal Tax Data page.

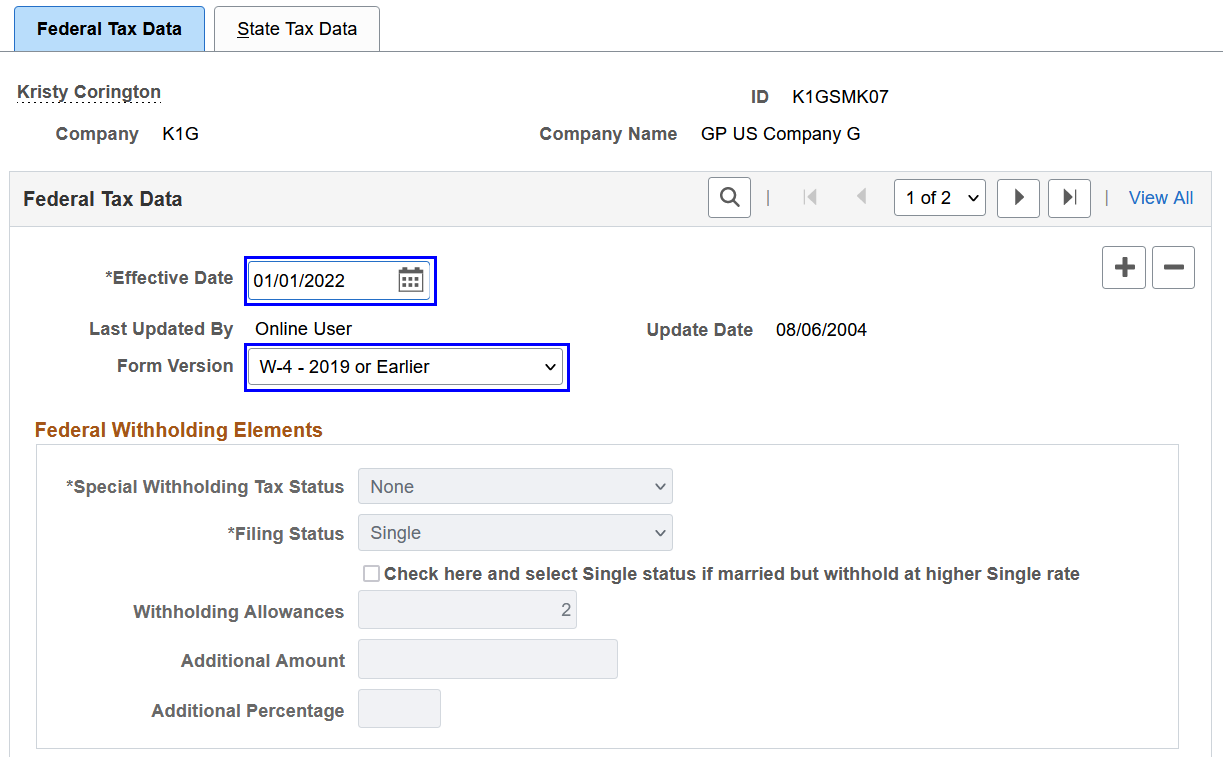

Example: Updating State Tax Data Effective 01/01/2020 or Later

In this example, a payee requests an update of the state allowances, effective 01/01/2022. The payee did not submit a Form W-4 2020, therefore; there are no changes to the Federal Tax Data page.

To update the tax data for this payee, insert a new row effective 01/01/2022. In this row, make the changes on the State Tax Data page as needed. Do not make any changes on the Federal Tax Data page.

Note: If you change the W-4 version from W-4 - 2019 or Earlier to W-4 - 2020 or Later, the calculation of the federal taxes is changed inadvertently. The federal taxes will be calculated on the Form W-4 2020 elections, which is not valid in this scenario.

This example displays the unchanged Form W-4 version selection when updating state tax data on or after January 1, 2020 (January 1, 2022 in this example) on the Federal Tax Data page.

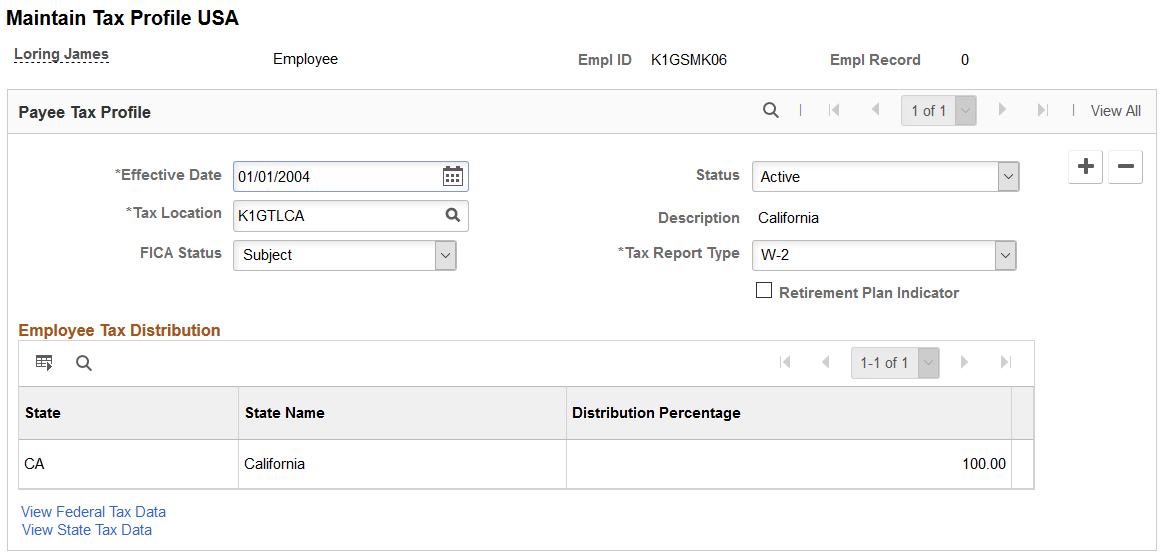

Use the Maintain Tax Profile USA page (GPUS_EE_TAX) to create and maintain payee tax profiles.

