Setting Up Share Schemes

To set up share schemes, use these components: Define Share Scheme Types GBR (GPGB_SS_TYPES), Define Share Scheme Limits GBR (GPGB_SS_LIMITS), and Define Share Schemes GBR (GPGB_SS_DEFN). This topic discusses how to set up share scheme types, limits, and definitions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_SS_TYPE |

Set up share scheme type IDs. |

|

|

GPGB_SS_LIMITS |

Define the minimum and maximum contributions for each type of share scheme. |

|

|

GPGB_SS_DEFN |

Set up the rules of share schemes, including the scheme duration, contribution limits, deductions elements, and rules for processing leavers and contribution holidays. |

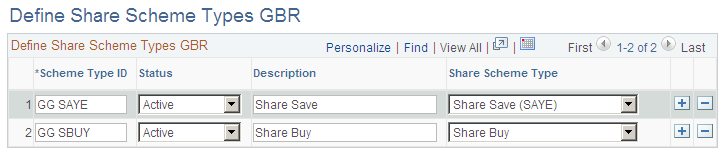

Use the Define Share Scheme Types GBR page (GPGB_SS_TYPE) to set up share scheme type IDs.

Navigation:

This example illustrates the fields and controls on the Define Share Scheme Types GBR page.

Field or Control |

Description |

|---|---|

Scheme Type ID |

Enter the identifier for the share scheme type. |

Share Scheme Type |

Select the share scheme type: Share Save (SAYE) or Share Buy. |

Use the Define Share Scheme Limits GBR page (GPGB_SS_LIMITS) to define the minimum and maximum contributions for each type of share scheme.

Navigation:

This example illustrates the fields and controls on the Define Share Scheme Limits GBR page.

Use this page to set up and maintain the HM Revenue and Customs (HMRC) statutory share scheme limits that identify the minimum and maximum contributions that can be made to share save and share buy schemes. Share scheme limits define the total contributions to share schemes of the same type. The limits do not apply per share scheme. Therefore if a payee contributes to more than one share scheme of the same type, the system compares the total contributions with the limits on this page.

The HMRC statutory share scheme limits are delivered as sample data, but you must maintain this data.

Field or Control |

Description |

|---|---|

Monthly Minimum and Monthly Maximum |

Enter the minimum and maximum contribution allowed per month. If you enter monthly limits, you cannot specify an annual limit. |

Weekly Minimum and Weekly Maximum |

Enter the minimum and maximum contribution allowed per week. If you enter weekly limits, you cannot specify an annual limit. |

Annual Maximum |

Enter the maximum contribution allowed per year. If you enter an annual maximum, you cannot specify weekly or monthly limits. |

Maximum Percentage |

Enter the maximum percentage of earnings that payees can contribute to share buy schemes. This field is not displayed if the share scheme type ID is defined as a share save scheme (SAYE). You specify which earnings are included in the calculation when you set up the share buy scheme rules on the Define Share Schemes GBR page. The Accumulator field specifies the accumulator that stores the relevant earnings. |

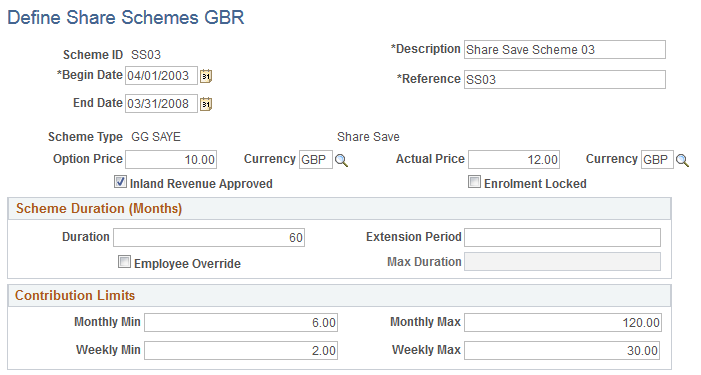

Use the Define Share Schemes GBR page (GPGB_SS_DEFN) to set up the rules of share schemes, including the scheme duration, contribution limits, deductions elements, and rules for processing leavers and contribution holidays.

Navigation:

This example illustrates the fields and controls on the Define Share Schemes GBR page (1 of 2).

This example illustrates the fields and controls on the Define Share Schemes GBR page (2 of 2).

Field or Control |

Description |

|---|---|

Reference |

Enter an identifier for the share scheme. |

Scheme Type |

Select the scheme type from the share scheme types you defined on the Share Scheme Type page. The scheme type you select affects the fields that are displayed on this page. |

Option Price |

Enter the price at which payees have the option to purchase shares and select the currency code for the shares. This field is only displayed if the share scheme type is defined as a share save scheme (SAYE). The price is for information only. It is not used in processing. |

Actual Price |

Enter the actual share price that applies at the scheme Start Date and select the currency code. This field is only displayed if the share scheme type is defined as a share save scheme (SAYE). The price is for information only. It is not used in processing. |

Inland Revenue Approved |

Select this check box if the share scheme is approved by HMRC. |

Enrolment Locked |

Select this check box when the enrolment period is closed and payees can no longer join this scheme. |

Scheme Duration (Months)

This group box is only displayed if the share scheme type is defined as a share save scheme (SAYE).

