Creating, Updating, and Reusing Pay Cycles

Use the Payment Selection Criteria component (PYCYCL_DEFN) to define pay cycles.

This section provides an overview of pay cycle definition and lists prerequisites.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PYCYCL_DEFN_DT |

Define pay cycle dates. |

|

|

PYCYCL_DEFN_OPT |

Set pay cycle general options. |

|

|

PYCYCL_DEFN_SRC |

Define the pay cycle by source transaction and business unit. |

|

|

PYCYCL_DEFN_BNK |

Specify bank information and payment methods. |

|

|

PYCYCL_DEFN_PYGRP |

Specify pay groups to include in the pay cycle and netting reference codes to use in performing payables/receivables netting. Specifying pay groups restricts the selection of payments to the pay group specified. The fields on this page are available for entry only if you select Use Supplier Pay Groups or specify a netting option of S on the Preferences page. |

|

|

PYCYCL_DFT_OPT |

Set Draft rounding and optimization options. |

This section provides an overview of pay cycle creation and discusses:

Other payment options.

Payment forecasting.

Netting.

Lost discount alert dates.

Pay Cycle Creation

In PeopleSoft Payables, a pay cycle is a set of payment selection criteria that you use to pay groups of vouchers that share certain characteristics. You can run the Pay Cycle process repeatedly, using the same pay cycle criteria to select payments, by updating the date information. Think of a pay cycle as a payment selection criteria template.

For example, you might want to create two types of pay cycles: one for regular suppliers, the other for employees set up as suppliers. Or you might want to create checks for each of your business units separately. In this case, you could set up a separate pay cycle for each business unit. PeopleSoft Payables creates payments only for the business unit or units specified in the pay cycle. You can also select payments based on bank information, supplier pay groups, or payment method.

Your pay cycle definition controls the scheduled payments that are eligible for payment in each cycle. Each individual voucher scheduled for payment within the cycle contains information that ultimately determines its selection. To create or update a pay cycle, you use the Payment Selection Criteria component. Each page of the Payment Selection Criteria component defines different aspects of the payment selection cycle.

Other Payment Options

After you have gone through the payment processing routine a few times, you will find that it runs easily. However, occasionally you might have payments that need to be paid outside of the regular payment processing routine. You can use the manual Payment Creation process or express payments to create manual payments, or you can create record-only payments on the Voucher - Payments page.

Payment Forecasting

To see the expected cash requirements for upcoming payment cycles, go to the Forecast by Bank Account page. You can also see the different time intervals for payments on the Forecast Cycle page. You can run the Payment Forecast report (APY2040), which enables you to see your cash requirements by business unit, supplier, bank, or payment method.

See Forecasting Payments.

Netting

When you create a pay cycle, you can specify to use the netting process to offset accounts receivable and accounts payable transactions for a customer who is also a supplier. Netting decreases the number of transactions between you and your customer or supplier and, by reducing banking fees, saves you business costs. The Netting Bank is a virtual bank account, meaning that no funds are actually paid into or out of the netting account. It is debited and credited by the netted amount of the accounts payable and accounts receivable transactions.

For example, suppose that you are both a customer and supplier to company A and that you set up a contractual netting relationship. You agree on certain intervals to conduct netting and zero out your respective accounts. At netting closing time, you might have the following transactions:

|

Accounts Payable Transactions (in USD) |

Accounts Receivable Transactions (in USD) |

|---|---|

|

100.00 |

150.00 |

|

200.00 |

50.00 |

|

Total: 300.00 |

Total: 200.00 |

|

<200.00> |

None |

|

Net: 100.00 |

None |

Instead of performing three accounts payable transactions and two accounts receivable transactions after the netting closing process, you pay a single outstanding payment of 100.00 USD to balance your account. In this example, the books for both you and company A mirror each other.

Netting closing can be run manually from the Manual Select Netting component (NET_MANUAL_SELECT), or it can be run automatically during Pay Cycle. You specify the automatic netting parameters in the Automatic Netting Selection component (NET_AUTO_SELECTION).

Enter the netting reference ID to specify which supplier accounts to run the netting process on. The system creates the netting reference ID when you define your PeopleSoft Payables netting relationship with your supplier. The netting reference ID is a unique identifier that contains information such as the netting date, status, bank, and settlement information.

The Netting Closing Application Engine processes (TR_NET_CLOSE and TR_NET_ARCLS), which are launched by the Pay Cycle process, base the settlement on information contained in the netting contract, maintained in PeopleSoft Cash Management. All balanced payments go through the normal Payment Selection process and are consolidated as a single payment. The netting payment currency and rate are automatically set to match the transaction currency and rate type.

