Entering Tax Distribution Information

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_DISTRIBUTION |

(USA, USF) Enter the employees work state or localities percentages for US employees. This information will be used in the Create Paysheet Process and create a payline for each state/locality combination. |

|

|

TAX_DIST_CAN |

(CAN) Enter tax distribution information for Canadian employees. |

|

|

Default Tax Data Report Page |

RUNCTL_FRMTHRU_PAY |

Run TAX016 (TAX016CN for Canada) to print employee tax and other hire data automatically generated by the system. |

Every employee must have at least one Tax Distribution record. It represents the work location(s) for the employee. It is used to calculate the work taxes. The system automatically populates the State, Province, and Locality fields from the Tax Location Code field on the employee's Job Data record. The state and locality codes come from the Tax Location table.

Creating Employee Tax Distribution Data Automatically

If you select the Automatic Employee Tax Data option on the Product Specific Page of the Installation table, Payroll for North America automatically sets up tax distribution records for the employee. It sets up federal, state (multiple, if necessary), provincial, and local (multiple, if necessary) records whenever an employee:

Is hired through PeopleSoft Human Capital Management (HCM) or the applicant tracking system.

Transfers to another company.

Has a job change that requires a new tax location to be entered on Job Data - Payroll page.

You can run the Employees Default Tax Data Report (TAX016), (TAX016CN is the Canadian version) to verify automatically created tax data. This report lists which employees have such default data on their tax records. The report checks records within the date range that you specify.

Note: (USF) The employee's retirement code coverage helps determine which tax data is generated by the system.

Default Tax Information

If the Automatic Employee Tax Data check box is selected on the Product Specific Page of the Installation Table component, the system:

References the employee's home address and tax location from human resources personal data and job data records.

Enters the data by default in the employee's federal, state, and local tax data.

Enters a tax status of S (single) in the employee's federal tax data record.

For the state and local tax data records, the default values can be different (such as N), depending on the state and local rules.

Enters a withholding allowance of 0 (for state and local data only).

Changes to tax location in job data using Correction mode do not automatically export the new data to the employee's tax distribution record or employee tax data record. Only changes made in Update/Display mode cause these tables to be updated.

If the Use State Residence for Local check box is selected on the Product Specific Page, then localities entered on the Tax Location table are indicated as resident locality in employee tax data. However, the system does not select the Resident check box automatically on the newly added local tax data row when 1) an employee transfers to a different work location in the same resident state; or, 2) a new employment instance is added for a different work location in the same resident state. Refer to the Understanding Resident Locality in Local Tax Data section for more information.

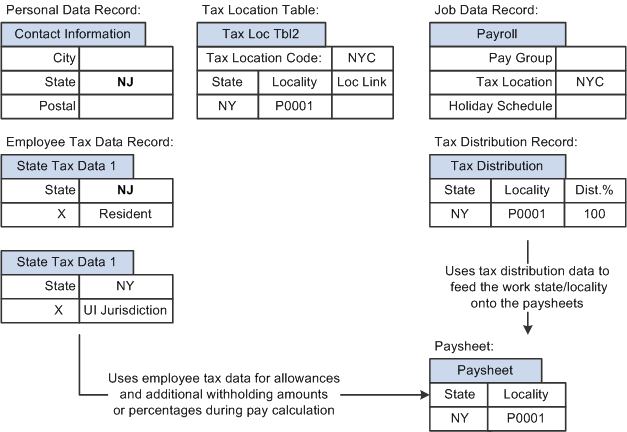

This diagram illustrates how the system enters tax data from the Personal Data Record, Tax Location Table, Job Data Record, Employee Tax Data Record, and the Tax Distribution Record automatically and how that data is used on paysheets:

This diagram illustrates how the system enters tax data from the Personal Data Record, Tax Location Table, Job Data Record, Employee Tax Data Record, and the Tax Distribution Record automatically and how that data is used on paysheets:

(USA) State Taxes for Multistate Employees

This is an example of how the system determines state taxes for multistate employees based on the distribution percents that you enter on the Tax Distribution pages.

Employee A is paid weekly and receives 1000 USD per week. The employee works 70 percent of the time in New York and 30 percent in Connecticut.

The system annualizes the pay period taxable earnings.

Employee A earns 1,000 USD for this pay period. Thus, the employee's annual taxable earnings are annualized by multiplying the week's earnings by 52 weeks: 1,000 USD × 52 = 52,000 USD.

The system calculates the annual tax for the taxable earnings for each state using the appropriate rate from the state's corresponding tax tables.

New York Annual Tax Calculation:

Because Employee A works 70 percent in New York, his annual taxable earnings is 52,000 USD x 70% = 36,400 USD. Assume that New York's tax rate from the tax table is 4.5%. Thus, the New York annual taxes are 4.5% x 36,400 USD = 1,638 USD.

Connecticut Annual Tax Calculation:

Because Employee A works 30 percent in Connecticut, his annual taxable earnings is 52,000 USD x 30% = 15,600 USD. Assume that Connecticut's tax rate from the tax table is 6%. Thus, the employee's Connecticut annual taxes are 6% x 15, 600 USD = 936 USD.

The system converts each state's annual tax amounts to weekly amounts and then applies these amounts to each state.

