(USA) Processing Forms W-4

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PAY_W4W5 |

(USA) Run the Determine W-4 Exempt Renewal process (PY_W4_EE) to identify and notify employees who must file a new W-4. |

|

|

RUNCTL_TAX103 |

(USA) Run the Reset W-4 Exempt List report process (TAX103) in update or report only mode. If run in update mode, the SQR inserts a new row into employee tax data with default values for employees who do not submit a new W-4 form. |

|

|

W-4 Audit Report Page |

RUNCTL_TAX107 |

(USA) Generate the W-4 Audit Report (TAX107) that lists all employees who either created or updated their W-4 information through the ePay self-service transaction. |

|

W-4 Print - Self Service Page |

RUNCTL_TAX108 |

(USA, USF) Run the W-4 Print Self-Service SQR Report (TAX108) to print Form W-4 information submitted by the employee in the ePay self-service transaction. |

|

W-4 Exemptions Report Page |

RUNCTL_TAX100 |

(USA) Generate the W-4 Exemptions Report (TAX100) that lists all employees in each company who have elected a special withholding tax status. |

Employees who claim exemption from federal withholding must submit a new Form W-4 each year by February 15 to maintain their exemption status. On February 15 of each tax year, the payroll administrator must reset the W-4 status of any employee who claimed exemption from federal withholding in the previous year and failed to file a new W-4 requesting the exemption for the current year.

Payroll for North America provides:

The PY_W4_EE workflow-enabled process that you can run at the end of each year to identify and notify employees who should complete a new Form W-4.

The TAX103 process to update the Federal Tax Data record of employees who were notified through workflow but did not update their W-4 data.

The TAX100 report to use for manual processing as an alternative to the workflow-enabled processing.

The TAX 107 and TAX108 reports for monitoring and printing W-4 data that employees submit through self-service transaction.

W-4 Workflow Processing Steps

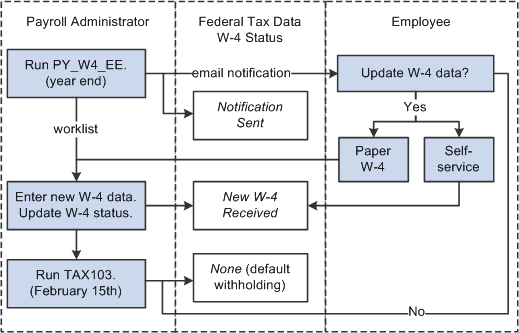

This diagram illustrates how workflow processing is used by both the payroll administrator and employee to manage W-4 exemption processing:

This diagram illustrates how workflow processing is used by both the payroll administrator and employee to manage W-4 exemption processing.

To process W-4 exemptions using workflow processing, the payroll administrator:

Runs the Determine W-4 Exempt Renewal Application Engine process (PY_W4_EE) to identify and notify employees who must submit a new Form W-4.

Selects the New W-4 Received W-4 Processing Status option on the employee's Federal Tax Data page and updates the other special tax withholding information after receiving the updated Form W-4.

A workflow link on the worklist provides easy access to the Federal Tax Data page to enter the data.

Note: If a notified employee uses the W-4 Withholding Certificate self-service transaction in PeopleSoft ePay to update W-4 tax information, the system selects the New W-4 Received W-4 Processing Status option on the Federal Tax Data page and updates the other withholding information. The payroll administrator's worklist notification remains active so that the administrator can verify that the employee submitted a new current-year Form W-4 stating that the employee is still exempt.

Runs the Report/Update W-4 Exempt Employees SQR Report process (TAX103) to reset the withholding information to default values for employees who fail to resubmit.

PY_W4_EE Process Description

Run the Determine W-4 Exempt Renewal process (PY_W4_EE) on the first day of the new year to:

Determine which employees must resubmit the Form W-4.

Notify these employees by email that they must resubmit.

Set the W-4 processing status to Notification Sent for employees identified.

Add a worklist instance to the payroll administrator's workflow role to process the new forms as they are received.

Note: Oracle PeopleSoft delivers Notification Composer Framework to manage the setup and administration of all notifications in one central location.

Once you have adopted the Notification Composer feature, you must use it to create new notifications and manage your existing notifications.

Notifications delivered with HCM Image 47 or later must use Notification Composer.

For more information about Notification Composer Framework, see Understanding Notification Composer.

The process also produces a list of employees who must resubmit the Form W-4.

TAX103 Process Description

The Report/Update W-4 Exempt Employees process (TAX103) selects employees whose W-4 processing status is Notification Sent on Federal Tax Data rows dated on or after the due date specified in the process run parameters.

You can run the process in either Report Only mode or Update mode:

Report Only mode lists employees who failed to submit a new W-4.

Update mode resets the withholding information for employees who failed to submit a new W-4.