Important! You must have PeopleSoft Cash Management and Receivables installed to use the netting functionality. However, if your organization is not using the PeopleSoft Payables netting functionality, you generally do not need PeopleSoft Cash Management installed on your system. Confirm that your implementation does not need PeopleSoft Cash Management installed, and then disable it on the Installed Products page. Disabling products that you do not have installed on the system improves performance.

Note: You can exclude certain vouchers from netting by setting up netting exclusion rules on the Netting Exclusion Parameters page in PeopleSoft Cash Management. The parameters that can determine exclusion include supplier ID, supplier location, supplier classification, and ChartField value.

Lost Discount Alert Dates

When you create a pay cycle, you can use the Include Lost Discounts option on the Payment Selection Criteria - Preferences page to elect to include in the current pay cycle any payments that would potentially lose discounts if paid in the next pay cycle. If you do not select the Include Lost Discounts option, the system alerts you to lost discounts using the Lost Discount Alert page when you run the pay cycle, after you run Payment Selection. You can use the Lost Discount Alert page only if you run Payment Selection and Payment Creation separately. Using the Lost Discount Alert page, you can manually include payments with potential lost discounts in the pay cycle before you run Payment Creation. Selecting the Include Lost Discounts option, however, is the only way to include payments with potential lost discounts in a pay cycle if you run Payment Selection and Payment Creation together.

The system calculates whether a discount was potentially lost by comparing the discount terms on the voucher to the next pay through date (the last scheduled payment date that will be included in the next pay cycle) and next payment date (the actual payment date that will be recorded for the payments made in the next pay cycle) that you enter on the Payment Selection Criteria - Dates page. If the following criteria are met for a voucher, then the system includes the payment in the current pay cycle (if you selected the Include Lost Discounts check box) or lists it on the Lost Discount Alerts page (if you didn't select Include Lost Discounts and you run Payment Selection separately from Payment Creation):

The payment due date on a voucher is greater than the pay through date for the current pay cycle, and indicates that it should be included in a later pay cycle.

The discount terms on the voucher are such that the discount due date is earlier than the next payment date, and thus a payment made in the next pay cycle would cause a lost discount.

The potential lost discount outweighs the potential interest earned on the payment amount if the payment is paid on the due date rather than the discount due date.

You set up discount evaluation criteria, including interest percentage, when you set up bank accounts.

If you lose discounts by not selecting Include Lost Discounts and not manually including payments with potential lost discounts in the pay cycle after running Payment Selection separately, the lost discounts are reported on the Discounts Denied page.

Note: Rebate terms on a voucher are evaluated in the same way as discount terms. However, vouchers that would lose rebates if they aren't paid in the current pay cycle (and pass the interest amount versus rebate amount evaluation) are always automatically taken during Pay Cycle processing, irrespective of whether you select Include Lost Discounts. Rebates are not tracked and don't appear on the Lost Discount Alert page.

The following example illustrates how the system handles potential lost discounts:

Suppose that a voucher has a discount due date of March 21. The pay cycle has a pay through date of March 15 and a pay date of March 18. The following pay cycle has a pay through date of March 31 with a pay date of April 15.

If you selected the Include Lost Discount option, the system automatically includes the item for payment in the current pay cycle.

If you deselected the Include Lost Discount option, the system alerts you on the Lost Discount Alerts page that you have a potential lost discount.

Before you can create pay cycles using the Payment Selection Criteria component, you must:

Set up banks and bank accounts.

(Optional) Define bank replacement rules.

(Optional) Set up supplier pay groups.

(Optional) Set up netting reference codes and exclusion parameters.

(Optional) Tailor your pay cycle definition.

Before you use a pay cycle, you must complete all PeopleSoft Payables setup and create vouchers with scheduled payments or define payment sources for the PeopleSoft Payables payment interface.

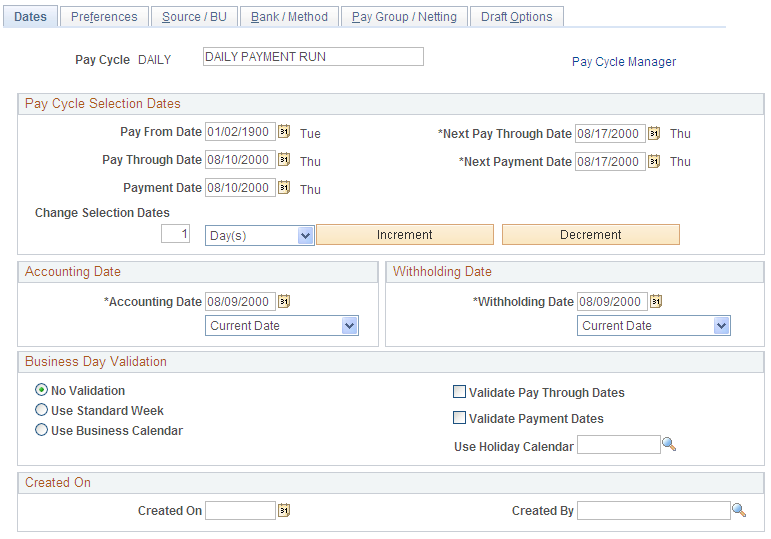

Use the Payment Selection Criteria - Dates page (PYCYCL_DEFN_DT) to define pay cycle dates.

