Defining Tax Installation Options

To define tax provider options, use the Tax Provider Options (TAX_PROV_INFO) component.

This section provides an overview of tax installation options setup and discusses how to define tax provider options.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_PROV_INFO |

Define tax provider (Taxware or Vertex) options. |

Order Capture works with third-party systems such as Taxware, Vertex, and WorldTax to calculate taxes on orders.

Once the preferred tax application is installed to work with PeopleSoft CRM applications, you must define tax settings for your business units and then define advanced tax installation options for either Taxware or Vertex. Taxware uses the STEP feature, while Vertex uses its Tax Decision Maker (TDM). If you use these, you must select the appropriate check boxes on the Tax Provider page.

Note: You can also take advantage of product groups.

Tax Settings for Business Units

Business units determine tax sets, which are entered when you define your business units on the Order Capture Definition page.

Tax Product Groups

You can set up product tax groups to take advantage of the Taxware Product Matrix or the Vertex Product Taxability files in Vertex TDM.

A tax product group is a product group with a product group type of Tax, which you define in PROD_GROUP_TBL.

Note: If you organize your data wisely, using tax product groups reduces taxing errors and product maintenance time.

Each order line has a single product ID. You can associate a tax product group with each product. Order Capture sends the product ID and the tax product group through the interface, and Taxware or Vertex determines whether the product ID or product tax group takes precedence.

Note: If you use Taxware, you can simplify data entry by creating tax product groups that are equal to any of the Taxware product codes that apply to your company's business. Create or update your product IDs with the tax groups that apply.

See Defining Products.

Use the Tax Provider Options page (TAX_PROV_INFO) to define tax provider (Taxware or Vertex) options.

Navigation

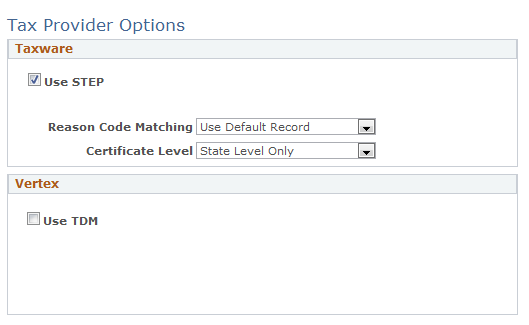

Image: Tax Provider Options page

This example illustrates the fields and controls on the Tax Provider Options page.

Taxware

|

Field or Control |

Definition |

|---|---|

| Use STEP |

Select, if you are using the Taxware STEP module, to indicate that additional fields must be sent through the interface. |

| Reason Code Matching |

Select how you want to handle tax certificate entry reason lookup in STEP. Select Exact Reason Code Match, the more restrictive of the two options, to have Taxware find only tax certificates that were entered with the exact reason code that you set up on the order line. If you select Use Default Record, Taxware looks for an exact match. If it does not find one, it uses a default tax certificate for exemption. |

| Certificate Level |

Select which taxing jurisdiction level tax certificates apply. If you select Individual Certificate Levels, STEP looks for certificates at all individual levels and exempts tax only for the levels at which a certificate is found. State Level Only prompts STEP to look for a certificate only at the state level. |

Vertex

|

Field or Control |

Definition |

|---|---|

| Use TDM |

Select to use the Vertex TDM application to set up exceptions to taxability rules in the states where they apply. In TDM, you can set up product classes, which are equivalent to tax product groups and product IDs. You can decide whether to use product IDs or product classes. |