Recording Payee Elections

This topic provides an overview of payee elections and discusses how to record payee optional form and payment elections.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_RT_EMP_FORM |

If you use Pension Administration to calculate optional forms of payment for a retiree or a QDRO alternate payee, you can record the payee's selection here. When you record the information here, the system calculates amounts that can be automatically transferred to the payment schedule page when you schedule payments. |

|

|

PA_RT_EMP_XFER |

Record other payment-related information. |

Payee elections are the choices that participants make with regard to their pension payments. These include the optional form of payment, tax withholding elections, direct deposit data, and deduction information.

You can monitor the receipt of election forms using the Assign Activity List page. Additionally, there are specific pages where you record the actual elections.

You only record optional form of payment selections for retirees and QDRO alternate payees. Beneficiaries do not make this selection because their payments are based on the original employee's choice. Be sure to record the optional form of payment selection before scheduling the payment; this enables the system to enter payment amounts into the schedule automatically.

All payees require tax elections. Direct deposit information and deduction information are optional. This information is not needed to schedule a payment, but it is needed before you actually start paying a person.

Use the Identify Optional Form page (PA_RT_EMP_FORM) to record a payee's optional form selection if you use Pension Administration to calculate optional forms of payment.

When you record the information here, the system calculates amounts that can be automatically transferred to the payment schedule page when you schedule payments.

Navigation:

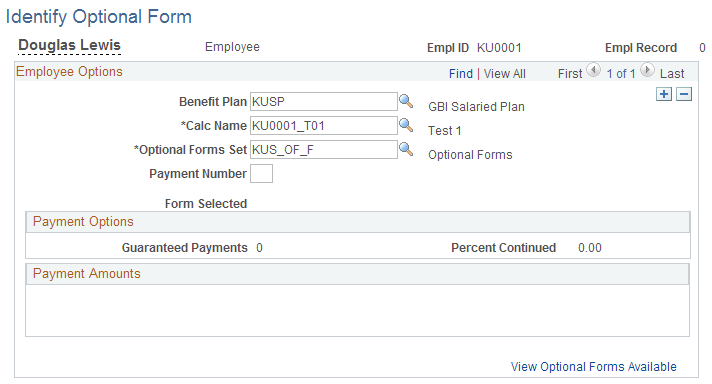

This example illustrates the fields and controls on the Identify Optional Form page as it first appears. When the page is in this initial mode, it displays only the fields that you use to identify a set of optional forms. After you click the View Optional Forms Available link, these fields disappear and the page instead displays information about the payment options in the selected set of optional forms.

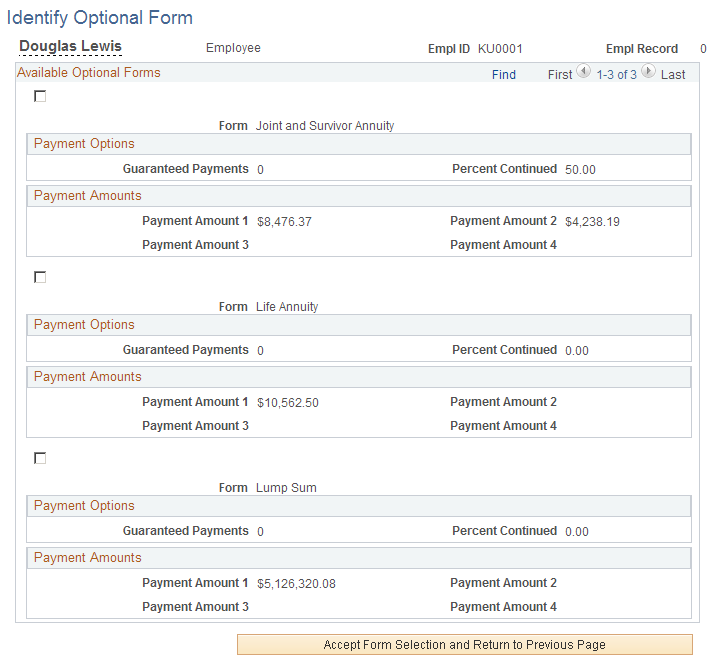

This example illustrates the fields and controls on the Identify Optional Form page as it appears after you click the View Optional Forms Available link. In this mode, the page displays information about specific payment options in the optional forms set.

