Defining Bank Replacement Rules

Use the Bank Replacement Rules component (BANK_RPL_RULE_DEFN) to define bank replacement rules.

This section provides an overview of bank replacement processing, lists prerequisites, and discusses how to define bank replacement rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BANK_RPL_RULE_DEFN |

Define bank replacement rules. |

PeopleSoft Payables enables you to use alternate bank accounts to replace the original bank accounts defined for a pay cycle according to bank replacement rules that you define on the Bank Replacement Rules page and select for a pay cycle on the Payment Selection Criteria - Preferences page.

Note: If financial sanctions are enabled at the bank level, you could replace a bank that does not require financial sanctions validation with one that does require validation. Because bank replacement occurs after the Payment Selection process, the system could select payments for suppliers that were not validated, even though the replacement bank does require financial sanctions validation. If you are using bank replacement processing, and you enable financial sanctions at the bank level, you should run the Financial Sanctions Validation Application Engine process (AP_SDN_VAL) prior to running the Pay Cycle process.

The replacement options that can make up a bank replacement rule are of five different types:

Replace All Payments: Replace the original bank accounts for all payments in a pay cycle with one alternate bank account.

This option also allows all payments to be reassigned to an alternate currency and payment method.

Replace Bank with Another Bank: Replace a particular original bank account or payment method with an alternate bank account or payment method.

Replace by Currency: Assign an alternate bank account, payment method, and currency to all payments scheduled to be made with a particular original currency.

Replace by Individual Payment Limit: Assign an alternate bank account to any individual payment that exceeds a monetary amount limit that is predefined for the original bank account.

Replace by Bank Maximum Limit: Assign an alternate bank account to any payments that remain after the monetary total of accumulated payments from a single bank account exceeds a defined monetary limit for that bank account. Note that the Pay Cycle process processes payments in order of amount, with the highest amount payments processed first.

For example, assume that you have ten payments in a pay cycle that are scheduled to be drawn from bank account A, as illustrated in the following table:

No.

Payment Amount

Bank Account

1

30,000.00 EUR

A

2

20,000.00 EUR

A

3

20,000.00 EUR

A

4

20,000.00 EUR

A

5

20,000.00 EUR

A

6

20,000.00 EUR

A

7

20,000.00 EUR

A

8

20,000.00 EUR

A

9

20,000.00 EUR

A

10

20,000.00 EUR

A

Assume further that you have defined a limit for bank account A of 100,000.00 EUR. You define a bank replacement rule dictating that when the accumulated payments in a single pay cycle exceed that amount, then all remaining payments scheduled to be paid out of that account will now be paid by bank account B. Because the fifth payment would bring the payment total to 110,000.00 EUR—over that 100,000.00 EUR limit—only the first four payments will be paid out of bank account A and the remaining six will be paid out of bank account B, as illustrated in this table:

No.

Payment Amount

Bank Account

1

30,000.00 EUR

A

2

20,000.00 EUR

A

3

20,000.00 EUR

A

4

20,000.00 EUR

A

5

20,000.00 EUR

B

6

20,000.00 EUR

B

7

20,000.00 EUR

B

8

20,000.00 EUR

B

9

20,000.00 EUR

B

10

20,000.00 EUR

B

You can indicate more than one alternate bank account to replace a bank account that reaches its maximum payment total for a pay cycle. You establish a priority for each alternate bank, such that when the first-priority replacement bank reaches its maximum payment total, the Pay Cycle process turns to the second priority replacement bank to pay the remaining payments, and so forth until all the payments have been made.

For example, assume that bank account B in the preceding scenario was the first priority replacement bank and had a maximum payment total of 80,000.00 EUR, and you also included a second priority replacement bank account C in your rule, with a maximum of 100,000.00 EUR. Your first four payments, totalling 90,000.00 EUR, would be made from the original bank, with its 100,000.00 EUR maximum, and the next four payments, totalling 80,000.00 EUR, would be made from bank account B, for which the maximum would then be reached exactly. The remaining two payments, totalling 40,000.00 EUR, would be paid from bank account C, as shown in this table:

No.