Navigation:

This example illustrates the fields and controls on the Payment Selection Criteria - Dates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Pay Cycle |

Enter a description for the pay cycle. |

Go To Pay Cycle Manager |

Click to save the pay cycle and open the Pay Cycle Manager, where you initiate and control processing for the pay cycle. |

Pay Cycle Selection Dates

Field or Control |

Description |

|---|---|

Pay From Date |

Enter the beginning date of the pay cycle. The system compares this date to the scheduled pay date for the voucher payment schedule. If the scheduled pay date is equal to or greater than the pay from date, the voucher payment schedule can be paid in the current pay cycle if the schedule meets the other payment selection criteria. |

Pay Through Date |

Enter the ending date of the pay cycle. The system compares this date to the scheduled pay date for the voucher payment schedule. If the scheduled pay date is on or before the pay through date, the voucher payment schedule can be paid in the current pay cycle if the schedule meets the other payment selection criteria. |

Payment Date |

Enter the payment date. The system tags all payments created in the pay cycle with this date and prints it on checks or shows it on other payment methods. It can differ from the pay through date. The scheduled pay date has to be between the pay from date and the pay through date so that it is included in the pay cycle. |

Next Pay Through Date |

Enter the estimated end date for the next pay cycle payment period. This estimate is used to help determine whether discounts will be lost if a payment is made in the next pay cycle. |

Next Payment Date |

Enter the estimated payment date for the next scheduled pay cycle. This estimate is used to help determine whether discounts will be lost if a payment is made in the next pay cycle. |

Change Selection Dates |

Change the specified payment dates by Day(s), Month(s) or Week(s). Click Increment to advance all dates by that amount, or click Decrement to decrease all dates by that amount. |

Accounting Date and Withholding Date

Field or Control |

Description |

|---|---|

Accounting Date |

Determines the fiscal year and period to which the payment accounting entries are posted. Three options are available for the date that the system uses as the accounting date for the payments created in the pay cycle: Current: The current date. Payment: The value in the Payment Date field. Specific: The specific value that you enter. When you select this option, the date field next to the Accounting Date field is activated. Enter the specific date in the date field. |

Withholding Date |

Enter the date that determines the reporting period in which a withholding amount is reported for a supplier. Three options are available for the date that the system uses as the withholding date for withholdings associated with payments created in the pay cycle: Current: The current date. Payment: The value in the Payment Date field. Specific: The specific value that you enter. When you select this option, the date field next to the Withholding Date field is activated. Enter the specific date in the date field. For example, you could be running a pay cycle for December 31 but actually want the withholdings to be reported for the following year. To accomplish this, you would specify January 1 as the Withholding Date and the withholdings would be declared the following year. This date is also used on period-based withholdings to determine which period is going to be used to properly calculate withholdings. |

Business Day Validation

Business calendars enable you to verify that transaction processing dates are valid working days. The business calendar is used throughout PeopleSoft applications to define nonworking days and holidays.

Select from the following options:

Field or Control |

Description |

|---|---|

No Validation |

Select when no holidays or weekends are considered when determining payment and discount due dates. |

Use Standard Week |

Select to use business days from Monday through Friday to determine valid payment dates. You can select Validate Pay Through Dates and Validate Payment Dates if you select this option. |

Use Holiday Calendar |

Select to use both business days and holidays to determine valid discount and payment dates. If you select this option, you must select an appropriate holiday business calendar from the Holiday List ID field. You can select Validate Pay Through Dates and Validate Payment Dates if you select this option. |

Validate Pay Through Dates |

Select to validate the pay through date that you enter, ensuring that the date falls on a valid business day. |

Validate Payment Dates |

Select to validate the payment date that you enter, ensuring that the date falls on a valid business day. |