New York Weekly Tax Calculation:

1,638 USD ÷ 52 weeks = 31.50 USD per week

Connecticut Weekly Tax Calculation:

936 USD ÷ 52 weeks = 18 USD per week

Note: The Create Paysheet COBOL SQL process (PSPPYBLD) uses tax distribution information to set the state and locality by default on the paysheet and to distribute the employee's hours and/or earnings as specified. If this tax distribution data is changed after the paysheet is created, you must manually update the paysheet with the distribution changes.

Note: If you want the earnings in the Other Earnings section of the paysheet to be distributed according to the tax distribution, you must set up and add the earnings as additional pay (either manually or through an interface) before paysheet creation. If you add the earnings directly to the payline, the system does not apply tax distribution.

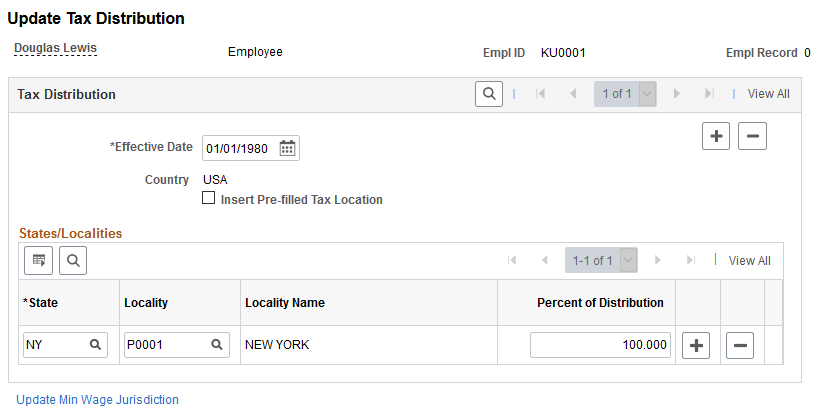

(USA, USF) Use the Update Tax Distribution page (TAX_DISTRIBUTION) to enter the employees work state or localities percentages for US employees.

This information will be used in the Create Paysheet Process and create a payline for each state/locality combination.

Navigation:

This example illustrates the fields and controls on the Update Tax Distribution page for the U.S.

Tax Distribution

Field or Control |

Description |

|---|---|

Insert Pre-filled Tax Location |

Select to automatically populate this record using the tax location ID specified on the employee's Job Data record and the corresponding information on the Tax Location Table. When a tax location code contains multiple states, and this check box is selected, the system:

|

States/Localities

Field or Control |

Description |

|---|---|

Percent of Distribution |

Specify the percent of the employee's time or earnings to apply to selected state/locality in the State and Locality fields. Note: This tax distribution is for work location taxes only and does not include resident-based taxes. Every employee must have at least one Tax Distribution record. State/locality percentages must total 100 percent. If the employee works in one state or locality, the distribution percent should be 100 for that row. However, if an employee is hired or transferred into a tax location that represents more than one state or locality, you must distribute taxes among the different states or localities. All the percentages must total 100. You cannot save the page until the distribution percent values total 100. Note: You can distribute taxes for salaried and exempt hourly employees only. If you select the Use Total Wages for Multi-State Employee check box on the Federal Tax Data 2 page, the system uses 100 percent of the employee's wages to determine the tax rate. |

Update Min Wage Jurisdiction (update minimum wage jurisdiction) |

Select to access the Update Minimum Wage Jurisdiction Page to modify or review the employee’s minimum wage jurisdiction setup.

This link appears if the pay group of the employee is enabled with

minimum wage jurisdiction.

|

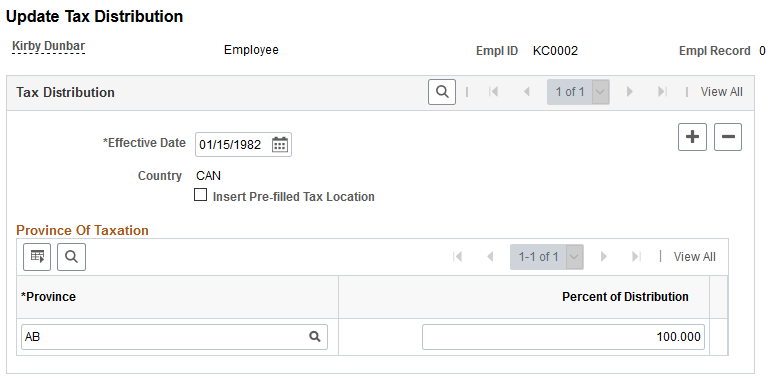

(CAN) Use the Update Tax Distribution page (TAX_DIST_CAN) to enter tax distribution information for Canadian employees.

Navigation:

This example illustrates the fields and controls on the Update Tax Distribution page for Canada.

Note: All fields on this page have the same functionality as the fields on Update Tax Distribution Page (TAX_DISTRIBUTION), the U.S. version except for the following fields.

Field or Control |

Description |

|---|---|

Province |

Canada does not allow distribution to more than one province. Enter the province in which the employee works. |

Percent of Distribution |

For Canadian payroll, the distribution percent must be 100 for a single row. The default value is 100. |