Navigation:

This example illustrates the fields and controls on the Maintain Tax Profile USA page.

|

Field or Control |

Description |

|---|---|

|

Tax Location |

Enter a tax location for the payee. The system populates the fields in the Employee Tax Distribution group box with the state and distribution percentage associated with the tax location that you select. If the payee belongs to a department with which you associated a tax location using the Department Table USA page, the system automatically populates this field. Note: When you save this page, the Federal and State Tax Data pages are populated. You can then access these pages to update or modify the data. See Department USA Page. |

|

FICA Status (Federal Insurance Contribution Act status) |

By default, the value of this field is based on the FICA Status Employee option selected on the Company Federal Tax Data USA page. You can override the default value by selecting: Subject: For payees subject to both OASDI and Medicare taxes. Exempt: For payees exempt from OASDI and Medicare taxes. Medicare Only: For payees subject to Medicare taxes only. |

|

Tax Report Type |

Select the report type that indicates which year-end form the system uses to report annual earnings and taxes. The system also uses this value to determine the Form W-4 version applicable to the payee. Specially, if the selected tax report type is W-2, both W-4 versions are available for selection when a new tax data row is added. If the selected tax report type is 1099-R, the W-4P version is used. |

Employee Tax Distribution

This group box displays the state and tax distribution information associated with the tax location that you select for the payee. If you select a tax location that includes a specified county, the system displays the County, County Name, and Rate fields in this group box.

|

Field or Control |

Description |

|---|---|

|

View Federal Tax Data |

Select to access the Federal Tax Data page for the payee. |

|

View State Tax Data |

Select to access the State Tax Data page for the payee. |

Note: Federal tax data and state tax data records are created after the Tax Profile page is saved. When a payee's tax profile is saved, links to the Federal/State Tax Data pages become available, enabling you to modify the tax information.

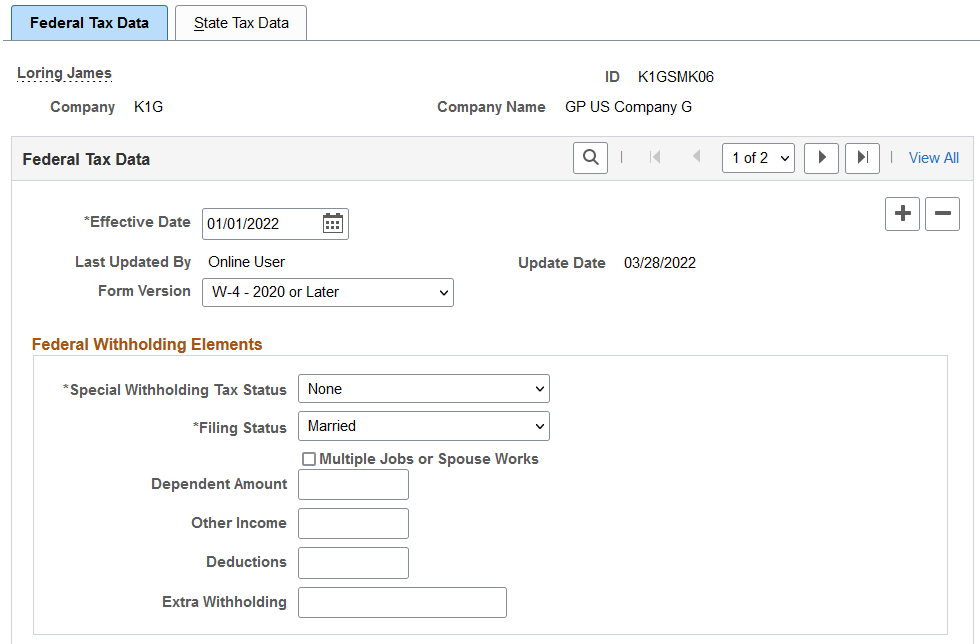

Use the Federal Tax Data page (GPUS_FWT_EE) to maintain federal tax information for individual payees.

Navigation:

This example illustrates the fields and controls on the Federal Tax Data page (1 of 2).

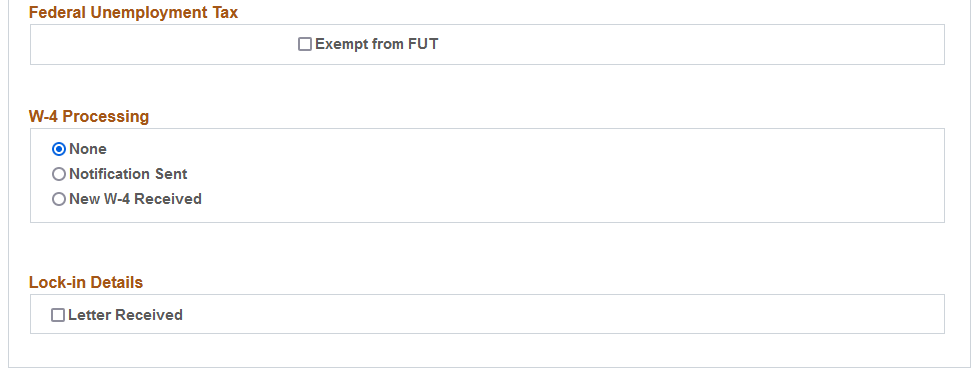

This example illustrates the fields and controls on the Federal Tax Data page (2 of 2).