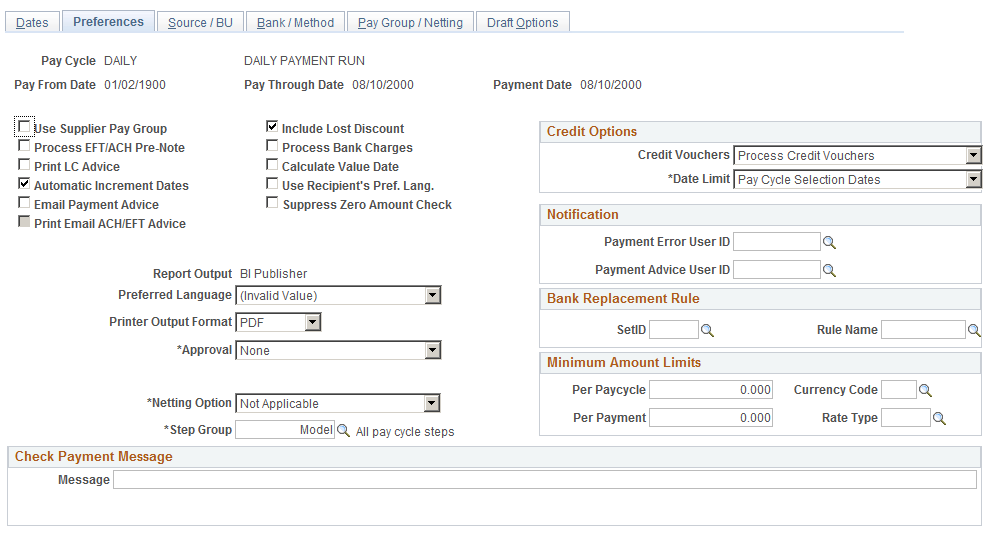

Use the Payment Selection Criteria - Preferences page (PYCYCL_DEFN_OPT) to set pay cycle general options.

Navigation:

This example illustrates the fields and controls on the Payment Selection Criteria - Preferences page . You can find definitions for the fields and controls later on this page.

General Options

Field or Control |

Description |

|---|---|

Use Supplier Pay Group |

Select to include supplier pay group information as part of your pay cycle selection criteria. Selecting this check box makes the supplier pay group information available for entry on the Pay Group/Netting page. The fields on the Pay Group/Netting page are not enabled unless you select this check box. Also, if you deselect this check box after specifying supplier pay groups, the system does not select the pay groups, even if you have pay groups defined for the pay cycle. Note: The Pay Cycle process uses supplier pay groups as selection criteria only for vouchers that were entered through PeopleSoft Payables. The Pay Cycle process ignores any supplier pay group selection criteria when selecting payments from non-PeopleSoft Payables sources that are integrated through the PeopleSoft Payables Payment Interface, such as PeopleSoft Expenses. |

Process EFT/ACH Pre-Note (process electronic funds transfer/automated clearing house prenote) |

Select to include any EFT or ACH prenotes in this pay cycle. Note: The system generates prenotes only if there is a payment selected in the pay cycle. To avoid generating prenotes for a bank that may not be set up for EFT or ACH and also does not have any EFT or ACH vouchers in that pay cycle, the system creates prenotes for all of the suppliers from the first bank that the pay cycle processes that has an EFT or ACH payment created. If there are no EFT or ACH vouchers in the pay cycle, the prenotes will be created for the first bank that the pay cycle processes. In addition, the system generates a prenote only if the remit location for the supplier is the same as its main supplier location. |

Print LC Advice (print letter-of-credit advice) |

Select to enable a process that prints advices for letter-of-credit payments. |

Automatic Increment Dates |

Select to enable a process that automatically advances the Pay From Date, Pay Through Date, Payment Date, Next Pay Through Date, and Next Payment Date fields on the Dates page. The new dates are validated, based upon the calendar and validation options set on the Dates page. Pay through dates automatically advance, taking into account non-work days (holidays, weekends) when such days immediately follow the calculated pay through date. The next pay cycle run date advances to the next working day. The increment is controlled on the Dates page and may be any number of days, weeks, or months. |

Email Payment Advice |

Select to enable the system to send an email payment advice to suppliers that have this option enabled. |

Print Email EFT/ACH Advice |

Select to enable the system to print advice for ACH/EFT that can be emailed. This option is available only if Email Payment Advice option is selected. |

Financial Sanctions list edit |

Select to validate the suppliers against financial sanctions lists (for example, the Specially Designated Nationals (SDN) list) during the Payment Selection process of the pay cycle. If financial sanctions validation is enabled at the installation level, all remit suppliers selected for this pay cycle are validated. If financial sanctions validation is enabled at the bank level, only selected remit suppliers whose banks are enabled for financial sanctions validation are validated. The system updates the supplier's financial sanctions status on the Supplier Information component (VNDR_ID). If you do not select this option, the system does not validate the suppliers during the Payment Selection process, but uses the existing financial sanctions status to determine whether the supplier is selected for payment. The system does not select payments for a supplier with a financial sanctions status of Blocked. The system also does not select payments for a supplier with a financial sanctions status of Review unless financial sanctions validation is enabled at the bank level and that supplier's bank does not require financial sanctions validation. If the system validates the suppliers during the Payment Selection process and the supplier's financial sanctions status changes to Review, the system creates payment validation errors for this supplier's payments. You can view these payment validation errors on the Pay Cycle Financial Sanction Warnings page. Note: Financial sanctions validation is performed only on remit suppliers with a source transaction of VCHR (Accounts Payable transactions). |

