Processing Customs Duty on Online Purchase Orders

This section provides an overview of purchase order customs duty processing and discusses how to:

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PO_LINE |

Enter or modify purchase order information online. |

|

|

Copy Purchase Order Page |

PO_COPY_TMPLT |

Create a purchase order by copying an existing contract, requisition, or purchase order. This feature includes the ability to copy PO_HDR_EXS, PO_LN_SHIP, EXS_PO_SHIP_TAX, and EXS_PO_LN_DIST information to the new purchase order. The Tax Determination and Tax Calculation processes are triggered upon completion of the copy. |

|

PO_SCHEDULE |

Specify ship to, quantities, due dates, comments, sales and use tax, miscellaneous charges, price adjustments, and multiple distributions per schedule within a purchase order line. |

|

|

PO_LN_SHIP_TAX_EXS |

Access excise and sales tax/VAT rate codes, corresponding tax component codes, and calculated results. Access the total excise duty amount, sales tax/VAT amount, excise duty recovery amount, and sales tax/VAT recovery amount at the schedule level. |

|

|

Maintain Purchase Order - Distributions for Schedule Page |

PO_SCHED_DISTRIB |

Define multiple distributions for each purchase order schedule. |

|

Excise/Sales Tax/VAT Details for Distribution Page |

PO_DISTRIB_TAX_EXS |

View excise duties, sales tax/VAT, and customs duties calculated on the purchase order schedule, prorated across the schedule's distribution lines. Excise duty, sales tax/VAT, and customs duty amounts appear in the transaction currency and the general ledger base currency. Total excise duty, sales tax/VAT, and customs duty amounts appear for each distribution line. |

|

PO_EXPRESS |

Enter purchase orders using a version of the Maintain Purchase Order - Purchase Order page, where you can view line, schedule, and distribution information all on one page. However, when using the Express Purchase Order - Purchase Order page you cannot distribute by amount, allocate header miscellaneous charges, nor copy from an existing contract, requisition, or purchase order. |

|

|

Purchase Order Inquiry - Schedules Page |

PO_SCHED_INQ |

View information about the purchase order schedule. |

|

Excise Duty/Sales Tax/VAT Details for Schedule Page(inquiry) |

PO_SHP_TAX_INQ_EXS |

Inquire on purchase order excise duty and sales tax/VAT details. |

Customs duty processing applies to import purchase orders with associated customs duty-related charges. Customs duties appear by default on the purchase order based on the tax rate code default hierarchy using parameters such as tax component code, tax rate code, tax rate, and tax determination structure.