|

Field or Control |

Description |

|---|---|

|

Effective Date |

Note that the effective date on the Federal Tax Data page is not used to calculate federal income tax withholding. For example, a payee submitted a state W-4 that added a new row to employee tax data in 2020, but did not fill out a new Form W-4 for 2020 (no changes on the Federal Tax Data page for the same row). In this scenario, the system uses the old formula for 2019 to calculate federal income tax withholding. If you wish to use the W-4 version for 2020 or later, enter an effective date that is on or after January 1, 2020, and select the W-4 - 2020 or Later version of Form W-4. |

|

Last Updated By and Update Date |

Indicates whether the payee’s federal tax data was last updated by an online system user, or by the payee in Employee Self-Service. The date of the most recent update appears. |

Form Version

Select the appropriate Form W-4 version in the Form Version field. The system determines the federal tax calculation to use to calculate the payee’s federal income tax withholding based on the version you select.

|

Field or Control |

Description |

|---|---|

|

W-4 - 2020 or Later |

Select (or displays as the only available value) when creating or inserting an employee tax data record that will include new or changed federal tax data from Federal Form W-4. The system calculates tax based on the Form W-4 2020 elections. This option became effective as of 01/01/2020. |

|

W-4 - 2019 or Earlier |

Leave this option unchanged (if it already exists) when creating or inserting an employee tax data record that will include only new or changed state tax data for a payee who has not yet submitted Federal Form W-4 for tax year 2020 or later (or Form W-4P for tax year 2022 or later). The system calculates tax based on the prior Form W-4, in which allowances are part of the calculation. |

|

W-4P - 2022 or Later |

Displays as the only value when creating or inserting an employee tax data record that will include new or changed federal tax data from Federal Form W-4P. Effective on or after 01/01/2022, this is the only option applicable to payees with the 1099-R tax report type. |

Federal Withholding Elements

|

Field or Control |

Description |

|---|---|

|

Special Withholding Tax Status |

Specify the payee’s special withholding tax status. The system calculates the withholding tax based on the value you select here and other factors.

|

|

Filing Status |

Select the appropriate tax status for federal withholding taxes (FWT) as indicated on the payee's completed Form W-4 or Form W-4P in line 1(c). Values are: Head of Household. This value appears when W-4 - 2020 or Later or W-4P - 2022 or Later is selected. Married Single The selected filing status cannot change when a lock-in letter is on file. |

These fields appear when either the W-4 - 2020 or Later or W-4P - 2022 or Later option is selected.

|

Field or Control |

Description |

|---|---|

|

Multiple Jobs or Spouse Works |

Select if the check box in line 2 (c) of the payee’s Form W-4 is selected. This field appears for form version W-4 - 2020 or Later. It becomes editable when the Special Withholding Tax Status field is set to None. The system selects this field automatically when a lock-in letter is on file and the withholding rate is Higher withholding rate. Do not clear this field unless you select Standard withholding rate. |

|

Job/Multiple Pension Income |

Enter the total job and multiple pension income amount in line 2(b)(iii) of the payee's Form W-4P. It can be a positive or negative amount. This field appears for form version W-4P - 2022 or Later. |

|

Dependent Amount |

Enter the dependent amount in line 3 of the payee’s Form W-4 or Form W-4P. The line 3 amount may include other tax credits indicated by the payee. This field becomes editable when the Special Withholding Tax Status field is set to None. When a lock-in letter is on file, the dependent amount can only be equal to or less than the value in the Annual Withholding Reductions field (lock-in letter). |

|

Other Income |

Enter the other income amount in line 4(a) of the payee’s Form W-4 or Form W-4P. This field becomes editable when the Special Withholding Tax Status field is set to None. When a lock-in letter is on file, the other income amount can only be equal to or greater than the value in the Other Income field (lock-in letter). |

|

Deductions |

Enter the deduction amount in line 4(b) of the payee’s Form W-4 or Form W-4P. This field becomes editable when the Special Withholding Tax Status field is set to None. When a lock-in letter is on file, the deductions amount can only be equal to or less than the value in the Deductions field (lock-in letter). |

|

Extra Withholding |

Enter the extra withholding amount in line 4(c) of the payee’s Form W-4 or Form W-4P. This field becomes editable when the Special Withholding Tax Status field is not set to No taxable gross; no tax taken. Leave the amount as $0 if the selected special withholding tax status is Maintain taxable gross; no FWT. If federal income tax should not be withheld, do not enter an amount for extra withholding. When a lock-in letter is on file, the extra withholding amount can only be equal to or greater than the value in the Additional Amount field (lock-in letter). |

These fields appear when the W-4 - 2019 or Earlier option is selected.

|

Field or Control |

Description |

|---|---|

|

Check here and select Single status if married but withhold at higher Single rate |

