Understanding the Receivables Update Application Engine Process

This topic discusses:

The Receivables Update process.

The Receivables Update multiprocess job (ARUPDATE).

Receivables Update processing options.

Accounting history and accounting periods.

The posting process in PeopleSoft Receivables is known as Receivables Update. The Receivables Update process occurs throughout the system as you post pending items. These pending items can be entered online, created by your billing interface, or created during payment processing, draft processing, direct-debit processing, or overdue charge processing, or during item maintenance activities.

When you post items in PeopleSoft Receivables, the system processes groups of pending items to update a customer's balance, system-defined history elements, and item balances. During processing, the system creates balanced, valid accounting entries. The Journal Generator Application Engine process (FS_JGEN) then summarizes the accounting entry information in general ledger journal format. The General Ledger Posting Application Engine process (GL_JP) updates the ledger balances.

Receivables Update processes records in these transaction tables:

Group Control (PS_GROUP_CONTROL) - Contains header information for the transaction group.

Pending Item (PS_PENDING_ITEM) - Contains the transaction type and transaction detail.

Pending Distribution (PS_PENDING_DST) - Contains accounting entries.

Pending VAT (PS_PENDING_VAT) - Contains value-added tax (VAT) transaction type and transaction detail.

Pending Tax (PS_PENDING_TAX) - Contains India excise duty tax and sales tax entries from a billing system.

Pending Tax Details (PS_PENDING_TAX_DTL) - Contains India excise duty tax and sales tax details.

The process updates six master tables:

Item (PS_ITEM) - Contains detailed information about the receivable.

Item Activity (PS_ITEM_ACTIVITY) - Describes the action taken on the receivable item.

Item Distribution (PS_ITEM_DST) - Contains the accounting entries for the item activity.

Item VAT (PS_ITEM_ACT_VAT) - Contains the VAT transactions for the item activity.

Item Tax (PS_ITEM_ACTTAX) - Contains tax information for India for the item activity.

Item Tax Details (PS_ACTTAX_DTL) - Contains tax line information for India for the item activity.

Note: If you enabled the options for processing entry events selected at the installation level and on the Receivable Update Request - Options page, the Receivables Update process calls the Entry Events Generator Application Engine process (FS_EVENTGEN), which updates the Entry Event Accounting Lines table (PS_EE_ITM_ACCTG_LN) with the supplemental accounting entries.

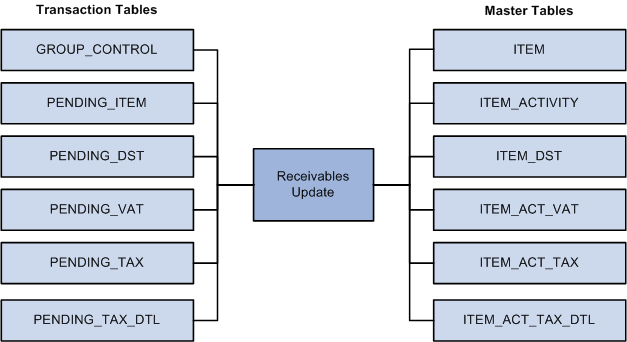

This graphic shows the flow of data for the Receivables Update process. The transaction tables (GROUP_CONTROL, PENDING_ITEM, PENDING_DST, PENDING_VAT, PENDING_TAX, PENDING_TAX_DTL) are processed using Receivables Update and updated in the master tables (ITEM, ITEM_ACTIVITY, ITEM_DST, ITEM_ACT_VAT, ITEM_ACT_TAX, ITEM_ACT_TAX_DTL).

Flow of data for the Receivables Update process. The transaction tables (GROUP_CONTROL, PENDING_ITEM, PENDING_DST, PENDING_VAT, PENDING_TAX, PENDING_TAX_DTL) are processed using Receivables Update and updated in the master tables (ITEM, ITEM_ACTIVITY, ITEM_DST, ITEM_ACT_VAT, ITEM_ACT_TAX, ITEM_ACT_TAX_DTL)

The Receivables Update process also updates the system-defined customer history elements.