(USF) Workflow Certification |

For U.S. Federal agencies only. Select to enable workflow notification of payment schedules requiring certification. Select Certifier as the approval option and enter the user ID of the certifier. |

Include Lost Discount |

Select to process scheduled payments automatically if you will earn a discount for the payment in the current pay cycle but might lose it if the payment is processed in the next pay cycle, as indicated by the next pay through date and the next payment date specified on the Dates page. |

Process Bank Charges |

If this option is selected, the system calculates the actual payment amount by deducting the bank transfer charge from the payment amount when the charge is to be paid by the supplier. The operation takes place during the Pay Cycle process and only applies to EFT payments. |

Calculate Value Date |

Select to enable value dates. You can choose to select a date a few days before or after the actual transfer date to make funds available. The date on which funds are available (either as a deposit or a settlement) is known as the value date of a transaction. Banks negotiate the value date to be a specified number of days before or after the business date of a transaction. For payments or settlements, set the value date to a specified number of days before the business date. This means that the check must clear the bank prior to settling with the individual beneficiary. For deposits, set the value date to a specified number of days after the business date. This is similar to the concept of float used in the United States. The decisions that you make about value dates, coupled with holiday options, influence your cash flow. You set up value date calculation for bank accounts on the External Accounts - Payment Methods page. |

Use Recipient's Pref. Lang. |

Sends payments in the supplier's preferred language. If it is not selected, the payments are sent in the language selected in the Preferred Language field in this pay cycle. |

Suppress Zero Amount Check (use recipient's preferred language) |

Select to process zero-amount checks without attaching a payment reference ID (check number). Note: The payment will have a payment ID (system identifier) associated with it. |

Report Output |

Select the format you want to use when printing checks. |

Printer Output Format |

Select the printer output format for printing checks from the options:

Note: The printer output format is PDF by default. The printer output format is PDF by default. You may select the PCL or the PS option and recreate the check with new reference number or reprint using same reference number. |

Preferred Language |

Select the language to use when printing checks. When printing checks from pay cycle, the system will use the language selected here even if the Use Recipient's Pref. Lang. field is selected. |

Approval |

Identify whether approvals are necessary and if so, by whom, the User or Certifier. Values are Certifier, None, or User. Selecting Certifier or User makes the pay cycle remain in unapproved status until the pay cycle is approved on the Pay Cycle Approval page. If you do not select this option, the pay cycle advances to Approved status without requiring approval. The Certifier option is for U.S. Federal agencies only. Note: Payments for pay cycles with User as the approval option selected are not eligible for posting until the pay cycle has been approved. |

(USF) Certifier |

Designate a user to certify payment schedules. This field appears only if you enable federal payment schedules on the installment options. Note: The certifier cannot be the same user as the initiator of the pay cycle. |

Netting Option |

Enables you to include the Payables and Receivables Netting Closing processes in this pay cycle. Values are: N: Not Applicable. The netting close processes don't run. A: Process All Netting IDs. The netting close processes run for all suppliers and customers. S: Specify Netting ID. Runs the netting close processes based on the netting ID that you specify on the Pay Group/Netting page. Selecting this option activates the fields in the Netting Group group box on the Pay Group/Netting page. |

Step Group |

Select which group of steps to use for this pay cycle. You must define these groups beforehand on the Pay Cycle Step Table page. Note: Oracle supplies a standard step group, or you can create your own pay cycle step group. |

Credit Options

Define processing options for credit vouchers.

Field or Control |

Description |

|---|---|

Credit Vouchers |

Select from the following values:

|

Date Limit |

Select from the following values: No Date Limit: The system applies all outstanding credit vouchers, regardless of date. Pay Cycle Selection Dates: Limits the search for credit vouchers to the pay cycle dates. |

Notification

Field or Control |

Description |

|---|---|

Payment Error User ID |

Enter the user ID that the system uses to route PeopleSoft Financial Gateway payment errors email notification. This field is part of the PeopleSoft Financial Gateway integration functionality. If the PeopleSoft Financial Gateway encounters errors when processing payments, defined users receive an email containing payment error summary information and a link to the Pay Cycle Errors page. Note: To select a user ID here, you must first enter a valid email address on the User Preferences - PayCycle page. |

Payment Advice User ID |

When the user selects the Email Payment Advice option, the current user ID will be entered by default into this field; you can select a different user ID, if necessary. |

See Setting Up the PeopleSoft Financial Gateway Integration.