Select the appropriate tax marital status for federal withholding taxes as indicated on the payee's completed Form W-4. If the payee has selected "Married, but withhold at higher Single rate" on Form W-4, you must select Single as the tax status and this check box. This setting results in the payee being reported with marital status W. Note: If you select this check box, the tax status automatically becomes Single when you save. |

|

Withholding Allowances |

Enter the number of allowances that the payee claims for FWT purposes. This number should match the number on the payee's Form W-4. |

|

Additional Amount and Additional Percentage |

Use these fields to indicate that additional FWT taxes are to be taken. You can specify both an amount and a percentage, if appropriate. When you enter an additional percentage, the additional withholding is calculated by taking a percentage of the taxable wages. The effect of this field depends on the option that you select in the Special Withholding Tax Status field. |

Federal Unemployment Tax

This section does not apply to the W-4P - 2022 or Later form version.

|

Field or Control |

Description |

|---|---|

|

Exempt from FUT (exempt from Federal Unemployment Tax Act) |

Select this check box if the payee is exempt from FUT (Federal Unemployment tax). The default value comes from the Exempt from FUTA check box on the Company Federal Tax Data USA Page, for the associated company. |

W-4 Processing

This section does not apply to the W-4P - 2022 or Later form version.

|

Field or Control |

Description |

|---|---|

|

None |

Indicates that W-4 processing does not apply to the payee. |

|

Notification Sent |

Indicates that you notified the payee that he must submit a new Form W-4. |

|

New W-4 Received |

Indicates that you received a new Form W-4 from the payee. |

Lock-In Details

Use the Lock-In Details group box to process lock-in letters from the IRS that limit employee withholding allowances.

This section does not apply to the W-4P - 2022 or Later form version.

|

Field or Control |

Description |

|---|---|

|

Letter Received |

Select this check box if a letter has been received from the Internal Revenue Service (IRS) specifying the allowances a payee is allowed to take. When selected, the system generates a message, stating that the Lock-in Letter Received status will be set to Y for the current row and all other federal data rows with a higher effective date than the current row. When the W-4 - 2020 or Later option is selected, the system generates another message, indicating that federal withholding elements will be changed to the values specified in the Lock-in Details section. |

This field appears when the W-4 - 2019 or Earlier option is selected.

|

Field or Control |

Description |

|---|---|

|

Limit On Allowances |

Enter the maximum number of allowances possible. The value that you enter in the Withholding Allowances field cannot exceed the value that you enter in this field. |

These fields appear when both the W-4 - 2020 or Later and Letter Received options are selected.

Use these fields to specify the withholding status, withholding rate and any annual reductions to withholding or additional amount to withhold per pay period. These values will be available in the lock-in letters to employers.

Federal withholding elements will be changed to the values specified in these fields.

|

Field or Control |

Description |

|---|---|

|

Withholding Status |

Specify the permitted withholding status. Values are: H-of-H (Head of Household) Married Single The system updates the value in the Filing Status field (federal withholding element) automatically at save with the selected withholding status. |

|

Withholding Rate |

Specify the permitted withholding rate. Values are: Higher withholding rate. If selected, the Multiple Jobs or Spouse Works check box (federal withholding element) is selected automatically. Standard withholding rate. If selected, the system clears the Multiple Jobs or Spouse Works check box (federal withholding element) automatically. |

|

Annual Withholding Reductions |

Enter the maximum value permitted for annual withholding reductions (Form W-4 line 3). The system updates the value in the Dependent Amount field (federal withholding element) automatically with the specified annual withholding reductions value. |

|

Other Income |

Enter the minimum value permitted for other income (Form W-4 line 4(a)). The system updates the value in the Other Income field (federal withholding element) automatically with the other income value specified here. |

|

Other Deductions |

Enter the maximum value permitted for deductions (Form W-4 line 4(b)). The system updates the value in the Deductions field (federal withholding element) automatically with the deductions value specified here. |

|

Additional Amount |

Enter the minimum value permitted for additional amount (Form W-4 line 4(c)). The system updates the value in the Extra Withholding field (federal withholding element) automatically with the additional amount value specified here. |

