Understanding the End of Year Processes

This topic discusses:

End of year processes.

Tax code updates.

Directory used by the end of year processes.

This table lists the processes that Global Payroll for the UK delivers for handling end of year submissions to HM Revenue and Customs (HMRC) and subsequent updates to your PeopleSoft database:

|

Process Name |

Process ID |

Usage |

|---|---|---|

|

GP UK End of Year Returns Application Engine process |

GPGB_EOYR |

Produces an electronic version of the P14 and P35 reports for magnetic media submission. |

|

Pay/Pension Numbers Application Engine process |

GPGB_PPIN |

Generates an employee listing that is submitted to HMRC for tax code processing purposes. |

|

Code Number Changes Application Engine process |

GPGB_CNC |

Updates employees' tax codes based on data received from HMRC. |

Note: As of the tax year 2004/05, HMRC requires all medium and large employers to submit end of year returns using EDI or the internet. Employers who submit magnetic media submissions will be liable to fines imposed by HMRC. Global Payroll for the UK provides the processes but these are no longer maintained.

At the end of every tax year, HMRC calculates employees' tax codes for the next tax year.

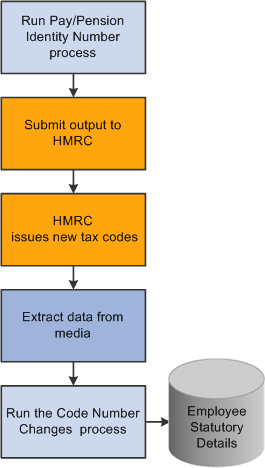

This diagram illustrates how the Pay/Pension Numbers and Code Number Changes processes enable you to submit information to HMRC and receive updated tax codes electronically:

The Code Number Changes process is discussed in an earlier topic.

All the processes use the following PeopleTools directory on the machine where your Process Scheduler runs: %PS_SERVDIR%\files

This directory is used as follows:

The files generated by the GP UK End of Year Returns and Pay/Pension Numbers processes are stored in this directory.

The Code Number Changes process searches this directory for the data file you received from HMRC. The process also creates a log file and error file in the same directory.