Bank Replacement Rules

Field or Control |

Description |

|---|---|

SetID |

Select a bank replacement SetID for this pay cycle. |

Rule Name |

Select a bank replacement rule name for this pay cycle. Bank replacement rules identify alternate bank accounts to replace the bank account specified on the voucher. They also identify the criteria that must be met for bank replacement to occur. You define bank replacement rules on the Bank Replacement Rules page. Note: If financial sanctions are enabled at the bank level, you could replace a bank that does not require financial sanctions validation with one that does require it. Because bank replacement occurs after the Payment Selection process, the system could select payments for suppliers that were not validated, even though the replacement bank does require financial sanctions validation. If you are using bank replacement processing, and you enable financial sanctions at the bank level, you should run the Financial Sanctions Validation process prior to running the Pay Cycle process. |

Minimum Amount Limits

Field or Control |

Description |

|---|---|

Per Paycycle |

Enter the minimum amount limit per paycycle. This is an optional field. The Pay Cycle will produce payments only when the total of the pay cycle meets or exceeds the Per Pay Cycle amount that is entered. |

Per Payment |

Enter the minimum amount limit per payment. The minimum per payment amount must be equal or less than the minimum per paycycle amount. Individual payments that do not meet or exceed the Per Payment amount will not be processed by this pay cycle. This is an optional field. |

Currency Code |

Specify a currency code from the list of currencies defined to use in your business. |

Rate Type |

Specify the currency rate type. |

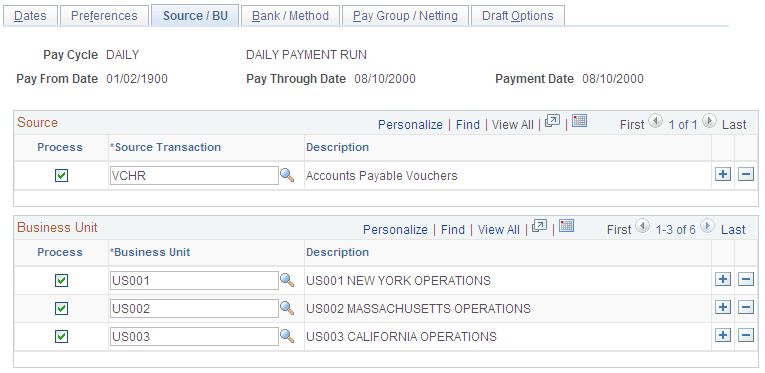

Use the Source / BU (Source / Business Unit) page (PYCYCL_DEFN_SRC) to define the pay cycle by source transaction and business unit.

Navigation:

This example illustrates the fields and controls on the Source / BU page. You can find definitions for the fields and controls later on this page.

Source

The source transactions define the types of payments processed in a pay cycle. Review delivered source transaction definitions on the Payment Source and Payment Source Search Definition pages, and source transaction mapping detail on the Pay Cycle Mapping and Pay Cycle Mapping Detail pages.

Select or deselect each source transaction by selecting or deselecting the Process check box next to the appropriate source transaction. These are the delivered values:

Field or Control |

Description |

|---|---|

EXAD |

Employee Advances Definition. |

EXPN |

Employee Expense Sheet Definition. |

TR |

Treasury Settlement Payments. |

TRET |

Treasury EFT Settlement Payments. |

VCHR |

Accounts Payable Vouchers. |

Note: You must select a least one source. At a minimum, you should select the Accounts Payable Vouchers source transaction.

Business Unit

You can select multiple business units. For example, your regular pay cycle can include all business units. Select the Process check box for each business unit that you want to include during the pay cycle to narrow the selection criteria. Only vouchers for the business units that you specify are included in the pay cycle. The system uses the supplier and voucher information at the business unit level unless you override that information. If you do not want to process a particular business unit during a specific run of the Pay Cycle process, deselect the Process check box for that business unit.

Note: You must select at least one business unit for the pay cycle to create any payments.

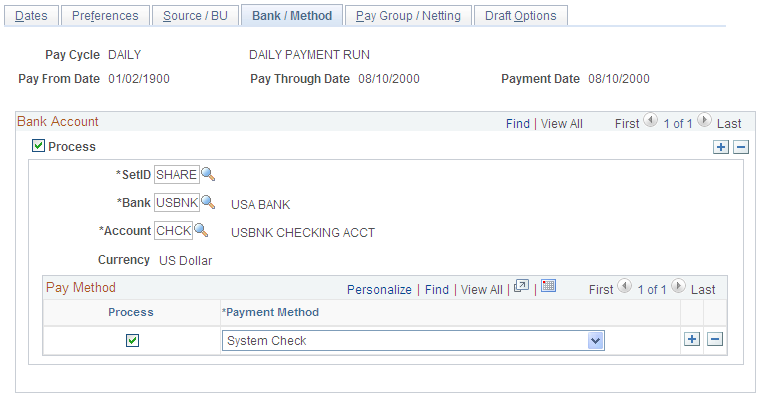

Use the Bank / Method page (PYCYCL_DEFN_BNK) to specify bank information and payment methods.