Payment Amount

Bank Account

1

30,000.00 EUR

A

2

20,000.00 EUR

A

3

20,000.00 EUR

A

4

20,000.00 EUR

A

5

20,000.00 EUR

B

6

20,000.00 EUR

B

7

20,000.00 EUR

B

8

20,000.00 EUR

B

9

20,000.00 EUR

C

10

20,000.00 EUR

C

The fact that the Pay Cycle processes highest-amount payments first means that it sometimes uses a lower priority replacement bank account before it uses a first priority replacement bank account—or even before it uses the original bank account. For example, if the preceding scenario is changed to add a payment in the amount of 10,000.00 EUR, then that eleventh payment would be processed last because it is least, but would be paid out of bank account B—the first priority replacement bank account—because bank account B still has 10,000.00 EUR available before it reaches its maximum.

Note: The maximum amount defined for a bank account decreases with each pay cycle run that creates payments from that bank account, but you can adjust the maximum amount definition for a bank account at any time.

Note: The Pay Cycle process does not split a payment among multiple banks when performing bank replacement.

Processing Order When a Bank Replacement Rule Includes Multiple Bank Replacement Options

You can define a bank replacement rule that combines more than one of these five bank replacement option types, subject to the following conditions.

If you select Replace All Payments to replace the original bank accounts for all payments in a pay cycle with one alternate bank account, you cannot select any of the other four bank replacement option types.

This replacement occurs during the Payment Selection subprocess.

The other four—options 2 through 5 in the preceding list—are processed in order (2 through 5).

This processing occurs during the Payment Creation subprocess.

Here's an example of processing if your bank replacement rule has definitions for options 2 through 5. Assume that you have the following bank replacement rule (the example is an unlikely one in actual practice, but it is designed to demonstrate the point simply):

|

Option type |

Condition |

|---|---|

|

Replace bank with another bank. |

Replace bank account A with bank account B. |

|

Replace by currency. |

Assign payments in Swedish kronor (SEK) to bank account C. |

|

Replace by individual payment limit. |

Assign any payment in bank account C over 10,000.00 SEK to bank account D. Assign any payment in bank account B over 5,000.00 EUR to bank account E. |

|

Replace by bank maximum limit. |

Assign any payment that causes bank account D to go over a 100,000.00 SEK threshold for the pay cycle to bank account F. |

Now assume that you have two vouchers with the following payment amount and bank account information:

7,000.00 EUR, Bank account A.

11,000.00 SEK, Bank account A.

The first voucher would be paid out of bank account E, because the replacement processing would happen in the following order:

Replace by bank account: bank account A replaced by bank account B.

Replace by currency: no action.

Replace by individual payment limit: 7,000.00 EUR is over the individual payment limit for bank account B, so bank account B is replaced by bank account E.

The second voucher would be paid out of bank account D, because the replacement processing would happen in the following order:

Replace by bank account: bank account A replaced by bank account B.

Replace by currency: because the payment is in SEK, bank account B is replaced by bank account C.

Replace by individual payment limit: 10,000.00 SEK is over the individual payment limit for bank account C, so bank account C is replaced by bank account D.

Now, if voucher 2 were one of ten vouchers in SEK in the pay cycle that together totalled over 100,000 SEK, and if it were processed by the pay cycle after the 100,000.00 SEK threshold was reached, then it would be paid out of bank account F.

Payment Method Replacement Considerations

When you replace the bank for all payments, replace a bank with another bank, or replace the bank for payments with a particular currency, you can specify the payment method for the payments drawn on the replacement bank account. If the original and replacement payment methods are one of the following, then Pay Cycle applies the replacement payment method to the payments:

System check.

Electronic funds transfer (EFT).

Giro electronic funds transfer (Giro EFT).

Automated Clearing House (ACH).

Wire.

Scheduled payments with a payment method other than these four will not be assigned a replacement payment method, but will keep the original payment method, regardless of the replacement payment method indicated in the bank replacement rule. For example, if the payment method for a voucher is Draft-Customer EFT and the bank rule specifies a replacement payment method of EFT, the pay cycle still generates a Draft-Customer EFT payment for that voucher, even if the bank account is slated for replacement. If the replacement bank does not support the original payment method in these cases, then the payment generates a bank replacement exception.