Note: If you do not schedule payments using system calculated values, you do not need to record the optional form of payment selection on this page.

Employee Options

When an employee's optional form of payment choices come from a system calculation, you can prompt for the same list of choices that the employee had. To do that, you fill in the fields in this group box, then click the View Optional Forms Available link.

Field or Control |

Description |

|---|---|

Plan |

Indicate the plan that was the basis for the employee's choice. |

Calc Name (calculation name) |

Indicate the calculation name that was the basis for the employee's choice. |

Optional Forms Set |

Indicate the optional forms set that was the basis for the employee's choice. This is necessary because a calculation can produce several different sets of values. For example, there may be forms sets based on early retirement and normal retirement. Contributory plans may also have separate form sets for the employee- and employer-paid portions of a benefit. |

Payment Number |

Enter a payment number. You use this number to distinguish among multiple payment streams, if necessary. If there is only a single payment stream, enter 1. If there are multiple streams, number them sequentially. |

Form Selected and Payment Amounts |

If you have not yet recorded an optional form of payment selection, the Form Selected field and the Payment Amounts group box are blank. After you record the optional form of payment selection, the page displays information about the selected form. |

View Optional Forms Available |

Click this link to see a scrolling list of the optional forms of payment. All other fields disappear. Note: This option is only available in new rows. After you save an optional form selection, you cannot redisplay the choices without first deleting the row. |

Available Optional Forms

Each form is identified by the form name, the percent continued for forms with a survivor benefit, and the guaranteed payments for term certain and certain and continuous forms.

Field or Control |

Description |

|---|---|

<check box> |

Select to identify the form of payment that an employee has chosen. |

Accept Form Selection and Return to Previous Page |

Click to copy the selected form to the previous page. |

If there are multiple payment streams based on system calculations, be sure to set up optional form of payment selections for each stream. To do this, insert an additional row for the second payment stream.

Note: The guaranteed payments are the number of years of guaranteed payments, not the actual number of payments.

Payment Amounts

For each form, you see the associated payment amounts, labeled Payment Amount 1 through Payment Amount 4. The type of payment in each field depends on the form. Payment Amount 1 is always the initial payment amount. For example, if the form is Joint and Survivor Annuity, Payment Amount 1 is the retiree amount and Payment Amount 2 is the survivor amount, while if the form is Level Income Option, the first amount is the pre-SSRA amount and the second amount is the post-SSRA amount.

Some forms may have zero amounts. These are forms that are offered by a plan, but are not available to a particular employee. These could include joint and survivor forms of payment for employees with no beneficiaries, level income options for employees older than the level income age, and any form of payment for an employee whose lump sum falls under the small benefit cashout threshold.

There are four types of retiree payments:

|

Retiree Payment Type |

Description |

|---|---|

|

Retiree Amount |

Amount due to the retiree. Except in the case of lump sums, this is normally a monthly amount payable until death. |

|

Retiree Pre-SSRA Amount (retiree pre-social security retirement age amount) Retiree Post-SSRA Amount |

Under a level income option (LIO), the retiree's benefit is higher before the retiree reaches social security retirement age (SSRA), and is lower afterwards when the retiree has presumably started receiving social security benefit. Therefore, LIO forms produce two separate retiree amounts, identified as the pre- and post-SSRA amounts. |

|

Pop Up Amount |

Under a pop-up form of payment, the retiree amount increases if the beneficiary predeceases the retiree. The pop-up amount is this increased retiree amount. |