Navigation:

This example illustrates the fields and controls on the Bank / Method page. You can find definitions for the fields and controls later on this page.

Bank Account

Enter banks and bank accounts from which to draw payments in the pay cycle. Every voucher that has a scheduled payment from a bank, bank account, and payment method that matches the ones you specify here becomes eligible for payment in this pay cycle. You can enter multiple banks and accounts.

Note: You can specify replacement bank accounts for a pay cycle if a voucher or set of vouchers meet certain criteria by selecting a bank replacement rule on the Payment Selection Criteria - Preferences page. You set up bank replacement rules on the Bank Replacement Rules page.

Field or Control |

Description |

|---|---|

Process |

Selects vouchers with scheduled payments drawn on the specified bank account for pay cycle processing. |

Currency |

Shows the default currency for the bank account. |

Pay Method

If the payment method for a voucher's scheduled payments is the same as the pay cycle payment method, the voucher is a candidate for selection. For each bank account, you can specify multiple payment methods. Specify the payment methods to be processed during the pay cycle by selecting the Process check box next to the appropriate payment method. These are the available payment method values:

Field or Control |

Description |

|---|---|

Automated Clearing House |

The Pay Cycle process creates an electronic file containing the required clearinghouse information. You send all applicable payments in one file to a clearinghouse. The clearinghouse then sends the payments to your supplier's bank. |

Draft-Customer EFT (draft-customer electronic funds transfer) |

The Pay Cycle process creates an EFT file instead of printed drafts. You send the file to your bank when the draft payment is due. |

Draft-Customer Initiated |

The Pay Cycle process creates customer-initiated draft payments before the draft due date that details the draft identification number, the draft amount, and the draft maturity date. You send the draft to your supplier. |

Electronic Funds Transfer |

The Pay Cycle process creates an electronic file containing the required bank and payment information. You send all applicable payments in one file to your bank for payment. The bank sends the payments to your supplier's bank. |

Giro-EFT |

The Pay Cycle process collects all EFT Giro transactions and creates an output data file containing the payment information. You send the output data file to the bank electronically or on taped media. This payment method is primarily used in Singapore. |

Letter of Credit |

The Pay Cycle process groups all vouchers that have the same letter of credit ID into a single payment. Only those payments for which you have selected the L/C Advice option on the Preference page have a printed letter of credit advice. |

System Check |

The system checks are scheduled payments that require a printed paper check and remittance advice. At voucher entry, indicate that the payment is a system check. When you run the Pay Cycle process, it creates system checks. |

Wire Transfer |

During the Pay Cycle process, the Wire Transfer payment method generates a remittance advice for paying by wire. |

Use the Pay Group / Netting page (PYCYCL_DEFN_PYGRP) to specify pay groups to include in the pay cycle and netting reference codes to use in performing payables/receivables netting.

Specifying pay groups restricts the selection of payments to the pay group specified. The fields on this page are available for entry only if you select Use Supplier Pay Groups or specify a netting option of S on the Preferences page.

Navigation:

You must select the Use Supplier Pay Group check box or enter a netting option on the Preferences page to enter values on this page.

Pay Group

Enter the SetID and pay group code for each pay group that you want to process. Select or deselect the Process check box, depending on whether you want to include the pay group in the current cycle. If you have pay groups selected, only scheduled payments that contain one of the selected pay groups are paid. Use the row insert function to add more pay groups to the pay cycle.

Note: If you deselect the Use Supplier Pay Group option on the Preferences page for a pay cycle, any information that you enter in this grid will not apply as payment selection criteria for that pay cycle.

Note: The Pay Cycle process uses supplier pay groups as selection criteria only for vouchers that were input through PeopleSoft Payables. The Pay Cycle process ignores any supplier pay group selection criteria when selecting payments from non-PeopleSoft Payables sources that are integrated through the PeopleSoft Payables Payment Interface, such as PeopleSoft Expenses.

Netting

For each qualified netting reference ID, the Pay Cycle process processes netting closing for both accounts payable and accounts receivable transactions. Select the Process option to indicate that the Pay Cycle process needs to run the Netting Closing processes. During the Pay Cycle process, the Payables Netting Closing process starts and selects those vouchers that fall within the netting date range with a netting status of A (approved). The system then launches the Receivables Netting Closing process. After processing the PeopleSoft Receivables transactions, the process returns to the Payables netting process, which updates the netting status to C (closed).