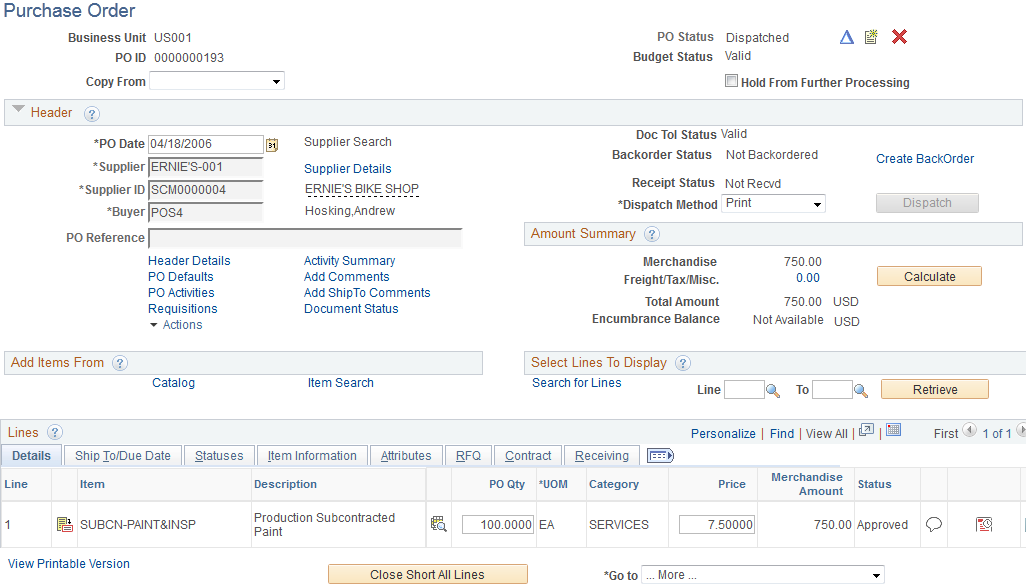

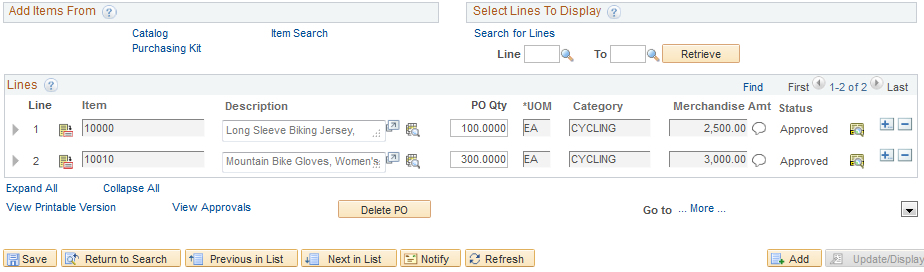

Use the Maintain Purchase Order - Purchase Order page (PO_LINE) to enter or modify purchase order information online.

Navigation:

This example illustrates the fields and controls on the Maintain Purchase Order - Purchase Order page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Item |

Entering an item with associated customs duty miscellaneous charges on an import purchase order triggers miscellaneous charge determination and calculation. |

PO Qty (purchase order quantity) |

Entering or modifying the purchase order quantity for an item with associated customs duty miscellaneous charges on an import purchase order triggers the determination and calculation of applicable miscellaneous charges. |

Use the Maintain Purchase Order - Schedules page (PO_SCHEDULE) to specify ship to, quantities, due dates, comments, sales and use tax, miscellaneous charges, price adjustments, and multiple distributions per schedule within a purchase order line.

Navigation:

Click the Schedule button on the Maintain Purchase Order - Purchase Order page.

Field or Control |

Description |

|---|---|

Ship To |

Entering or modifying the ship to location for an item with associated customs duty miscellaneous charges on an import purchase order triggers the determination and calculation of applicable miscellaneous charges. |

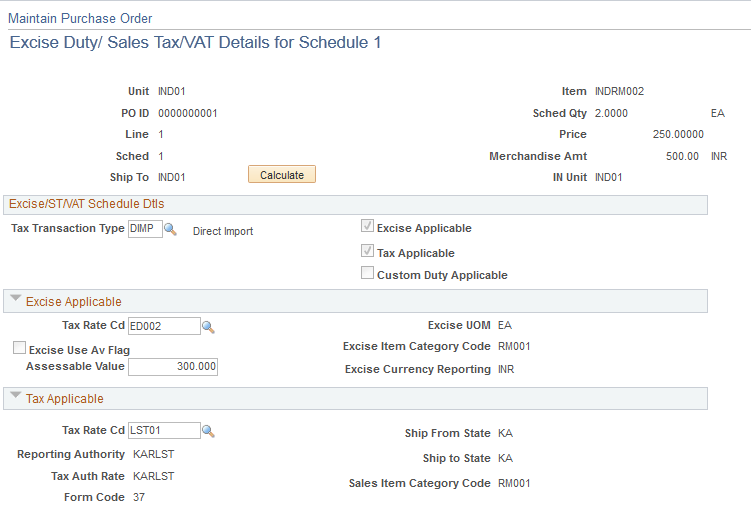

Use the Excise Duty/Sales Tax/VAT Details for Schedule page (PO_LN_SHIP_TAX_EXS) to access excise and sales tax/VAT rate codes, corresponding tax component codes, and calculated results.

Access the total excise duty amount, sales tax/VAT amount, excise duty recovery amount, and sales tax/VAT recovery amount at the schedule level.

Navigation:

Click the Excise/Sales Taxbutton on the Maintain Purchase Order - Schedules page.

