Calculating Standard Costs Using Cost Rollup Process

For purchased items, you can have the system calculate the frozen standard cost using the Cost Rollup process. This process includes one material cost per item and any other additional landed costs. Cost rollups for purchased items do not include any lower level costs, bill of materials, or item routings.

The Cost Rollup process can calculate the costs for purchased items. These new costs are temporarily stored in the CE_ITEMCOST table where you can review them using several PeopleSoft inquiry pages. If you discover that the new costs are incorrect, then you can change the data and then run the Cost Rollup process again. Once you are satisfied with the results, run the Update Production process (Cost Update/Revalue process page) to freeze and move the new standard costs into the CM_PRODCOST table as the new frozen standard costs. The Update Production process also revalues the current inventory for costing future inventory transactions.

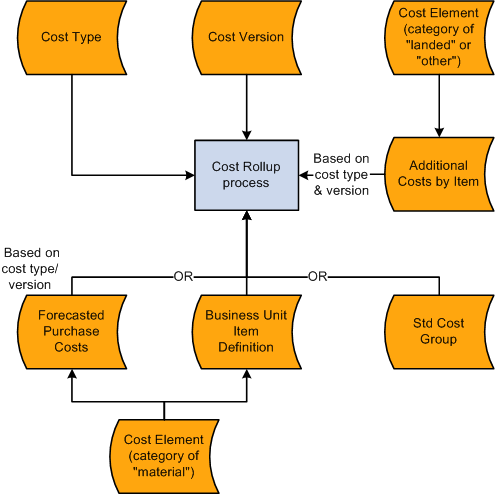

This diagram illustrates the cost rollup for purchased items. Based on the cost type and cost version, the Cost Rollup process determines one material cost per item and any additional landed costs:

To calculate standard costs for purchased items:

Define the standard cost structure using the topic: "Structuring Your Cost Management System."

Define cost versions.

(Optional) Create standard cost groups.

(Optional) Use forecasts for material costs.

Add landed and miscellaneous costs using the Additional Item Costs page.

Calculate costs using the Cost Rollup process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CE_VERSION |

Create different versions for a cost type to maintain a history of the different costs calculated for each cost type. You can base these cost versions on different sets of assumptions, such as different effective dates or different budgets. |

|

|

CM_COSTGROUP |

Cost groups (also known as standard cost groups) enable you to group together a set of items for cost rollup and update, comparing costs and reporting inventory value. |

|

|

CE_FCST |

Use negotiated prices for the items as the basis for the standard costs. |

|

|

CE_ITEMEXP |

Add other costs to the cost rollup of the items. Examples of additional costs are landed costs such as, duty, freight, inspection, procurement expenses, and material handling. |

|

|

CE_ROLLUP_REQ |

Run this process to calculate the standard cost for the items. |

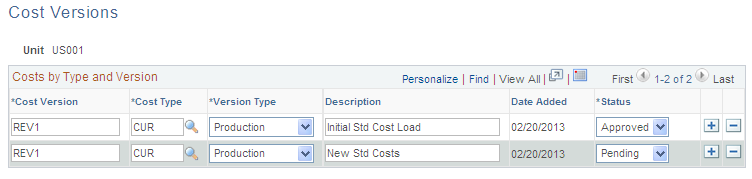

Use the Cost Versions page (CE_VERSION) to create different versions for a cost type to maintain a history of the different costs calculated for each cost type.

You can base these cost versions on different sets of assumptions, such as different effective dates or different budgets.

Navigation:

This example illustrates the fields and controls on the Cost Versions page. You can find definitions for the fields and controls later on this page.

Use this page to define the different cost versions for a cost type. You can create unlimited cost versions for any cost type. By using different versions for a cost type, you can maintain a history of the different costs calculated for each cost type. You can base these cost versions on different sets of assumptions, such as different effective dates or different budgets.