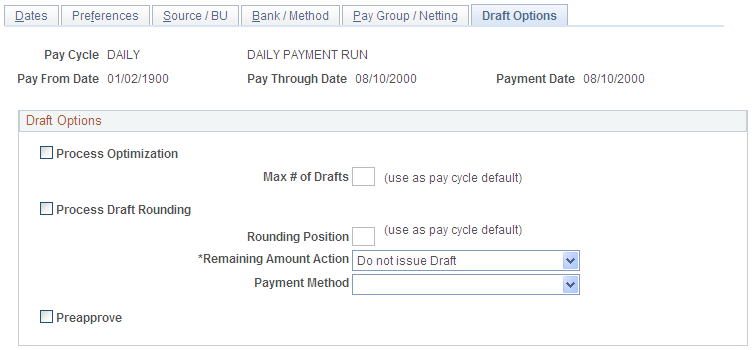

Use the Draft Options page (PYCYCL_DFT_OPT) to set Draft rounding and optimization options.

Navigation:

This example illustrates the fields and controls on the Draft Options page. You can find definitions for the fields and controls later on this page.

Draft optimization, or stamp tax minimization, in PeopleSoft Payables is primarily applied to Japanese domestic drafts that are created during the customer-initiated Draft Staging Application Engine process (AP_DFT_PROC). Draft rounding enables you to control at what point a draft is issued for payment and what alternate payment method is used for those payments that do not meet your specifications.

Field or Control |

Description |

|---|---|

Process Optimization |

Select to enable draft optimization processing for the pay cycle. |

Max # of Drafts |

If you selected Process Optimization, you can either leave this blank to have the system use the default specified at the supplier, or you can specify the maximum number of drafts that are created during the pay cycle by entering a value in this field. Note: At the supplier level, you can either specify a maximum number of drafts or select the Pay Cycle Default value. If you select Pay Cycle Default for a supplier, then Pay Cycle processing uses the value of the maximum number of drafts that you enter here. If you enter a maximum number of drafts for the supplier and leave the Max # of Drafts field blank on this page, then Pay Cycle processing uses the number for the supplier. |

Process Draft Rounding |

Select to enable draft rounding for the pay cycle. |

Rounding Position |

If you selected Process Draft Rounding, you can either leave this blank to have the system use the default specified at the supplier, or specify the rounding position used during the pay cycle by entering a value in this field. The rounding position rounds the draft payment amount down to the whole value that you set. For example, if you enter 4, then the draft payment must be equal to or greater than 1,000 before a draft is created. All amounts above 1,000 are rounded down to the nearest 1,000, and the remaining amount is handled according to the remaining amount action that you specify. Note: At the supplier level, you can either specify a rounding position or select the Pay Cycle Default value. If you select Pay Cycle Default for a supplier, then Pay Cycle processing uses the value of rounding position that you enter here. If you enter a rounding position value for the supplier and leave the Rounding Position field blank on this page, then Pay Cycle processing uses the rounding position value for the supplier. |

Remaining Amount Action |

Specifies the handling of the remaining draft amount after draft rounding is complete. These are the available values: Alternate Pay Mthd (alternate pay method): You use the Payment Method field to specify by what payment method the remaining draft amount is paid. Do not issue Draft: Holds the remaining draft amount and adds it to the next draft payment. A draft payment for the remaining amount is not issued. Because the remaining draft amount is not paid on this pay cycle, it is available for payment in the next pay cycle, provided that the selection criteria are met. |

Payment Method |

Select the payment methods by which the amount left after rounding calculation is paid. You can select a payment method only if you specify Alternate Pay Mthd in the Remaining Amount Action field. |

Preapprove |

Creates draft payments with a status of Approved. If this check box is deselected, draft payments are created with a status of Created. If the status is Created, then you must either manually approve drafts on the Draft Approval page or run the Draft Recon and Approval (draft reconciliation and approval) process. Depending on the Payables Definition setup, a status of Approved may be required before accounting entries can be generated in the Payment Posting process. |

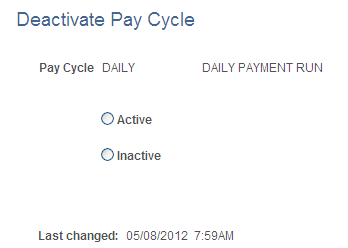

Use the Deactivate Pay Cycle page (DEACTIVATE_PYCYCL) to activate or deactivate the pay cycle.

Navigation:

This example illustrates the fields and controls on the Deactivate Pay Cycle page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Active and Inactive |

Select the desired check box to activate or inactivate the pay cycle. Inactivating a pay cycle does not delete the pay cycle. The active and inactive status is used in the search views for Pay Cycle Selection and Pay Cycle. An inactivated pay cycle can be activated any time. |

Last Changed |

Displays the last changed date and the operator. |