There are four types of beneficiary payments:

|

Payment Type |

Description |

|---|---|

|

Plan Beneficiary Amount |

Amount payable to a spouse beneficiary on the retiree's death. This can come from two different sources: a joint and survivor form (or any form which includes a percent continued) elected by the retiree, and an automatic plan benefit for which there is no actuarial reduction. |

|

Non-spouse Beneficiary Amount |

Amount payable to a non-spouse beneficiary after the retiree's death under a joint and survivor form of payment. |

|

Spouse Demonstration J&S (spouse demonstration joint and survivor) |

If a married retiree selects a non-spouse beneficiary, the retiree's spouse is entitled to know the amount that would have been payable to the spouse had the retiree named the spouse as the beneficiary, instead of naming a non-spouse beneficiary. This is different from the non-spouse beneficiary amount because the actuarial adjustment is based on the spouse's age, rather than the non-spouse beneficiary's age. This type of payment is not actually available for payments; it is informational only. |

|

Survivor Amount |

In a last to survive form of payment, the amount due to the retiree or spouse after the other one has died. |

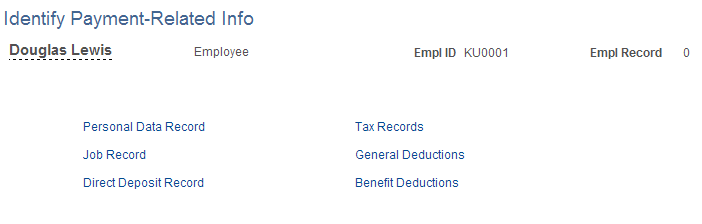

Use the Identify Payment-Related Info page (PA_RT_EMP_XFER) to record various payment-related information other than the optional form of payment.

Navigation:

This example illustrates the fields and controls on the Identify Payment-Related Info page.

Field or Control |

Description |

|---|---|

Personal Data Record and Job Record |

Because you have already set up the payee's personal data and job data, you do not usually need to return to those pages when you set up payments. However, if there has been a change of address or other relevant data, you can use the Personal Data Record and Job Record buttons to navigate to the appropriate page. |

Direct Deposit Record and Tax Records |

The Direct Deposit Record and Tax Records buttons take you to the PeopleSoft Payroll for North America pages, where you record employee direct deposit and tax election information. Tax elections are always required. Direct deposit information is required for employees who want to take advantage of this option. Note: There are no default tax elections. You must enter tax elections in order to pass this information along to the third-party trustee who cuts your pension checks. |

General Deductions |

The General Deductions button takes you to the General Deduction Data page, where you sign up retirees for non-benefit deductions, such as garnishments. You can also use general deductions for benefit deductions if your deduction is a flat amount or a percentage of gross pay. You do not need to run a process to calculate the deduction. The instructions picked up by the trustee extract, a flat amount or a percentage of gross pay, are sufficient for your trustee to determine the deduction amount. You can use the General Deduction Data page to set up medical or other benefit deductions if you know the deduction amount, and you do not want to go through the more complex process of administering benefit deductions using PeopleSoft HR: Manage Base Benefits or PeopleSoft Benefits Administration. Note: Each button on this page opens a new page. Remember to close pages when you finish with them. |

Benefit Deductions |

The Benefit Deductions button takes you to the Benefit Program Participation page, where you enroll retirees in benefit programs. Enrolling retirees in benefit programs does not automatically sign them up for medical or other benefits; it simply establishes that they're eligible for such benefits. To learn more about using the PeopleSoft HCM system to manage retiree benefits, refer to your PeopleSoft HR: Manage Base Benefits and PeopleSoft Benefits Administration documentation. Note: Benefit deduction elections only translate into actual deduction amounts if you use PeopleSoft Payroll Interface to calculate the deductions amounts. To run the deduction calculation, use the Deduction Calculation Run Ctl page. |

With the exception of the Personal Data Record and Job Record links, the links on the Identify Payment-Related Info page are shortcuts to take you to other pages in the PeopleSoft system. You can also navigate directly to these pages:

|

Button |

Page Navigation |

See Also |

|---|---|---|

|

Direct Deposit Record |

|

|

|

Tax Records |

|

|

|

General Deductions |

|

|

|

Benefits Deductions |

|