Field or Control |

Description |

|---|---|

Version Type |

For purchased items, set this value to Production. |

Status |

Each cost version must have a status of Pending, Denied or Approved. You can only update the standard costs in the live environment when the status is Approved. |

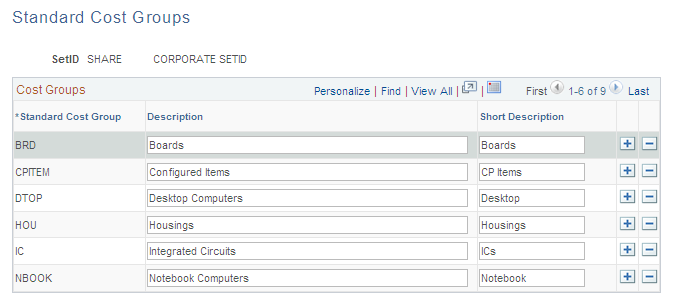

Use the Cost Groups page (CM_COSTGROUP) to cost groups (also known as standard cost groups) enable you to group together a set of items for cost rollup and update, comparing costs and reporting inventory value.

Navigation:

This example illustrates the fields and controls on the Standard Cost Groups page. You can find definitions for the fields and controls later on this page.

Standard cost groups enable you to group together a set of items for cost roll up and update, comparing costs and reporting inventory value. Add items to the cost group by entering the standard cost group on the item's Define Business Unit Item - General: Common page. Then, enter a standard cost group on the Cost Rollup page or the Cost Update/Revalue page instead of defining a range of item IDs.

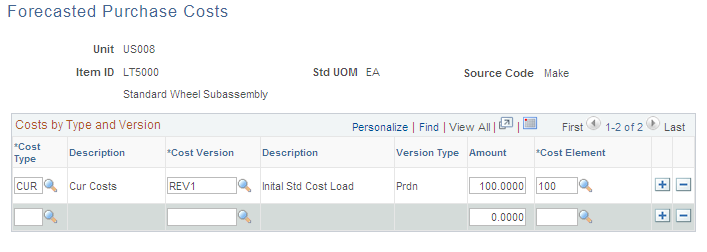

Use the Forecasted Purchase Costs page (CE_FCST) to use negotiated prices for the items as the basis for the standard costs.

Navigation:

This example illustrates the fields and controls on the Forecasted Purchase Cost page. You can find definitions for the fields and controls later on this page.

Use the Forecasted Purchase Costs page to use a negotiated price as the material cost of the item in the Cost Rollup process. This enables you to use forecasted prices as a basis for the cost. The amount that you entered should be the material cost of the item only, exclusive of any freight, duty, landed costs, or procurement expenses. The cost element that you selected must have a cost category of Material assigned on the Cost Elements page.

Note: Be sure that the cost type that you select designates Forecasted purchase costs as the purchase cost. If you use forecasted purchase costs, define a cost for every purchased item.

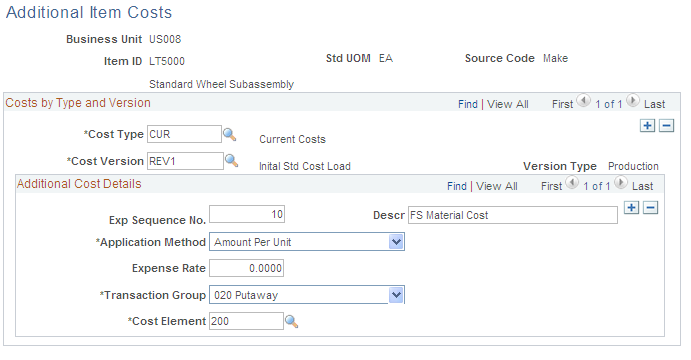

Use the Additional Item Costs page (CE_ITEMEXP) to add other costs to the cost rollup of the items.

Examples of additional costs are landed costs such as, duty, freight, inspection, procurement expenses, and material handling.

Navigation:

This example illustrates the fields and controls on the Additional Item Costs page. You can find definitions for the fields and controls later on this page.

Landed costs and other miscellaneous costs can be added into the standard cost of an item by using the Additional Item Costs page. You define these additional costs (one cost at a time) for each cost type or cost version combination.