Click the Excise/Sales Tax button on the Express Purchase Order - Purchase Order page.

This example illustrates the fields and controls on the Excise Duty/Sales Tax/VAT Details for Schedule page (1 of 2). You can find definitions for the fields and controls later on this page.

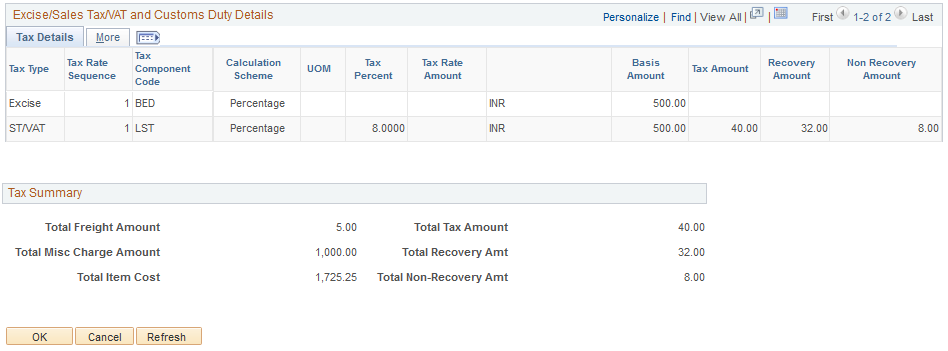

This example illustrates the fields and controls on the Excise Duty/Sales Tax/VAT Details for Schedule page (2 of 2). You can find definitions for the fields and controls later on this page.

Excise/ST/VAT Schedule Dtls

Field or Control |

Description |

|---|---|

Tax Transaction Type |

Displays the tax transaction type assigned to the transaction. Values for purchases are: DIMP (direct import) DOM (domestic) LIMP (local import) |

Excise Applicable |

Indicates whether excise duties are applicable to the transaction. |

Tax Applicable |

Indicates whether sales taxe/VAT are applicable to the transaction. |

Custom Duty Applicable |

Indicates whether custom duties are applicable to the transaction. Note: If this check box is selected, the Custom Duty Applicable group box will appear. |

Custom Duty Applicable

Field or Control |

Description |

|---|---|

Tax Rate Cd (tax rate code) |

Displays the custom duty tax rate code for the transaction that was derived using the Tax Determination process and tax rate code default hierarchy. |

Excise/Sales Tax/VAT and Custom Duty Details

Field or Control |

Description |

|---|---|

Tax Type |

Displays the tax type associated with the tax component code on the transaction. Values are:

|

Tax Rate Sequence |

Indicates the order in which tax component codes in the tax rate code should be calculated. |

Tax Component Code |

Displays the tax component codes in the selected tax rate code. |

Calculation Scheme |

Displays the default calculation scheme associated with the selected tax component code. Values are: Amount: Adhoc amount-based tax calculation. Percentage: Percentage-based tax calculation. Percentage appears as the default. Quantity: Quantity-based tax calculation. |

UOM (unit of measure) |

If the Calculation Scheme is set to Quantity, then this field displays the unit of measure against which the tax rate amount is applied. Note: If the transaction unit of measure is different from the tax rate code unit of measure, the system performs the conversion using the PeopleSoft-delivered unit of measure conversion feature. |

Tax Percent |

If the Calculation Scheme is set to Percentage, then this field displays the percentage to be applied against the taxable amount value in the Basis Amount field. |

Tax Rate Amount |

If the Calculation Scheme is set to Quantity, then this field displays the amount to be applied against the transaction quantity, according to the transaction quantity in the UOM value. Note: If the transaction unit of measure is different from the tax rate code unit of measure, the system performs the conversion using the PeopleSoft-delivered unit of measure conversion feature. If the Calculation Scheme is set to Amount, this is the tax amount. |

Basis Amount |

Displays the base amount on which tax is calculated. |

Tax Amount |

Displays the tax amount for the tax rate sequence. |

Recovery Amount |

Displays the amount of tax that can be recovered based on the Tax Amount and Recovery Percentage values. |

