Creating Alternate Ledger Journal Entries for Lessee Leases

In some instances, organizations are required to report on leased assets for multiple entities. To ensure accurate reporting, some organizations store and report information for these different entities using different ledgers. Standard balance sheet lessee accounting journal entries are stored in the AA ledger. However, in order to report information to or from multiple entities, you might also write lessee accounting journal entries to an alternate ledger.

Additionally, some entities within the same organization can be governed by different accounting standards. This can occur when a child company resides in one country, and must report financial information to a parent company that resides in another country.

Depending on the reporting requirements of your organization, you can use one of these methods to generate your required journal entries:

Use alternate schedules to generate journal entries in the alternate ledger.

Use this method when the lease classification for the asset is different for the reporting entities.

Use the primary schedules to generate journal entries in the alternate ledger.

Use this method when the lease classification for the asset is the same for the reporting entities.

Use the Alternate Ledger Type Pairing program (P15174) to define pairing for alternate ledger types. Based on the leases you are currently processing, determine the transaction to domestic currency pairs. You must also determine the ledger type to hold the domestic only lease alternate schedules or alternate ledger transactions To define pairing for alternate ledger types:

Add ledger types for both the base (domestic) currency and the transaction (foreign) currency to UDC 09/LT.

In the Ledger Type Master Setup program (P0025), add the ledger types to the Ledger Type Master table (F0025).

In the Denominated Currency Code (Ledger Currency section), you must enter the base or transaction currency for the ledger type to ensure that the decimal placement is correct on the journal entries.

In the Alternate Ledger Pairing Type program (P15174), create the ledger type pairs by entering in the Domestic Ledger Type grid column the ledger type that you want to use to create journal entries.

Enter the second ledger type in the Foreign Ledger type grid column.

Select the Alternate Ledger Pair Type

Select Alternate Ledgers for Lessee Alternate Ledger Journals batch program (R15181).

Select Alternate Schedules batch program (R15182) for all other alternate schedule processing.

Click OK.

Whichever method you choose, you use the Lessee Alternate Schedules Journal program (R15182) to create lease commencement (including the option for As Of Balance) and monthly journal entries in an alternate ledger. Use the processing options for this program to specify:

The domestic alternate ledger type.

The through month and year.

The processing mode.

How the system handles remaining balances.

The G/L date to use for the journal entries.

Versions, rules, and dates to use when approving and posting journal batches.

If alternate schedules exist for an asset, the R15182 uses the data on the alternate schedules to create the journal entries. If alternate schedules do not exist, the R15182 uses the data on the primary schedules to create the journal entries.

When you run the R15182 for an asset the first time, the system generates lease commencement journal entries in the alternate ledger. As you continue to run the R15182 each month, the system generates monthly journal entries in the alternate ledger. This program prints a report, and includes a message with each line that tells you what kind of journal entries were created. Also be aware that:

A leased asset must be at lease liability status 40 (commencement complete) before you can run the R15182.

You can only run the R15182 for an asset for periods that have already been processed through monthly balance sheet lessee accounting processing. You cannot create journal entries in an alternate ledger before they have been created in the AA ledger for a specified period.

Example 1: Using Alternate Schedules to Generate Alternate Ledger Journal Entries

This example illustrates how to use alternate schedules to generate alternate ledger journal entries. In this scenario:

A child company is operating in the United States, and is governed by FASB accounting standards. They have a lease which is considered an operating lease under the FASB standards.

The parent company is located in Germany, and is governed by IASB accounting standards. Under these standards, the same lease is considered a finance lease.

The child company is maintaining the lease, and reporting all information, as needed, to the parent company.

Therefore, you would complete these steps:

Create the lease, and then process lease commencement, which includes generating amortization schedules and lease commencement journal entries. The lease is at status 40, and the lease classification on the primary schedules is operating lease.

Create alternate schedules for the lease using the Work With Amortization Schedules program (P15171).

Run the R15182 for the lease the first time to create lease commencement journal entries in the alternate ledger.

Run monthly processing on the primary schedules using the Balance Sheet Lessee Accounting Journals program (R15180) to generate journal entries in the AA ledger.

After you process the previous step for a specific period, you then run the R15182 for that period to generate journal entries in the alternate ledger for the same period. Note that journal entries for a specified period must exist in the AA ledger before you can create them in an alternate ledger.

Repeat steps 4 and 5 until the lease is complete.