Field or Control |

Description |

|---|---|

Duration |

Enter the duration, in months, of the share scheme. |

Extension Period |

Enter the duration, in months, of the extension period if applicable to the scheme. This is the period from the scheme end date in which payees who are enrolled in the scheme can either continue contributing or leave funds and bonus in the scheme. |

Employee Override |

Select this check box if the rules of the scheme allow the duration to be defined at the employee level. You must enter a maximum duration if you allow employee overrides. |

Max Duration (maximum duration) |

Enter the maximum duration, in months, if the share scheme allows duration to be defined at employee level. |

Contribution Limits

This group box is only displayed if the share scheme type is defined as a share save scheme (SAYE).

Field or Control |

Description |

|---|---|

Monthly Min (monthly minimum) and Monthly Max (monthly maximum) |

Enter the minimum and maximum monthly contribution. |

Weekly Min (weekly minimum) and Weekly Max (weekly maximum) |

Enter the minimum and maximum weekly contribution. |

Contribution Basis

This group box is only displayed if the share scheme type is defined as a share buy scheme.

Field or Control |

Description |

|---|---|

Basis |

Select the basis for the contribution: Fixed Amount: Contributions are a fixed amount per pay period. Percentage: Contributions are a percentage of earnings. |

Monthly Min (monthly minimum) and Monthly Max (monthly maximum) |

Enter the minimum and maximum monthly contribution. These fields are available if you select Fixed Amount as the basis for the contribution. |

Weekly Min (weekly minimum) and Weekly Max (weekly maximum) |

Enter the minimum and maximum weekly contribution. These fields are available if you select Fixed Amount as the basis for the contribution. |

Min % (minimum percentage) and Max % (maximum percentage) |

Enter the minimum and maximum percentage of earnings that payees can contribute to share buy schemes. These fields are available if you select Percentage as the basis for the contribution. |

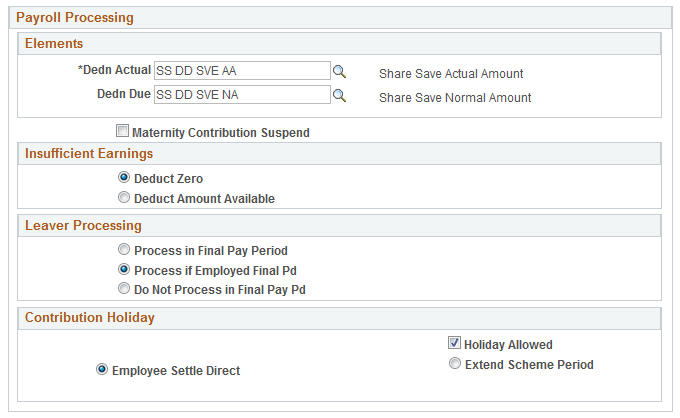

Payroll Processing

Field or Control |

Description |

|---|---|

Dedn Actual (deduction actual) |

Select the deduction element that stores the actual amount deducted from payees' salary. This is a required field. You can use the same deduction for all share schemes of the same type, or you can use a different deduction for each scheme. If the same deduction element is used for multiple schemes of the same type, multiple resolutions of that element are processed. This has implications for setting up deduction recipients. |

Dedn Due (deduction due) |

Select the deduction element that stores the full contribution amount. This field is optional. |

Accumulator |

Select the accumulator that the system uses to calculate contributions based on a percentage of earnings. This field is displayed if the scheme is a share buy scheme and you select Percentage as the basis of contributions. The accumulator SS AC BUY is delivered for this purpose. |

Maternity Contribution Suspend |

Select this check box if contributions are suspended while payees are on maternity leave. The system checks the payees' absence history records (ABSENCE_HIST). If the payee is on maternity leave during the pay period, the system suspends contributions. Note: Contributions are only suspended if you use the absence management functionality in Global Payroll for the UK and PeopleSoft HCM. |

Insufficient Earnings |

Select an option to define what happens if there are insufficient earnings to deduct the full contribution amount: Deduct zero: No deduction is made for the pay period. Deduct amount available: To deduct the maximum available to reduce earnings to zero. Deduct maximum percentage: To deduct the maximum percentage available. This option is only available if you are defining a share buy scheme and you select Percentage as the basis of contributions. The system calculates an employee's contribution by applying the percentage defined for the employee. If there are insufficient earnings to deduct this amount, then the maximum percentage from the Share Scheme limits GBR page is applied to the available pay (defined by GBR AC NETT SEG). |

Leaver Processing |

Select an option that defines how share scheme contributions are processed for employees terminated within the pay period: Process in Final Pay Period: Processes contributions as normal. Process if Employed Final Pd: Processes contributions only if the employee worked for the whole pay period. The system checks that the last day worked is the pay period end date. Do Not Process in Final Pay Pd: Contributions are not processed for payees who leave during the pay period. |

Contribution Holiday

This group box is only displayed if the share scheme type is defined as a share save scheme (SAYE).

Field or Control |

Description |

|---|---|

Holiday Allowed |

Select this check box if the rules of the share save scheme allow employees to stop contributing to the scheme temporarily. When you select this check box, two options are displayed to define how the system manages contribution holidays. Select the option that applies: Extend Scheme Period: Extends the scheme duration. Enter the total duration of the contribution holidays permitted under the rules of the scheme in the Total Duration (in months) field. Employee Settle Direct: The scheme duration is unchanged and the employee pays the shortfall directly to the scheme administrators. |

Total Duration (Months) |

Enter the maximum duration, in months, of contribution holidays. |