The Receivables Update multiprocess job (ARUPDATE) consists of up to eight steps. This table describes each step:

|

Step |

Description |

|---|---|

|

Receivables Update Application Engine process (ARUPDATE) |

The process takes groups from all worksheets that are set to post and creates the GROUP_CONTROL and PENDING_ITEM records. (For pending item groups entered online or imported from a billing system, or for groups whose accounting entries have been created online, the GROUP_CONTROL and PENDING_ITEM records already exist.) This step prepares tables for parallel processing. Note: Any parameters that you add to narrow the scope or to change processing are ignored in the first step. |

|

Pending Group Generator multiprocess job (AR_PGG) |

The AR_PGG multiprocess job runs a predefined number of Pending Group Generator Application Engine processes (AR_PGG_SERV) in parallel. The Pending Group Generator process creates accounting entries and VAT lines for any groups that are set to post. This includes the output from the Receivables Update process (ARUPDATE), as well as any billing groups for which accounting entries are not already created. The process creates VAT lines only for certain types of system-generated groups. Note: For this step, you can narrow the scope of processing by one field. |

|

Posting multiprocess job (AR_POST) |

The AR_POST multiprocess job runs a predefined number of AR Posting Application Engine (AR_POSTING) processes in parallel. This process posts the transactions in each group. Note: For this step, you can specify multiple narrowing and chunking options. |

|

(Optional) Entry Events Generator Application Engine process (FS_EVENTGEN) |

Each AR Posting process calls the Entry Events Generator process to generate entry events. Entry events enable PeopleSoft Receivables to create standard accounting entries automatically based on accounting lines generated by receivables document posting. This process runs only if you have the options for processing entry events selected at the installation level and on the Receivable Update Request - Options page. |

|

Receivables Update Clean Application Engine process (AR_UPDATE2) |

This process updates customer history for all business units and performs cleanup tasks. |

|

(Optional) Revenue Estimate Application Engine process (AR_REV_EST) |

The AR_UPDATE2 process calls the Revenue Estimate process to create source transactions for control budgets if you have enabled the commitment control feature for PeopleSoft Receivables and the business unit. |

|

(Optional) Budget Processor Application Engine process (FS_BP) |

The AR_UPDATE2 process calls the Budget Processor by way of the Revenue Estimate process to budget check the source transactions that the Revenue Estimate process created and creates the budget lines. The process uses the default source transaction type that you assigned to the business unit. |

|

(Optional) Journal Generator (FS_JGEN) |

The AR_UPDATE2 process calls the Journal Generator to create the journal lines for the general ledger if you enable the option to run it when you create the run control for the Receivables Update process. |

When you run the Receivables Update process, you normally run it as a scheduled process. However, PeopleSoft Receivables enables you to post groups from a group action page immediately instead of waiting for a scheduled batch process to run. Use this function for small groups when you need to post a transaction immediately. Each posting action is associated with an on-demand process group by default, and you enable users to use an on-demand process group in user preferences. These posting options are available from the action pages:

Term |

Definition |

|---|---|

Do Not Post |

Saves the changes to the group, but no posting takes place. You also use this option to change the posting option for a group set to Batch Standard or Batch Priority if the group has not been processed yet. The Do Not Post option is associated with the ARACTIONA on-demand process group. |

Post Now |

Runs the Receivables Update process immediately, which calls the Revenue Estimate and Budget Processor processes if you have enabled the commitment control feature for PeopleSoft Receivables and the business unit. If the user enabled the notification feature, the system displays a message when the process finishes. This is not intended for large jobs. The Post Now option is associated with the ARPOST on-demand process group. |

Post Now to GL |

Runs the Receivables Update process immediately and runs processes to create and post journals to the general ledger. If the user enabled the notification feature, the system displays a message when the process finishes. This is not intended for large jobs. The Post Now to GL option is associated with the ARPOSTGL on-demand process group. |

Batch Priority |

Runs the Receivables Update process the next time that a priority job is scheduled or the next time that a standard batch job is scheduled if that occurs first. The Priority option is associated with the ARACTIONN on-demand process group. |

Batch Standard |

Runs the Receivables Update process the next time that a standard batch job is scheduled. This may occur once a day depending on how often your organization schedules standard jobs. The Batch Standard option is associated with the ARACTIONL on-demand process group. |

Standard Jobs

To schedule a batch standard job, create a run control and do not create any RP_RUN_OPTIONS on the Application Engine Request page for the AR_POST Application Engine. Each time that the system runs the Receivables Update process for this run control, it processes all groups for which the posting action is set to Batch Priority or Batch Standard.