Example 2: Using Primary Schedules to Generate Alternate Ledger Journal Entries

This example illustrates how to use primary schedules to generate alternate ledger journal entries. In this scenario both the parent and child companies are governed by the same accounting standards. The child company maintains the lease, and reports information to the parent company.

The lease classification is the same for both entities. However, the child company must report to the parent company using the LM ledger type. Therefore, you would complete these steps:

Create the lease, and then process lease commencement, which includes generating amortization schedules and lease commencement journal entries. The lease is at status 40, and the lease classification on the primary schedules is finance lease.

Run the R15182 for the lease the first time to create lease commencement journal entries in the alternate ledger. In this scenario, the R15182 uses data from the primary schedules to generate the journal entries.

Run monthly processing on the primary schedules using the Balance Sheet Lessee Accounting Journals program (R15180) to generate journal entries in the AA ledger.

After you process the previous step for a specific period, you then run the R15182 for that period to generate journal entries in the alternate ledger for the same period. Again, the R15182 uses the primary schedule data to generate the journal entries. Note that journal entries for a specified period must exist in the AA ledger before you can create them in an alternate ledger.

Repeat steps 4 and 5 until the lease is complete.

Reviewing Alternate Schedules

If you create alternate schedules, you can use the Work With Amortization Schedules program (P15171) to review the schedules. The Work With Amortization Schedules form includes radio buttons that enable you to display all assets, assets with or without schedules, and assets with or without alternate schedules.

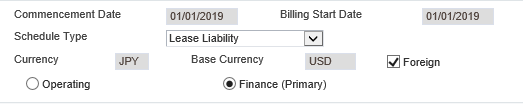

When you select a schedule to review, the system brings you to the Lease Liability Amortization Schedule form. For a multicurrency lease, if you select the Foreign check box, the system displays the amounts in the foreign currency of the transaction. If you do not select this check box, the system displays amounts in the domestic currency of the transaction.

If an alternate schedule exists, the system enables the Operating and Finance radio buttons, and specifies (Primary) next to the button associated with the primary schedule. If no alternate schedules exist, these radio buttons are disabled. This graphic shows how the buttons appear when an alternate schedule exists, and the lease classification on the primary schedule is Finance:

Reviewing Alternate Ledger Journal Entries

As with standard commencement and monthly journal entries for balance sheet lessee accounting, you can then use the Balance Sheet Lessee Accounting Batch Review program (P150911) to review, approve, delete, and post these alternate ledger journal batches. Use the Ledger Type field in the header of the form to specify the alternate ledger type.

Note that the R15182 updates the Explanation/Remark field on the journal batch with Alternate Schedule Commence or Alternate Schedule Journals to identify the type of journal batch that was created.

See Reviewing, Approving and Posting Lease Commencement Journal Entries for detailed instructions.

Remeasurement and Early Termination Processing for Alternate Ledgers

If you are generating journal entries in an alternate ledger, and you process a remeasurement or an early termination, you must ensure that your journal entries in the alternate ledger reflect the remeasurement or the early termination.

If you are using alternate schedules to generate your alternate ledger journal entries, the system automatically updates the alternate schedules when you make changes to the lease terms that require a remeasurement or early termination. When you run the remeasurement or early termination process, the system generates remeasurement or termination journals for the primary and the alternate schedules at the same time.

If you are generating alternate ledger journal entries without using alternate schedules, running the remeasurement or early termination process will only create journal entries in ledger AA. To update your alternate ledger, you run the R15182 after you process the remeasurement or early termination to generate your monthly alternate ledger journal entries. This program uses the information in the schedules to identify that a remeasurement or early termination has occurred, and creates the remeasurement or termination journal entries for the alternate ledger as needed.

Just as remeasurement and termination journal entry batch information is stored on the primary schedule, the system uses similar fields to store the information on the alternate schedules. For example, when you run the remeasurement process, the system updates the Remeasurement Document Number and Remeasurement G/L Date fields on the primary schedule. When alternate ledger journal entries exist, the system also updates the Alternate Remeasure Document Number and the Alternate Remeasure G/L Date.

If you delete a batch of remeasurement or termination journal entries for either the primary schedule (ledger AA) or the alternate schedule or ledger type, the system also deletes the associated batch for the primary or alternate ledger.

See Changing Lease Terms After Schedule Creation for additional information about remeasurement and early termination processing.