If the replacement payment method is EFT, ACH, or Giro EFT and the original payment method on a voucher is System Check, then the Payment Selection subprocess validates that a remit-to bank account exists and routing information is set up for the remit to supplier for the voucher. If not, the payment generates a bank replacement exception.

Note: The Pay Cycle process does not recalculate payment dates when payment methods are replaced. The original scheduled payment date remains the payment date, regardless of any new payment method.

Currency Considerations

If the default currency for an original bank account is different from that of the replacement bank account, then the Pay Cycle process converts the original currency into the replacement bank account's default currency when it is comparing payment amounts to bank account maximum amounts. The exchange rate is based on the payment date.

If a replacement bank does not have a valid payment currency, the Pay Cycle process drops the payment and generates a bank replacement exception.

Bank Replacement Exceptions

Any voucher payments that fail bank replacement processing during pay cycle processing are logged on the Bank Replacement Exceptions page. These vouchers return to their original state, with their original bank account, payment methods, and payment currency intact, waiting to be run in the next pay cycle.

When processing pay cycles through the PeopleSoft Financial Gateway functionality, the system verifies that a payment's layout code is valid for the replacement bank. If the layout code is not valid, the system logs a bank replacement exception. You can resolve or avoid exceptions in the following way:

To resolve these exception types, add the appropriate layout code to the replacement bank external account definition (on the External Accounts – Payment Methods page). Then rerun the Pay Cycle process.

To avoid these exception types, confirm that the origin bank and the replacement bank are defined with the appropriate layouts before processing pay cycles.

To use the Replace by Individual Payment Limit and Replace by Bank Maximum Limit options, you must define individual payment limits and bank account maximums in the PayCycle Amount Limits group box on the External Accounts - Account Information page when you set up bank accounts.

Use the Bank Replacement Rule page (BANK_RPL_RULE_DEFN) to define bank replacement rules.

Navigation:

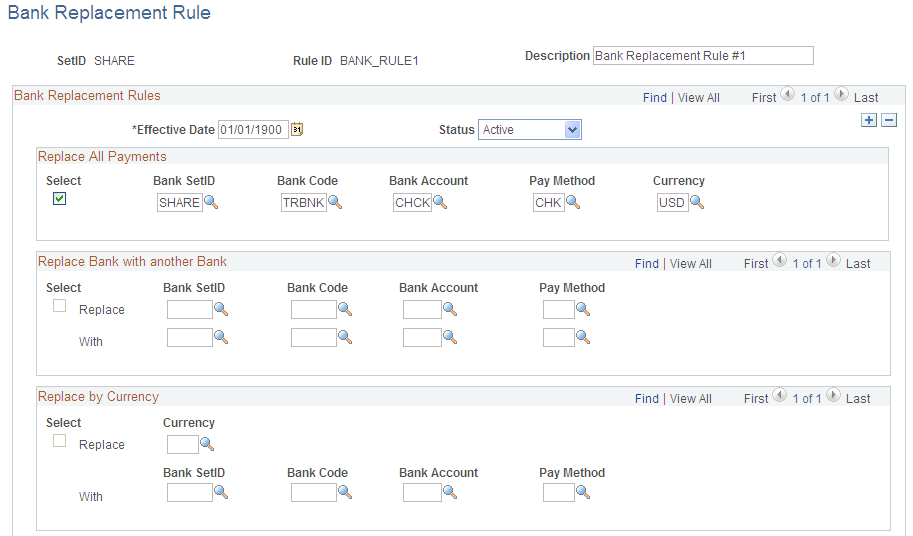

This example illustrates the fields and controls on the Bank Replacement Rule page (1 of 2). You can find definitions for the fields and controls later on this page.