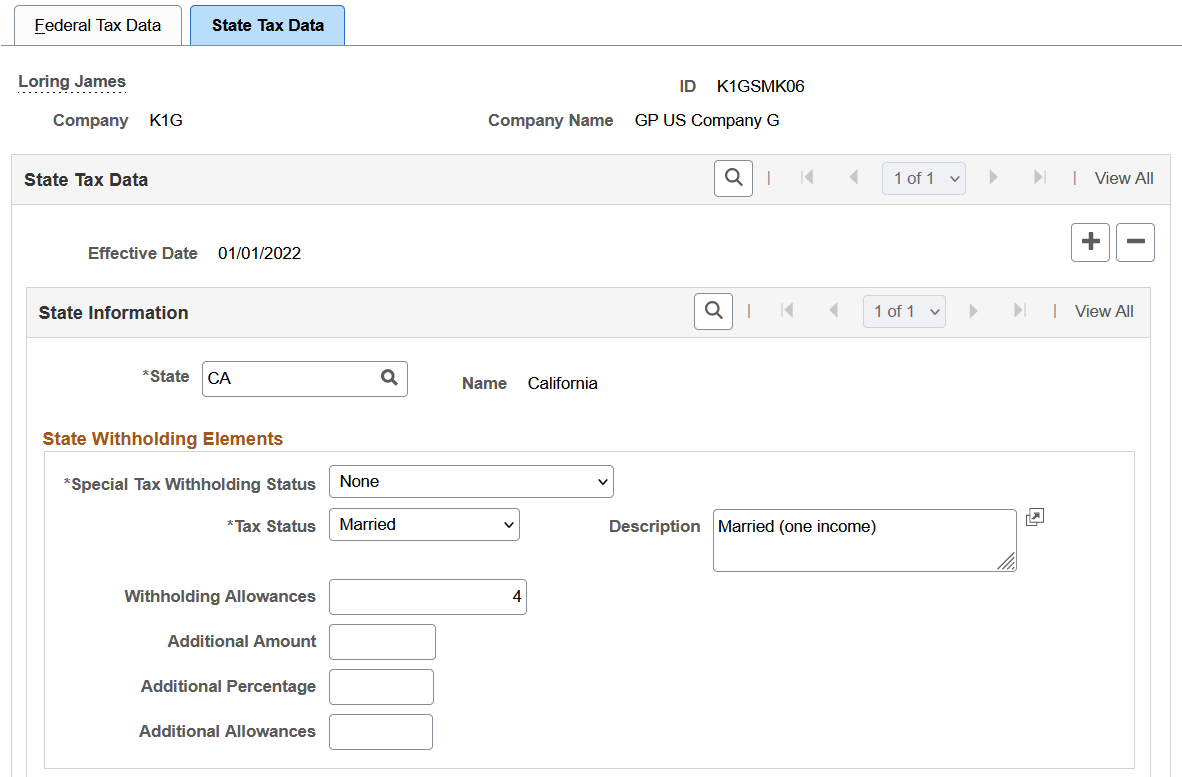

Use the State Tax Data page (GPUS_SWT_EE) to maintain state tax information for individual payees.

Navigation:

This example illustrates the fields and controls on the State Tax Data page.

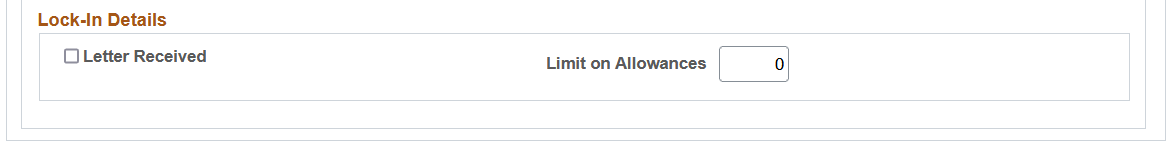

This example illustrates the fields and controls on the State Tax Data page (2 of 2).

State Information

|

Field or Control |

Description |

|---|---|

|

State |

Enter the state for which you are entering tax data. Normally, the system populates this field automatically based on the tax location selected on the Payee Tax Profile page. |

Colorado-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Form DR 0004 Received |

Select if the payee submitted Form DR 0004. When selected, the Annual Allowance Based On field appears, and these fields become unavailable for edit: Special Tax Withholding Status (set to None), Tax Status (set to N/A), and Description (set to Not Applicable). |

Oregon-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Do not withhold Oregon Statewide Transit Tax |

Select this check box if you do not wish to withhold Oregon Statewide Transit Tax from payments that are made to the payee. For example, if the payee is an Oregon resident who works outside of the state, the out-of-state employer can, as a courtesy, withhold transit tax for the payee but it is not required. If the withholding is disabled, it is the payee's responsibility to pay the tax while filing for personal income tax return. Note: Retirees are exempted from the Oregon Statewide Transit Tax. No tax will be withheld from payments to individuals with the 1099-R tax report type selected on the Maintain Tax Profile USA Page. |

State Withholding Elements

Use these fields to enter state-specific withholding information.

|

Field or Control |

Description |

|---|---|

|

Special Tax Withholding Status |

None. Select if the payee has no special tax status. With this option, the system calculates SWT based on the payee's taxable gross, marital status, and withholding allowances. If you select this option and specify an additional amount or percentage, the system calculates taxes based on the information in the tax table and withholds the additional withholding amount indicated. No taxable gross; no tax taken. Select to disable the tracking of state taxable gross balance for the payee. Maintain taxable gross; no SWT. Select to override the normal tax calculation with the additional amount or percentage indicated. The system determines taxable gross for SWT using the individual earnings paid to the payee. The tax withheld becomes either a flat amount or a percentage of the state taxable wages. |

|

Tax Status and Description |

Select the appropriate tax status for SWT. The description for the status is displayed after the selection. Note: This field is has a value of N/A (not applicable) for states that do not use marital status for tax calculation. |

|

Withholding Allowances |

Enter the number of allowances that the payee claims for SWT. This number should match the number on the payee's state withholding allowance certificate. This field applies to many but not all states. |

|

Additional Amount |

Enter an additional flat amount to withhold. The effect of this field depends on the option that you select in the Special Tax Withholding Status field. |

|

Additional Percentage |

Enter an additional percentage to withhold. The system calculates the additional withholding using a percentage of the payee's taxable wages. |

|

Additional Allowances |

(CA, IL, IN, GA, PR, and VA) Enter any additional allowance that the payee claims for SWT. (VA) This field is applicable if the specified tax status is not 65/Blind. |

Arizona-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Withholding Percent |

Enter the percentage of taxable gross that constitutes the Arizona state withholding. |

Colorado-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Annual Allowance Based On |

Specify where to locate the annual withholding allowance amount. This field appears if the Form DR 0004 Received option is selected. Values are: Specified Amount. It refers to the value specified in the Annual Allowance Amount field. Use Federal Tax Status Values. Use this value if Box 2 on Form DR 0004 is blank. The system uses the filing status (on the Federal Tax Data page) to identify the associated allowance amount from the Allowances and Exemptions section on the State Tax Rates USA Page. Zero Amount. Use this value if the payee specified the zero amount (not blank) in Box 2 on Form DR 0004. |

|

Annual Allowance Amount |

Enter the annual allowance amount that is entered in Box 2 on Form DR 0004. This field appears if the annual allowance is based on Specified Amount. |