Priority Jobs

To schedule a batch priority job, create a run control and enter PRIORITY in the Value field and select RP_RUN_OPTIONS in the Bind Variable Name field on the Application Engine Request page for the AR_POST Application Engine. Each time that the system runs the Receivables Update process for this run control, it processes all groups for which the posting action is set to Batch Priority.

Setup for Receivables Update Processing Options

You must enable all users to run one of the system-defined process groups on the Define User Preferences - Process Group page. This enables users to select a posting action on the group action page. You specify from which group action page the user has access to these options. You can set this up for:

Pending item entry.

Payment worksheets.

Maintenance worksheets.

Transfer worksheets.

Unpost groups.

Item split.

Important! The Post Now and Post Now to GL options should be limited to a small group of users and should not be used as the standard method for posting transactions.

PeopleSoft Receivables defines which processes are included in each process group and from which pages a user can run the process groups. In addition to the Define User Preferences - Process Group page, you must specify any real-time run control options and real-time process options such as the server name and whether to use event notification on the On Demand Processing Options page.

Note: To check the status of the process if you do not set up event notification, check the FS_STREAMLN job in the PeopleSoft Process Monitor.

The ARPOST process group (Post Now option) posts the transactions in the group and creates the accounting entries. It runs these processes:

Pending Group Generator.

Interunit Central Processor (IU_PROCESSOR).

Posting.

Entry Event Generator (if enabled).

Revenue Estimate (if commitment control is enabled).

Budget Processor (if commitment control is enabled).

The ARPOSTGL process group (Post Now to GL option) posts the transactions in the group, creates accounting entries, generates the journal entries, and posts the journal entries to the general ledger. It runs these processes:

Pending Group Generator.

Interunit Central Processor.

Posting.

Entry Event Generator (if enabled).

Revenue Estimate (if commitment control is enabled).

Budget Processor (if commitment control is enabled).

Journal Generator.

Edit Journals (GLJEDIT) (if you have PeopleSoft General Ledger).

Post Journals (GL_JP) (if you have PeopleSoft General Ledger).

Note: If you select the ARPOSTGL option and you do not have PeopleSoft General Ledger installed on the system, disable General Ledger on the Installed Products page so that the Journal Generator process does not call the Edit Journals or Post Journals processes.

PeopleSoft Receivables gives you control over both your calendar periods and when you update history elements. You define detail calendars based on your processing schedule. Each period in this calendar represents a week, a month, or any other amount of time.

You assign a detail calendar for history calculations on the Receivables Options - General 1 page for each SetID. The system calculates, summarizes, and stores all monetary transactions that fall within the date range for the periods that you define. You also specify which period in the calendar to use to calculate days sales outstanding (DSO) on the Receivables Options - General 1 page. The Receivables Update process uses this period to update the DSO history element. You also control when to update other history statistics using the Customer History Options check boxes on the Receivable Update Request page. When you select the option to update DSO, the page displays the period for which it will calculate the historical information.

Another factor to consider is the calendar that you use for accounting periods. You assign a calendar ID to a general ledger business unit on the Ledgers for a Unit page. By default, each receivables business unit has the same open periods with the same opening and closing dates as the general ledger business unit with which it is associated. However, you can have different periods open in PeopleSoft Receivables or even different beginning and ending dates for the period. You override the general ledger period information for an individual receivables business unit on the Open Period page. After you close an accounting period for a PeopleSoft Receivables business unit, you can no longer post transactions to that period.

After running Receivables Update to calculate historical information, if you do not want to log any additional activity to a historical period, you may want to do one of two things:

Use the same detail calendar for your history elements that is used for the accounting periods for the general ledger business unit.

Make sure that the period is closed before you run the Receivables Update process to calculate the DSO.