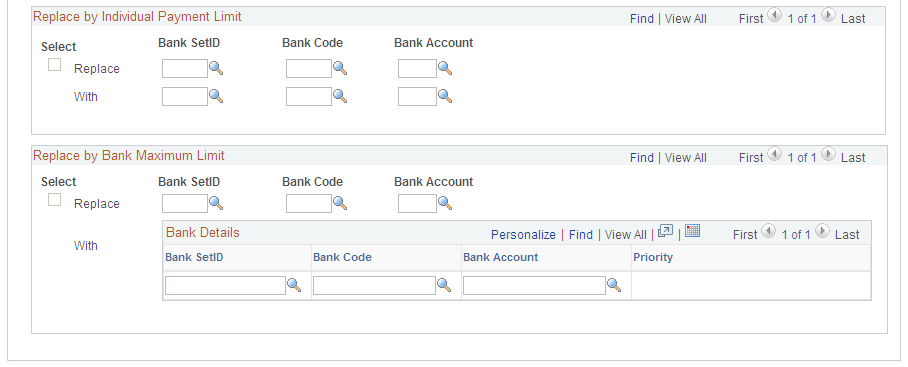

This example illustrates the fields and controls on the Bank Replacement Rule page (2 of 2). You can find definitions for the fields and controls later on this page.

Use the Select check box to select the bank replacement options that you want to include in the bank replacement rule.

Replace All Payments

Field or Control |

Description |

|---|---|

Bank SetID, Bank Code, and Bank Account |

Enter the identifying information for the bank account from which you want to pay all payments in the pay cycle. This bank account will replace all original bank accounts for the payments selected to run in the pay cycle. |

Pay Method |

(Optional) Select a replacement payment method. Available payment methods include:

This payment method will replace the original payment method on all payments selected for the pay cycle, as long as the original payment method is System Check, EFT, ACH, or Giro-EFT. Payments with any other original payment method specified will still be paid in that original payment method. If you do not specify a payment method, the payments will be made using the payment method specified on the voucher. Note: If the payment will be made using the original payment method, and that payment method is not available for the replacement bank, the system will generate a bank replacement exception and the payment will be dropped from the pay cycle. See Bank / Method Page. |

Currency |

(Optional) Specify a replacement currency. This currency will replace the original currencies specified on all payments selected for the pay cycle. The currency conversion uses the payment date to determine the exchange rate. If you do not specify a currency, the payments will be made in the currency specified on the voucher. Note: If you do not specify a replacement currency and the currency on the voucher is not valid for the replacement bank, the system will generate a bank replacement exception and the payment will be dropped from the pay cycle. |

Note: You cannot select any other replacement options when you select Replace All Payments.

Replace Bank with Another Bank

Select to have all payments from a specified bank account (and optionally, payment method) paid from a replacement bank account (and optionally, payment method).

In the Replace row, enter the identifying information for the original bank account that you want to replace. Do the same in the With row for the replacement bank account.

The bank SetID, bank code, and bank account are required, but the payment method is optional. If you opt to replace the payment method, the same conditions apply as when you specify a replacement payment method for the Replace All Payments option.

Note: The replacement bank account must support the currencies supported by the original bank account. If the original currency on a voucher is not valid for the replacement bank, the system generates a bank replacement exception and the payment is dropped from the pay cycle.

Replace by Currency

Select to have all payments in a specified currency paid from a replacement bank account.

Enter the currency and the identifying information for the replacement bank account. Payment method is optional, and if you opt to replace the payment method, the same conditions apply as when you specify a replacement payment method for the Replace All Payments option.

Note: The currency must be valid for the replacement bank account.

Replace by Individual Payment Limit

Select to assign an alternate bank account to any individual payment that exceeds a monetary amount limit that is predefined for the original bank account.

Enter the identifying information for the original bank account in the Replace row, and enter the identifying information for the replacement bank account in the With row.

Note: You set up the maximum amount for an individual payment from a bank account on the External Accounts - Account Information page.

Replace by Bank Maximum Limit

Select to assign an alternate bank account to any payments that remain after the monetary total of accumulated payments from a single bank account exceeds a defined monetary limit for that bank account.

Enter the identifying information for the original bank account in the Replace row, and enter the identifying information for the replacement bank accounts in the With grid. You can enter multiple replacement bank accounts for each original bank account that you specify. The Pay Cycle process assigns payments to each replacement bank account in the order that you add them to the grid, moving on to the next replacement bank account when an earlier bank account in the order has reached its maximum payment limit.

When you save or refresh the page, the Priority field is populated with a number indicating the processing order. The first row has priority 1, the second has priority 2, and so forth.