Connecticut-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Adjustment |

Indicate whether the withholding adjustment amount is an increase or decrease amount. The system increases or decreases the employee's withholding only on payments of regular wages. If regular and supplemental wages are paid concurrently, the system applies the increase or decrease to the regular earnings only, and not to the supplemental wages. Values are: Decrease Additional Amount Increase Additional Amount |

Louisiana-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Adjustment |

Indicate whether the withholding adjustment amount is an increase or decrease amount. The system increases or decreases the employee's withholding only on payments of regular wages. If regular and supplemental wages are paid concurrently, the system applies the increase or decrease to the regular earnings only, and not to the supplemental wages. Values are: Decrease Additional Amount Increase Additional Amount |

Mississippi-Specific Page Element

|

Field or Control |

Description |

|---|---|

|

Annual Exemption Amount |

Enter the annual exemption amount from the payee's completed Mississippi withholding exemption certificate. This exemption amount reduces the payee's taxable gross before the SWT calculation for each pay period. |

Lock-In Details

|

Field or Control |

Description |

|---|---|

|

Letter Received |

Select if you received a letter from the state taxing authority that specifies the number of allowances that the payee can claim. |

|

Limit on Allowances |

Enter the maximum number of allowances that the payee can claim. The value that you enter in the Withholding Allowances field is not allowed to exceed this number. |

Use the W-4 Employee's Withholding Certificate page (GPUS_W4_DATA) to maintain W-4 tax information.

Navigation:

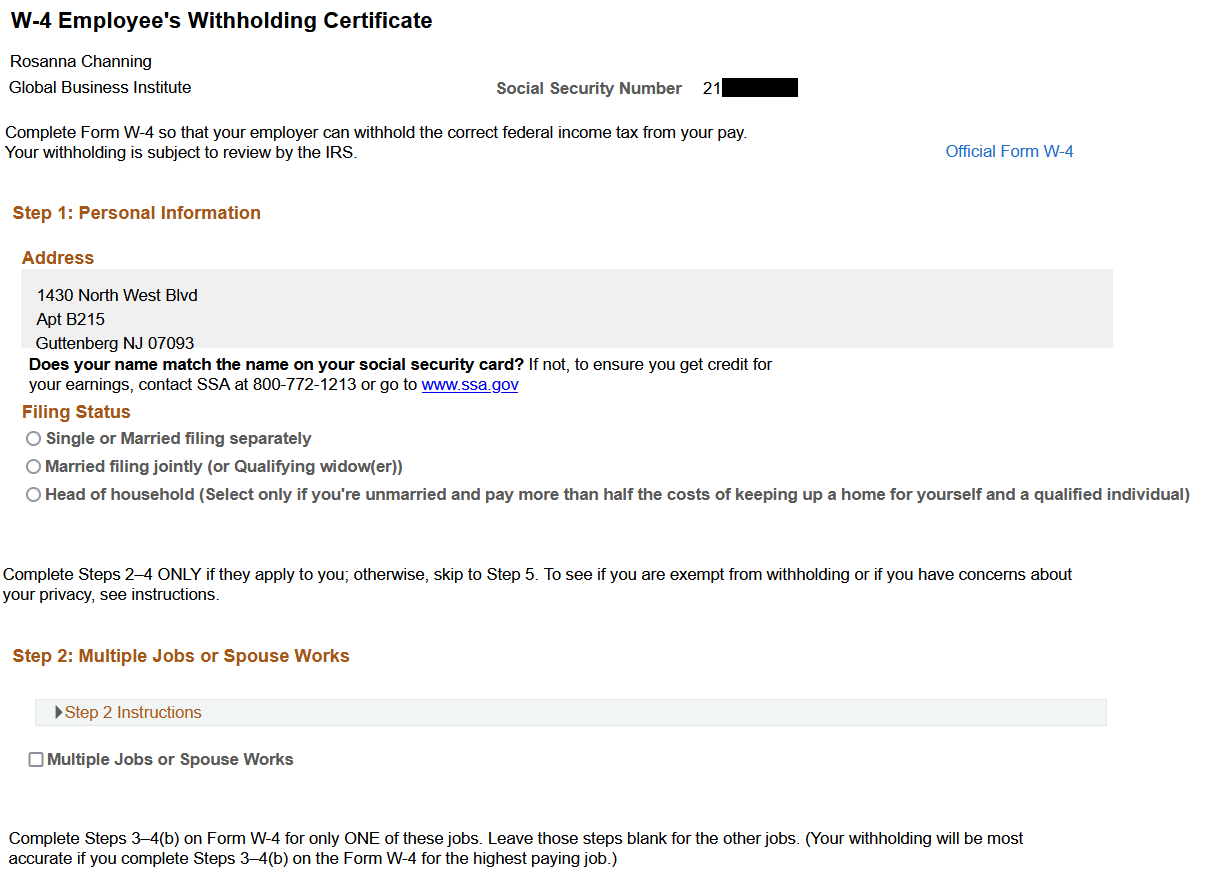

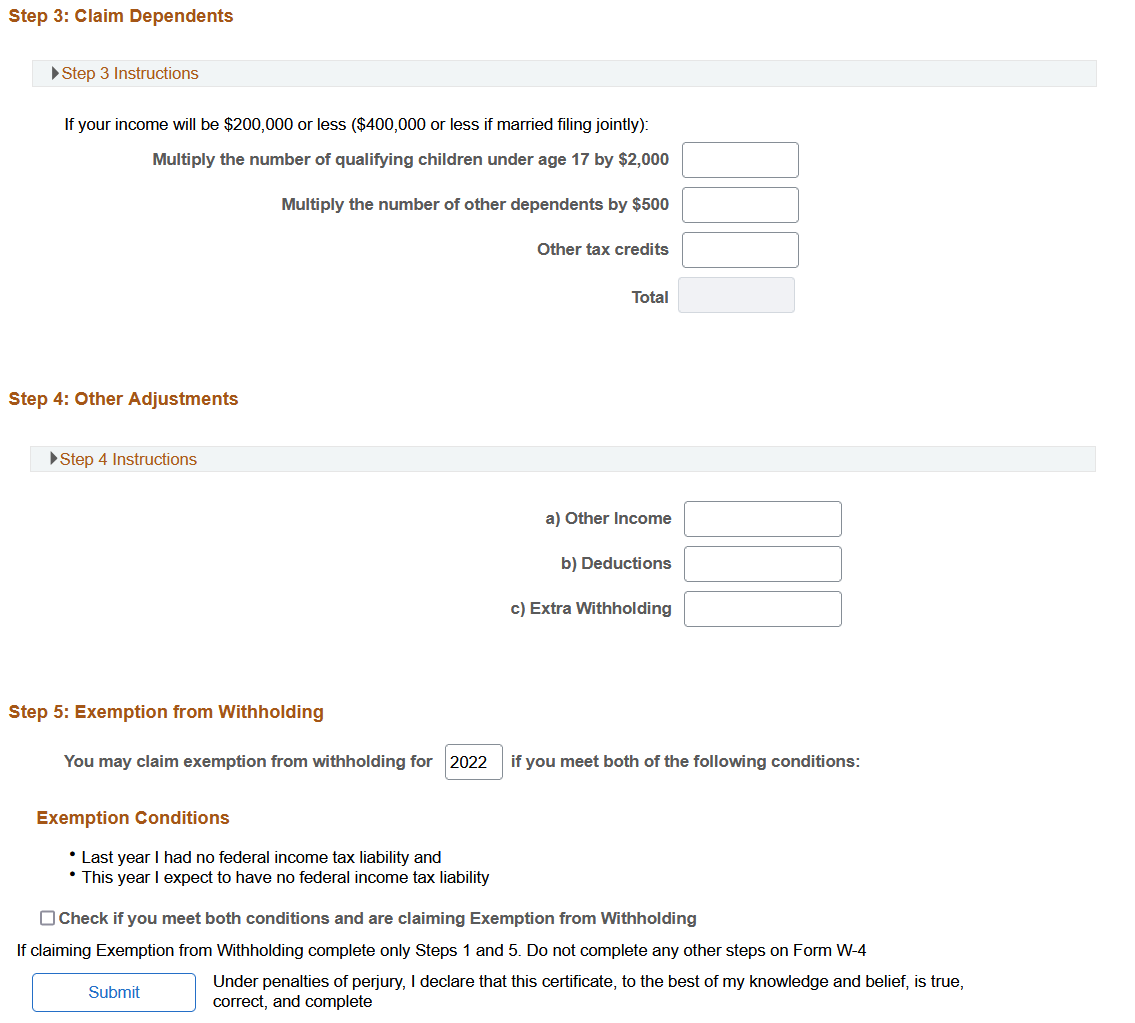

This example illustrates the fields and controls on the W-4 Employee's Withholding Certificate page (1 of 2).

This example illustrates the fields and controls on the W-4 Employee's Withholding Certificate page (2 of 2).

This self-service page enables payees to update their Federal W-4 tax information. They can change their filing status, dependents, other income, and other current elections. If they want to view or print a copy of the official Form W-4, they can select the Official Form W-4 link to access the form in PDF format. They may also access the official Social Security website.

Note: Both links go to a third-party server. Therefore, you must use the URL Maintenance Page to update the link periodically to make sure it is still valid.

Use the W-4P Employee's Withholding Certificate for Periodic Pension or Annuity Payments page (GPUS_W4_DATA) to maintain W-4P tax information.

Navigation:

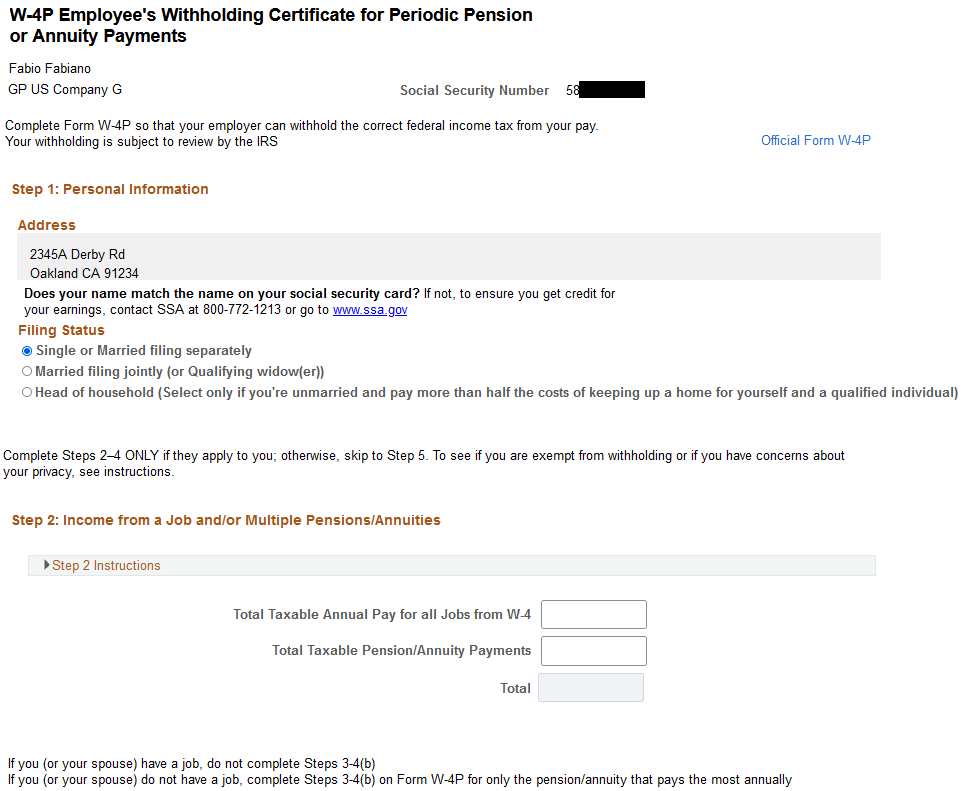

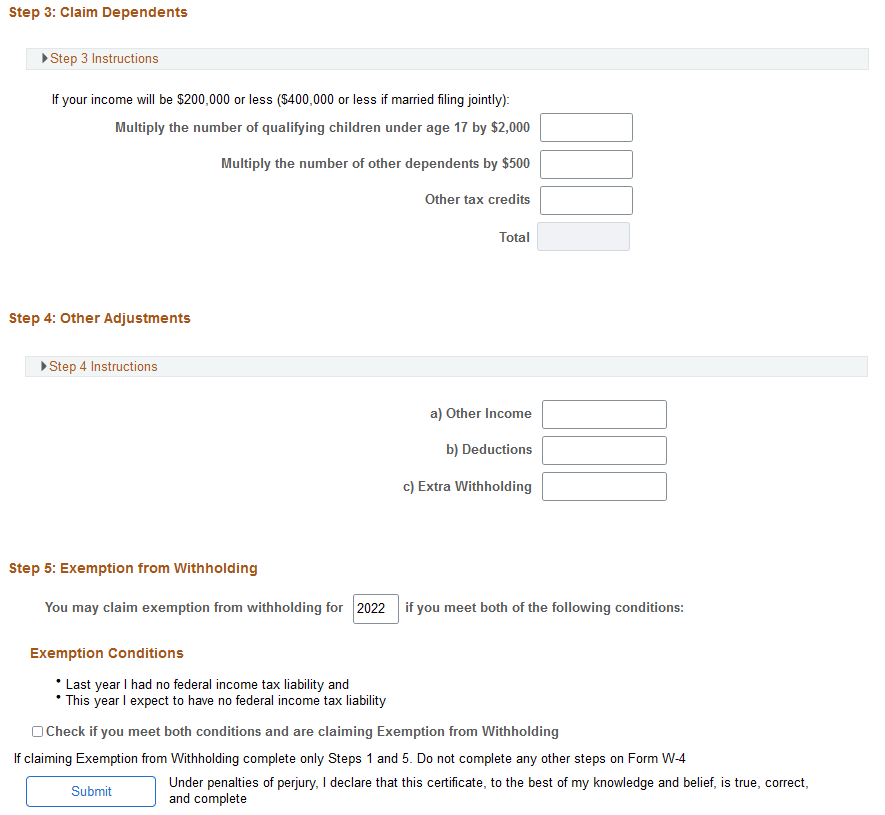

This example illustrates the fields and controls on the W-4P Employee's Withholding Certificate for Periodic Pension or Annuity Payments page (1 of 2).

This example illustrates the fields and controls on the W-4P Employee's Withholding Certificate for Periodic Pension or Annuity Payments page (2 of 2).

This self-service page enables payees with the 1099-R tax report type to update their Federal W-4P tax information. They can change their filing status, dependents, other income, and other current elections. If they want to view or print a copy of the official Form W-4P, they can select the Official Form W-4P link to access the form in PDF format. They may also access the official Social Security website.

Note: Both links go to a third-party server. Therefore, you must use the URL Maintenance Page to update the link periodically to make sure it is still valid.

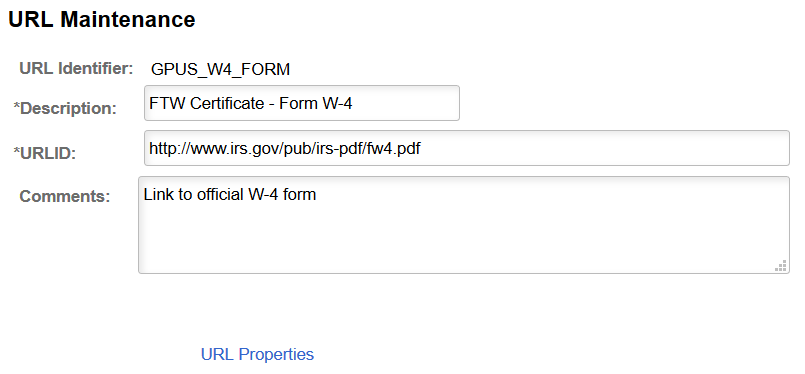

Use the URL Maintenance page (URL_TABLE) to maintain the URLs for links that access official tax forms on third-party servers.

Navigation:

This example illustrates the fields and controls on the URL Maintenance page.

Use this page to maintain the URL accessed by the Official Form W-4 link on the W-4 Tax Information self-service page. The URL identifier for the link is GPUS_W4_FORM. Make changes to the URL field to update the link.