When you use this page to add landed cost components to an item, you can track and analyze the total landed cost for that item. You can set up consigned items as landed cost items; if you do, the system transacts all accrued landed cost charges when the consigned item is consumed. No variances is computed for landed costs applied using this page. See the topic, "Structuring Landed Costs" for further information.

See Understanding Landed Costs.

The Exp Sequence No (expense sequence number) determines the order in which the system applies costs; it is especially critical when it applies the rate to the total cost. For a purchased item, the total cost base includes material and any additional cost previously applied to that point.

Define how the system calculates the additional cost. Application Method values include:

Field or Control |

Description |

|---|---|

% of Materials Cost (percentage of material cost) |

Multiplies the percentage specified by the item's material cost. |

% of Total Costs (percentage of total costs) |

Includes material costs plus any previously calculated additional costs as the total cost basis. For example, suppose that the item's material cost is 1.00 and you define an additional cost for sequence 10 as 50 percent of material cost, and sequence 20 as 100 percent of total cost, then the basis for applying additional costs for sequence 20 is 1.50 (1.00 of material cost plus 50 percent of 1). |

Amount Per Unit |

This amount is added to the cost of each unit of the item. |

The Transaction Group defines the point at which you apply the additional costs into inventory. Select Stocking to include these costs in the standard cost calculations.

Note: If you have already run the Cost Update/Revalue process (RUN_CES5001) for the item specified, then you cannot change the transaction group selection.

Enter a cost element for each additional cost. The cost element that you entered must have a cost category of Landed or Other entered on the Cost Elements page.

To calculate the standard cost of an item, use the Cost Rollup (CE_COST_ROLLUP) component.

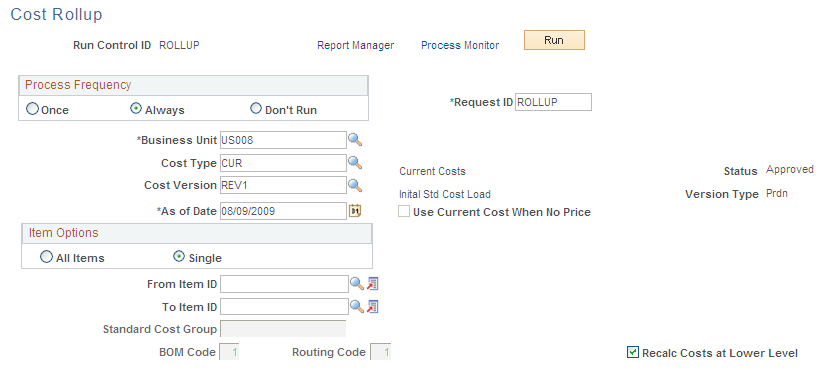

Use the Cost Rollup page (CE_ROLLUP_REQ) to run this process to calculate the standard cost for the items.

Navigation:

This example illustrates the fields and controls on the Cost Rollup page. You can find definitions for the fields and controls later on this page.

Use the Cost Rollup page to perform a cost rollup for a single item, a range of items, or a group of items within a business unit, cost type, or cost version combination.

Field or Control |

Description |

|---|---|

Cost Type and Cost Version |

Select the combination that you want to calculate. The cost type and version determine which set of material and additional landed costs PeopleSoft Cost Management uses in the cost calculation. |

Version Type |

Displays the version type. The Version Type must be Prdn (production) in order for the calculated cost to be used as the system's standard costs. Version type is determined on the Cost Versions page. |

Use Current Cost When No Price |

Select to insure that all items have a material cost. If the method of calculating the material cost results in zero or a nonexistent price, then zero is replaced with the current purchase cost on the Define Business Unit Item - General: Common page. |

BOM Code |

Not applicable for purchased items. |

Routing Code |

Not applicable for purchased items. |

Recalc Costs at Lower Level |

Not applicable for purchased items. |

Recalc Config Items & Levels |

Not applicable for purchased items. |