It inserts a new Federal Tax Data record to reset the employee special withholding tax status and tax status to the default values. It sets the W-4 processing status to None.

It also updates future-dated records that currently specify exemption from withholding.

Other W-4 Reports

Payroll for North America provides these additional reports to track employees' W-4 information:

W-4 Exemptions SQR Report (TAX100).

Lists all employees in each company who are exempt from federal income tax withholding.

W-4 Audit SQR Report (TAX107).

Lists employees who either created or updated their W-4 information through the ePay self-service transaction.

W-4 Print Self-Service SQR Report (TAX108).

Prints employee W-4 information submitted electronically in PeopleSoft ePay.

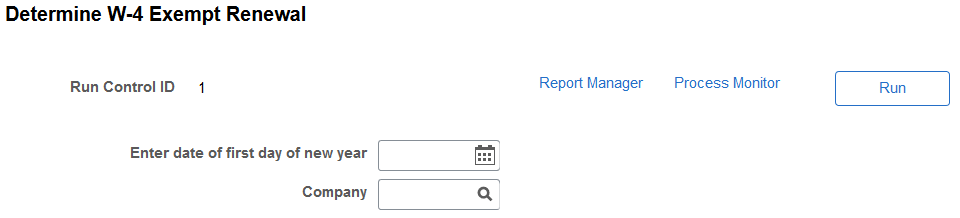

(USA) Use the Determine W-4 Exempt Renewal page (RUNCTL_PAY_W4W5) to run the Determine W-4 Exempt Renewal process (PY_W4_EE) to identify and notify employees who must file a new W-4.

Navigation:

This example illustrates the fields and controls on the Determine W-4 Exempt Renewal page.

Field or Control |

Description |

|---|---|

Company |

Select a company to run the process for all employees in that company only. To run the process for all employees in all companies, leave this field blank. |

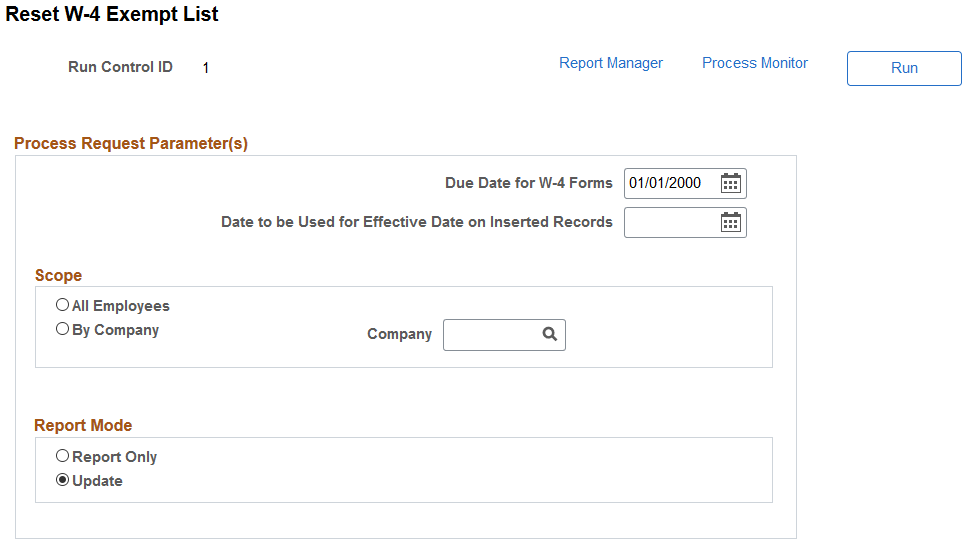

(USA) Use the Reset W-4 Exempt List page (RUNCTL_TAX103) to run the Reset W-4 Exempt List report process (TAX103) in update or report only mode.

Navigation:

This example illustrates the fields and controls on the Reset W-4 Exempt List page.

Note: Run the Reset W-4 Exempt List process on February 15 of each new tax year. If run in update mode, the SQR inserts a new row into employee tax data with default values for employees who do not submit a new W-4 form.

Field or Control |

Description |

|---|---|

Due date for W-4 forms |

Enter the due date for the W-4 forms. The IRS due date is Feb 15 of each new year. The report uses this date to check for Federal Tax Data records with an effective date on or after the date specified. |

Date to be used for Effective date on inserted records |

Enter the effective date to enter on new Federal Tax Data records created by the process for employees who failed to refile. Run the reset process in update mode on Feb 15 of each new year. |

All Employees |

Select this option to include all employees in this process. |

By Company and Company |

Select this option to include specific companies, and enter the company name. |

Report Only |

Select this option to identify employees who, although notified by the Determine W-4 Exempt Renewal process, have not filed a new W-4 by February 15 to continue their exemption from withholding. The report also identifies future-dated records. |

Update |

Select this option to insert a new Tax record to reset the employee's special withholding tax status to None and tax status to S (single). |