Non Recovery Amount |

Displays the amount of tax that is nonrecoverable based on the Tax Amount and Tax Percent values. |

Recovery Percentage |

Displays the recovery percentage. The system uses this value to split taxes into recoverable and nonrecoverable components. If the Tax Type field value is set to Customs, this is the CENVAT percentage that can be recovered for the Customs Duty. For example, a field value of 100 indicates that the full amount of tax is eligible for CENVAT credit. |

Tax Dependency Code |

Displays the tax dependency code assigned to the tax rate code. Tax dependency codes indicate the basis for calculating tax, as well as the precedence of taxes of the same tax type that must be included. |

Include Base |

If this check box is selected, indicates the inclusion of the base value in the tax calculation. If this check box is clear, the base value is excluded from the tax calculation. For example, this check box may be clear for a surcharge tax component, which is calculated based on a preceding tax component rather than on a base value. However, this check box would generally be selected for basic excise duties and local sales taxes. |

Include Freight |

If this check box is selected, indicates the inclusion of freight as a part of the base value in tax calculation. |

Include Miscellaneous Charges |

If this check box is selected, indicates the inclusion of miscellaneous charge expenses as a part of the base value for tax calculation. |

Tax Summary

Field or Control |

Description |

|---|---|

Total Freight Amount |

Displays the total freight charge amount for the schedule. |

Total Misc Charge Amount (total miscellaneous charge amount) |

Displays the total miscellaneous charge amount for the schedule. |

Total Item Cost |

Displays the total cost of items on the schedule. This value includes the merchandise amount, total freight amount, total miscellaneous charge amount, and total nonrecoverable tax amount. |

Total Tax Amount |

Displays the total tax amount on the schedule. |

Total Recovery Amt (total recovery amount) |

Displays the total recoverable tax amount on the schedule. |

Total Non-Recovery Amt (total non-recovery amount) |

Displays the total nonrecoverable tax amount on the schedule. |

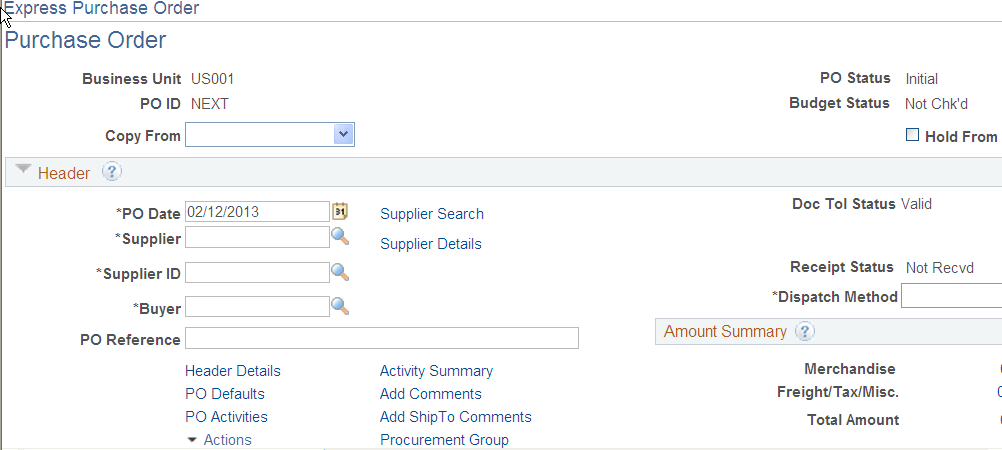

Use the Express Purchase Order - Purchase Order page (PO_EXPRESS) to enter purchase orders using a version of the Maintain Purchase Order - Purchase Order page, where you can view line, schedule, and distribution information all on one page.

However, when using the Express Purchase Order - Purchase Order page you cannot distribute by amount, allocate header miscellaneous charges, nor copy from an existing contract, requisition, or purchase order.

Navigation:

This example illustrates the fields and controls on the Express Purchase Order - Purchase Order page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Express Purchase Order - Purchase Order page (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Benefit ID |

You must enter a benefit ID for each item on an import purchase order. This information appears by default on BOEs and other reports. |